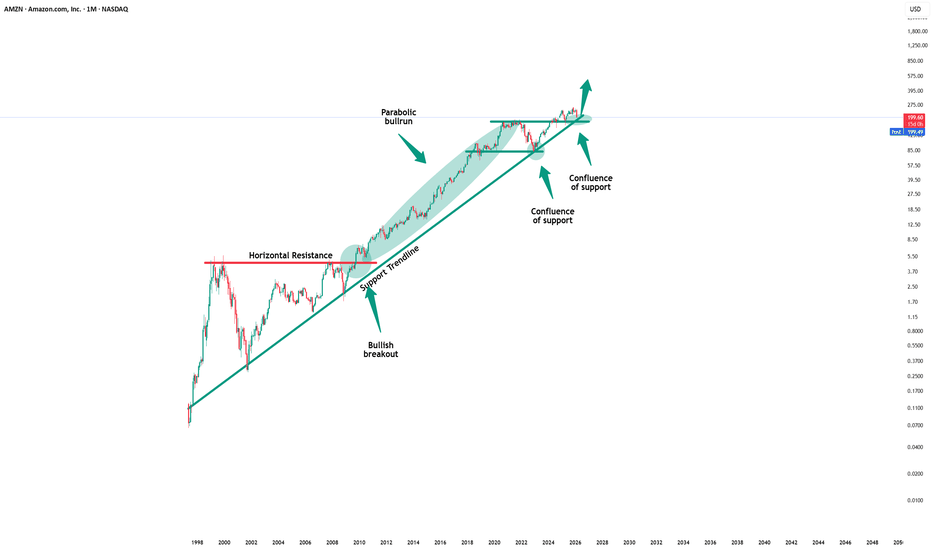

Amazon - This stock is still 100% bullish!🎉Amazon ( NASDAQ:AMZN ) just remains totally bullish:

🔎Analysis summary:

This month alone, Amazon is down about -15%. But looking at the higher timeframe, the underlying uptrend still remains incredibly strong. And even if Amazon drops another -15%, it will retest a significant support and su

Amazon.com, Inc. Shs Cert Deposito Arg Repr 0.00694444 Sh

No trades

Key facts today

In December, Amazon committed to building out AI infrastructure in India, emphasizing its focus on expanding within the country's rapidly advancing AI ecosystem.

65 ARS

96.73 T ARS

892.88 T ARS

About Amazon.com, Inc.

Sector

Industry

CEO

Andrew R. Jassy

Website

Headquarters

Seattle

Founded

1994

IPO date

May 15, 1997

Identifiers

2

ISIN ARBCOM460176

Amazon.com, Inc. engages in the provision of online retail shopping services. It operates through the following business segments: North America, International, and Amazon Web Services (AWS). The North America segment includes retail sales of consumer products and subscriptions through North America-focused websites such as amazon.com and amazon.ca. The International segment offers retail sales of consumer products and subscriptions through internationally-focused websites. The Amazon Web Services segment involves in the global sales of compute, storage, database, and AWS service offerings for start-ups, enterprises, government agencies, and academic institutions. The company was founded by Jeffrey P. Bezos in July 1994 and is headquartered in Seattle, WA.

Related stocks

Why AMZN had a Flash Crash and what comes next.

TradingView has awesome tools for your trading. However, tools along are not enough. AMZN had a Flash Crash on strong earnings and revenues for its 4th quarter of 2025. The reason it had a Flash Crash has NOTHING to do with its earnings. It had a Flash Crash on a NON-event which is a fear that so

Why Amazon Is a Buy NowWhy Amazon Is a Buy Now

Amazon is currently going through a significant transition period in early 2026.

Although the stock has experienced recent volatility with a drop of nearly 20% so far this year the analyst consensus remains mostly bullish with price targets ranging between $260 and $300.

Amazon (AMZN) Shares Struggle to Find Support After Weak ReportAmazon (AMZN) Shares Struggle to Find Support After Weak Report

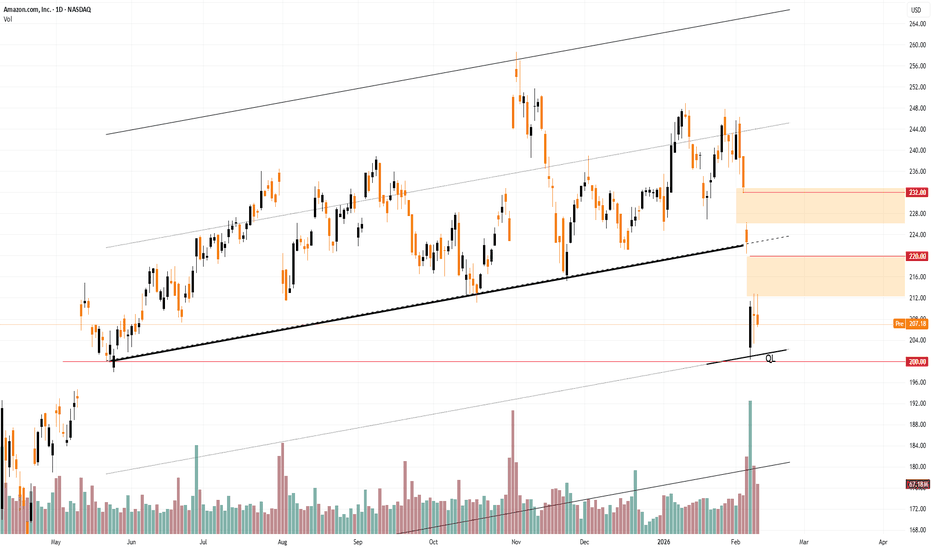

As the chart shows, Amazon (AMZN) shares have displayed pronounced bearish momentum following the release of a weak earnings report on 5 February:

→ Revenue: $213.4 bn (forecast: $211.4 bn)

→ Earnings per share (EPS): actual $1.95, f

Amazon stock continues to show weakness near the $200 levelAmazon shares have lost more than 9% of their value since earnings were released on February 5. Despite generally solid results — EPS of $1.95 per share versus an estimated $1.97, and revenues of $213 billion compared to $211 billion expected — what truly concerned the market was the increase in the

Amazons next move.Right now, Amazon is swimming in red flags that are dragging sentiment and stock performance into troubling territory. After reporting solid top-line growth with revenue gains and AWS expansion, investors shocked markets by unveiling a massive $200 billion capital expenditure plan for 2026, far abov

QS V4 ELITE: Extreme Oversold Signals AMZN ReversalAMZN QuantSignals V4 Weekly 2026-02-09

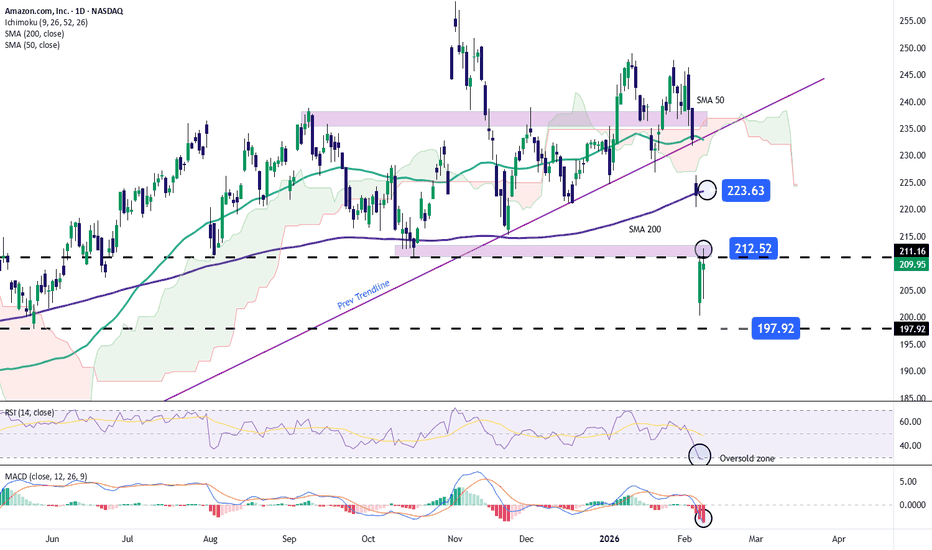

Amazon shares recently dropped following earnings, showing the market is sensitive to guidance and margins.

Some analysts warn that a technical signal similar to past setups preceded declines, highlighting risk if momentum fails.

🎯 Key Levels to Watch

(Use

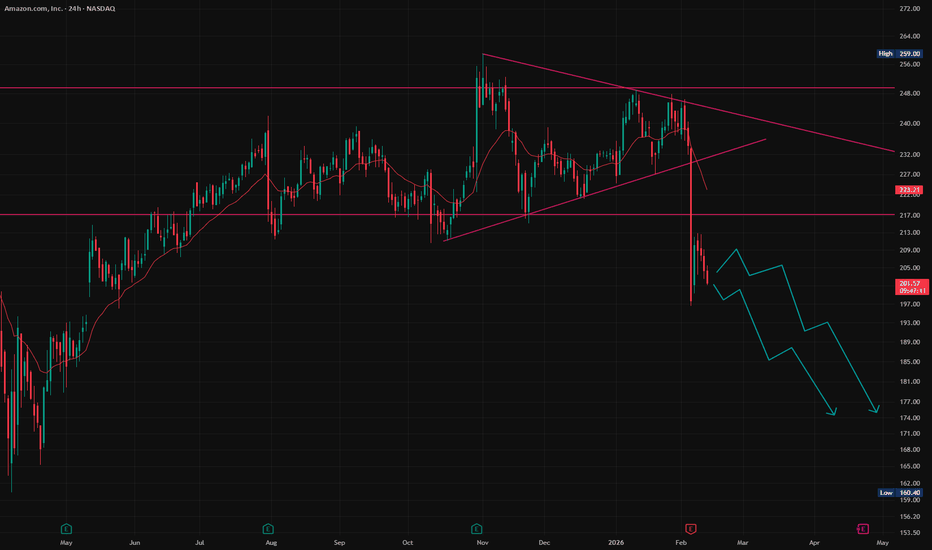

Amazon $AMZN has likely entered corrective phase.Three reasons:Amazon NASDAQ:AMZN - has likely entered a corrective phase.

Three reasons: 👇

- It broke below a six-month range and has remained there for several sessions, increasing the probability of further downside.

- The most recent lower high failed to approach the prior higher low — this is a sign of a

AMZN Wait For The Crack!This is a complete structure with 4 points, 3 waves, and a hook revealing a rising wedge.

The first mini-crack has already taken place.

The structure is all set up, valid, and ready to crack! All you have to do is wait.

🚨CAUTION! To all the bulls!

If you enjoy the work:

👉 Boost

👉 Follow

👉 Drop a

AMZN (H1): Bearish Continuation Scenario in FocusOn the 1-hour timeframe, AMZN appears to be transitioning from a corrective recovery phase into a renewed impulsive decline. The structure suggests that the recent advance may have completed a Wave 2 (or wave b in an alternative count), with price now rolling over into a potential Wave 3 or wave c s

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

AMZN6237342

Amazon.com, Inc. 5.55% 20-NOV-2065Yield to maturity

5.68%

Maturity date

Nov 20, 2065

AMZN5182960

Amazon.com, Inc. 3.25% 12-MAY-2061Yield to maturity

5.58%

Maturity date

May 12, 2061

AMZN6237344

Amazon.com, Inc. 5.45% 20-NOV-2055Yield to maturity

5.57%

Maturity date

Nov 20, 2055

AMZN4531868

Amazon.com, Inc. 4.25% 22-AUG-2057Yield to maturity

5.57%

Maturity date

Aug 22, 2057

AMZN5396185

Amazon.com, Inc. 4.1% 13-APR-2062Yield to maturity

5.56%

Maturity date

Apr 13, 2062

AMZN4996701

Amazon.com, Inc. 2.7% 03-JUN-2060Yield to maturity

5.54%

Maturity date

Jun 3, 2060

AMZN5182959

Amazon.com, Inc. 3.1% 12-MAY-2051Yield to maturity

5.50%

Maturity date

May 12, 2051

AMZN5396184

Amazon.com, Inc. 3.95% 13-APR-2052Yield to maturity

5.48%

Maturity date

Apr 13, 2052

AMZN4996700

Amazon.com, Inc. 2.5% 03-JUN-2050Yield to maturity

5.47%

Maturity date

Jun 3, 2050

AMZN4531866

Amazon.com, Inc. 4.05% 22-AUG-2047Yield to maturity

5.42%

Maturity date

Aug 22, 2047

US23135AQ9

Amazon.com, Inc. 4.95% 05-DEC-2044Yield to maturity

5.23%

Maturity date

Dec 5, 2044

See all AMZN bonds