AMD (2025+) Catalysts & Risks: 300 USD PT Bulls🟥 AMD (2025+) Catalysts & Risks: Analyst Views

________________________________________

🔑 Key Catalysts Driving AMD’s Stock Growth (2025+)

🌌 Quantum-Centric Supercomputing with IBM

AMD’s collaboration with IBM to merge CPUs/GPUs with quantum computing promises a whole new class of hybrid archi

Key facts today

Analysts at Jefferies warn that AMD could face more federal scrutiny due to its ties with the government and exposure to adversarial nations, especially China.

175 ARS

1.50 T ARS

23.61 T ARS

About Advanced Micro Devices Inc

Sector

Industry

CEO

Lisa T. Su

Website

Headquarters

Santa Clara

Founded

1969

ISIN

ARBCOM4601M3

Advanced Micro Devices, Inc. engages in the provision of semiconductor businesses. It operates through the following segments: Data Center, Client, Gaming, and Embedded. The Data Center segment includes server-class CPUs, GPUs, AI accelerators, DPUs, FPGAs, SmartNICs, and Adaptive SoC products. The Client segment refers to the computing platforms, which are a collection of technologies that are designed to work together to provide a more complete computing solution. The Gaming segment is a fundamental component across many products and can be found in APU, GPU, SoC or a combination of a discrete GPU with another product working in tandem. The Embedded segment focuses on the embedded CPUs, GPUs, APUs, FPGAs, and Adaptive SoC products. The company was founded by W. J. Sanders III on May 1, 1969 and is headquartered in Santa Clara, CA.

Related stocks

AMD...What's next?The Good (Bullish Side)

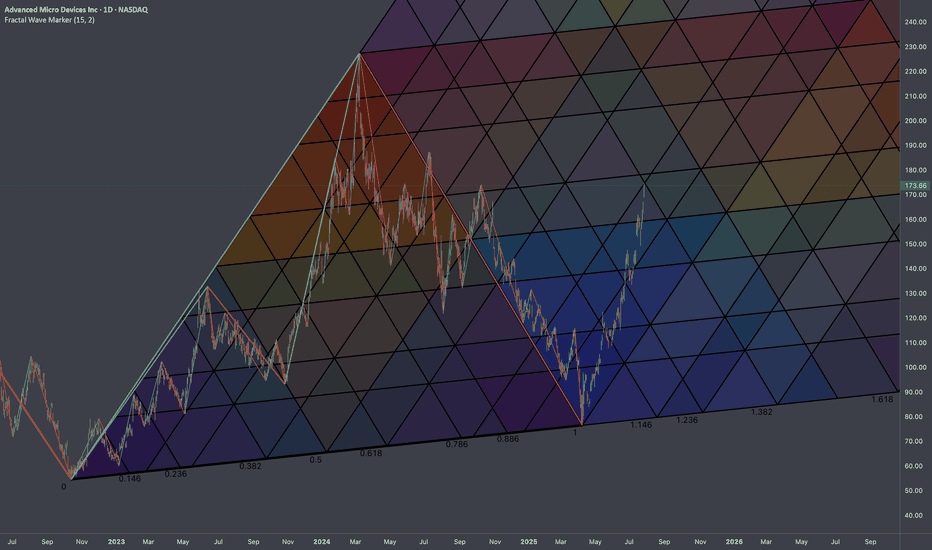

Uptrend Recovery: After bottoming near $76 in April 2025, AMD has made a strong rebound, more than doubling into the $180s. That’s a powerful recovery with momentum behind it.

Support Levels: $140.98 (Bull Target 1, now support) held beautifully during the climb. As long as

Buy AMD with Confidence. Hello I am the Cafe Trader.

My goal is to help you find great pricing for your long term, and help you finesse your position the markets.

Today we are going to take a closer look at AMD.

As of right now AMD has just peeled off it's highs, gapping down. Is this where buyers are stepping in? Shoul

AMD Pullback Opportunity After 70%+ Rally – Watching $111–$120 📈 AMD Update – Strategic Re-Entry Plan

From our original buys at $108, AMD has delivered an impressive 70%+ rally. This strong momentum reflects continued bullish sentiment and growth potential in the semiconductor sector.

We’re now looking to add on a pullback into a confluence support zone betwe

AMD Trendline Break – Short-Term Weakness, Long-Term AI Power PlAMD has broken below its long-standing ascending trendline, which has been respected multiple times since April. This is the first real sign of weakness after months of steady upside. The $162–165 zone, once strong support, is now acting as resistance. Unless bulls can reclaim this area quickly, AMD

a return to solid buyers presents a cheap =BUY opportunity 1->3 : creates a higher high with number 2

being a solid low , meaning the buyers that

came from here surpassed the sellers from

high number 1

4: a return to the solid buyers

* what do I think will happen :

* a return to solid sellers is always a good idea for

a buy setup

* some negative fac

AMD – Not Chasing, Just WaitingWaiting for a realistic pullback here — not interested in chasing strength. I’ve mapped out two potential entry zones depending on how deep the correction goes. If price pulls back and holds the first key area, I’ll start building the position. If it breaks lower, I’m prepared to add further at the

AMDPrice has moved in and out of the target box twice now. The micro pattern hasn't given enough information yet as to what prices immediate intentions are. We have move lower that could very well be the first a wave in wave (C). It could also just be yet another consolidation before we get another sli

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

AMD6026359

Advanced Micro Devices, Inc. 4.212% 24-SEP-2026Yield to maturity

—

Maturity date

Sep 24, 2026

AMD6026360

Advanced Micro Devices, Inc. 4.319% 24-MAR-2028Yield to maturity

—

Maturity date

Mar 24, 2028

See all AMD.B bonds

Curated watchlists where AMD.B is featured.