$Nestle PLC over 40% retracement in a Falling WedgeNestlé Nigeria Plc is a leading food and beverage company in Nigeria, manufacturing and marketing a variety of products under renowned brands such as Maggi, Milo, Nescafé, and Golden Morn.

MYX:NESTLE all time high is about 1600 Naira/share

Current price: 975 Naira/share - A 40% discount from all time high.

In the past, after #nestle price action broke out its falling wedge, it made over a 100% move upwards. IF HISTORY REPEATS, Nestle stands a chance to reclaim these resistances: 1026, 1253, 1553 and even higher.

This idea invalidates under 793.

$MTNN MTN almost 50% retracement from all time high...NSENG:MTNN MTN Nigeria just had about a 50% retracement from an all time high of 319naira/share.

Current Price: 170

#MTN price action previously rose through it's rising channel from 159 to 319.

Currently, price action is at the bottom of this channel, making for a low risk buy zone (btw 159-180).

Time to buy MTN Nigeria shares?

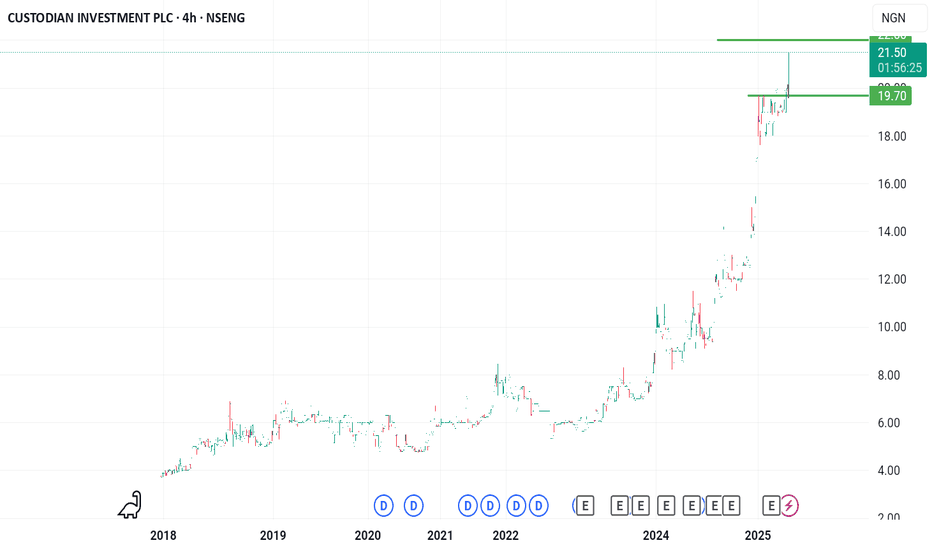

CUSTODIAN stock on Nigeria Exchange to likely hit N21 soon.CUSTODIAN stock on Nigeria Exchange to likely hit N21 soon.

This stock made it to the position of 3rd best performing stock on the NGX gainers table.

The move from N19.6 to N21.5 was a rapid one.

I will be looking at N22 as a likely resistance to the upward move.

GTCO: Testing Key Support – Will It Hold?GTCO: Testing Key Support – Will It Hold?

GTCO has demonstrated remarkable price action over the years, reflecting both bullish surges and periods of retracement.

On January 22, 2018, the stock reached an all-time high (ATH) of approximately N57 before experiencing a prolonged decline.

However, the tides shifted on October 4, 2022, when GTCO rebounded from a low of N17, igniting a sustained upward trajectory.

Despite intermittent corrections, this stock has maintained a broader bullish structure, culminating in a fresh ATH of N64.5 on March 3, 2025.

Key Technical Questions:

1️⃣ Will the N57 Level Act as a Strong Support?

The previous ATH of N57, now potentially acting as a support zone, is a crucial level to watch.

If this level holds, it could serve as a strong demand zone, providing a foundation for further price appreciation.

However, a decisive breakdown below N57 with increased selling pressure may signal a deeper retracement.

2️⃣ What’s Next for GTCO?

If N57 proves resilient, a consolidation phase could set the stage for another rally toward higher price targets.

A sustained breakout above N64.5 would confirm continued bullish momentum, potentially opening doors for price discovery into uncharted territory.

Conversely, a failure to hold above N57 could see the stock revisiting lower support levels, with N57 and N49.5 being key areas to monitor.

Conclusion

GTCO remains in an overall bullish structure, but the ability of the N57 support level to hold will dictate its next major move. Traders and investors should watch for confirmation signals—such as volume trends and price action near this critical zone—before making strategic decisions.

TRANSCORP heading to N43 zone.TRANSCORP heading to N43 zone.

This is 3rd week of straight loss for this asset.

I am looking at a buy opportunity around N43 which happens to be a confluence of an ascending trendline and a horizontal support level.

If this is favoured by fundamentals, we should be targeting a RR of 1:4.5

Long term investors have no worry with SL

MTN Nigeria Stock: A Strong Rally with ₦250 in SightMTN Nigeria Stock: A Strong Rally with ₦250 in Sight.

MTN Nigeria stock has demonstrated remarkable growth since trading around the 170 naira zone in December 2024.

As of December 9th, the stock was priced at 170 naira but has steadily rallied in recent weeks to surpass 240 naira today.

Based on this momentum, the next potential resistance level appears to be around 250 naira.

If buying interest continues and market conditions remain favourable, we could see the stock test 250 naira level in the near term.

TRANSCORP (NGN) Breaks Out of Consolidation – Potential UpsideTRANSCORP (NGN) Breaks Out of Consolidation – Potential Upside Ahead

TRANSCORP has successfully broken out of its immediate consolidation zone and is currently trading at ₦61.

If this breakout is sustained, it presents a promising opportunity for bullish momentum.

Given the current market structure, I am looking to maintain a buy position around ₦58 - ₦61, with ₦70 and ₦80 as my key target price (TP) zones.

As with all trades, patience is essential, and I am prepared to hold my position strategically for optimal returns.

Trade wisely and manage risk accordingly.

$INTBREW OVER 75% RETRACEMENT & 4-YEAR CONSOLIDATIONEven though NSENG:INTBREW International Breweries PLC has shown Market Leadership & Strong Brand Portfolio Owning popular brands like Trophy, Hero, Beta Malt, and Castle Lite it's share price has lost over 75% of its value across 4years.

#INTBREW Current Price: 5.4

In light of the value lost, Price action has also shown a 4year consolidation between 3.5 - 6.5 (termed Buy Zone) in the Charts.

A break out of price above 6.5 can lead to much higher prices.

Resistance above: 6.5, 9.6, 13.9

This idea is invalidates when price action loses support at 4.0

Want to know more about Nigerian shares? Also get my Share picks for 1st quarter of 2025?

Chat me up! Check the link on my profile. Cheers

I am optimistic about the outlook for STANBIC stockI am optimistic about the outlook for STANBIC stock.

Currently, Stanbic IBTC Holdings (STANBIC) on the NGX is trading above a rising trendline that is providing solid support.

While I am bullish on the stock, I am awaiting a pullback to the N57 level to execute my two planned entries.

To manage risk, I will set my stop loss at the N51.25 level for both entries.

My first target price (TP1) is N68.6, aligning with the FIB61.8% retracement level. For my second target (TP2), I am setting my sights on the all-time high (ATH) zone, which is N83.

Update! 1st Quarter Nigerian Share Picks for 2025 (DEC30-JAN30)Between the two given dates (DEC30 - JAN30), stock prices have shown a positive overall trend, with an average percentage change of approximately 16.29% across all listed stocks.

Key observations:

Significant Gainers: Some stocks like SCOA(+97.5%). MULTIVERSE(+50%) MTNN (+20.31%) and UPDC (+26.58%), experienced notable growth.

Moderate Increases: Stocks such as FBNH (+3.72%), FTNCOCOA (+5.00%), and GUINNESS (+9.61%) saw steady increases.

Broad Market Growth: Most stocks had a price increase, indicating a general upward trend in our 1st quarter share picks for 2025.

Overall, our portfolio appears to have performed well over the period, with most stocks appreciating in value. Let me know what you think!

Oando Plc stock has lost nearly a third of its ATHOando Plc stock has lost nearly a third of its ATH.

This stock moved from around 9.4 naira to nearly 100 naira per stock in just 5 months.

The stock has been down significantly from that peak.

It is situated on FIB23.6 currently as resistance.

Should we expect this stock to fall further?

Can this asset ever get to the 37 naira zone again anytime soon?

Where Is TRANSCORP on NGX Heading Next?TRANSCORP recently broke its previous all-time high (ATH) of ₦53.5, setting a new ATH at ₦54.5.

However, the bullish momentum did not sustain, and the price has retraced to the ₦50 zone, which is now acting as a key support level.

Currently, there are no strong fundamental drivers indicating the possibility of a new rally. This raises the question:

Could we see the price decline further to the ₦46 zone, a level that has served as strong support multiple times in the past?

The Nigerian Exchange (NGX) has been quite volatile recently, and TRANSCORP is no exception.

Unilever Stock on NGX: Technical Analysis and ForecastUnilever stock on the NGX reached its all-time low of ₦10 around March 30, 2020, during the global market downturn. From March 2020 to November 4, 2024, it traded in a range between ₦10 and ₦20, consolidating within this zone.

On November 4, 2024, the stock broke out of the ₦10-₦20 range, signalling the start of a bullish rally that has since propelled the price upward.

Currently, the stock has completed a 50% retracement from its last highest point, a significant level often observed in technical analysis. Additionally, its present price is at the FIB 50 level, a key resistance zone that could determine the continuation or reversal of the upward trend.

Traders should closely monitor ₦40, as it represents a significant psychological and technical level to watch for further price action.

Forecast:

If the price breaks above FIB 50, it may continue its rally toward the ₦40 zone.

A rejection at FIB 50 could result in a pullback to test lower support levels.

OKOMUOIL Hits a New All-Time High (ATH) on NGXOKOMUOIL Hits a New All-Time High (ATH) on NGX

OKOMUOIL on the Nigerian Exchange (NGX) has reached an impressive new All-Time High (ATH) of N440, breaking past its previous high set between August and September 2024.

A Quick Recap

After hitting its last ATH, OKOMUOIL retraced close to the Fibonacci 50% level, stabilizing around the N334 zone before regaining momentum.

This healthy pullback provided a solid foundation for the current bullish breakout.

The Key Question: What’s Fueling OKOMUOIL?

Several potential drivers could be behind this recent surge:

Strong Fundamentals: Increased earnings, strategic expansions, or operational efficiency improvements could have boosted investor confidence.

Market Sentiment: Positive sentiment around the agricultural or oil palm sector may be driving increased demand for OKOMUOIL shares.

Macroeconomic Factors: Government policies favoring local industries or rising commodity prices could be contributing to the upward momentum.

Technical Outlook

With the breakout above N440, the next step is to watch for potential consolidation or further rallying. Key areas to monitor include:

Support Levels: The N440 breakout level and the previous pullback zone at N334.

Fibonacci Extensions: These could help project potential future price targets.

Final Thoughts

OKOMUOIL’s price action reflects a strong bullish trend, but traders and investors should remain cautious. Understanding the fundamental catalysts and monitoring technical levels will be key to navigating the next move.

GTCO Faces Stiff Resistance at its 2018 All-Time HighGTCO Faces Stiff Resistance at its 2018 All-Time High.

Guaranty Trust Holding Company (GTCO) continues to grapple with breaking past its 2018 all-time high (ATH), a significant technical resistance level that has challenged the stock since November 2024. Despite showing moments of strength, the stock has been unable to sustain momentum above this critical level.

This persistent struggle suggests that investor sentiment may still be cautious, with the ATH acting as a psychological and technical barrier. For GTCO to convincingly surpass this level, it may require a strong catalyst—either in the form of robust financial performance, positive macroeconomic news, or heightened buying interest from institutional investors.

Traders and investors should closely monitor volume trends and price action around this resistance zone. A decisive breakout accompanied by increased trading volume could signal the start of a new bullish trend.

Conversely, repeated rejections could lead to a pullback, making the stock vulnerable to further corrections.

Hopefully, GTCO is going to be among the stocks on NGX breaking ATH this year.

Transcorp Stock Analysis and ForecastTranscorp Stock Analysis and Forecast

Transcorp's stock is currently testing its All-Time High (ATH) of approximately N53.5. This is a critical resistance level that could determine its next movement.

Bullish Scenario:

If buying momentum remains strong and the stock successfully breaks and sustains above the ATH, we could witness a significant upward trend as the stock moves into uncharted territory.

Bearish Scenario:

However, if the resistance at the ATH holds, a temporary pullback is likely. This retracement could offer an opportunity to enter the stock at a more favourable price point.

The overall market sentiment appears bullish with the current high demand for Transcorp shares on the Nigerian Exchange (NGX). As such, monitoring price action closely around the ATH is advisable to make informed entry or exit decisions.