Silver - Here comes the bullrun top!☠️Silver ( OANDA:XAGUSD ) creates its final top now:

🔎Analysis summary:

Silver still remains totally bullish. But Silver also remains totally overextended and the metal is also approaching the final resistance trendline. With all of this short term weakness, this might be the final top on Silver. Just please wait for bearish confirmation.

📝Levels to watch:

$100

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

XAG USD (Silver / US Dollar)

Silver at $110 in Fierce Rally, Gold Tops $5,100. What’s Behind?(What a chart.)

Silver OANDA:XAGUSD is on a tear. Actually, scratch that — silver is on a mission. Prices have surged more than 250% over the past year, including a blistering 50% jump in January alone, lifting the metal to around $109 an ounce and placing the $110 level firmly in sight .

That performance puts silver ahead of nearly every major commodity and even ahead of gold, the traditional anchor of the precious-metals complex. Momentum has been relentless, headlines have grown louder, and price action has moved from steady to explosive.

When markets accelerate this quickly, attention follows. So does risk.

🪙 Gold Climbs with Purpose

Gold OANDA:XAUUSD has also started 2026 in strong form, trading above $5,100 an ounce for the first time in history. The move builds on a powerful rally that delivered a 60% gain in 2025, driven by familiar macro forces that continue to shape investor behavior.

Compared with silver’s all-over-the-place sprint, gold’s climb looks measured and deliberate. That difference highlights the contrasting roles the two metals play in portfolios. Gold behaves like a heavyweight asset, absorbing large flows with relative calm. Silver responds more sharply to changes in sentiment and positioning.

⚙️ Silver’s Fundamental Case Gains Strength

Silver’s story extends beyond safe-haven demand. Industrial use now forms the backbone of the market. As one of the most efficient conductors of electricity, silver plays a central role in electronics, solar panels, circuit boards, and energy infrastructure.

According to Metals Focus, industrial demand now accounts for around 60% of total silver consumption, up significantly from a decade ago. That shift has aligned silver with long-term trends in electrification and renewable energy investment.

Supply dynamics add further pressure. Roughly three-quarters of new silver supply comes as a byproduct of mining other metals such as copper and zinc. Production responds slowly to price signals, and demand has exceeded supply every year since 2018. Last year’s deficit reached nearly 20%, with another shortfall expected in 2026.

📈 Speculation Takes the Wheel

But also, price behavior suggests fundamentals alone no longer explain silver’s trajectory. Speculative positioning has become a dominant force.

The silver market carries a total value of roughly $5.3 trillion, far smaller than gold’s $33 trillion footprint. That size difference amplifies volatility and accelerates moves when capital flows surge.

Intraday swings have grown aggressive. Moves of several dollars within minutes have become common, shifting hundreds of billions of dollars in market value in short bursts. Traders accustomed to slower commodity cycles have found themselves navigating price action that resembles high-beta equities.

🌍 Politics Add Energy to the Trade

Geopolitical tension is adding support for another leg up. President Donald Trump’s renewed trade and military rhetoric toward Europe, including commentary around Greenland , has reinforced demand for real assets.

At the same time, the administration clarified that tariffs on silver and other critical minerals remain off the table. That clarification did little to slow momentum, raising questions about how much of the rally rests on positioning rather than policy.

🥇 Gold’s Rally Follows Familiar Lines

On the other hand, gold’s advance reflects a broader macro backdrop. Elevated inflation, a weaker US dollar , and continued central-bank buying have supported demand.

Expectations for further Federal Reserve rate cuts in 2026 strengthen the case, as lower yields reduce the appeal of fixed-income alternatives. (Make sure you watch the economic calendar to catch any surprise announcements.)

Gold also benefits from deep scarcity. According to the World Gold Council, total gold mined throughout history amounts to approximately 216,265 tons, enough to fill just about four Olympic-size swimming pools.

The US Geological Survey estimates another 64,000 tons remain underground, though production growth is expected to level off as accessible deposits diminish. That constraint continues to anchor gold’s role as a long-term store of value.

⚖️ Valuation Questions Surface

Debate has shifted toward valuation. Very few analysts expect silver to revisit the $20-to-$30 range last seen in late 2022. Structural demand and supply dynamics suggest a higher baseline.

Prices above $100, however, place silver in rare territory where momentum and leverage exert significant influence. In such environments, price discovery becomes less orderly and reactions grow sharper.

🎁 The Takeaway

Silver and gold are rising for different reasons and behaving in distinct ways. But one thing unites them. Right now, it’s more about speculation than anything else.

Off to you : Are you sleeping on the rally or you’ve bet on either of these metals? Share your approach in the comments!

SILVER | Pullback as Precious Metals Rally PausesPRECIOUS METALS MINERS | Pullback as SILVER Rally Pauses

European precious metals miners opened lower as investors took profits after the recent strong rally in TVC:GOLD and TVC:SILVER . The pause in bullion momentum weighed on mining equities, which tend to amplify moves in underlying metal prices.

In early London trade, Fresnillo and Hochschild fell around 3.2% and 2.5%, respectively, while losses extended beyond precious-metals-focused miners, reflecting a broader risk-off tone at the open.

Technical Outlook

The price maintains a bearish structure while trading below the 112.91 pivot.

As long as price remains below 112.91, downside pressure is expected toward 110.40.

A confirmed 1H close below 110.40 would strengthen bearish continuation toward 107.46, followed by 103.35.

On the upside, bullish momentum would only be activated with a 1H close above 112.91, opening the way toward 117.19 and 119.83.

Key Levels

• Pivot: 112.91

• Support: 109.41 – 107.47 – 103.40

• Resistance: 115.00 – 117.20 – 119.84

XAGUSD (Silver) 3H — chart pattern...XAGUSD (Silver) 3H — chart pattern.

Strong impulsive bullish breakout

Price above trendline + above Ichimoku cloud

No nearby resistance until the upper range

🎯 Upside Targets

Current price: ~103.4

✅ Target 1 (TP1 – conservative)

105.80 – 106.00

Psychological level + minor structure pause

Good spot to secure partials

🎯 Target 2 (TP2 – main target)

110.50 – 112.00

Matches my marked target point

Measured move from the last consolidation leg

High-liquidity zone from prior range expansion

🚀 Extension (if momentum stays aggressive)

115.00

Round number + trend acceleration target

❌ Invalidation / Pullback Zone

Bullish bias holds as long as price stays above 98.50–99.00

Deeper retrace support: 96.00 (top of cloud)

Summary:

Bias = bullish continuation

Best target = 110–112 zone 🎯

Silver Inflation AdjustedHow much is the market willing to pay in real (inflation-adjusted) terms?

Roughly 20 times its historical real average ($3), which puts silver around $60 inflation-adjusted.

That means silver can still double from here—and do it faster than most expect.

Would I hold the entire position to those levels? No.

Would I let a small runner ride using house money? Yes.

Here are other Valuation metrics I have posted for your review.

That’s how you participate in upside without turning a trade into a belief system

If you enjoy the work: 👉 Drop a solid comment. Let’s push it to 6,000 and keep building a community grounded in raw truth, not hype.

Silver Breaks $110 — Time to Rotate Out? Silver just printed a new all-time high at $110.25 — a clean Fibonacci extension rally that’s now entering major resistance zones :

• $111.40

• $116.98

• $134.95

The move from $50 to $110 has been explosive. But parabolic advances don’t last forever , and this chart now outlines a potential local top formation .

We could see a rejection at $111–116 and a retest of key zones below :

• $103.86 (previous resistance)

• $92 and $86 if things accelerate

📺 All of this was broken down in the full macro video — along with why Bitcoin might be next in line to move:

🔗 Silver $110, Gold $5K — Bitcoin Pump Next?

Silver bulls have feasted. Now it’s time to ask — are you late to the party, or early to the rotation?

Perspective Shift 🔄

Every rally ends with FOMO — and that’s often your exit cue. Silver's rally is historic, but the rotation clock is ticking. With BTC sitting on macro support , this could be the last leg before capital flows shift.

Disclaimer: I'm not a financial advisor — I'm a master of Prognosis. These are my personal views. I read charts like a poet reads the stars. You still gotta trade at your own risk. 🧠💥

One Love,

The FXPROFESSOR 💙

Silver (XAG/USD): Bearish Reversal Potential at Parallel ChannelSilver filwaqt 15-minute timeframe par aik mazzboot ascending channel ke andar trade kar raha hai, lekin price action ab exhaustion (thakawat) ke signs dikha raha hai. Market ne channel ki upper boundary ko touch kiya hai jo ke aik major resistance zone hai, aur yahan se aik bearish reversal ka imkan nazar aa raha hai.

Technical Analysis & Strategy:

Channel Resistance: Price ne channel ki oopri satah (upper rail) par resistance li hai. Ye area buyers ke liye thora mushkil sabit ho raha hai kyunke yahan supply mazzboot hai.

Projected Bearish Path: Black arrows se wazeh hota hai ke market aik "Lower High" structure banane ki koshish kar rahi hai. Agar price channel ki midline ko break karti hai, to ye niche ki taraf aik barri move ka signal hoga.

Key Targets:

TP 1: 106.000 (Internal support level)

TP 2: 102.500 (Major structural demand zone)

Risk Management: Setup tab tak valid hai jab tak price halia swing high yaani 112.500 ke niche rehti hai. Is level ke ooper closing bullish trend ko dubara activate kar degi.

Market Sentiment: Filwaqt sellers control gain karne ki koshish kar rahe hain. Trendline ka breakdown is setup ki confirmation ke liye zaroori hai.

Silver Bells, Silver Bells, Silver all the way...Silver Bells, Silver Bells

Silver all the way

Oh what fun it is to ride

"in a One Horse" open sleigh

Silver Bells, Silver Bells

Silver all the way

Oh what fun it is to ride

"in a One Horse" open sleigh

Dashing through the snow

"In a One Horse" open sleigh

Over the hills we go

Laughing all the way

Bells on Bobtails ring

Making spirits bright

What fun it is to ride and sing

A Silver song tonight...

Happy Silver New Year!

GBPUSD: consolidation at 1.37🛠 Technical Analysis: On the H1 chart, GBPUSD remains bullish after a strong impulse move and is now compressing beneath the marked resistance zone around 1.37000. Price is holding inside a rising structure, with the steep trend channel still intact and suggesting continuation if buyers defend the pullbacks. The moving averages are angled higher and sit below price, reinforcing the upward bias. A clean push above the resistance area opens the way toward the next upside target, while a drop back below the consolidation base would signal a deeper retracement into the nearest support zone.

———————————————

❗️ Trade Parameters (BUY)

———————————————

➡️ Entry Point: 1.36872

🎯 Take Profit: 1.37532

🔴 Stop Loss: 1.36438

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

XAG/USD: Identifying Trend Exhaustion and Potential Mean ReversiSilver (XAG/USD) is currently displaying signs of bullish exhaustion on the 15-minute timeframe after a sustained rally within a well-defined ascending channel. The price action has reached the upper boundary of this channel, which coincides with a significant psychological resistance zone. We are now monitoring for a structural shift that could lead to a healthy corrective phase.

Technical Deep-Dive:

Ascending Channel Analysis: The price has been respecting the parallel channel boundaries, but the recent rejection from the top rail suggests that buying momentum is fading at these premium levels.

Structural Shift (The Black Path): The projected trajectory indicates the formation of a "Lower High," which is a precursor to a "Change of Character" (ChoCh). A break below the lower trendline would confirm that the bearish cycle has begun.

Liquidity Targets:

Primary Objective: 106.000 – This level represents a prior consolidation zone and serves as the first area of interest for take-profit.

Secondary Objective: 102.500 – A deeper retracement to clear built-up sell-side liquidity resting at the base of the current impulsive move.

Risk Management: The bearish thesis remains valid as long as the price trades below the recent swing high of 112.500. A decisive close above this level would signal a continuation of the parabolic trend.

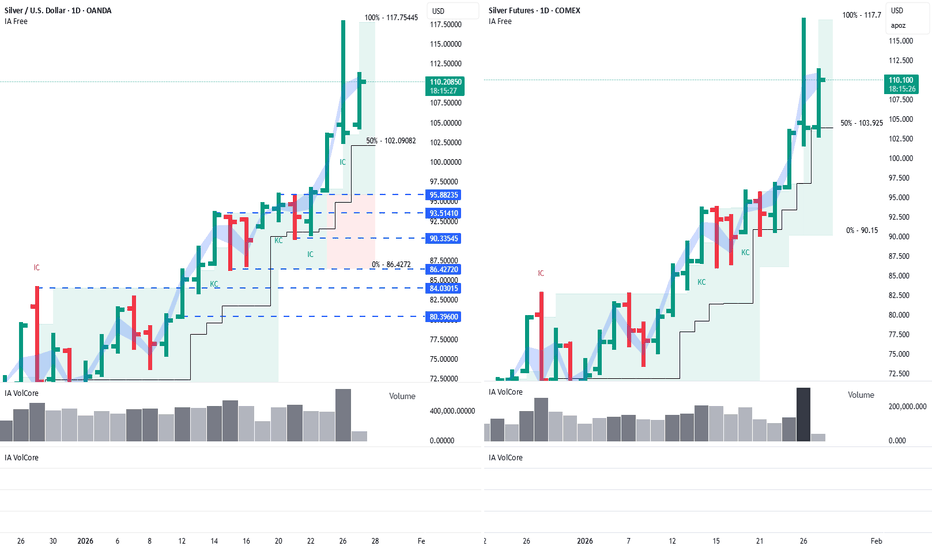

Silver: Record volume —consolidation and correction likelyHi traders and investors!

On January 26, trading volume on OANDA reached an all-time high — such volume has never been recorded there before. On COMEX futures, a higher volume occurred only twice, once in 2020 and once in 2021.

Considering this volume and the structure of the daily candles (with the main volume accumulated in the upper part of the range), there are reasons to believe that the price is close to a high, where the market may enter a phase of consolidation, followed by a correction.

Based on the CFD chart (on the left), two potential correction zones can be identified:

First correction zone: 96–90

Second correction zone: 86.5–80

Profitable trades!

This analysis is based on the Initiative Analysis (IA) method.

Silver - Looking To Buy PullbacksH1 - Strong bullish move.

Currently it looks like a pullback is happening.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------

Gold breakout supported at 4957The Gold remains in a bullish trend, with recent price action showing signs of a breakout within the broader uptrend.

Support Zone: 4957 – a key level from the previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 4957 would confirm ongoing upside momentum, with potential targets at:

5242 – initial resistance

5350 – psychological and structural level

5495 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 4957 would weaken the bullish outlook and suggest deeper downside risk toward:

4862 – minor support

4737 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Gold holds above 4957. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Silver drops after biggest nominal rallySilver rose nearly $14.5 dollars from its opening price to its highest point today, making it the biggest nominal daily gain ever...percentage wise the gain was 14% at one stage. The metal then hit supply at $117.74 from where it sold off around 8% to dive back below $109.00. This is the bears' first real attempt at trying to create a top. The long legged 4H doji candle certainly looks bearish. Let's see where silver closes today's session. Was this a blow off top, or a mere correction before the next up leg? Keep an eye on the key levels shown on the chart.

By Fawad Razaqzada, market analyst with FOREX.com

XAG/USD: Assessing Distribution Phase and Potential Trendline BrSilver (XAG/USD) ki halia price action 15-minute timeframe par aik mazzboot "Ascending Channel" ke andar trade karne ke baad ab aik critical junction par khari hai. Price ne channel ki oopri satah (resistance) se mazzboot rejection li hai, jo ke market mein buyers ki thakawat (exhaustion) ko zahir karti hai. Hum ab aik "Distribution Phase" dekh rahe hain jahan sellers control dobara haasil karne ki koshish mein hain.

Key Technical Observations:

Channel Exhaustion: Price action ne channel ki upper boundary ko multiple times test kiya hai lekin wahan hold karne mein nakam rahi hai. Ye aik classic sign hai ke market ab ooper jane ke liye mazeed liquidity dhoond rahi hai.

Structure Shift: Black path se wazeh hota hai ke hum aik "Lower High" formation ki tawaqqo kar rahe hain. Agar price channel ki lower trendline ko decisively break karti hai, to ye market structure ka bullish se bearish mein tabdeeli (Change of Character) ka signal hoga.

Liquidity Targets: Niche ki taraf hamara pehla target 106.000 ka level hai, jo aik intermediate base hai. Agar bearish momentum barkaraar rehta hai, to price mazeed niche 102.500 ke major support area tak gir sakti hai taaki purani liquidity ko clear kiya ja sakay.

Risk Parameters: Ye bearish view tab tak valid hai jab tak Silver 112.500 ke halia peak ke niche trade kar raha hai. Is level se ooper ki closing is setup ko invalidate kar degi aur trend continuation ka ishara degi.

Silver/XAG short tradeSilver just hit 2.618 on the macro fibonacci retracement.

I see it extremely unlikely that it will reach the max extension in one fell swoop.

My target is 75-90 range

We're at a point now where selling becomes very lucrative, both for holders and for traders, so extreme caution at this point is a must.

I could see it extend toward the 120-130 range before crashing, but i lean towards it correcting now rather than later.

With that said, i believe there are decent odds in case of a retracement, to rebound towards the max fibonacci extension relatively quickly.

GBPJPY: targets at 214 and 216🛠 Technical Analysis: On the H4 chart, GBPJPY remains in a clear ascending channel, keeping the broader bullish structure intact. Price is currently in a pullback toward the 211.8–210.9 support area, where buyers previously defended momentum. The SMA cluster (50/100) is nearby and can act as a pivot—holding above support favors a continuation push. A sustained rebound from this zone opens the path back toward the 214.25 resistance, with the channel top as a potential extension.

———————————————

❗️ Trade Parameters (BUY)

———————————————

➡️ Entry Point: 212.238

🎯 Take Profit: 214.249

🔴 Stop Loss: 210.874

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

BTCUSD: continuation of the fall🛠 Technical Analysis: BTC is trading below the 90K psychological zone after the recent pullback, with price compressing near the MA cluster (dynamic resistance). The rising support line and the 88,335 area act as the key “trigger” zone: a clean breakdown can open the way for a deeper correction. Nearest resistance is 92,193 . Key downside support/target zone is 80,820.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: 88335.83

🎯 Take Profit: 80820.02

🔴 Stop Loss: 92193.50

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

XAG/USD – A Market That Refuses to Go LowerThere is one thing that stands out very clearly on XAG/USD right now:

the market has absolutely no intention of moving lower.

The news flow is quiet, with no major shocks — and paradoxically, that is exactly what favors the BUY side. The Fed is not hawkish enough to choke precious metals, real yields are failing to create pressure , and defensive sentiment remains quietly present beneath the surface.

For silver, the narrative is even stronger than gold: it is both a safe-haven asset and an industrial metal. Capital inflows are not speculative hit-and-run trades — this is hold, push, and accumulate behavior.

Looking at the chart, price is clearly advancing within a clean and steep ascending channel. Every pullback is disciplined and controlled — p rice taps the lower trendline and immediately reacts upward. No panic, no aggressive sell-offs.

This is a textbook sign that smart money is in control, not a market driven by FOMO.

Ichimoku may only be playing a supporting role here — but it is an extremely reliable one. Price is firmly above the cloud, the cloud itself is sloping upward, and the distance between price and the cloud confirms that bullish momentum still has room to run. There are no signs of exhaustion or distribution at this stage.

The 112.7 zone is not a level to fear — it is a trend-validation boundary. As long as price holds above this area, every retracement should be viewed as an opportunity for the market to reload. And once momentum is fully rebuilt, a move toward 124.3 becomes a matter of time, not doubt.

The "Grinding" Bull—High Noise, Low EfficiencyUnlike the smooth Gold rally, Silver is struggling. The Neural Brain identifies a trend that is moving up but fighting heavy resistance every step of the way.

1. THE PHYSICS: Efficiency Score (0.05)

Status: Critical Inefficiency

The Data: For every $1 the price gains, it travels $20 in total path ($0.91 Net Move vs. $18.05 Total Noise).

The Meaning: The market is "churning." Buyers and sellers are in a violent tug-of-war. The price isn't gliding; it's clawing its way up.

2. THE MIND: Conviction (LOSING)

Status: Repelling Risk

Conviction: LOSING. The AI sees the chaotic volatility and determines the probability of a clean move is dropping.

Mode: FLAT (REPELLING). The system is mathematically rejecting new entries because the "Micro Action" is too messy.

3. THE STRATEGY: "HOLDING (Ignoring Noise)"

Status: Sit on Your Hands

Macro: Strong Bullish (Trend is up).

Micro: Noisy/Chop (Price action is messy).

Action: HOLD. The trend hasn't broken, so don't sell—but the "cost" of movement is too high to buy more. Wait for the Efficiency Score to recover (>0.30) before adding size.

Silver XAG/USD - Breakout + Retest Signals Upside Continuation📝 Description🔍 Setup (Market Structure) FX:XAGUSD

XAG/USD is forming a well-defined Triangle Breakout pattern on the M30 timeframe.

After a strong bullish move, price consolidated with lower highs and higher lows, compressing volatility — a classic sign of an upcoming expansion.

Price has now broken above the triangle resistance and is showing a healthy breakout & retest, supported by EMA and holding above the structure.

This favors a bullish continuation scenario.

📍 Support & Resistance

🟨 Support Zone: 104.70 – 106.00

🟢 1st Resistance: 123.90

🟢 2nd Resistance: 130.00 – 130.20

⚠️ Disclaimer

This analysis is for educational purposes only.

Commodities are volatile — always use proper risk management and position sizing.

💬 Support the Idea👍 Like if you’re bullish on Silver

💬 Comment: Clean breakout or fake move?🔁 Share with traders watching XAG/USD

#XAGUSD #Silver #CommodityTrading #TriangleBreakout #PriceAction #TechnicalAnalysis #TradingView #Kabhi_TA_Trading

#XAGUSD Silver – Monthly Chart (Higher Time Frame Analysis Updat📈 #XAGUSD Silver – Monthly Chart (Higher Time Frame Analysis Update)

On the monthly COMEX chart, Silver has reached a historically critical zone — a level it has touched only three times since its inception on the forex market ⚡️

### 🕰 Historical Context

1️⃣ 1980:

Silver made its first-ever major peak around $48, followed by a massive correction all the way down to $5.

2️⃣ April 2011:

The metal created another lifetime high at $49.80, but history repeated itself — price crashed sharply, touching lows near $11.50 in subsequent years.

3️⃣ October 2025 (Current Scenario):

Silver has now printed a new high at $51.20, marking its third attempt in history to sustain above the psychological barrier of $50.

---

### 🔍 Key Technical Outlook

Both previous times, Silver failed to sustain above $50, leading to deep corrections.

Hence, this time, we need to see at least 1–2 consecutive weekly candle closings above the $50–$51 zone to confirm a strong breakout and trend continuation.

Once that confirmation comes in, we could confidently plan fresh long entries, as this would signal a potential super-cycle rally in Silver 🔥

---

### 🎯 Upside Projections

If Silver manages to hold above $50 convincingly, the next major targets on a higher timeframe would be:

* First Target: $60

* Extended Target: $68

This move could potentially open the doors for a massive long-term bullish phase, supported by both technical breakout and global precious metal demand fundamentals 💎

XAUUSD: false breakout setup🛠 Technical Analysis: On the 4-hour timeframe, XAUUSD remains in a strong uptrend, but the price is currently squeezing below a clearly defined resistance band in the 5080-5100 region. A probable breakout above this zone could potentially form a "false breakout," trapping buyers before a corrective move begins. The key trigger is the rising trendline support: a confirmed break below it would confirm a bearish correction scenario. The price is still above the 50/100/200 SMA, but a loss of the trendline + SMA50 area will likely accelerate the downward momentum. The next important demand zone is near 4900. A sustained hold above the resistance zone (and especially above the 5184 area) would invalidate the sell signal and maintain the bullish trend.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell on a confirmed false breakout at 5,080–5,100 followed by a break below the rising trend support (approx. 5,050–5,070)

🎯 Take Profit: Support near 4,900

🔴 Stop Loss: 5,184

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.