USD/JPY Plunges: Intervention & Market AnalysisA multi-domain dissection of the Japanese Yen’s sudden resurgence and its global impact.

The Macroeconomic Shift: Hawkish Signals

The Japanese Yen (JPY) staged a dramatic recovery this week, surging 3.6% against the US Dollar in just two sessions. The catalyst was the Bank of Japan’s (BoJ) January 2026 policy meeting. While the BoJ held interest rates at 0.75%, the accompanying report was decidedly hawkish. The central bank raised inflation forecasts for fiscal 2026 and 2027, signaling a commitment to policy normalization. This shift creates a critical divergence: as the US Federal Reserve stabilizes, Japan is tightening, narrowing the interest rate differential that historically suppressed the yen.

Management and Leadership: A Break from Consensus

A significant cultural shift is occurring within Japan’s monetary leadership. The BoJ’s decision featured a rare 8-1 vote split, with one board member dissenting in favor of an immediate hike to 1.0%. This deviation from traditional Japanese corporate consensus culture signals a new era of aggressive policy debate. Furthermore, Prime Minister Sanae Takaichi has staked her political capital on stabilizing the currency, warning of "bold action" against abnormal movements. This alignment between political will and central bank policy empowers the Ministry of Finance to act decisively.

Geopolitics and Geostrategy: The Global Risk Matrix

Currency markets are reacting to a heightened geostrategic risk profile. The recent US escalation regarding Greenland and associated tariff threats have injected volatility into the Atlantic alliance, driving capital toward safe-haven assets. This follows earlier instability involving US-Venezuela relations. In times of acute geopolitical stress, the yen historically competes with the US Dollar and Swiss Franc as a refuge. The current "triple threat" of trade wars, military posturing, and monetary tightening is accelerating yen repatriation.

Technology and High-Frequency Trading

The mechanics of the recent move suggest algorithmic involvement. Reports indicate the Federal Reserve conducted "rate checks" inquiries into bank position sizes at the London close on Friday. In the world of high-frequency trading (HFT), this acts as a digital signal flare. Algorithms interpret these checks as a precursor to physical intervention, triggering cascading sell orders on USD/JPY. This highlights the cyber-sensitivity of modern FX markets, where regulatory signaling can execute market corrections faster than actual capital deployment.

Industry Trends and Patent Analysis

The volatility in USD/JPY critically impacts Japan’s high-tech export sector. Companies like Sony and Toyota rely on stable exchange rates to fund long-term R&D and patent filings. A rapidly strengthening yen squeezes repatriated profits, potentially forcing a contraction in innovation budgets. Patent analysis suggests that Japanese firms maintain a "defensive moat" of intellectual property; however, maintaining this advantage requires consistent capital flow. If the yen appreciates too rapidly, it risks eroding the profit margins that fuel Japan’s science and technology leadership.

Economics and Commodity Correlation

The currency shock has spilled over into commodity markets. Silver surged 6% to reach $110/oz, driven by the weaker dollar and the unwinding of the "carry trade." When the yen strengthens, global investors who borrowed cheaply in yen to buy assets like silver or stocks are forced to sell those assets to repay loans. This "unwind" creates a correlation where a stronger yen often leads to temporary liquidity shocks in other sectors, threatening the stability of equity markets like the Nikkei 225.

Future Outlook: The Intervention Cap

Goldman Sachs analysts argue that "intervention risk" now acts as a soft cap on USD/JPY upside. While the currency may technically warrant weakness based on fundamental fiscal risks, the threat of state action limits speculative shorting. Traders must now navigate a market where price discovery is driven not just by economics, but by the looming threat of coordinated government suppression.

Yen

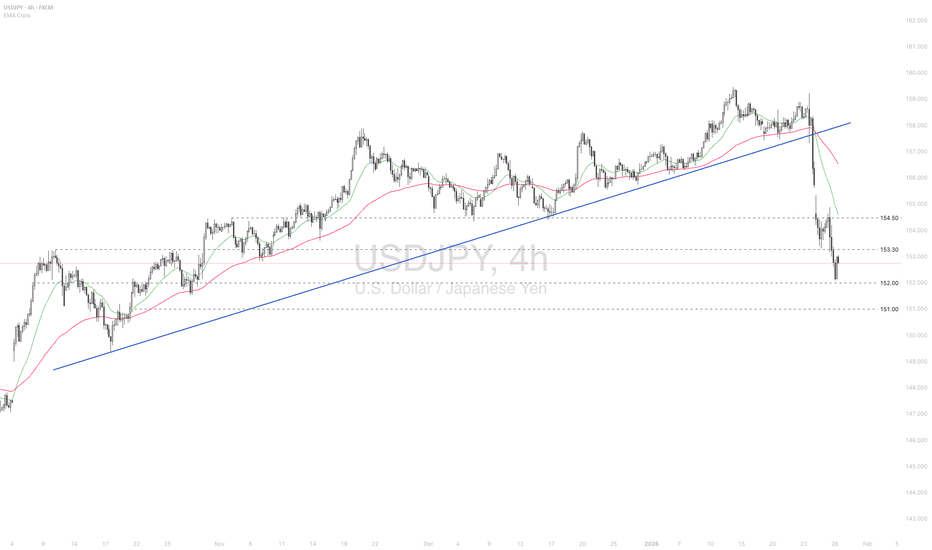

USDJPY - Where Trends Like to Reload!USDJPY remains overall bullish, and this pullback is doing exactly what strong trends usually do.

Price is now approaching a key confluence:

the rising trendline lining up perfectly with a former support zone.

As long as this trendline + support intersection holds, I’ll be looking for trend-following longs, not counter-trend trades. 🐂

A clean reaction here keeps the bullish structure intact and opens the door for continuation toward higher levels.

If support fails, the idea is invalid. Until then, the trend gets the benefit of the doubt.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

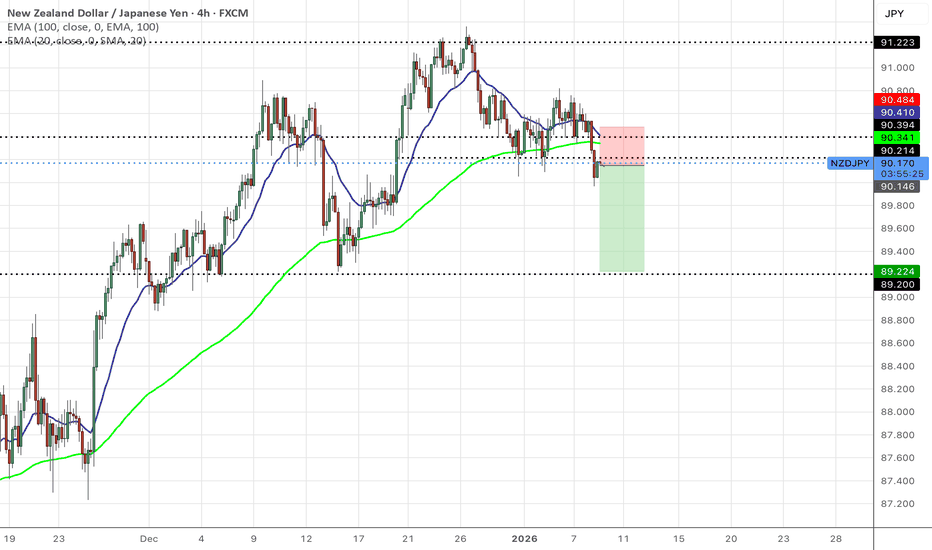

NZDJPY LONGS 0 NZD/JPY has been making higher highs and higher lows showing a clear uptrend for a number of months.

We can see after last weeks retracement the pair has found support at 91.6 zone - which is also in line with the 100MA on the four hour. This shows a strong level of supports where buyers are ready to re enter the market to push the pair higher hopefully to create its next swing high.

TP1 - 94.017

NZDJPY LONG CONTINUATION NZD/JPY has been making higher highs and higher lows showing a clear uptrend for a number of months.

We can see after last weeks retracement the pair has found support at 91.6 zone - which is also in line with the 100MA on the four hour. This shows a strong level of supports where buyers are ready to re enter the market to push the pair higher hopefully to create its next swing high.

TP1 - 94.017

LONG ON AUD/JPYThe Jpy Index pushed up on Friday but is now starting to retrace/pullback/correct or fall.

We have a nice choc (change of character) from down to up on AJ on the 15min timeframe.

I expect price to drop first to 106.392 then rise.

This is a buy limit order. I will be looking to catch 100-200 pips.

USDJPY slid on US uncertainty and Japan’s intervention risk< Fundamentals>

The dollar-yen continued to weaken amid speculation of intervention, weighing on sentiment.

Meanwhile, the BoJ Dec meeting minutes revealed that the board anticipates several rate hikes to reach the expected neutral rate, though the pace will remain gradual and data-dependent.

Concerns over intervention and the broader weakening of the US dollar remain to support the yen.

USDJPY breached above 154.50 but failed to hold above the level and fell below 153.30. Diverging bearish EMAs indicate a downtrend extension potential. If USDJPY breaks below 152.00, the price may retreat further toward the next support at 151.00. Conversely, returning above 153.30 may lead to an advance toward the subsequent resistance at 154.50.

CHFJPY LONGS - NEXT LEG UPCHF/JPY has been making higher highs and higher lows showing a clear uptrend for a number of months.

We can see after last weeks retracement the pair has found support at 198.480 zone - which is also in line with the 100MA on the four hour. This shows a strong level of supports where buyers are ready to re enter the market to push the pair higher hopefully to create its next swing high.

TP1 - 201.020

Gold at $5k? RSI divergence vs. breakout – which comes first?Gold is just $30 away from the historic $5,000 level, and silver is approaching $100 for the first time ever. But before you chase the breakout, we need to talk about the RSI divergence flashing on multiple timeframes and what it means for the next move.

In this video, we analyse the technical setup as gold approaches the most critical resistance level of this bull run. We explain why the "no safe haven" thesis—with the dollar collapsing on Greenland tensions and the yen crashing past 158 after the BOJ decision—is flooding capital into precious metals. But we also map out the warning signs that suggest $5K could trigger heavy profit-taking.

Key topics :

Measured move complete : The corrective leg projects to 4,930, which we just hit. Similarly, the Elliott Wave net distance (Waves 1-4) also targets the same level—two confluences at resistance.

Accelerated channel : Gold is trading in a parabolic, accelerated channel. As long as we hold 4,680 (61.8% Fib on daily) and 4,770 (61.8% Fib on 4H), the bias remains bullish.

RSI divergence : Weekly, daily, and 4-hour charts all show bearish divergence. Price is making new highs, but momentum is not confirming—classic topping behaviour.

The $5K test : Next upside targets are 5,012, 5,100, and 5,200. But $5K might be where sell orders are stacked. A failure here could trigger a sharp correction to 4,770-4,800.

Risky counter-trend Play : For the brave, a short at $5K with a stop at $5,050 and a target at $4,770 (61.8% support). But remember: "The trend is your friend."

Are you buying the dip or fading the $5K level? Let us know in the comments!

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Persistent yen weakness is lifting USDJPY

The yen continues to trade on a structurally weak footing as Japan’s persistently accommodative monetary stance contrasts with growing skepticism over further Fed rate cuts. Japan’s Katayama voiced concern over the one-sided depreciation of the yen, stressing that US Treasury Secretary Bessent expressed similar concerns following bilateral discussions.

Today’s US inflation data will have a direct impact on the dollar’s valuation and could drive heightened volatility in the yen.

USDJPY surged sharply, breaking above 159.00. Diverging bullish EMAs indicate a potential extension of the uptrend. If USDJPY closes above 159.00, the price may advance toward 159.50. Conversely, if USDJPY breaks below 159.00, the price could decline further toward 158.50.

USDJPY eyes 160 as Japan politics crushes yen ahead of US CPI!USDJPY is currently breaking out towards the 160 psychological handle, with an inverse head-and-shoulders on the monthly chart seeing further long-term upside just hours before the US CPI comes out. The big trader question: Why is the yen collapsing even as the US dollar faces its own crisis?

We analyse the rare divergence driving this pair: Japan's political chaos, with snap election risks threatening aggressive "Sanaenomics", is overpowering US dollar weakness caused by the Powell investigation. We then zoom in to the daily chart to reveal a triangle pattern that suggests this rally could target 165 and even 175+ in the long term.

Key drivers

Japan political risk : Prime Minister Takaichi's potential snap election and fiscal expansion plans are terrifying investors, causing capital flight from the yen despite 10-year yields hitting 27-year highs.

US dollar crisis : The greenback is struggling due to the criminal inquiry into Fed Chair Powell, yet USDJPY rises because the yen is the weakest link.

CPI catalyst : Today's US inflation data is the immediate trigger. A hot print could confirm the breakout above 160, while a miss might create the perfect buy-the-dip scenario if Japanese investors continue to exit.

Technical breakdown

5-month rally : This is the 5th consecutive month of gains, accelerating toward the 160 level.

Double top break : We are breaking the January 2025 high at 158.90. Above this, we have clear air to the July 2024 cycle high at 161.90.

Long-term iH&S : A potential massive inverse head and shoulders suggests a measured move much higher.

Targets : 162.00 (cycle high), 165.66 (78.6% Fib), and 176.50 (major extension).

Are you buying the breakout to 162 or waiting for a CPI pullback? Let us know in the comments!

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

CHFJPY - Pullback Into a Key Confluence!CHFJPY has been overall bullish , respecting the rising blue channel nicely over the past weeks.

Right now, price is pulling back into an important intersection:

the demand zone lining up with the lower blue trendline.

This is the kind of area where trends usually get tested, not broken.

As long as this confluence zone (highlighted by the blue circle) continues to hold, my bias remains straightforward:

I’ll be looking for trend-following long setups, preferably after confirmation on lower timeframes.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

EUR/JPY to 185.00 next?With the USD/JPY breaking out today, it’s also worth keeping an eye on other yen crosses, and chief among them is EUR/JPY. This pair continues to print bullish price action and has recently been consolidating within what looks like a bull flag pattern. Today, it appears the bulls are back, and we could potentially see a break above the resistance trendline of this pattern.

If that happens, the next upside target would be the liquidity resting above the most recent high, which was made at 184.92. Beyond that, the 185.00 handle is the next key level to watch.

In terms of support, the area around 183.00 is quite important, given that this zone previously acted as resistance. We broke above it during the rally, and after a retest, the level has held so far.

By Fawad Razaqzada, market analyst with FOREX.com

The Yen Conundrum / USDJPY/ Carry trade / Educational Where to start. This is mainly for the traders who partook in a short position is USDJPY during the week of the the USD rate cut and the JPY rate hike.

I am here to try to answer the question the obvious question.

Quick back round on me. Trading for 7+ years. 3+ years profitable.

I am going to try to keep this simple.

Why did USD/JPY go up on BOJ rate hike?

USD RATE CUT/ 3.50%

USD INFLATION/ 3%

REAL USD INTEREST RATE 0.5%

Now very important, USD inflation was 3%, the interest rate has been and is still above the inflation rate.

JPY RATE HIKE/ +0.75%

JPY INFLATION/ 3%

REAL JPY INTEREST RATE NEGATIVE 2.25%.

They could hike a little more but prefer not too because chances of causing a fiscal crisis is high.

There is no confidence here in what they are doing, interest rates still favor the dollar enough to earn, Why would it strengthen

The elephant in the room, Structure of flow

Okay for starters, The carry trade. Sell yen buy other things and collect that gooey interest in-between.

Lets go bigger. Your in charge of a Japanese pension fund, You have billions to invest. Nothing is safe in your country, Nothing has any kind of real yield. They invest abroad.

Imports/exports

Exporters Love it, They import mostly energy and food.

Every time they buy energy... you guessed it, they sell yen/ buy dollar to pay for their energy.

Could it fall, Could it revert? Could the carry trade unwind?

Yes, But for now the macro flows are against you.

Any thing anyone wants to add is the comment section below is welcomed!

Happy trading and happy new year!

USD/JPY: The Yen Regains Strength At present, USD/JPY has posted a streak of three consecutive bearish sessions, recording a short-term decline of more than 1.3%, as a consistent selling bias has begun to dominate year-end price action. For now, selling pressure has remained firm, as markets are increasingly pricing in expectations that the Bank of Japan could continue with a series of interest rate hikes heading into 2026. This outlook has helped keep Japanese bond yields at attractive levels, supporting steady demand for the yen in the short term. As long as confidence around higher rates in Japan during the first part of 2026 remains in place, selling pressure in USD/JPY is likely to continue shaping price movements over the coming trading sessions.

The Aggressive Trend Begins to Weaken

Since the early days of October, USD/JPY had managed to sustain an aggressive bullish trend. However, recent price action has started to reflect growing weakness, in line with the yen’s short-term strengthening. This has prevented the trendline from posting new highs consistently, highlighting an emerging neutral tone in price behavior. If this dynamic persists, it could place the prevailing bullish trendline—still the most relevant technical structure on the chart—at risk. Should buying pressure fail to hold, price action could give way to a short-term consolidation range, marked by persistent indecision.

Indicators

At the moment, both the RSI and the MACD are oscillating close to their respective neutral levels of 50 and 0. This suggests that indecision is building both in the average momentum of the past 14 sessions and in short-term moving average strength. If this behavior continues across both indicators, it could reinforce a more pronounced neutral phase, favoring the development of a short-term sideways range in USD/JPY price action.

Key Levels to Watch:

158.89 – Key resistance: This level corresponds to the 2025 highs and stands out as the most relevant bullish barrier to monitor. Bullish moves that manage to break above this zone could revive a stronger buying bias and open the door to an extension of the aggressive uptrend.

157.48 – Nearby barrier: A level aligned with recent highs that could act as a short-term equilibrium point. Price action holding around this area may amplify market indecision and support the formation of a more defined sideways range.

154.51 – Major support: This level aligns with the 50-period simple moving average. Bearish moves that break below this zone could put the aggressive bullish trendline at risk and open the door to a dominant bearish bias toward the close of 2025 for USD/JPY.

Written by Julian Pineda, CFA, CMT – Market Analyst

Forget the Textbook: A 30-Year Reality CheckA Big Policy Moment

A central bank (BOJ) just pushed interest rates to levels not seen in 30 years.

That’s not a routine tweak — that’s a regime shift.

Textbooks might suggest a clean, logical market response.

Reality? Markets got emotional. Fast.

Selling Got Loud

Instead of an orderly adjustment, selling pressure exploded.

Not just “price going down,” but effort going through the roof.

That’s where Volume Delta comes in — the net difference between buying and selling volume. It tells us who is pressing the gas pedal.

And in this case, sellers floored it.

When an Indicator Starts Yelling

Now here’s the interesting part.

Bollinger Bands weren’t applied to price…

They were applied to Volume Delta itself.

Result?

Volume Delta plunged far below its lower Bollinger Band.

That’s not normal selling.

That’s everyone trying to get out at the same time.

Does that mean price must reverse?

Nope. But it does suggest selling is becoming inefficient.

No Safety Net Below

Here’s the catch.

There are no meaningful UFO supports (UnFilled Orders) below current price.

No obvious institutional “safety net.”

Instead, only two old technical floors remain:

0.0063330

0.0062415

Think of them as floors, not trampolines. Price may react… or punch straight through.

Reaction Beats Guessing

This is where patience matters.

Extreme selling doesn’t mean “buy now.”

It means watch closely.

At those levels, traders are looking for:

Selling pressure slowing down

Price stabilizing

Daily closes showing acceptance or rejection

No assumptions. Only reactions.

Don’t Forget the Ceiling

Even if price bounces, there’s a ceiling waiting above.

A clear sell-side UFO resistance sits near 0.0065640.

That’s leftover supply — the kind that often stops rallies in their tracks.

So any upside move?

Treat it as corrective until structure says otherwise.

Contract Specs

This analysis uses both standard and micro futures to illustrate scalable risk. Japanese Yen Futures (6J) have a tick size of 0.0000005 with a $6.25 tick value and currently require roughly ~$2,800 in margin per contract, while Micro JPY/USD Futures (MJY) use a 0.000001 tick size with a $1.25 tick value and margin closer to ~$280. Margin requirements vary by market conditions and broker policies, and micro contracts can be especially useful when volatility expands following major macro events.

The Big Takeaway

Historic policy decisions don’t end stories — they start messy chapters.

Extreme Volume Delta shows stress, not certainty.

Structure decides what comes next.

When markets digest big shocks, the edge doesn’t come from predicting —

It comes from staying disciplined while everyone else reacts.

Want More Depth?

If you’d like to go deeper into the building blocks of trading, check out our From Mystery to Mastery trilogy, three cornerstone articles that complement this one:

🔗 From Mystery to Mastery: Trading Essentials

🔗 From Mystery to Mastery: Futures Explained

🔗 From Mystery to Mastery: Options Explained

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.