China mining giant's global push will get trickier

By Ka Sing Chan

The glistening trading debut of Zijin Mining's 601899 overseas gold unit spotlights its Chinese parent's astronomical rise. The $108 billion diversified miner has deftly capitalised on high metal prices and an aggressive global expansion strategy. But this resource push will be hard to sustain.

Zijin Gold 22259 shares jumped as much as 66% on Tuesday morning following its $3.2 billion initial public offering. Assuming an overallotment option is exercised, its market capitalisation will be $42 billion, or over 80 times its 2024 earnings, against industry leader Newmont’s NEM 15 times, per LSEG. That's punchy: Zijin Gold is one of the world’s fastest-growing gold producers, with net profit increasing at a compound annual rate of 62% since 2022, but it will take another four consecutive years of breakneck growth for the Chinese firm to match Newmont’s 2024 earnings.

The debut values Zijin Mining's remaining 85% stake in the company at $35 billion, or 31% of its own market value, even though Zijin Gold generated just 10% of its parent's earnings last year. The lithium, copper and rare earths producer's valuation at 18 times trailing earnings thus looks relatively attractive even though its Hong Kong-listed stock surged 126% this year.

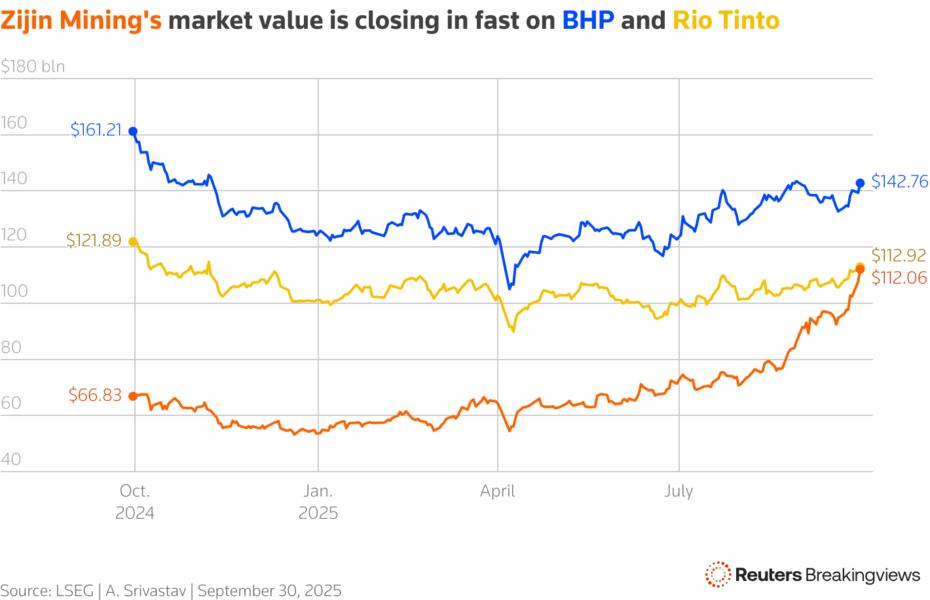

The strong rally has fuelled speculation in the People’s Republic that Zijin Mining may soon become the world’s most valuable mining company: it's just behind Rio Tinto’s RIO,

RIO $113 billion and BHP’s

BHP $139 billion, per LSEG.

Yet global miners spent much of the past decade scaling back investment. The capital expenditure of the world’s top 40 miners as a percentage of their EBITDA, per PwC, more than halved in a decade to the early 2020s. Their mood soured as growth in China slowed.

By contrast, Zijin Mining is arguably the most acquisitive Chinese firm in the past decade. The state-backed giant has picked up assets that are deemed unpromising by its global rivals, and it boasts lower profit margins as a result. Some of Zijin Gold’s most recent acquisitions in Colombia and Ghana, for example, were disposals by Newmont.

Zijin Mining may find new projects more difficult to come by. Multinational rivals are less willing to sell as Chinese demand drives up prices of critical metals. Many will also want to avoid provoking President Donald Trump, whose administration is stepping up to counterbalanceChina’s influence in resource-rich countries such as the Democratic Republic of Congo, where Zijin is also heavily invested.

The timing of Zijin Gold’s IPO is perfection, as prices for the safe-haven metal hit a fresh record high on Monday. Yet its parent's global push is likely to get rocky.

CONTEXT NEWS

Shares of Zijin Gold International, the overseas gold mining unit of Zijin Mining, rose 66% on their trading debut in Hong Kong on September 30.