GBP/AUD Market Analysis: Macro + Structure [MaB]1. The Macro Context (The "Why") 🌍

Hi traders! Before looking at the candles, let's look at the money.

My fundamental scoring table speaks clearly: there is a -4 differential, indicating a Bearish (Moderate) bias that we cannot ignore.

Key Factor Analysis:

🏦 Current Rates: Explanation: BoE at 3.75% offers an attractive carry level, while RBA at 3.6% remains the second highest in the G7. Score GBP: +1 Score AUD: +1

🌍 Economic Regime: Explanation: GBP is in a Goldilocks expansion phase; AUD is facing reflation with accelerating inflation. Score GBP: +1 Score AUD: +2

📊 Rate Expectations: Explanation: BoE is dovish with an easing trend (25bp cut in Dec); RBA remains neutral with a stable holding trend. Score GBP: -1 Score AUD: 0

🎈 Inflation: Explanation: Both currencies face high inflation above target, maintaining hawkish pressure on their respective central banks. Score GBP: +1 Score AUD: +1

📈 Growth/GDP: Explanation: Both economies show growth (GBP 1.3%, AUD 2.3%) that appears unsustainable given high inflation levels. Score GBP: 0 Score AUD: 0

⚖️ Risk Sentiment: Explanation: Market sentiment is currently in a neutral regime with no specific bias for either currency. Score GBP: 0 Score AUD: 0

🏛️ COT Score: Explanation: Commitment of Traders shows a bearish build-up for GBP, while AUD sees strong longs and accelerating purchases. Score GBP: -1 Score AUD: +2

🗞️ News Bonus: Explanation: GBP saw a strong acceleration in the services sector (PMI +2.9 to 54.3); no significant surprises for AUD. Score GBP: +1 Score AUD: 0

Currency Score Summary: Total Score GBP: +2 (Neutral/Bullish) Total Score AUD: +6 (Strong Bullish)

Synthesis: GBP (Weak, Score +2): High rates but dovish BoE in an easing cycle with heavy speculative selling. AUD (Strong, Score +6): Solid growth and very strong speculative accumulation in progress.

Conclusion: With this scenario, we are only looking for Short setups. Going against this bias would be statistical suicide.

2. The Technical Setup (The "Where") 📉

Timeframe: 1h | Pair: GBP/AUD

The SMC Market Structure + Price Zones indicator gave us the confirmation we needed for our statistical edge. Here is where the indicator makes the difference. Look at the dashboard on the right, numbers don't lie:

🚀 Continuation Rate (64.7%): We are well above the 60% threshold. This tells us the market is in a healthy, directional trend. Statistically, betting on continuation pays off more than looking for a reversal.

🔥 Streak (1) & Streak Pct (2%): We are at the 1st consecutive impulse. It's a fresh trend, so we have plenty of room for the move to develop before it becomes overextended.

🔄 Retest (84.5%): The indicator tells us that statistically, when price creates a new Break of Structure (BOS), it retraces into the previous zone 84.5% of the time. This gives us high confidence in our entry zone.

💥 BOS/Ret Rate (59.8%): This parameter tells us that once price retraces inside the previous zone, it has a high probability of reacting and creating a new BOS.

🎯 Extension Rate (1.65x): The algorithm projects an ambitious target. We expect this move to extend 1.65 times the current pullback leg. That's where we'll take profit.

3. Execution Plan on Chart

Moving to the chart, the SMC Market Structure + Price Zones indicator supports us in pinpointing liquidity to define entry and stop loss:

Entry and Stop Loss: We place a limit entry in the Supply Zone 1h (Red Band) and the stop loss a few pips above the zone.

Take Profit: We leverage the asset's statistical analysis offered by the Extension Rate and place the target by measuring with Fibonacci at 1.65x relative to the pullback leg.

Trade Parameters:

Entry Price: 1.96654 Stop Loss: 1.97083 Take Profit: 1.93428

⚠️ Disclaimer: This analysis is based on a proprietary algorithm and is shared exclusively for educational and didactic purposes. It does not constitute financial advice or investment solicitation in any way. Trading involves significant risk.

Zone

IOTA Testing Long Term Descending SupportIOTA is currently trading at a critical long term support zone after a prolonged decline within a descending structure. Price is holding near the lower boundary of the channel, an area that has previously acted as strong demand.

The recent selloff appears to be slowing down, and price is attempting to stabilize near this support region. If buyers continue to defend this level, a relief move toward the mid range of the structure is possible, followed by a potential retest of the upper descending resistance.

However, failure to hold this zone could open the door for a deeper downside move before any meaningful recovery. This area is important for trend continuation or reversal, making it a key region to monitor closely.

This setup favors patience, as confirmation is needed before expecting a sustained move.

AUD/CHF Market Analysis: Macro + Structure [MaB]1. The Macro Context (The "Why") 🌍

Hi traders! Before looking at the candles, let's look at the money. My fundamental scoring table speaks clearly: there is a huge differential that we cannot ignore.

Key Factor Analysis: 🏦 Rate Expectations: Explanation: The RBA is neutral at 3.6% in the G7 context, offering an interesting carry. The SNB is at 0.0%, the lowest rate among major currencies. Score AUD: +1 Score CHF: -1 🎈 Inflation: Explanation: AUD inflation is at 3.4%, sitting above target but with a justified stance. CHF inflation is at 0.02%, effectively in a state of de facto deflation. Score AUD: +1 Score CHF: -1 📈 Growth/GDP: Explanation: Australia shows robust 2.3% growth. Switzerland's growth is moderate at 1.2%, which is acceptable for their economy. Score AUD: 0 Score CHF: 0 🏭 PMI Data: Explanation: AUD weighted PMI is 51.8 (Expansion). Swiss manufacturing PMI has collapsed to 45.8, indicating strong contraction. Score AUD: +1 Score CHF: -1 ⚖️ Risk Sentiment: Explanation: The market regime is currently neutral for both pairs with no significant net flows. Score AUD: 0 Score CHF: 0 🗞️ News Catalyst: Explanation: No significant surprises on secondary data for AUD. The CHF PMI slump was already factored into the dedicated PMI metric. Score AUD: 0 Score CHF: 0

Currency Score Summary: Total Score AUD: +3 (Strong) Total Score CHF: -3 (Weak)

Synthesis: AUD (Strong, Score +3): Supported by attractive interest rates and expansionary PMI data. CHF (Weak, Score -3): Dragged down by zero rates, deflationary pressure, and a manufacturing collapse. Conclusion: With this scenario, we are only looking for Long positions. Going against this bias would be statistical suicide.

2. The Technical Setup (The "Where") 📉

Timeframe: 4H | Pair: AUD/CHF

The SMC Market Structure + Price Zones indicator gave us the confirmation we needed for our statistical edge. Look at the dashboard on the right, numbers don't lie:

🚀 Continuation Rate (63.2%): We are well above the 60% threshold. This tells us the market is in a healthy, directional trend. Statistically, betting on continuation pays off more than looking for a reversal. 🔥 Streak (2) & Streak Pct: We are at the 2nd consecutive impulse. It's a fresh move with room to develop, so as long as the music plays, we dance. 🔄 Retest (42.1%): The indicator tells us that statistically, when price creates a new Break of Structure (BOS), it retraces into the previous zone only 42.1% of the time. Therefore, we should try to enter before a deep retracement to avoid missing the move. 💥 BOS/Ret Rate (54.2%): This parameter tells us that once price retraces inside the previous zone, it has a solid probability of reacting and creating a new BOS. 🎯 Extension Rate (1.76x): The algorithm projects an ambitious target. We expect this move to extend 1.76 times the current pullback leg.

3. Execution Plan on Chart

Moving to the chart, the SMC Market Structure + Price Zones indicator supports us in pinpointing liquidity to define entry and stop loss:

Entry and Stop Loss: We place a limit entry in the Demand Zone 4H (Blue Band) and the stop loss a few pips below the zone at 0.53359. Take Profit: We leverage the asset's statistical analysis offered by the Extension Rate and place the target by measuring with Fibonacci at 1.76x relative to the pullback leg.

Trade Parameters: Entry Price: 0.53522 Stop Loss: 0.53359 Take Profit: 0.54831

⚠️ Disclaimer: This analysis is based on a proprietary algorithm and is shared exclusively for educational and didactic purposes. It does not constitute financial advice or investment solicitation in any way. Trading involves significant risk.

USDJPY short term LONGUJ is at good S/R zone, although market is kinda crazy right now and dollar is having a rough time, thats why i will risk only 0.5% here cuz i like the setup but its riskier than usual.

⚠️ Disclaimer ⚠️

🛑The ideas I post here are just my vision of the market and not a signal, financial advice or something.

👁️Unfortunately I don't have enough time in front of the the computer to update or post every idea or trade management I do.

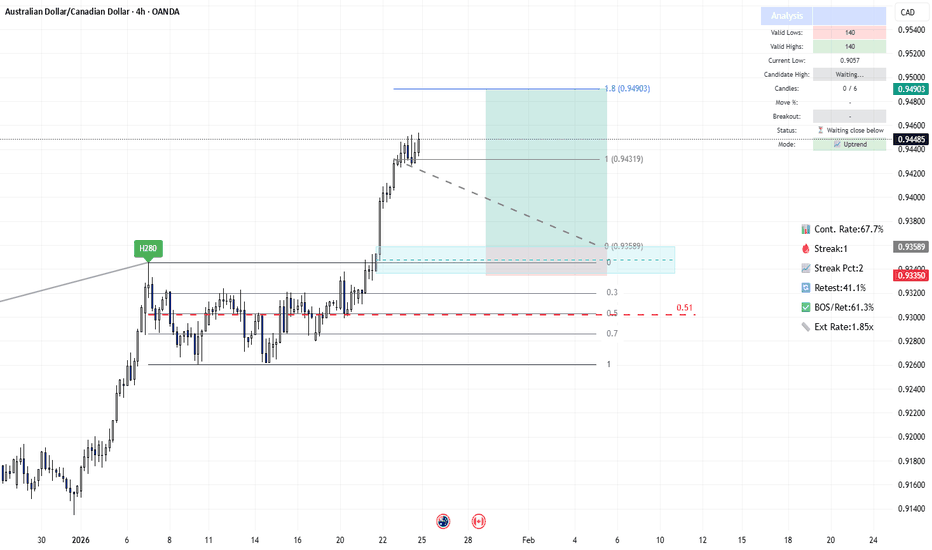

[AUD/CAD] Market Analysis: Macro + Structure [MaB]1. The Macro Context (The "Why") 🌍 Hi traders! Before looking at the candles, let's look at the money. My fundamental scoring table speaks clearly: there is a significant differential here that we cannot ignore for the upcoming sessions.

Key Factor Analysis:

🏦 Rate Expectations: The RBA maintains a neutral but relatively high rate at 3.6%, offering a carry advantage. Conversely, the BOC is showing a dovish tilt following their October cut, despite the current pause. Score AUD: +1 Score CAD: -1

🎈 Inflation: Australian inflation remains sticky at 3.4% (above target), while Canadian inflation has cooled to 2.22%, approaching the Bank of Canada's comfort zone. Score AUD: +1 Score CAD: 0

📈 Growth/GDP: Australia is showing resilient growth at 2.3%, outpacing the Canadian GDP of 1.6%. Score AUD: 0 Score CAD: 0

🏭 PMI Data: Both regions show expansionary signals; Australia's weighted PMI is at 51.8, while Canada's Ivey PMI saw a strong jump to 51.9. Score AUD: +1 Score CAD: +1

⚖️ Risk Sentiment: The current market regime is neutral for both cyclical currencies. Score AUD: 0 Score CAD: 0

🗞️ News Catalyst: No major disruptive news for either pair, keeping the focus on structural data. Score AUD: 0 Score CAD: 0

Currency Score Summary: Total Score AUD: +3 (Strong) | Total Score CAD: 0 (Neutral)

Synthesis: With a net differential of +3 in favor of the Aussie, we are looking exclusively for LONG setups. The fundamental divergence suggests that any dip in AUD/CAD should be viewed as a buying opportunity.

2. The Technical Setup (The "Where") 📉 Timeframe: 4H Pair: AUD/CAD

The SMC Market Structure +Zones indicator has confirmed the bullish bias on the 4H chart. Looking at the dashboard, the statistical edge is clear:

🚀 Continuation Rate (67.7%): We are well above the 60% threshold. This indicates a high-probability trending environment where following the established structure is mathematically superior to picking tops.

🔥 Streak (1): We are currently on the first impulse of this sequence, meaning the move is fresh and likely has significant room to run.

🔄 Retest (41.1%): The indicator shows that price retraces into the previous zone only 41.1% of the time. This suggests we should look for entries at the top of the demand zone to avoid being left behind.

💥 BOS/Ret Rate (61.3%): Once price reaches our zone, there is a 61.3% probability of a successful reaction resulting in a new Break of Structure (BOS).

🎯 Extension Rate (1.85x): The algorithm projects an extension of 1.85 times the current pullback leg, giving us a very clear and ambitious target for our Take Profit.

3. Execution Plan on Chart Moving to the chart, the indicator supports us in pinpointing liquidity to define entry and stop loss:

Entry and Stop Loss: We are placing a limit entry at the top of the Demand Zone (Blue Band) . The stop loss is tucked safely below the structural low of the zone. Take Profit: We leverage the asset's statistical analysis offered by the Extension Rate and place the target at 1.85x relative to the pullback leg.

Trade Parameters: Entry Price: 0.93589 Stop Loss: 0.93350 Take Profit: 0.94903

⚠️ Disclaimer: This analysis is based on a proprietary algorithm and is shared exclusively for educational and didactic purposes. It does not constitute financial advice or investment solicitation in any way. Trading involves significant risk.

AUDCAD Short Waiting for AUDCAD to reach this crispy zone of S/R.

⚠️ Disclaimer ⚠️

🛑The ideas I post here are just my vision of the market and not a signal, financial advice or something.

👁️Unfortunately I don't have enough time in front of the the computer to update or post every idea or trade management I do.

USDCAD SHORT Well, last trade didnt work out, price just rocketed upwards and now she is at another good zone of S/R, thats why i sold at the level I marked( it a late post, sorry). Im giving enough space to roam and tp is as usual 1:1.

I think the probability is a bit higher this time, because it's a clearer setup and price haven't had a reasonable daily pullback since 3 weeks.

USDCAD short term sell USDCAD broke and now is retesting a good S/R zone in which price bounced like 7+ times in the past 6-7 months.

Im selling here from 4H EMA and from this tight little zone formed from previous 4 touches. TP is the bottom of the leg, which gives plenty of room for the price to move

USDCAD LONG / SIMPLE and EFFECTIVE strategy !!The strategy is plain and simple:

Buy at major support or sell at major resistance level without waiting for confirmations for best entry and shorter SLs and TPs. RR is 1:1, don't be fooled about all this 1:3-1:5 RR, with 1:1 u will be much more consistent with very low DD periods !!!

Its up to you how much space u will give price to move from the major zone. I personally put my SL at reasonable distance above/below the previous highs/lows, not so much and not 2 pips away from previous wicks.

That's all to the strategy, nothing complicated and engaging, just put alarms previous to the zone and wait for them to pop up on your phone.

XAUUSD INTRADAY – Breakout + Retest Reaction SetupFOREXCOM:XAUUSD

Key Scenarios

✅ Bullish Case (Primary Bias)

If price holds the 4060–4070 retest zone and prints bullish confirmation, buyers may target:

🎯 1st Target: 4105–4112

🎯 2nd Target: 4150–4165

This scenario remains valid as long as price stays above 4040.

❌ Bearish Case (Invalidation Trigger)

If price fails to hold above 4040 and breaks below the demand zone, a deeper sell-side expansion may follow toward:

Only a clean break below 4040 shifts sentiment bearish.

Current Levels to Watch

Supply Zone: 4060–4075

Support Zone / Entry Interest: 4045–4040

Key Demand: 4025–4035

Major Resistance: 4165–4175

⚠️ Disclaimer:

This analysis is for educational purposes only. It is not financial advice. Please manage risk and trade based on your own strategy.

AUDUSD: Complexity is in it's peak!Dear Traders, The Aussie is not easy to trade these days! However, I've been asked for an analysis. I suggested to risk less than an ordinary trade!

This is the daily chart

We might have seen newly form bearish channel! However, it might be just a correction!

We'll see

While we are ready for long in this setup!

A shorting from here with stop-loss over the bearish trendline is also considerable.

ETHUSD – Demand Zone Reaction | Bullish Reversal Expected BITSTAMP:ETHUSD

Market Overview

ETHUSD has been consolidating under a descending trendline while repeatedly respecting the key demand zone.

This area has historically absorbed heavy selling pressure, indicating institutional buy orders building up.

If price breaks above minor internal resistance (around 4,050), the breakout could confirm a new bullish leg targeting upper liquidity zones.

Key Scenarios

✅ Bullish Case 🚀 → 🎯 Target 1 4,080 | 🎯 Target 2 4,150 | 🎯 Target 3 4,210

❌ Bearish Case 📉 → Close below 3,920 could extend decline toward 3,860

Current Levels to Watch

Resistance 🔴 4,080 – 4,150

Support 🟢 3,940 – 3,920

⚠️ Disclaimer: This analysis is for educational purposes only. Not financial advice.

EURUSD – Triple Top Zone Formed | Correction Expected Before FX:EURUSD

📊 📉

Market Overview

EURUSD continues to respect its ascending structure but is currently struggling to break above the top resistance, forming equal highs — a liquidity trap area.

A clean rejection here could drive price toward the 1.1620–1.1610 demand base before the next bullish impulse.

Buyers are expected to re-enter at this region to continue the broader bullish leg.

Key Scenarios

✅ Bullish Case 🚀 → After correction to 1.1620–1.1610, expect move toward 🎯 1.1650 | 🎯 1.1680

❌ Bearish Case 📉 → Break below 1.1600 may shift structure toward 1.1560 zone

Current Levels to Watch

Resistance 🔴 1.1645 – 1.1650

Support 🟢 1.1620 – 1.1600

⚠️ Disclaimer: This analysis is for educational purposes only. Not financial advice

BTCUSD – Bullish Continuation Expected from Demand Zone BITSTAMP:BTCUSD

🟢

Market Overview

BTC has been consolidating within a corrective pattern after a sharp impulsive rise from the same demand zone.

The zone has held multiple times, confirming strong institutional interest.

As long as price respects this area, bullish momentum is expected to resume, targeting mid-range liquidity levels and previous structural highs.

Key Scenarios

✅ Bullish Case 🚀 → 🎯 Target 1 113 100 | 🎯 Target 2 114 500 | 🎯 Target 3 116 000

❌ Bearish Case 📉 → Break and close below 110 700 may open move toward 109 700 – 108 700 support

Current Levels to Watch

Resistance 🔴 113 100 – 114 500

Support 🟢 110 700 – 109 700

⚠️ Disclaimer: This analysis is for educational purposes only. Not financial advice.

GOLD (XAUUSD) – Decision Zone Ahead | Bulls Holding DemandTVC:GOLD

Market Overview

Gold has shown repeated rejections from the demand base, confirming aggressive buyer interest.

Every retest of the yellow box created higher lows, showing accumulation before a potential expansion toward new highs.

If bulls hold above 4 200, continuation toward the 4 228–4 235 zone (previous all-time-high region) is expected.

Key Scenarios

✅ Bullish Case 🚀 → 🎯 Target 1 4 218 | 🎯 Target 2 4 230 | 🎯 Target 3 4 240

❌ Bearish Case 📉 → Rejection from decision zone → Retest of 4 185 then 4 165

Current Levels to Watch

Resistance 🔴 4 218 – 4 230

Support 🟢 4 185 – 4 165

⚠️ Disclaimer: This analysis is for educational purposes only. Not financial advice.

XAUUSD (GOLD) 15 Min – Bullish Setup Forming TVC:GOLD

Market Overview

Gold has recovered beautifully after the pullback and is now consolidating just above the demand base. The structure shows a potential higher-low formation, signaling bullish momentum buildup. If price breaks above 4,165, continuation toward the top resistance zone (around 4,178) is expected.

Key Scenarios

✅ Bullish Case 🚀 → Possible rally continuation toward 🎯 4,165 → 🎯 4,178

❌ Bearish Case 📉 → Invalidation below the demand zone near 4,132

Current Levels to Watch

Resistance 🔴 : 4,165 – 4,178

Support 🟢 : 4,132 – 4,145

⚠️ Disclaimer: This analysis is for educational purposes only. Not financial advice.

BTCUSD (15M) – Bullish Continuation SetupBITSTAMP:BTCUSD

🚀

Structure | Trend | Key Reaction Zones

Price rebounded strongly from the yellow demand zone, confirming bullish structure formation.

A descending channel breakout is forming, showing potential for continuation.

The 113,000–112,000 range is acting as a short-term support and accumulation base.

Market Overview

BTC has regained momentum after tapping into the demand zone, showing strong buyer reaction and a shift in structure. If the market maintains support above 113,000, we can expect continuation toward the 114,500–116,000 range. Retracements toward 112,800–112,000 may offer fresh long opportunities for continuation plays.

Key Scenarios

✅ Bullish Case 🚀 → 🎯 Target 1: 114,500 → 🎯 Target 2: 116,000

❌ Bearish Case 📉 → Invalidation below 111,800

Current Levels to Watch

Resistance 🔴: 114,500 – 116,000

Support 🟢: 112,000 – 111,800

⚠️ Disclaimer: This analysis is for educational purposes only. Not financial advice.