DXY [US$ INDEX] EWP TC FIB ANALYSIS MONTHLY TFDXY – Monthly Macro Structure

The U.S. Dollar Index continues to trade within a long-term descending macro channel originating from the 1985 Plaza Accord high. The 2001 and 2022 peaks both align precisely with this falling resistance, confirming a multi-decade pattern of lower highs.

The advance since the 2008 low appears corrective, forming a large W–X–Y structure rather than a five-wave impulse. The current recovery phase represents the final wave Y, now approaching confluence between declining channel resistance, horizontal supply, and Fibonacci retracement levels.

Momentum supports this interpretation. Monthly RSI shows clear bearish divergence relative to the 2022 high, indicating structural exhaustion rather than trend continuation.

If wave Y completes within this resistance zone, a decisive breakdown below the corrective structure would signal the end of the entire post-GFC dollar rally. Long-term technical projections point toward the 58 region, aligning with historical support and lower-channel targets.

From a macro perspective, current strength remains corrective until proven otherwise.

Like and follow for more charts like this.

Wave Analysis

XAU/USD Outlook: Potential Trendline Breach and StructuraAfter a sustained bullish run, XAU/USD is showing signs of consolidation near local highs. This analysis monitors the interaction between the current supply zone and the ascending trendline.

Technical Observation: Price is struggling to maintain momentum above 5,100. The black path highlights a potential breakdown scenario if the lower trendline fails to hold.

Key Levels:

Supply/Resistance: 5,115

Immediate Support: 5,025

Major Target: 4,925 (Internal Liquidity)

Execution Logic: This setup focuses on a "Change of Character" (ChoCh). If price breaks the ascending support, we anticipate a deeper retracement to clear built-up liquidity below.

Note: Keep an eye on the US session volatility for confirmation of the move.

CHFJPY: Bulls Will Push

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the CHFJPY pair which is likely to be pushed up by the bulls so we will buy!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Natural Gas at Decision Zone! Waiting For The Price DirectionNatural Gas at Decision Zone! Waiting For The Price Direction

After a strong impulsive rally, Natural Gas entered a consolidation phase, forming a clear range between 3.40 and 3.70. This zone is now acting as a key decision area for the next major move.

🔼 Bullish Scenario:

If price manages to break and hold above 3.70, bullish momentum could resume. A successful breakout would open the path toward the next resistance targets at 3.93 and 4.21, confirming continuation of the broader uptrend.

🔽 Bearish Scenario:

A breakdown below 3.40 would increase selling pressure, exposing lower targets at 3.23 and potentially 2.96, where stronger demand is expected.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

GOLD: Bearish Continuation & Short Trade

GOLD

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell GOLD

Entry - 5076.5

Stop - 5090.6

Take - 5052.9

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Gold is fluctuating at high levels! It's time to sell.

Amidst heightened global policy uncertainty, gold is once again playing its core role as a safe-haven asset. Trade concerns, the uncertainty surrounding U.S. policy direction, and discussions about the independence of monetary policy all constitute important logical foundations supporting gold prices. From a technical perspective, gold prices have not yet shown clear signs of peaking, and any pullback is more likely to be seen as a consolidation opportunity within the trend. As long as macroeconomic uncertainty persists, the value of gold as an investment will continue to be favored by the market. In the short term, focus on the impact of the Federal Reserve's statements on the pace of fluctuations; the medium-term direction remains biased towards upward fluctuations. This statement is seen as a signal that could reshape the international trade and economic landscape, directly boosting the attractiveness of safe-haven assets. In addition, discussions about the independence of the Federal Reserve's policy also provide additional support for gold prices. The market is closely watching President Trump's upcoming announcement of the next Federal Reserve chairman. Previously, Trump stated that he had completed the interview process for the candidates. If the future policy stance is more dovish, it may strengthen market expectations for further interest rate cuts this year, thereby reducing the opportunity cost of holding gold and benefiting this non-interest-bearing asset. On the macroeconomic data front, investors will focus on the U.S. ADP employment change data and consumer confidence index released on Tuesday to assess the resilience of the U.S. economy and the outlook for monetary policy. Market focus will then shift to the Federal Reserve's interest rate decision on Wednesday. The market generally expects the Federal Reserve to maintain the interest rate range of 3.50%-3.75%. However, Federal Reserve Chairman Powell's statements at the post-meeting press conference will be a key factor in determining short-term market trends. If the rhetoric is hawkish, it may boost the dollar in the short term, thus putting some pressure on gold priced in dollars; conversely, any dovish signals could continue to push gold prices higher.

I believe it's starting to peak in the short term, but both bulls and bears will be very aggressive, making risk management especially important.

Yesterday, I said that due to the news, there was a rapid surge in the short term, and there will inevitably be a significant decline in the near future, and the single-day decline is highly likely to break last year's record of $300; therefore, everyone should pay close attention to the key turning points for both bulls and bears.

The bullish trend cannot stop; once it stops, the bears will counterattack.

Now, the bulls have a certain opportunity to take profits. The 4-hour MACD chart shows no significant volume and an early top divergence. Yesterday's 1-hour chart completed a downward correction. The 4-hour chart is currently undergoing a rebound and correction after the decline. If the downtrend continues, it could lead to a significant drop, potentially even breaking below $4990! Considering the intraday bearish resistance level, we should watch the 5110 area. A break below 4990 could trigger an accelerated decline! If 4990 holds, there might be a temporary wide range of fluctuation. In short, today's outlook favors a bearish trend! Unless the European market breaks above $5110, but even then, a significant rally is unlikely. More likely is a wide range of fluctuation, so be wary of a bearish attack!

In summary, the short-term trading strategy for gold today is primarily bearish. The key short-term resistance level is 5100-5110, and the key short-term support level is 4990-5000. Please follow the trend accordingly.

Boeing - Lowering HeightsWe are analyzing the move since November 2025, identifying two main impulses, which can be viewed as a three -wave structure of a larger five -wave move.

At this stage, it’s not critical whether this impulse is considered wave 5 or wave B of a larger move.

Currently, a downward move is expected. The exact corrective type will clarify the structure of the larger move.

Holding altitude above 207 would keep the flight on course and support continuation of the impulsive move.

Main targets:

240

232

225

219

---

Please subscribe and leave a comment!

You’ll get new information faster than anyone else.

---

XAUUSD | 1H Elliott Wave Analysis📈 XAUUSD | 1H Elliott Wave Analysis

Wave Count:

1️⃣ Wave (1): Initial upward move from ~4,360

2️⃣ Wave (2): Corrective retracement to ~4,390

3️⃣ Wave (3): Strong impulsive rally peaking ~4,540

4️⃣ Wave (4): Pullback to ~4,425

5️⃣ Wave (5): Projected target 4,760–4,780 ✅

🔹 Key Observations:

Trend: Bullish continuation expected – Wave (4) completed.

Support: 4,425 (Wave 4 low). Break below may invalidate bullish count.

Resistance / Targets:

Minor: 4,550–4,560

Final Wave (5) Target: 4,760–4,780

💡 Trading Plan:

Aggressive Buy: Current price ~4,507

Stop Loss: 4,420 (below Wave 4)

Take Profit: 4,700 → 4,760–4,780

Conservative Buy: Wait for breakout above 4,550

⚡ Notes:

Momentum confirmation recommended (RSI / MACD).

Watch USD/interest rate news; XAUUSD is sensitive.

Elliott Wave structure is non-repainting.

Summary:

Wave (5) is likely underway. Ideal bullish scenario sees XAUUSD rally toward 4,760–4,780. Support holds key for continuation.

GBPJPY Massive Long! BUY!

My dear friends,

My technical analysis for GBPJPY is below:

The market is trading on 210.57 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 211.67

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

USDJPY Technical Analysis! BUY!

My dear friends,

Please, find my technical outlook for USDJPY below:

The instrument tests an important psychological level 153.70

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 154.23

Recommended Stop Loss - 153.39

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPJPY Bullish Breakout Signals Wave (5) UpsideGBPJPY has confirmed a bullish breakout above a key long-term resistance, with Elliott Wave structure pointing to further upside toward the 215–220 zone.

GBPJPY is breaking out of its base channel after pushing above the 208 level, which also acted as a major resistance throughout 2024. Since the breakout, price action shows a strong recovery, suggesting an impulsive move originating from the 192 area.

The market is currently undergoing a corrective pullback in wave (4), testing the projected 210 support zone. As long as this support holds, a bullish continuation into wave (5) is favored, with upside targets in the 215–220 area.

The bullish outlook is invalidated below 205. As long as price remains above this level, the broader trend stays bullish.

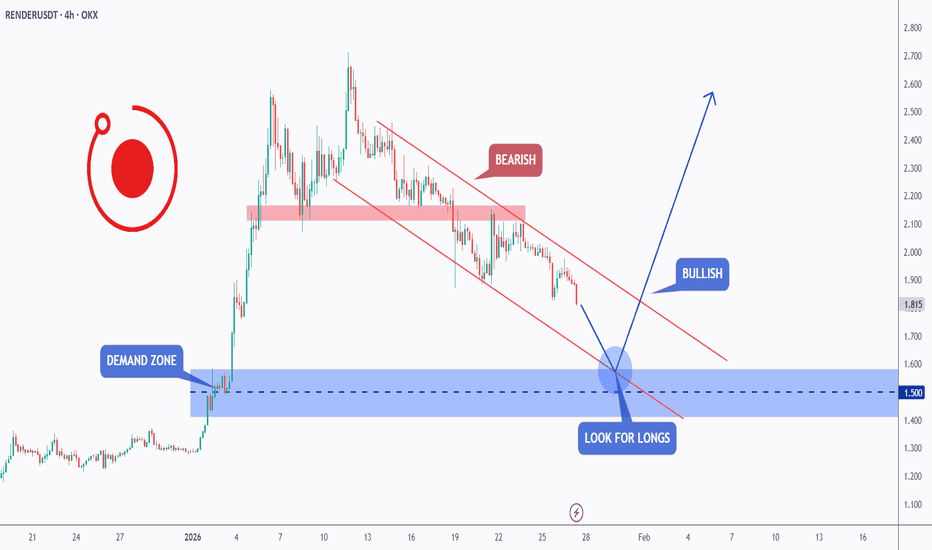

RENDER - Decision Zone ApproachingRENDER is slowly grinding lower and approaching a clear demand zone, an area where buyers have previously stepped in aggressively.

As long as price is holding inside this blue demand zone, the plan is simple:

👉 look for longs, patiently, with confirmation...

That said, context matters.

For the bulls to fully take control again, one thing is still missing:

a clean break above the red falling channel. Until that happens, any upside remains corrective rather than impulsive.

In short:

Demand zone = opportunity.

Channel break = confirmation.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

USDCAD - From Sellers to BuyersLast week, the focus was clear:

price was trading inside the orange supply zone, and that was a clean area to look for shorts. Sellers did their job perfectly there.

Fast forward to now, and the context has changed.

USDCAD has pushed lower and is retesting a strong demand zone, an area where buyers have previously stepped in.

As long as this demand holds, the bias shifts again, this time toward looking for longs, not chasing, but waiting for price to show rejection.

Let price confirm… then react📈

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

EURUSD: Bullish Continuation via Regular Flat CorrectionThe Euro has completed a textbook Bullish Re-Accumulation phase, offering a high-probability long entry in line with the higher timeframe trend.

Technical Confluence:

Elliott Wave Structure: We observed a Regular Flat Correction (3-3-5). This acted as a necessary pause in the uptrend to clear out weak hands. The "C-Wave" of this flat provided the final dip we needed.

FVG Mitigation: The correction terminated precisely inside the Bullish Fair Value Gap (FVG). Price "tapped" this imbalance (as marked on the chart) and instantly rejected lower prices, confirming strong buying interest.

Market Structure: The trend remains firmly bullish. This flat correction is simply the "fueling" process for the next leg higher.

The Trade Plan:

Direction: Long / Buy

Entry: Taken on the rejection of the Bullish FVG (Discount Zone).

Logic: Buying the dip after the structural correction is complete.

Target: New Highs (Liquidity above the previous range).

Disclaimer: This analysis is for educational purposes only and represents my own view of the market. Trading involves significant risk. Please manage your risk according to your own capital rules.

#AGLD/USDT Alert! Imminent Rise#AGLD

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.277, and the price has bounced from this level several times. Another bounce is expected.

The RSI is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.283

First Target: 0.294

Second Target: 0.307

Third Target: 0.322

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

GBPUSD 1H (FXCM): Bullish Continuation SetupGBPUSD 1H (FXCM): Bullish Continuation Setup, Range Compression Below a Weak High

GBPUSD is still structurally bullish on the 1H chart after the strong impulsive leg up, and price is now consolidating in a tight top-range. This is the classic “pause before expansion” environment where liquidity builds on both sides of the box. The key detail on your chart is the marked weak high above the range, which often gets swept before the real move accelerates.

Today’s execution should focus on the range edges and confirmation, not the middle of the box.

Market Structure and Price Action

1H bias: bullish (clean BOS sequence into the current range).

Current phase: re-accumulation / compression under resistance.

Liquidity map: equal highs/equal lows inside the range, inviting stop runs.

If price holds the range floor, continuation remains favored. If the floor breaks with a confirmed retest failure, the market can rotate into the nearest demand band before any continuation attempt.

Key Levels (Support and Resistance)

Resistance

1.3695–1.3710: range ceiling / supply lid.

Weak High zone above 1.3710: primary liquidity target (potential sweep zone).

1.3745–1.3750: next upside extension area if acceptance occurs above the weak high.

Support

1.3680–1.3675: intraday pivot inside the box.

1.3660–1.3650: range floor (key bullish invalidation).

1.3605–1.3590: first demand pocket if 1.3650 breaks.

1.3505–1.3490: deeper demand zone from the prior structure.

Fibonacci Roadmap (Where Pullbacks Often React)

Anchor Fibonacci from the start of the impulsive rally into the current top:

0.382 often aligns near the range floor area (around 1.365x).

0.5 typically overlaps the first demand pocket (1.360x).

0.618 aligns closer to the deeper demand zone (1.350x).

This supports a simple rule:

Hold 1.3650 = shallow pullback, trend continuation higher.

Lose 1.3650 = deeper rotation likely before any further upside.

EMA and RSI Filters (Fast Confirmation Rules)

EMA (EMA20/EMA50 on 1H)

Bull continuation: price holds above EMA20 and EMA20 stays above EMA50.

Warning: repeated 1H closes below EMA20 while capped under resistance often precede a liquidity flush.

RSI (14)

Bull control: RSI holds above 50 during consolidation.

Breakout confirmation: RSI pushes above 60 with a 1H close above 1.3710.

Breakdown risk: RSI slips below 45 while price is below 1.3650.

Trading Scenarios (Entry, SL, TP)

Scenario 1: Buy Breakout With Acceptance Above 1.3710 (Continuation)

Trigger

1H close above 1.3710 and the next candle holds above (no instant rejection).

Entry

Buy the retest of 1.3710–1.3700 as support.

Stop loss

SL below 1.3675 (tight) or below 1.3660 (safer).

Take profit

TP1: 1.3745

TP2: 1.3750+ (trail with EMA20 / last 1H higher low)

Scenario 2: Weak High Sweep Then Buy (Best Trend-Following Entry)

Trigger

Price wicks above the weak high and then closes back inside the range with rejection, followed by a strong reclaim candle.

Entry

Buy after reclaim confirmation (often best on a pullback to the reclaim level).

Stop loss

SL below the reclaim swing low.

Take profit

TP1: range top

TP2: 1.3745–1.3750 if the second push breaks and holds.

This is ideal when the market “hunts stops” first, then resumes the trend.

Scenario 3: Buy Pullback at Range Floor 1.3660–1.3650 (Higher R:R)

Trigger

Price tests 1.3660–1.3650 and prints rejection (lower wick absorption, bullish engulfing).

Entry

Buy at the floor after confirmation.

Stop loss

SL below 1.3625–1.3620 (avoid tight stops; GBPUSD often hunts).

Take profit

TP1: 1.3685

TP2: 1.3710

TP3: 1.3745 if breakout follows.

Scenario 4: Sell Breakdown Below 1.3650 (Rotation Into Demand)

Trigger

1H close below 1.3650 and retest fails (1.3650 flips to resistance).

Entry

Sell the retest rejection near 1.3650–1.3660.

Stop loss

SL above 1.3680.

Take profit

TP1: 1.3605–1.3590

TP2: 1.3505–1.3490 if downside expands.

This is the only clean bearish setup—avoid selling inside the middle of the range.

Execution Notes (Avoid Chop)

Don’t trade the center of the box (around 1.3675–1.3685). It is designed to chop.

Best decisions are at:

range top / weak high (sweep vs acceptance),

range floor (breakdown confirmation),

demand pockets (structured dip-buys).

Summary

GBPUSD 1H remains bullish, consolidating just below a weak high. The highest-quality trades are:

buy breakout only with acceptance above 1.3710,

buy a confirmed weak-high sweep + reclaim,

or buy the range-floor rejection at 1.3660–1.3650.

Bearish bias only activates if 1.3650 breaks and fails on retest, opening a rotation to 1.360x and possibly 1.350x.

EQT Corporation -Bullish channel, watching for a bounceEQT Corporation — Daily

Long trade idea. Volatility isn’t huge, but price has respected the channel well, which makes it more suitable for a longer-term swing trading horizon.

Price is moving in a slightly bullish channel, making higher highs and higher lows.

In the past, volume spikes were followed by decent upside moves, so participation looks constructive.

ATR has cooled off but is still holding above the level where momentum picked up before.

Price could easily pull back a bit more, but if the structure holds, that wouldn’t be a bad thing.

The marked area is on my radar for potentially adding on the way down — for those with a strong stomach, it could offer a great risk/reward if the trade plays out.

That said, trading is what it is — sometimes totally hectic. None of this guarantees anything, it’s just a structured idea based on how price has behaved so far.

EURUSD 1H (FXCM): Bullish StructureEURUSD 1H (FXCM): Bullish Structure, But Distribution Under a Weak High Signals a Likely Sweep Then Drop to Key Demand

EURUSD remains structurally bullish on the 1H chart after the impulsive rally, but the current behavior at the top is not clean continuation. Price is stalling inside a top-range and repeatedly reacting under a marked weak high. This is the exact profile where liquidity is built above the highs and below the equal lows, often leading to:

a weak-high sweep (false breakout) to trap late buyers, then

a rotation lower into the nearest demand zones and the major horizontal support.

Your projected path (blue) fits that logic: chop → sweep/failed acceptance → drop toward the black support line.

This plan uses Fibonacci, trendlines, EMA, RSI, and clear support/resistance to define high-probability entries with strict risk.

Market Structure and Price Action Read

Primary trend (1H): bullish (BOS sequence intact).

Current phase: distribution/accumulation range near the highs.

Key clue: weak high + repeated CHoCH inside the range = unstable bullish continuation.

As long as price is stuck under the weak high, continuation trades have lower quality unless there is clear acceptance above the range top.

Key Levels to Watch (Support and Resistance)

Resistance

1.1887–1.1890: current range top pressure area.

Weak High zone (above 1.1890): liquidity target; expect a potential sweep.

1.1900: psychological level; acceptance above here changes the intraday bias back to clean continuation.

Support

1.1860–1.1855: immediate pullback support inside the range.

1.1835–1.1825: first demand pocket (grey band).

1.1785–1.1780: major horizontal support (black line) and the primary downside target if breakdown confirms.

1.1745–1.1740: deeper demand band if 1.1780 fails.

Fibonacci Roadmap (Where Price Is Likely to React)

Anchor Fibonacci from the impulse swing low (pre-rally base) to the recent high near the weak high:

0.382 typically overlaps the first demand zone (around the 1.183x–1.182x band).

0.5 often aligns near the major mid-support (commonly around 1.178x on this structure).

0.618 sits closer to the deeper demand band (around 1.174x).

This supports a bearish rotation scenario if the range floor fails.

Trendline, EMA, RSI Filters (Fast Confirmation)

Trendline

The impulse trendline is no longer the best execution tool because price has transitioned into a horizontal range. In this phase, horizontal levels dominate.

EMA (EMA20/EMA50 on 1H)

Bull continuation: price holds above EMA20 and EMA20 > EMA50.

Distribution warning: repeated closes below EMA20 while still capped under resistance often precede a flush.

RSI (14)

Bull control: RSI holds above 50 during consolidation.

Breakdown risk: RSI dips below 45 and fails to reclaim 50 during bounces.

Breakout confirmation: RSI pushes above 60 with a 1H close above 1.1900.

Trading Plan (Entry, SL, TP)

Scenario 1: Weak High Sweep Then Sell (High-Probability Setup)

Trigger

Price wicks above the weak high (above 1.1890) but closes back inside the range with a strong rejection candle.

Entry

Sell after the rejection close, preferably on a pullback into the sweep zone (lower timeframe confirmation).

Stop loss

SL above the sweep high.

Take profit

TP1: 1.1860

TP2: 1.1835–1.1825

TP3: 1.1785–1.1780 (black line support)

This matches the most likely “trap then dump” pattern under a weak high.

Scenario 2: Sell Breakdown of the Range Floor (Clean Rotation Setup)

Trigger

1H close below 1.1860–1.1855, followed by a failed retest (support flips to resistance).

Entry

Sell the retest rejection around 1.1860.

Stop loss

SL back inside the range (above the retest swing high).

Take profit

TP1: 1.1835–1.1825

TP2: 1.1785–1.1780

TP3: 1.1745–1.1740 if momentum expands.

Scenario 3: Buy Only With Acceptance Above 1.1900 (Continuation)

Trigger

1H close above 1.1900 and the next candle holds above (no immediate rejection).

Entry

Buy on retest 1.1900–1.1890 as support.

Stop loss

SL below 1.1865–1.1860 (or below the retest structure).

Take profit

TP1: new high extension

TP2: trail with EMA20 if trend strength continues.

This is the only bullish setup worth taking in the current top-range environment.

Execution Rules (Avoid Getting Trapped)

Do not trade the middle of the range. It is engineered to chop both sides.

Highest-quality decisions happen at:

weak high (sweep vs acceptance),

range floor (breakdown confirmation),

demand zones (reaction buys only if structure stabilizes).

Summary

EURUSD 1H remains bullish in structure, but the current distribution under a weak high strongly favors a liquidity sweep and a rotation lower toward 1.183x and potentially 1.178x. The best trades are either:

selling a confirmed weak-high sweep,

selling a confirmed breakdown + failed retest,

or buying only after a clean acceptance above 1.1900.

XAUUSD 1H (OANDA): Bull TrendXAUUSD 1H (OANDA): Bull Trend, But Price Is Trapped Under a Weak High – Expect a Sweep or a Deeper Rotation

Gold remains in a strong 1H uptrend overall, but the latest price action is flashing a key short-term warning: the market is consolidating under a marked weak high after a sharp push up. On your chart, the top box shows repeated reactions, multiple CHoCH prints inside the range, and a clear liquidity structure (equal highs/equal lows) that often precedes either:

a liquidity sweep above the weak high to trap breakout buyers, then a selloff, or

a clean breakout with acceptance that continues the bullish trend.

This is a classic “decision zone” where you should trade the edges, not the middle.

Market Structure and Price Behavior

Macro bias (1H): still bullish (the staircase advance with BOS legs is intact).

Current phase: distribution-like consolidation near the highs.

Key observation: the market is “advertising” the weak high. Weak highs are frequently swept before the real move happens.

If price fails to hold the current top-range support, the next move is likely a rotation into the nearest demand bands marked on the chart.

Key Resistance and Support Levels (From the Chart)

Resistance

5,090–5,105: current supply lid / top-range pressure area.

Weak High zone: the marked weak high above the range (primary liquidity target).

5,120: next major upside magnet if a breakout is accepted.

Support

5,060–5,040: immediate pullback support (reaction zone after the sell spike).

5,000–4,980: psychological + structural support (key intraday defense).

4,920–4,900: first highlighted demand band (strong reaction zone if breakdown confirms).

4,820–4,800: second demand band (deeper pullback target).

4,660–4,620: broader base support (trend would weaken significantly if price returns here).

Fibonacci Roadmap (Best Dip-Buy Zones)

Anchor Fibonacci from the latest impulse swing low (around the last major push before the top consolidation) to the recent high:

0.382 typically aligns near the first pullback pocket (often around the 5,040–5,000 region here).

0.5 aligns with the next demand band (commonly around 4,920–4,900).

0.618 often overlaps deeper demand (around 4,820–4,800).

This creates a clean hierarchy:

Hold above 5,000 = shallow correction, trend continuation remains favored.

Lose 5,000 = rotation risk increases toward 4,920 and potentially 4,820.

EMA and RSI Filters (Quick Confirmation Rules)

EMA (use EMA20 and EMA50 on 1H)

Bullish continuation: price holds above EMA20 and EMA20 stays above EMA50.

Distribution warning: repeated 1H closes below EMA20 while trapped under resistance often leads to a flush.

RSI (14)

Bull control: RSI holds above 50 during consolidation.

Breakout strength: RSI pushes above 60 with a 1H close above resistance.

Breakdown risk: RSI slips below 45 while price loses the range floor.

Trading Plan (Clear Entry, SL, TP)

Scenario 1: Buy Breakout Only With Acceptance (Continuation Setup)

Trigger

1H candle closes above the range top (above the current supply lid) and the next candle does not instantly reject.

Entry

Buy on a retest of the broken level (range top becomes support).

Stop loss

SL below the retest swing low (or below the range top if you want a tighter invalidation).

Take profit

TP1: retest of the weak high zone

TP2: extension toward 5,120 if momentum remains strong (trail with EMA20)

Best practice

Avoid buying a single wick above the range. Acceptance matters more than the spike.

Scenario 2: Liquidity Sweep Above Weak High Then Sell (High-Probability Reversal Pattern)

Trigger

Price spikes above the weak high but closes back inside the range with a strong rejection candle.

Entry

Sell after the rejection close, ideally on a lower-timeframe pullback toward the sweep zone.

Stop loss

SL above the sweep high.

Take profit

TP1: 5,060–5,040

TP2: 5,000–4,980

TP3: 4,920–4,900 if 5,000 breaks with confirmation

This aligns closely with the projected path drawn on your chart.

Scenario 3: Sell Breakdown of Range Support (Rotation Into Demand)

Trigger

1H close below the range floor (the lower boundary of the top box) and retest fails.

Entry

Sell the retest rejection.

Stop loss

SL back inside the range.

Take profit

TP1: 5,000–4,980

TP2: 4,920–4,900 demand band

TP3: 4,820–4,800 if selling pressure expands

Scenario 4: Buy the Dip at Demand (Safer Trend-Continuation Approach)

Trigger

Price reaches a marked demand band and prints rejection (strong lower wick, engulfing, or impulsive reclaim).

Entry zones

First buy zone: 5,000–4,980

Second buy zone: 4,920–4,900

Deep buy zone: 4,820–4,800

Stop loss

Place SL below the demand band low (avoid placing it too tight; gold often hunts stops around round numbers).

Take profit

TP1: back to 5,040–5,060

TP2: range top / weak high zone

Execution Notes (Avoid the Chop)

Do not trade the middle of the range. The range is designed to trap both sides.

The best decisions happen at:

the range top / weak high (sweep or breakout)

the range floor (breakdown confirmation)

the demand bands (structured dip buys)

Summary

XAUUSD 1H is still bullish structurally, but the current consolidation under a weak high increases the probability of a liquidity sweep and a rotation lower before continuation. The highest-quality setups are:

buy only after breakout acceptance,

sell a confirmed weak-high sweep,

or wait to buy the dip at 5,000–4,980 and the demand bands at 4,920–4,900 / 4,820–4,800.

#CVX/USDT : Long-Term Breakout Signals Massive Upside Potentia#CVX

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 2.01, and the price has bounced from this level several times. Another bounce is expected.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 2.058

First Target: 2.08

Second Target: 2.12

Third Target: 2.16

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.