CORN → Bullish Bias Above Key Moving Averages🌽⚡ CORN CFD | High Voltage Breakout Strategy 📊 (Day/Swing Setup)

🎯 TRADE PLAN OVERVIEW

Asset: CORN Futures/CFD (ZC) - Agricultural Commodities Market

Bias: 🐂 BULLISH MOMENTUM ACTIVATED - Multiple MA rejections + pullback structure locked in

Strategy Type: Thief's Multi-Layer Limit Entry System 🥷💰

📍 ENTRY ZONES - THIEF'S STEALTH LADDER METHOD

💎 YOU CAN ENTER AT ANY PRICE LEVEL - But the Thief plays it SMART with layered limits:

Layer 1: 432.00 🎯 (First steal)

Layer 2: 434.00 🎯 (Second steal)

Layer 3: 436.00 🎯 (Third steal)

Layer 4: 438.00 🎯 (Final steal)

This is the THIEF'S STRATEGY METHOD OF ENTRY - Dollar Cost Average like a pro, accumulate on dips, maximize the ride! 🌊💸

⚡ TAKE PROFIT TARGET

TP @ 447.00 🚀🔥

Why this level? HIGH VOLTAGE ELECTRIC SHOCK WALL acting as brutal resistance ⚡🧱 + Overbought zone + Bull trap territory + Correction magnet! Escape with your profits before the shock hits! 💰✨

⚠️ IMPORTANT NOTE: Dear Ladies & Gentlemen (Thief OG's) - I am NOT recommending you set only my TP. It's YOUR choice! You can make money, then take YOUR money at YOUR own risk! Scale out, trail it, or ride - YOU decide! 🎲🔥

🛑 STOP LOSS

Thief's SL @ 430.00 ❌🚨

Clean invalidation below structure support. This is the "game over" line if price breaks below.

⚠️ IMPORTANT NOTE: Dear Ladies & Gentlemen (Thief OG's) - I am NOT recommending you set only my SL. It's YOUR choice! You can make money, then take YOUR money at YOUR own risk! Adjust according to YOUR account size and risk appetite! 🧭💪

🔗 CORRELATED PAIRS TO WATCH 👀

These instruments move together - watch them for confluence signals! 🧬📈

Agricultural Sector:

AMEX:WEAT (Wheat Futures) 🌾 - Direct grain sector correlation | When wheat pumps, corn often follows

AMEX:SOYB (Soybeans) 🫘 - Rotation flows between crops | Farmers switch planting based on prices

AMEX:DBA (Agriculture ETF) 🚜 - Broad sector sentiment barometer | Overall ag market health check

Macro Drivers:

DXY (US Dollar Index) 💵 - INVERSE correlation | Weak dollar = stronger commodity prices (exports cheaper)

NYSE:CL (Crude Oil) 🛢️ - Energy costs impact farming/production | Lower oil = cheaper fertilizer & transport

AMEX:NG (Natural Gas) 🔥 - Fertilizer production costs | Lower gas = better farmer margins

🔑 Key Correlation Play: When DXY drops + Energy stabilizes = 🚀 BULLISH rocket fuel for ag commodities!

📰 FUNDAMENTAL & ECONOMIC FACTORS (Real-Time Analysis)

🌍 Current Market Drivers:

✅ Weather Conditions - U.S. Corn Belt weather patterns critical (drought/flooding = supply shock potential) 🌦️

✅ USD Weakness - Recent dollar softness making U.S. grain exports more competitive on global market 💵📉

✅ China Demand - World's largest grain importer - watch Chinese purchase data closely 🇨🇳

✅ Ethanol Production - ~40% of U.S. corn → ethanol fuel | Crude oil prices directly impact demand ⛽

✅ Fertilizer Costs - Natural gas prices affect production costs (lower = bullish margins) 🌱

✅ Global Food Security - Geopolitical tensions driving strategic grain stockpiling 🌍

📅 Upcoming Economic Events to Monitor:

🔥 USDA Monthly Crop Reports - Supply/demand estimates (MASSIVE market mover!)

🔥 Weekly Export Sales Data - Released every Thursday (shows global demand strength)

🔥 WASDE Report (World Agricultural Supply & Demand) - Major volatility trigger

🔥 Fed Interest Rate Decisions - Impacts dollar strength & commodity capital flows

🔥 EIA Ethanol Production Reports - Shows corn-to-fuel conversion demand

🔥 NOAA Weather Forecasts - Critical for growing season outlook

📊 Current Macro Setup: Moderating inflation + potential Fed pivot + weak dollar environment = favorable conditions for commodity rally! 🎯

THIEF TRADER STYLE - WISHES & MOTIVATION 💎

"The market doesn't reward the greedy, it rewards the strategic. Layer in, scale out, live to trade another day." 🧠💰

📈 TRADE SMART, TRADE SAFE, TRADE LIKE A THIEF!

Drop a 🚀 if you're riding this CORN rocket with me!

Drop a 💎 if you're layering in like a PRO!

Drop a ⚡ if you're ready for that high voltage resistance battle!

Let's get this GRAIN! 🌽🔥

Corn

Corn CFD Outlook: Institutional Breakout Setup Explained🌽 CORN VS DOLLAR: BULLISH MOMENTUM CONFIRMED | Swing/Day Trade Opportunity

📊 MARKET OVERVIEW

Asset: CORN Futures (ZCH26) / USD

Current Price: $446.40 (Dec 23, 2025)

Market Status: ✅ Simple Moving Average Breakout Confirmed

Trade Type: Swing / Day Trade

Signal: 🟢 BULLISH SETUP ACTIVE

🎯 TRADE PLAN: "THIEF STRATEGY"

Entry Strategy - Layered Limit Orders (Multiple Entry Points)

The "Thief Strategy" uses multiple limit buy orders to average into positions at different price levels:

Suggested Layer Entries:

🔹 Layer 1: $444 (Current support zone)

🔹 Layer 2: $446 (Mid-range entry)

🔹 Layer 3: $448 (Breakout confirmation)

Note: You can increase/decrease layers based on your capital allocation and risk tolerance

Alternative: ✅ ANY PRICE LEVEL ENTRY - Current market allows flexible entry as breakout is confirmed

🛡️ RISK MANAGEMENT

Stop Loss (SL):

Thief OG's SL: $442

⚠️ IMPORTANT DISCLAIMER: Dear Traders (Thief OG's) - I am NOT recommending you set only my SL. This is YOUR trade, adjust your stop loss based on YOUR strategy, risk tolerance, and account size. Trade at your own risk.

💰 PROFIT TARGETS

Primary Target:

Target Price: $458

Rationale: Simple Moving Average acts as a strong resistance level (police barricade). Potential overbought conditions + trap formations suggest TAKE PROFITS at this level.

⚠️ IMPORTANT DISCLAIMER: Dear Traders (Thief OG's) - I am NOT recommending you set only my TP. Take profits at YOUR own discretion based on your trading plan. Make money, secure money at YOUR OWN RISK.

📈 CORRELATED PAIRS TO WATCH

Agricultural Complex:

ZW (Wheat) - Current: $514.38 (+1.06%) ↗️

Grains correlation - watch for sector strength

ZS (Soybeans) - Current: $1,053.55 ↘️

Inverse correlation - weakness supports corn demand

ZO (Oats) - Monitor for broader grain sentiment

Dollar Index:

DXY (US Dollar Index) - Current: 97.93 ↘️

KEY INVERSE CORRELATION: Weaker dollar = bullish for commodities

Dollar at October 2025 lows supports corn rally

Energy:

CL (Crude Oil) - Watch ethanol production correlation

🌍 FUNDAMENTAL FACTORS (LATEST)

✅ BULLISH CATALYSTS:

1. Supply-Demand Dynamics (USDA WASDE Dec 2025):

📉 US corn ending stocks reduced to 2.029 billion bushels (-125 million bushels)

📈 Exports raised to 3.2 billion bushels (RECORD HIGH)

✅ Strong export pace exceeding 2024 records

2. Export Demand Surge:

US export sales reaching record levels to Mexico, Colombia and other buyers

Outstanding US sales and inspections pointing to faster shipments

Recent sales: 186,000 MT to unknown destinations

3. Ethanol Production at ALL-TIME HIGHS:

US ethanol output rose to record weekly levels

Increased feedstock demand tightening available supplies

4. Dollar Weakness:

DXY fell to 97.93 on December 23, 2025, down 9.49% over the last 12 months

Weaker USD makes US corn more competitive globally

5. Supply Chain Issues:

Ukrainian shipments running below a year ago because of harvest and logistical delays

Prompt physical supplies tightened outside the US

6. Brazilian Factors:

Brazilian sellers withholding inventory focusing on planting

Creates near-term supply gaps favoring US exports

⚠️ RISK FACTORS TO MONITOR:

1. Federal Reserve Policy:

Markets pricing in two quarter-point rate reductions in 2026

Affects dollar direction and commodity flows

2. China Purchase Commitments:

Monitor China's soybean purchases (affects corn indirectly)

Trade policy uncertainty with new administration

3. South American Weather:

Brazilian corn planting 97% complete

Watch for production updates (Jan 2026 WASDE)

4. Technical Resistance:

Price approaching June 2025 highs around $450

Strong resistance zone requires momentum confirmation

📊 UPCOMING ECONOMIC EVENTS TO WATCH:

USDA WASDE Report - January 12, 2026 ⭐

Weekly Export Sales - Every Thursday

CFTC Commitment of Traders - Weekly Friday releases

Fed Policy Decisions - Monitor rate cut timing

Brazilian Crop Progress - Ongoing through Q1 2026

💡 TRADING STRATEGY SUMMARY:

✅ Setup Type: Bullish SMA breakout with fundamental support

✅ Entry Method: Layered limit orders OR current market price

✅ Risk/Reward: Favorable with tight stop vs. extended target

✅ Timeframe: Swing trade (multi-day) or day trade (intraday moves)

✅ Confirmation: Export data + dollar weakness + supply tightening

⚠️ FINAL DISCLAIMER:

This analysis is for educational purposes only. I am NOT providing financial advice or recommendations. Every trader must:

✅ Conduct their own due diligence

✅ Use proper position sizing for their account

✅ Set stop losses based on their risk tolerance

✅ Take profits according to their trading plan

✅ TRADE AT YOUR OWN RISK

Past performance does not guarantee future results.

🔔 ENGAGEMENT:

👍 LIKE if you found this analysis helpful!

💬 COMMENT your thoughts and trade setups below

📊 FOLLOW for more commodity market analysis

Let's make profitable trades together, Thief OG's! 🚀

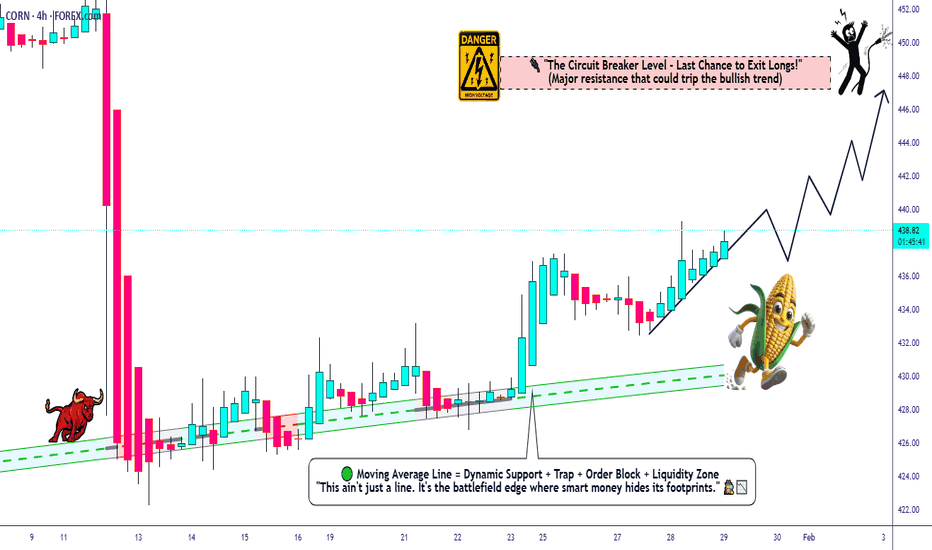

CORN Bulls in Control? Retest Pullback Confirms Trend Bias🌽 CORN Institutional Edge Plan (Swing/Day Trade Setup)

🔍 Market Context

CORN (CFD on US Corn Futures) is showing signs of bullish momentum after testing a key resistance area. Institutional order flow hints at accumulation in the mid-420s region — a potential pullback zone before continuation higher.

🧭 Thief Strategy Plan — Layered Entries

This setup follows the “Thief Strategy”, a layered entry approach using multiple buy limit orders to capture volatility and improve average entry cost.

📈 Layered Buy Zones:

1️⃣ 428

2️⃣ 430

3️⃣ 432

(Traders may extend layers based on risk appetite and confirmation signals.)

🛑 Protective Stop (Thief SL): Around 424

🎯 Profit Zone (Thief TP): Around 445

🧠 Plan Insight

Expecting a resistance retest pullback to confirm the bullish structure.

Momentum aligns with higher-timeframe bias after institutional demand emerged near 420s.

Targets align with overbought resistance and prior liquidity traps — best to secure profits and protect gains as price nears 445.

💡 Note: Each trader should manage risk independently. This setup is educational only — showing how to structure a layered “Thief-style” plan, not a recommendation to buy/sell.

🔗 Correlated Assets to Watch

OANDA:WHEATUSD – Often mirrors agricultural flow shifts.

$SOYBEANUSD – Moves inversely at times; watch for divergence.

TVC:DXY – A stronger dollar can pressure commodity prices.

OANDA:SPX500USD – Risk appetite correlation; strong equities can support commodity demand.

🕵️♂️ Thief’s Key Notes

Dear Ladies & Gentlemen (Thief OG’s) — this plan shows how I structure entries, not where you should trade.

You can make money — then take money — at your own risk.

Manage your own stop-loss, target, and position sizing like a pro.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

📜 Disclaimer:

This is a Thief-style trading strategy created just for fun and educational purposes.

Not financial advice. Trade responsibly.

#CORN #Commodities #Futures #InstitutionalTrading #SwingTrade #DayTrading #LayeredEntries #ThiefStrategy #SmartMoney #PriceAction #CommodityMarket #Agriculture #DXY #WHEAT #SOYBEAN #TradingView #ThiefTrader

Corn Agro Market Strategy Map – Bullish Path Ahead!🚜🌽 CORN Agro Commodities Wealth Strategy Map (Swing/Day Trade)

📌 Plan: Bullish (Swing + Day Trade Setup)

✅ Market sentiment favors bullish bias in CORN.

🎯 Swing/Day traders can look for upside continuation until resistance zones.

🎯 Entry Plan (Layering Style Method)

🔑 You can enter at any price, but pullbacks are safer.

Layered Buy Limit Orders (multi-entry strategy):

🟢 417

🟢 420

🟢 422

🟢 425

🟢 427

📌 You can extend or add more layers depending on your personal risk appetite.

🛡️ Stop Loss (Protective Exit)

🚨 Thief SL is placed at 415.

📝 Note: This is my personal style. You can set your own SL depending on your strategy & risk comfort.

🎯 Target Levels (Profit Booking)

🏁 447 → Suggested take-profit zone.

🚔 450 = “Police Barricade” → Acts as a strong resistance + potential trap + overbought zone.

💡 Best practice: Exit at 447 before the heavy resistance wall to lock in profits.

🗣️ Important Note for Readers (Thief OG’s 🕶️)

🙏 This is not financial advice.

⚡ You are free to set your own TP/SL.

📌 I share my strategy map — you manage your own risk.

🏦 Market is open to everyone → take profits in your own style, at your own risk.

🔍 Key Insights & Market Correlations

🌾 Agro Commodity Correlations:

CORN often moves in relation to CAPITALCOM:WHEAT and $SOYBEAN.

Soft commodities like PEPPERSTONE:COFFEE can also reflect agro market sentiment.

💵 Currency Link (Dollar Impact):

TVC:DXY (US Dollar Index) plays a key role.

Stronger dollar = bearish pressure on commodities.

📈 Indices & Risk Sentiment:

Global equities ( CAPITALCOM:US30 , SP:SPX , NASDAQ:NDX ) indirectly influence commodities via sentiment.

⚡ Energy Connection:

NSE:OIL & FX:NGAS affect input costs → higher energy = higher agro costs.

Farmers & supply chains react, impacting commodity pricing.

📊 Related Pairs to Watch

🌽 CAPITALCOM:CORN

🌾 CAPITALCOM:WHEAT

CAPITALCOM:SOYBEAN

☕ PEPPERSTONE:COFFEE

🛢️ NSE:OIL

💵 TVC:DXY

📊 CAPITALCOM:US30 / SP:SPX / NASDAQ:NDX

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

⚠️ Disclaimer: This is a thief-style trading strategy, designed for fun and community sharing. Not financial advice. Please trade responsibly and at your own risk.

#CORN #AgroCommodities #SwingTrade #DayTrading #TradingStrategy #LayeringStrategy #MarketAnalysis #WHEAT #SOYBEAN #COFFEE #DXY #US30 #SPX #Commodities

CORN Setup: Is This The Bullish Breakout We've Been Waiting For?🌽 CORN CFD | Money Heist Plan 🎭 (Swing / Day Trade)

🔑 Trading Plan (Thief Style Strategy)

Entry (Breakout Trigger): 📈 406.00 — when candle breaks ATR resistance, bullish plan activates.

Layering Entries (Thief Method):

Buy Limit Layers: 400.0 | 402.0 | 405.0 | 407.0 | 410.0 (flexible — adjust/add more based on breakout confirmation).

Layering helps manage entries & average position smartly.

Stop Loss (Thief’s Safety Lock): @ 395.00 🛑 after breakout trigger.

⚠️ Adjust SL based on your own risk tolerance.

Target (Escape Point): 🎯 421.00

Resistance zone + overbought condition = “police barricade” (take profits before getting trapped).

🌍 Why This Plan? | Thief Technical + Macro/Fundamental Mix

📊 Technical Edge

ATR breakout level at 406.00 ⚡

Momentum build-up near resistance, potential squeeze if volume spikes.

Layered entries provide risk-managed exposure.

🌽 CORN Market Data (10 Sep 2025)

Daily Change: -1.05% 🔴

Monthly Performance: +3.13% 🟢

Yearly Performance: -1.90% 🔴

👥 Investor Sentiment

Retail: 45% Long 😊 | 55% Short 😟 (slightly bearish bias).

Institutions: Net short 91,487 contracts 🏦 (hedging against oversupply).

😨 Fear & Greed Index

Score: 51/100 (Neutral 😐)

Balance between fear (supply risks) vs greed (demand resilience).

📉 Fundamentals & Macro Score

Supply Side

Record US production: 16.7B bushels 🟢

Brazil’s harvest adds oversupply pressure 🔴

Crop diseases (Tar Spot & Southern Rust) hurting yields 🔴

Demand Side

Exports YTD: +46.8% 🌍

Ethanol production: 1.105M barrels/day ⛽ (+30k WoW) 🟢

Tariff risks (China/Mexico) could slow trade 🔴

Macro Score: 6/10 → Moderately Bullish

🎯 Market Outlook Summary

Bull Case (Long) ✅

Strong exports (+28.6% YTD)

Biofuel/ethanol demand supporting floor

Technical rebound chances

Bear Case (Short) ❌

Record harvests (US/Brazil/Ukraine) = oversupply

Institutions scaling up shorts

Global glut risks

📌 Outlook Bias: Bearish-to-Neutral 🐻⚖️

Short-term pressure from supply glut, but demand stabilizes downside.

📌 Key Takeaways for Traders

Breakout Watch: 406.00 🚨

Layered Entry: Manage risk via staggered buys.

Target Zone: 421.00 (book profits before trap).

Macro Mix: Demand solid but supply risks dominate.

Watch List: CAPITALCOM:CORN , CBOT:ZS1! (Soybeans), CBOT:ZW1! (Wheat), CBOT:ZC1! (Corn Futures)

🔗 Pairs to Watch (in USD)

AMEX:SOYB (Soybeans CFD): Moves in lockstep with CORN due to shared ag trends.

AMEX:WEAT (Wheat CFD): Grains often trend together—keep an eye out!

TVC:USOIL : Influences ethanol demand, impacting CORN indirectly.

TVC:DXY (US Dollar Index): A rising USD could pressure commodity prices.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#CORN #Commodities #SwingTrade #DayTrade #ThiefStrategy #MoneyHeistPlan #Futures #LayeringStrategy #BreakoutTrading #Agriculture #Ethanol #TradingCommunity

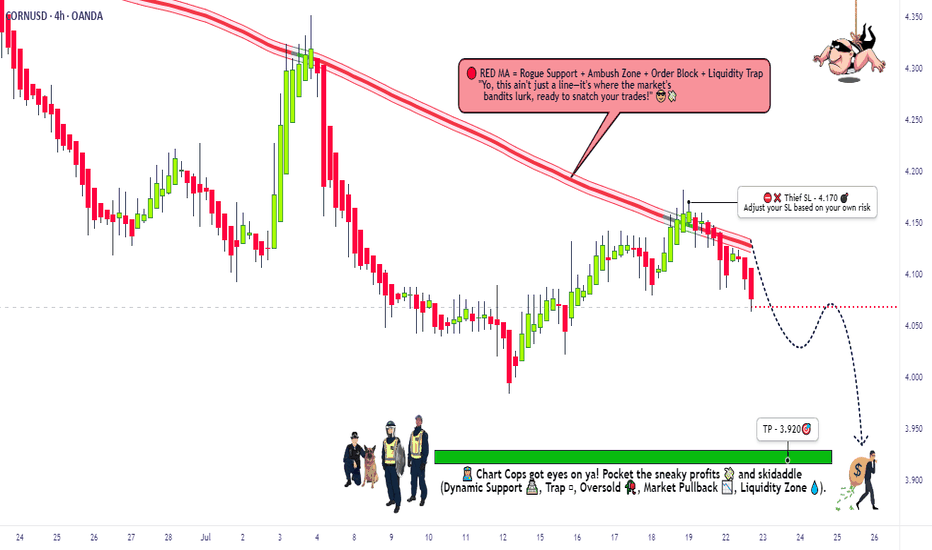

CORN Heist: Steal Short Profits Before Bulls React!🚨 CORN HEIST ALERT: Bearish Raid Ahead! 🚨 Swipe the Loot Before Cops Arrive! 🌽🔻

🌟 Attention, Market Bandits & Profit Pirates! 🌟

🔥 Thief Trading Intel Report 🔥

The 🌽 CORN CFD market is setting up for a bearish heist—time to short-swipe the loot before the bulls rally their defenses! Police barricade (resistance) is holding strong, but oversold conditions + consolidation hint at a trend reversal trap. High-risk, high-reward—just how we like it!

🎯 Heist Strategy (Swing/Day Trade)

Entry (Bearish Raid) 🏴☠️

"Vault’s unlocked! Swipe shorts at any price—OR set sell limits *near 15M/30M pullbacks for a cleaner steal!"*

Stop Loss (Escape Route) 🛑

Thief’s SL at nearest 4H swing high (4.170)—adjust based on your risk tolerance & lot size.

Pro Tip: Tighten SL if trading multiple orders!

Target (Profit Escape) 🎯

3.920 (or bail early if cops (bulls) show up!)

🌽 Market Snapshot: Why CORN is Ripe for a Raid

Neutral trend leaning bearish—consolidation breakout likely!

Key Drivers:

Macro pressure (USD strength, crop reports)

COT data hinting at big players positioning short

Seasonal trends favoring downside

Want full intel? 🔍 Check COT reports & intermarket analysis!

🚨 Trading Alerts (Avoid the Cops!)

News = Volatility Trap! 📰🚔

Avoid new trades during high-impact news.

Trailing stops to lock profits on running heists!

💥 Boost This Heist! 💥

"Like & boost this idea to fuel our next raid! More steals = more profits for the gang! 🏴☠️💰

Stay tuned—another heist drops soon! 🚀🤝

CORN; Heikin Ashi Trade Idea📈 Hey Traders!

Here’s a fresh outlook from my trading desk. If you’ve been following me for a while, you already know my approach:

🧩 I trade Supply & Demand zones using Heikin Ashi chart on the 4H timeframe.

🧠 I keep it mechanical and clean — no messy charts, no guessing games.

❌ No trendlines, no fixed sessions, no patterns, no indicator overload.

❌ No overanalyzing market structure or imbalances.

❌ No scalping, and no need to be glued to the screen.

✅ I trade exclusively with limit orders, so it’s more of a set-and-forget style.

✅ This means more freedom, less screen time, and a focus on quality setups.

✅ Just a simplified, structured plan and a calm mindset.

💬 Let’s Talk:

💡Do you trade supply & demand too ?

💡What’s your go-to timeframe ?

💡Ever tried Heikin Ashi ?

📩 Got questions about my strategy or setup? Drop them below — ask me anything, I’m here to share.

Let’s grow together and keep it simple. 👊

THE GREAT CORN GRAB! (Bearish CFD Heist)🌽 THE CORN HEIST: Bearish Raid Plan (Swing/Day Trade) 🚨💰

🌟 Attention, Market Robbers & Money Makers! 🌟

(Hola! Oi! Bonjour! Hallo! Marhaba!)

🔥 Based on the ruthless Thief Trading Style (TA + FA), we’re plotting a bearish heist on the CORN Commodities CFD Market! Time to short like a bandit and escape with profits before the bulls catch us! 🏴☠️💸

🎯 MASTER HEIST PLAN (BEARISH RAID)

Entry Point (Sell Limit / Market):

"The vault is open—swipe the bearish loot at any price!"

🔹 *For safer heists, set sell limits near pullbacks (15M/30M).*

Stop Loss (Escape Route):

📌 Thief SL at nearest swing high (1D timeframe) – 4.4000

📌 Adjust SL based on risk, lot size, & multiple orders.

Profit Target (Escape Before Cops Arrive):

🎯 4.1000 (or exit early if the trap snaps shut!)

🌽 MARKET TREND: NEUTRAL (BEARISH OPPORTUNITY!)

Consolidation zone = Thief’s playground!

Oversold? Maybe. But the real trap is where bullish robbers get slaughtered.

High risk = High reward—only for cold-blooded traders!

📡 FUNDAMENTAL INTEL (DON’T SKIP THIS!)

🔗 Get full reports (COT, Macro, Seasonals, Sentiment, Intermarket Analysis) in our bio0!

🚨 TRADING ALERT: NEWS = DANGER ZONE!

❌ Avoid new trades during news!

🔐 Use trailing stops to lock profits & escape alive!

💥 BOOST THIS HEIST! (HELP US ROB THE MARKET!)

🔥 Hit LIKE & FOLLOW to strengthen our robbery squad!

💸 More heists = More profits. Stay tuned for the next raid!

🐱👤 See you in the shadows, bandits! 🤑🚀

ZCU25 CORN... It ALWAYS comes down to cornAND I'M BACK AND DUMBER THAN EVER

Listen up Honkies, this trade has a 93% probability based on the historical data over the last 30 years. So I bet Muhammad my 3rd ex-wife and a half of my second step child. The reason this trade works is easy! We all have felt and understand FUD (Fear, Uncertainty, and Doubt) and how the market reacts, I understood this on my second ex-wife when she got a boyfriend. So in late June pollination season occurs with corn and the yield is unknown for the next year, this is a very simple way of looking at the agricultural industry and how the market corrects. The trade is set up in two stages in order to maximize profit. The first stage, with the FUD in pollination season typically results in a 15-20% drop, I split the difference at 17% lets make it easier than my first divorce. This usually occurs around June 26th and can extend to July 17th. Around July 15th to the 20th the projected yield is shared and the market recorrects to the upside as the numbers represented due to the FUD don't represent the price action in the futures market, and because the futures market is speculatory (Adult Gambling) the degens will pump the contracts up looking for a quick buck like my third wife. Now in order to not go broke while you're trying to buy your ex wife's boyfriend's son a new car, you need to hedge the contract in a calendar spread aka intra-commodity spread, so do the opposite in combination on the march 2026 corn contract as the maintance is lower and the price action isn't there due to open interest in the market, so let that contract ride if it goes against you. SO! you short the ZCU25 while longing the ZCH26, then offset the contracts when direction changes and long ZCU25 and short ZCH26, it's as easy as 1,2,8. Had to repost this forgot the Tags my bad.

"all I need is one trade to pay all the alimony for this year."

-KewlKat

CORN.c CORN.c Short Trade Plan (Daily Timeframe)

📍 Trade Setup

Direction: Short

Entry: Instant / Current Market Price (CMP)

Stop Loss (SL): 465.97

Take Profit 1 (TP1): 403.36 (≈ 1:1 Risk-Reward)

Take Profit 2 (TP2): 387.00 (≈ 1:1.5 Risk-Reward)

📊 Technical Justification

Trend: Downtrend confirmed – price forming Lower Highs and Lower Lows.

Candle Pattern: Bearish shooting star near resistance – strong rejection signal.

🌽 Top 3 Bearish Fundamental Reasons

Favorable U.S. Weather Conditions

→ Ideal for crop growth → higher yield expectations → bearish pressure.

Weak Global Export Demand

→ Sluggish corn exports (e.g., China slowdown) → less global demand for U.S. corn.

Strong U.S. Dollar

→ Makes U.S. corn more expensive internationally → lowers export competitiveness.

🎯 Risk Management & Execution Plan

Risk-Reward (TP1): ~1:1

Risk-Reward (TP2): ~1:1.5

📌 Once TP1 is hit:

✅ Move SL to Entry (Breakeven) to protect capital and ride remaining position to TP2.

CShort

Shady CORN Scheme: Bullish Plot or Market Trap?🌟 Ultimate CORN Heist Strategy: Swing Trade Plan 🌟

Greetings, Wealth Chasers & Market Mavericks! 🤑💸

Ready to pull off a legendary heist in the 🌽 CORN Commodities CFD Market? Our Thief Trading Style blends sharp technicals and fundamentals to craft a high-octane plan for massive gains. Follow the strategy below, stick to the chart, and aim to cash out near the high-risk Red Resistance Zone—an electrified level where overbought conditions, consolidation, or trend reversals could spark traps from bearish bandits. Let’s lock in profits and treat ourselves to the spoils! 💪🎉

📈 Entry Plan: Launch the Heist! 🚀

Wait for a breakout above the Moving Average at 4.5800 to ignite your long entry—bullish riches are calling!

Option 1: Set Buy Stop Orders just above the MA for breakout confirmation.

Option 2: Place Buy Limit Orders on a pullback to the most recent swing low/high within a 15- or 30-minute timeframe.

📢 Pro Tip: Set an alert on your chart to catch the breakout in real-time! ⏰

🛑 Stop Loss: Protect Your Loot! 🔒

For Buy Stop Orders, place your Stop Loss after the breakout confirms to avoid premature exits.

Thief SL Recommendation: Set at the recent swing low on the 4H timeframe (4.4300) for day/swing trades.

Adjust SL based on your risk tolerance, lot size, and number of open orders—play it smart! ⚠️

Feeling rebellious? Set your SL wherever you dare, but don’t blame us if the market bites back! 😎🔥

🎯 Target: Grab the Gold! 🏴☠️

Aim for 4.8000—take partial profits or exit fully before hitting this level.

Scalpers: Stick to long-side scalps. Got deep pockets? Jump in now. Otherwise, join swing traders for the full heist.

Use a trailing Stop Loss to lock in gains and keep your money safe. 💰

🌽 CORN Market Outlook: Why This Heist Works 🌟

The CORN CFD market is currently neutral but shows strong bullish potential, driven by:

📰 Fundamentals: Check macroeconomic data, COT reports, geopolitical events, and news sentiment for a full picture.

📊 Intermarket & Seasonal Analysis: Aligns with favorable positioning and future trend targets.

⚠️ Trading Alert: News & Position Management 🚨

Avoid new trades during major news releases to dodge volatility spikes.

Use trailing Stop Loss orders to secure profits and protect open positions.

Stay updated via reliable sources like Investing.com for real-time news impacting CORN prices.

💥 Boost the Heist! 🚀

Support our Thief Trading Style by hitting the Boost Button to amplify our robbery squad’s strength! 💪 Together, we’ll swipe profits effortlessly every day. Stay tuned for the next heist plan—more riches await! 🤑🐱👤

Let’s make this CORN heist legendary! 🌽💸🎉

Front-loaded Exports has fuelled rally in Corn. Can it last?After President Trump instituted broad new tariffs on 2nd April 2025, corn futures initially wavered but then rallied sharply. While this may seem counterintuitive given tariffs' disruptive impact on trade, near-term support for corn comes from front-loaded U.S. exports, a weaker dollar, and lower-than-expected domestic supply.

However, prices are likely to face downward pressure as the U.S. harvest season approaches. This paper examines the short-term bullish factors, outlines the potential risks ahead, and presents a hypothetical trade setup involving a calendar spread on CME Micro Corn futures.

CME Corn futures gapped lower on 3rd April but quickly recovered, jumping 4.5% over the next three trading days to six-week highs by 9th April. This move aligns with the typical spring seasonal trend, as corn often firms in late spring during planting & strong demand season.

Surging Export Commitments Amid Tariffs

Export commitments have surged post-tariff announcement. USDA reports that U.S. exporters had already booked about 85% of the 2024/25 season target by early April, according to Reuters , well above the 5‐year average.

In the week ending 3rd April, net U.S. corn sales hit ~40.2 million bushels, reflecting heavy front-loading. Large private sales continue: for example, in early April exporters announced a 9.4-million-bushel sale of 2024/25 corn to Spain.

These front-loaded sales (especially to Mexico & Europe) suggest buyers are rushing to secure supply before possible trade disruptions. Overall, extraordinarily strong export pace and large “flash” sales are underpinning the market.

Supply is Weaker than Initially Thought

USDA’s April WASDE cut U.S. 2024/25 ending stocks to just 1.465 billion bushels – a 75 million bushels reduction – implying a stocks/use ratio around 9.6%. For context, that ratio is near multi-decade lows for corn. The USDA simultaneously raised exports to 2.55 billion bushels, a full 100 million bushels above the previous estimate.

On the supply side, USDA’s Prospective Plantings (March 2025) projected 95.3 million corn acres for 2025, roughly 5% higher than 2024, above expectations (highlighted by Mint Finance in a previous paper ). This suggests that while near-term stocks remain stressed the situation is likely to improve drastically following the harvest.

Weaker Dollar Supports Increased Corn Exports

A key bullish factor for U.S. corn exports is the recent weakness of the U.S. dollar. After the tariff announcement, the trade-weighted dollar tumbled – hitting fresh lows (e.g. a 10-year low versus the Swiss franc). Through April 10, the dollar was down ~2–3% on the week. A weaker dollar makes U.S. corn cheaper for overseas buyers, supporting export competitiveness. With dollar at multi-year lows, U.S. corn is more attractive globally, partly offsetting any Chinese retaliatory tariffs.

COT and Options Data

Managed-money funds have dramatically pared back their long corn bets since the beginning of March. CFTC COT data show net long positions peaking around 364,000 contracts in early February, then plunging to ~54,000 by the 8th April report. However, the pace of decline has slowed dramatically over the past few weeks and seems to be signalling an end of the cutback by asset managers.

Interestingly, despite the tariff introduction (2/April) and the WASDE release (10/April), implied volatility (IV) moderated. IV has since normalized from the spike observed in March. During this period, skew also declined, reaching a negative value on 8th April - indicating that put options briefly became more expensive than calls.

Although this trend has since reversed, skew remains near its lowest levels in 2025, suggesting sustained interest in put options among market participants.

Source: CME CVOL

OI shift over the past week also signals a cautious tone despite the rally. Near term options have seen an increase in put OI, suggesting participants remain cautious despite the rally.

Source: CME QuikStrike

Hypothetical Trade Setup

While bullish factors have driven a sharp rally in corn prices over the past two weeks, there are dark clouds on the horizon. Tariffs risk disrupting trade and as most importers have already loaded up on US corn, they could slow the pace of future purchases.

Additionally, a downbeat seasonal trend along with an expected bumper harvest signal that prices could reverse sharply from here. On the technical front, momentum remains solidly bullish but approaching a potential overbought level amid a slowing bullish trend.

Corn prices remain pressured from a bumper harvest expected in September. Along with expected trade disruptions and a slowdown in the pace of US exports, prices are likely to decline during the summer. Regardless, prices remain bullish in the near term from a weakening dollar and near-term front loading.

To express views on these converging trends, investors can deploy a calendar spread on CME Micro Corn futures consisting of a long position on the near-term May contract (MZCK2025) and a short position on the September contract (MZCU2025). A hypothetical trade setup providing a reward to risk ratio of 1.8x is mentioned below:

A calendar spread on CME Micro Corn Futures is highly capital efficient with the above trade requiring maintenance margin of just USD 23 as of 15/April. The position remains protected from near-term price increase but benefits from the eventual price decline in September during harvest season.

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme .

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

Short Idea On ZC1! (Corn)1)On Cot data,we can see the commercials shorting at the extremes.

2)Seasonality gives us a short bias and quantitative data shows 80% win rate for shorts.

3) We overvalued on daily and weekly timeframe against several benchmarks

4) On weekly timeframe,the price rejected the EMA Forming a Pin bar reversal

5) I set the entry and stoploss on the supply structure as you can see in the picture

What Lies Beyond the Cornfield's Horizon?The narrative of corn in the global agricultural scene is not merely about sustenance but a complex ballet of economics, innovation, and policy. This staple crop stands at the intersection of international trade, with U.S. farmers gaining a foothold in Mexico's market through a significant legal victory against GMO corn restrictions, highlighting the nuanced dance between technology and trade agreements. Meanwhile, Brazil's agricultural strategies reveal a shift towards leveraging corn for ethanol, showcasing a potential future where corn could play an even more pivotal role in sustainable energy solutions.

In science and technology, the development of digital corn twins presents a frontier in crop breeding. This innovative approach could redefine how we think about plant resilience and efficiency, potentially leading to crops tailored to withstand the capricious whims of climate change. The challenge lies in translating theoretical models into practical, field-ready solutions that can benefit farmers and consumers alike.

However, the journey isn't without its threats. The unexpected rise of corn leaf aphids in 2024 serves as a stark reminder of the ongoing battle with nature's unpredictability. Farmers are now challenged to anticipate and manage these pests, pushing the boundaries of traditional farming practices into more predictive, data-driven methodologies. This situation beckons a broader inquiry into how agriculture can evolve not just to react but preemptively adapt to ecological shifts.

As we look beyond the cornfield's horizon, we see a landscape where policy, technology, and biology converge. The future of corn involves navigating this triad with foresight, ensuring that each step taken today not only secures current yields but also plants the seeds for a sustainable agricultural legacy. This exploration into corn's evolving role invites us to ponder how we can harness these developments for a future where food security and environmental stewardship walk hand in hand.

crypto is crypto, but do you need to buy corn? - If the trend line breaks, this is the beginning of a bullish trend.

- a Formulated is Golden Cross Moving Average

- the reason for the rise in corn prices is the decrease in the EU corn harvest in 2024/25. This is the third consecutive year of poor harvest.

If you have anything to add, please write in the comments.

Bullish time in CORN ahead \o/You can see here the CBOT:ZC1! price displayed in a line chart. After reaching its high in early 2022, the bears took control, driving the price down significantly until now.

The factors in play are as following:

Seasonality: Corn prices have historically shown strength from December through March, aligning with planting and crop cycles. This seasonal trend could provide a solid backdrop for a potential price recovery. (highlighted in green on the chart)

Interest Rates: We’ve reached a pivotal moment in the Federal Reserve's interest rate cycle. The rate hikes that began in March 2022 coincided with the start of the bearish trend, while recent rate cuts in September 2024 may support a rebound in commodity prices, including corn. This shift in monetary policy could act as a bullish catalyst for corn and other commodities. (highlighted in orange on this chart)

Technical Indicators: For additional confirmation, one could wait for a bullish crossover of the moving averages (a golden cross). Such a cross would reinforce the technical setup and definitively signal the onset of a new bull market in corn.

With these factors in play, corn could be setting up for a strong rally in the months ahead.

Corn Reversal: Classical 5 bar trend confirmed!Corn CBOT:ZC1! is showing signs of a reversal, and it has confirmed the following:

The daily trend was activated at yesterday's close, with enough momentum to push above 450.

The weekly trend is also active, following a classic five-bar trend pattern, indicating a strong reversal signal.

Once it reclaims 433, it should quickly move toward the first target of 466.

If everything aligns as expected, it could aim for a break of the current trend. For now, it’s important to take it level by level.

15% to 35% Upside Ahead for Corn (Divergence Strategy)Corn recently has had the monthly bullish divergence confirmed with Septembers monthly close. This has major implications for corn, as I anticipate corn to now trade up at least 15% from current prices, up to a max move of approximately 35%. Monthly divergence triggers such as this are signals that the prudent trader must pay attention to. This does not mean I anticipate this market to go straight up from here. However, it does mean that, in my opinion, dips are for buying in the Corn market until we reach these upside targets.

Have a great week.

Can Corn Conquer Climate Change?The global food system is under siege from the escalating climate crisis, and corn, a pivotal commodity, is facing a particularly formidable challenge. Rising temperatures, erratic rainfall patterns, and the increased prevalence of pests and diseases are all conspiring to undermine corn production. This article delves into the intricate relationship between corn and climate change, examining the potential consequences for food security, economic stability, and social well-being.

Beyond the immediate threats posed by climate change, the impacts on corn production can have far-reaching consequences. Reduced yields can lead to price volatility, making it difficult for low-income households to afford basic food staples. This can contribute to food insecurity and malnutrition, particularly in vulnerable populations. Moreover, corn production is a major source of income for many farmers, especially in developing countries. Climate change-induced crop failures can have devastating consequences for rural livelihoods and economic stability.

However, the challenges are not insurmountable. By adopting sustainable agricultural practices, investing in climate-resilient crop varieties, and fostering global cooperation, we can safeguard the future of corn and ensure a more sustainable and equitable food system for generations to come. Climate-smart agriculture, which includes practices like crop rotation, cover cropping, and precision agriculture, can improve soil health, reduce water use, and enhance resilience to climate change. Additionally, breeding for resilience can develop corn varieties that are more tolerant to heat, drought, and pests.

Furthermore, promoting crop diversification can help reduce the risk of crop failures and ensure food security even in the face of climate-related challenges. Governments can also play a crucial role in supporting farmers by providing financial assistance, access to climate information, and investments in agricultural research and development.

In conclusion, the future of corn is inextricably linked to our ability to adapt to a changing climate. By embracing sustainable practices, investing in innovation, and fostering global cooperation, we can ensure that corn continues to play a vital role in feeding the world. It's a call to action, a challenge to rethink our approach to agriculture, and a reminder that the future of food is in our hands.