BTC Faces Major Resistance Before FOMC – Breakdown or Breakout?As I expected in the previous idea , Bitcoin( BINANCE:BTCUSDT ) has followed the anticipated bullish and bearish trends and has reached all of its targets (full target).

Now, the question is whether Bitcoin can sustain above the $90,000 level. Stay tuned!

At the moment, Bitcoin is moving near the resistance zone($90,600-$89,300) and around the 50_SMA(Daily), and the resistance line.

From an Elliott Wave perspective, it seems that Bitcoin is completing a Double Three Correction(WXY) within the ascending channel.

I expect that Bitcoin might not break through this resistance zone($90,600-$89,300) on the first attempt and could start to decline, potentially dropping to around $88,133. If the bearish momentum continues, we might see even lower targets.

First Target: $88,133

Second Target: Cumulative Long Liquidation Leverage: $87,000-$85,630

Stop Loss(SL): $91,823(Worst)

Cumulative Short Liquidation Leverage: $92,000-$91,000

CME Gap: $93,060-$92,940

In the coming hours, markets face the Fed Funds Rate decision and Powell’s press conference, which typically bring elevated volatility. If the Fed holds rates at 3.75% as expected, the initial reaction may be muted, but real movement will depend on forward guidance. Historically, when outcomes align with expectations, gold tends to stay supported amid uncertainty, especially with U.S. government shutdown risks in the background, while Bitcoin remains sensitive to liquidity signals and risk sentiment. Any shift in Powell’s tone — whether more cautious or more hawkish — can quickly drive sharp moves.

⚠️ Traders should expect volatility both at the release and during the press conference, avoid impulsive entries, and prioritize risk management.

Note: Rising tensions in the Middle East could quickly intensify Bitcoin's downward trend

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Bitcoin Analysis (BTCUSDT), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Wave Analysis

GOLD - Control Cycle Structure | Path to $5,000+Heads up….

The pullback from $4,549 isn’t weakness. It’s structure resetting before continuation. Gold completed a clean five-wave impulse from the Liberation Day tariff break at $3,000 to the Boxing Day high at $4,549. Wave (I) is complete. Price around $4,440 is Wave (ii) - corrective and controlled. Shallow matters.

Add Zone: $4,000–$4,200

This is where buyers position.

Below $4,000 sits the line that defines the structure.

Invalidation: $3,900.

Break it and the structure fails. Above it, momentum holds. Corrections compress in strong trends. Floors rise in control regimes. Sellers don’t get paid.

This is a control cycle, not a growth cycle. Central banks continue accumulating. USD reserve diversification is structural. FED cuts are expected Q2 as Powell exits May 2026. Policy paths are narrow. Gold functions as a trust anchor, not a trade. Supply chains are being managed. Strategic materials are politicised.

Gold prices this in advance.

Levels

Current: $4,430

Add zone: $4,000–$4,200

Major support: $4,000

Invalidation: $3,900

Targets:

$4,700 → $5,000 (Wave iii, Q2–Q3)

Extension toward $5,400 (Q4)

Skew remains asymmetric while $3,900 holds.

Corrections don’t end trends in control regimes. They prepare the next leg. Gold isn’t reacting. It’s leading.

Stay long. Outguess the break.

BLSH - Almost BottomedWhat's very interesting is Cathie Wood's has been dollar cost averaging into this stock all along this recent down-turn.

Purely a technical play, price is nearing the 1.618 of an A-B move, and also looks like a good long-term entry. If this is the botttom, would expect price's next move to go to all-time-high's. $100+ a share is likely.

Wave-Count confidence: Average

Note: I am not currently in this stock, but I am eyeing awaiting an entry.

Time & Price Map – Intraday NIFTY (Educational)Time & Price Map – Intraday NIFTY (Educational)

Markets don’t move just on levels —

they move when price reaches a level at the right time.

Today’s intraday structure is guided by a Time & Price Map, where demand is expected to respond within a defined time window.

🧠 Educational Framework:

CMP: 25,380

Strategy: Buy on Dips

Support Validity: Above 25,325

Stop Loss: Below 25,325

⏳ Time is the Key Variable:

This setup remains active on or before 2:15 PM.

If price respects support within this time window, probability favors continuation.

🎯 Projected Price Zones:

Target 1: 25,510

Target 2: 25,595

📐 Why This Matters (Learning Point):

Price reaching a level without time confirmation is incomplete.

When time and price align, moves become decisive and fast.

📊 Viewer Takeaway:

Intraday trading is not about prediction —

it’s about mapping where price should be, and by when.

⚠️ Educational view only. Risk management is essential.

COIN [Coinbase] EWP TC FIB ANALYSIS DAILY TFCOIN – Daily Structure Overview

After five swings up, completing a motive wave, price formed a double top near 430 and has since entered a corrective phase. The market is now retracing the entire bullish leg from the 2022 low, with downside targeting the golden zone around the 85 area. This region represents a major confluence support and potential termination zone for the correction. As long as price holds above the golden zone, the higher-timeframe bullish structure remains intact. Upon completion of the correction, the next impulsive advance may resume, with the primary bullish target remaining at 795. A sustained break below the 85 zone would invalidate this scenario and suggest a deeper corrective structure.

Like and follow for more charts like this.

NAS100 QQQ CRACKING! AGAIN!NASDAQ has been CRACKING everywhere, structure after structure. Now it's forming a major double top.

What we need to see now is lower lows and highs in a commanding way. If it continues this back-filling, then I would call this a High base for more upside.

This is a simple, low-risk, short setup. Trading it against previous highs. (even if it breaks a bit above it) with a lot of downside potential!

This is the cost of doing business the right way. Be willing to take the small hits until you get PAID! WELL!

So I would forget about this trade if I were planning to jump in and out. I would hold it, giving time to PAY ME!

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in raw truth, not hype.

Elite | XAUUSD – 15M – Corrective Phase After SellOANDA:XAUUSD PEPPERSTONE:XAUUSD

The aggressive drop appears corrective within a broader bullish environment rather than a full trend reversal. Price is consolidating above a key demand area after liquidity was swept to the downside. As long as this base holds, a recovery toward higher resistance remains valid.

Key Scenarios

✅ Bullish Case 🚀 →

Holding above 4,950 – 4,980 may trigger a bullish rotation back into the range.

🎯 Target 1: 5,190

🎯 Target 2: 5,320

🎯 Target 3: 5,600

❌ Bearish Case 📉 →

A clean breakdown and acceptance below 4,950 could extend selling toward 4,800.

Current Levels to Watch

Resistance 🔴: 5,190 – 5,320, then 5,600

Support 🟢: 4,950 – 4,980

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice

PLTR CAUTION!PLTR is at a key critical area, which has already given a warning shot to bulls.

We have a complete rising wedge structure with 3 waves up and a hook that has already cracked! Within it, we also have a head and shoulders at the top, which is bearish. (H&S not a top is usually a continuation pattern.) AS is always the case, if the overall market is not ready to head south, it will fail as a full-on reversal pattern.

I urge CAUTION!! to PLTR bulls.

For shorts, you need to see a crack, gap fill, plus follow through for a new lower low in a small time frame. You can't have a reversal without lower lows and lower highs.

Thank you ALL FOR getting me up to 5,000 followers!! ))

Click boost, follow, comment nicely for more authentic, no BS, raw analysis. Let's get to 6,000 followers. ))

Gold, Inflation, and the money velocity correlation.Good day traders and investors,

The “you’ll own nothing and be happy” Prophecy, no. Prediction, no. Planning, yes. It means, you’ll be priced out and there is nothing you can do about it.

Central planning at it’s finest, or worst, depending on your point of view. Make no mistake, these moves by Gold are direct result of central planning. Nothing is accidental.

Golds unprecedented rise should scare you, even if you own some. Golds rise to me is screaming the next wave of inflation is coming and will likely be twice as powerful from the previous wave. The money velocity could be a conferential confirmation. Money velocity is the rate of money moving and changing hands in the economy. It’s generally a very good thing, and healthy robust economy should have a very high velocity. However, there can be instances where it can be fueled by inflation, so it can be deceptive and that’s not so good. It could be rising because of higher prices. The last couple years the velocity was stagnate and going sideway. Just recently it started to up tick, exactly like in 2020 with golds rise. The lower version of the velocity chart which is the rate of change annually that came out of 2020 was the highest ever in recorded history. This could prove to be good or bad thing. If it catches support and keeps going higher along with inflation, it will not be a goof thing. However if inflation does get back into control then it would not be bad, as it would show accelerated growth in the economy (likely not, at least for now).

It wasn’t until after Gold found a top and went sideways while consolidated that inflation really came in. The market needed time to absorbed what happened. It realized products were to cheap, to how much money was out there and inflation took it’s course. History could repeat over the next couple years IMO. Bitcoin could get some of this pouring into it along with alts, just like back in 2021. It took time, a few months for it to come in and propel Bitcoin to it’s new highs. During golds run bitcoin was essentially just going sideways, then corrected to key market structure at 9.8k to 10k. Once it found support, it took off from there and didn’t stop until 70k. This could happen very similarly this time. A retest of 69k could be the bottom of the correction before it build up of pressure for the final run up either late this year or 2027.

This is my prediction from my analysis at this time. Let me know what you think down below.

I’ll leave you with a quote you may or may not know.

“Allow me to issue the currency of a nation and I care not who rules it”

Regards,

WeAreSat0shi

XAGUSD - A QUICK BUY SET UP - 29-01-2026XAGUSD -G-Money's short version analysis based purely on technical analysis only, no nonsense or "BS". I do totally ignore any fundamental analysis, technical analysis only

XAGUSD -still kinda on the "move" and continue up...

Who did enter this trade earlier congratulations! Who missed it... See you next time! ;)

Chart is itself explaining. Kept a "KISS" approach all the way ( "Keep It Simple, Stupid") & beginners friendly... ;)

I do hope that nobody ignoring SL ( Stop Loss) ! Without it, It is a fastest way to loose hard earned money...

;)

Trade safe & don't do "gambling". In the end it never pays, not worth it to risk loose all your $...

PS: above technical analysis is done for the community & educational purpose only! It is not a financial advice. Just share my very own insight to it.

AUDUSD – Higher Timeframe Setup (D1)Price is trading into a major HTF resistance / supply zone (~0.69871) that previously acted as strong distribution. The recent move up looks corrective, forming lower highs inside a broader bearish structure. Liquidity is likely resting above this zone (“stops”), which often gets swept before a strong bearish expansion.

If price rejects this zone, the higher-timeframe bias favors a continuation to the downside, with downside targets toward the 0.55 liquidity area marked below.

Bias: Bearish below HTF resistance

Idea: Wait for rejection → sell confirmation → ride the HTF move

📌 I trade structure, liquidity, and HTF zones — not indicators.

If you want to learn how to spot these setups early and trade them with confidence, follow me and check my 90-day trading plan.

Trade with a plan. Trade with structure.

Gold Rejection at 5550: Correction to 5010 Before Rebound?XAUUSD | Intraday Smart Money Plan – H1

Gold has transitioned from a steady bullish climb into a corrective phase after tapping the 5,550 area. The prior move showed a clear expansion from accumulation, followed by a push into premium where buy-side liquidity was engineered and taken. Since that delivery, price has failed to print strong continuation and instead formed a sharp bearish displacement and a ChoCH on H1.

Current behavior suggests Smart Money is shifting from markup to rebalancing. The selloff left inefficiencies and points to a draw toward deeper discount pricing before any sustainable upside attempt.

Market Context

Today’s tone for gold remains sensitive to macro headlines:

• Ongoing uncertainty around the Fed’s policy outlook

• USD fluctuations driven by mixed data expectations

• Safe-haven demand still present but not aggressively chasing highs

Higher-timeframe sentiment supports gold overall, but intraday order flow shows distribution first, continuation later.

Market Structure & Liquidity

• H1 bullish structure partially weakened by ChoCH

• Clear rejection from 5,550 premium zone

• Strong displacement down = institutional activity

• Unmitigated imbalance and liquidity resting near 5,010

• Logic: Premium sell → Discount mitigation → Reassessment

Smart Money prefers to rebalance inefficiencies before repricing higher.

Key Trading Scenarios

🔴 Premium Sell Setup (Intraday Reaction)

Zone: 5,550–5,552

SL: 5,560

Confluence:

• Prior rejection area

• Fibonacci premium zone

• Weak follow-through after highs

Expectation: another rejection can continue the correction lower.

🟢 Discount Buy Setup (Primary Interest)

Zone: 5,010–5,008 (1.618 fib area)

SL: 5,000

Confluence:

• Deep discount pricing

• Liquidity pool below recent lows

• Likely imbalance mitigation zone

Buy only with bullish confirmation (LTF ChoCH/BOS).

Invalidation

Strong acceptance back above 5,560 on H1

→ Suggests correction is over and external liquidity may be targeted.

Expectation & Bias

• Intraday bias: corrective / rotational

• Liquidity likely targeted below before continuation

• Patience over prediction

• Let structure confirm entries

Gold is in a rebalancing phase. The key question is whether price completes the discount draw toward 5,010 liquidity first, or quickly reclaims premium and resumes expansion.

AAVE ROADMAP (D)AAVE has confirmed the previous idea. It's clear that the entire pattern goes in a correction mode named as "triple zig-zag".

Sadly, AAVE will not be recovering from here any time soon.

As long as price stay below $206, the fate of AAVE shows a major signal through downside.

That entire wick from the last flashcras will be filled entirely.

USD/JPY SHORT FROM RESISTANCE

Hello, Friends!

Bearish trend on USD/JPY, defined by the red colour of the last week candle combined with the fact the pair is overbought based on the BB upper band proximity, makes me expect a bearish rebound from the resistance line above and a retest of the local target below at 151.907.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

USOIL BEARS WILL DOMINATE THE MARKET|SHORT

USOIL SIGNAL

Trade Direction: short

Entry Level: 65.09

Target Level: 63.63

Stop Loss: 66.05

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURCAD: Bullish Forecast & Bullish Scenario

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to buy EURCAD.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

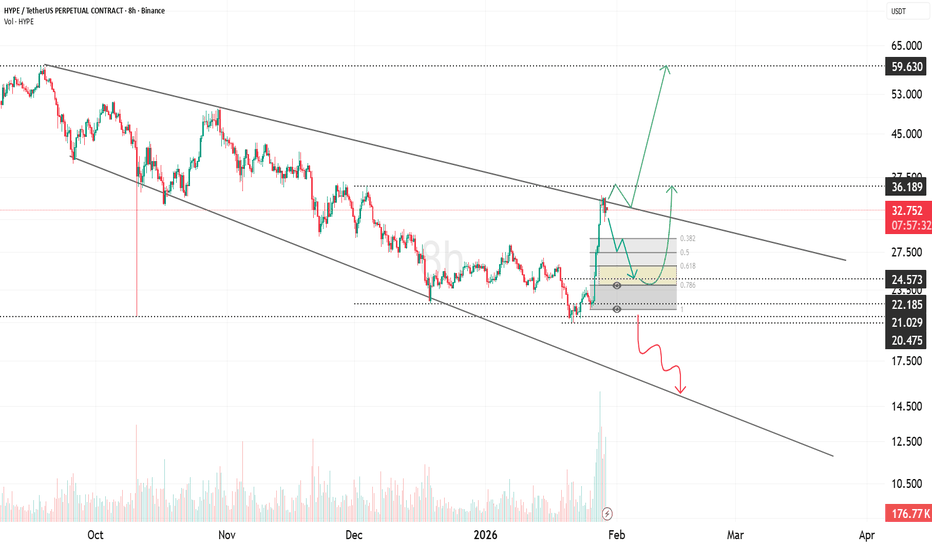

HYPE Testing Broadening Wedge ResistanceHYPE is forming a broadening wedge pattern, where price action is expanding with higher volatility over time. After reacting from the lower boundary of the structure, price has moved back toward the upper trendline, which is acting as a key resistance zone.

This area is important because broadening wedges often signal increasing market participation and volatility before a larger directional move. A sustained breakout above the upper wedge resistance could confirm bullish continuation and open the path toward higher supply zones marked on the chart.

If price fails to break this resistance and gets rejected, a pullback toward the lower boundary of the broadening wedge remains possible. The market is approaching a decision point, and a strong move is likely once this range resolves.

Elliott Wave Analysis XAUUSD – January 30, 2025

1. Momentum

Weekly timeframe (W1)

Weekly momentum is currently rising. With this condition, the market is likely to continue moving higher or remain sideways for at least the next 1–2 weeks.

Daily timeframe (D1)

Daily momentum is currently declining. This suggests that over the next 1–2 days, price may continue to fall or move sideways until D1 momentum reaches the oversold zone.

H4 timeframe

H4 momentum is compressed and overlapping in the oversold area. This indicates that the current bearish or sideways phase may continue, however, the probability of a bullish reversal on H4 is relatively high.

2. Wave Structure

Weekly Wave Structure (W1)

On the weekly chart, the five-wave structure (1–2–3–4–5) in blue is still forming.

Yesterday, price experienced a strong decline. However, to confirm that blue wave 5 has completed, price needs to produce a bearish close below the 4282 level.

At the moment, since W1 momentum remains bullish, this decline is more likely a corrective move within blue wave 5, rather than a completed top.

Daily Wave Structure (D1)

Daily momentum is declining, therefore price may continue to move lower or sideways for another 1–2 days until D1 momentum reaches oversold conditions.

Within the context of blue wave 5, price is likely forming yellow wave 4, which belongs to the internal 1–2–3–4–5 yellow structure of blue wave 5.

Once yellow wave 4 is completed, price is expected to resume its advance to form yellow wave 5, thereby completing blue wave 5.

From the RSI perspective, the previous rally reached extremely overbought conditions. This suggests that buying pressure remains strong enough to support at least one more push to a new high, potentially accompanied by bearish divergence at the top. This further supports the scenario that yellow wave 5 will form, and that the market is currently in yellow wave 4.

H4 Wave Structure

The current decline has already reached the 0.382 Fibonacci retracement of yellow wave 3.

From a momentum standpoint, D1 momentum is still declining, so in the near term, another 1–2 days of decline or sideways movement remain possible. Meanwhile, H4 momentum is compressed in the oversold zone, indicating a high probability of a bullish reversal on H4.

Therefore, the most likely scenario is continued sideways movement on H4, or a minor continuation lower before a bullish reaction develops.

RSI from the prior bullish leg remains in a strongly overbought condition, reinforcing the idea that the current decline is corrective in nature, and that the market may still form a new high afterward.

3. Trading Plan

Swing setups:

At this stage, there are no attractive swing positions, as the market is currently in the late phase of an extended wave, where price behavior becomes difficult to predict.

Additionally, today is Friday and also the monthly candle close, which significantly increases volatility risk. The appropriate approach is to remain patient and observe, waiting for D1 momentum to reach the oversold zone, at which point higher-probability swing setups can be considered.

XAG/USD - A QUICK UPDATE - 30-01-2026XAGUSD - G-Money's short version analysis based purely on technical analysis only, no nonsense or "BS". I do totally ignore any fundamental analysis, technical analysis only

XAGUSD - PATIENCE TIME...

1H DID HIT TP TARGET AND 15m was "excluded" and nicely "manipulated"

Who did enter this trade earlier congratulations! Who missed it... See you next time! ;)

Chart is itself explaining. Kept a "KISS" approach all the way ( "Keep It Simple, Stupid") & beginners friendly... ;)

I do hope that nobody ignoring SL ( Stop Loss) ! Without it, It is a fastest way to loose hard earned money...

;)

Trade safe & don't do "gambling". In the end it never pays, not worth it to risk loose all your $...

PS: above technical analysis is done for the community & educational purpose only! It is not a financial advice. Just share my very own insight to it.

BITCOIN Next Weve Hello everyone, I hope you're all doing well

Bitcoin's price has been moving sideways for about three months, just as I predicted.

So what's next ?

I expect the price to enter a new downward trend soon, with the targets as shown in the chart.

Something will trigger the crash

Exchange crashes, a war between countries, bank failures, and other events will be the spark that helps bring about the expected collapse

Elise | BTCUSD – 30M | Bearish ContinuationBITSTAMP:BTCUSD

After a strong impulsive sell-off, BTC attempted a corrective move into prior supply but lacked acceptance above resistance. The rejection from this zone suggests continuation toward sell-side liquidity, with downside targets aligned with previous demand and unfilled liquidity pools.

Key Scenarios

❌ Bearish Case 📉 → Continuation below 87.8K

🎯 Target 1: 86,100

🎯 Target 2: 84,200

✅ Bullish Invalidation 🚫 → Strong acceptance and close above 89,000 would invalidate this bearish view.

Current Levels to Watch

Resistance 🔴: 88,700 – 89,000

Support 🟢: 86,100 → 84,200

⚠️ Disclaimer: This analysis is for educational and informational purposes only. It is not financial advice. Please conduct your own research before trading.

$CCUSDT 1D CHART UPDATE 📌 NYSE:CC has already broken the descending trendline, showing a change in price structure ✅

📌 After the breakout, price needs to retest and hold above the support zone marked on the chart ✅

📌 If this support holds, we can expect further upside continuation as shown in the projection ✅

📌 If price fails to hold this zone, the bullish idea will be invalidated ❌

📌 Final conclusion: breakout is done, but retest confirmation is important before continuation 🔥