General Motors (GM) Shares Hit All-Time HighGeneral Motors (GM) Shares Hit All-Time High

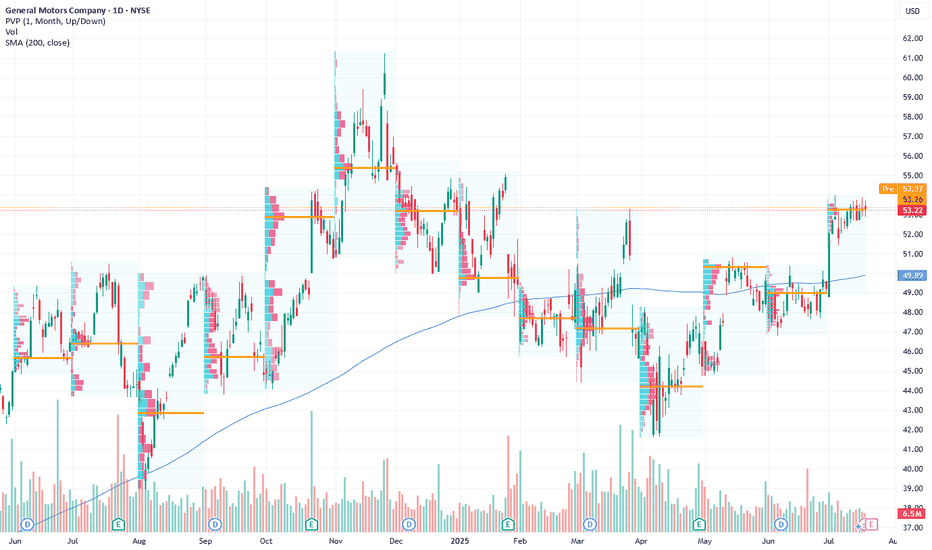

As shown on the General Motors (GM) stock chart:

→ During yesterday’s intraday session, the share price climbed above $67.40, surpassing the previous record high set in January 2022.

→ GM was among the top performers on the stock market, rising by aroun

Key facts today

General Motors posted strong earnings, surpassing expectations due to high demand, smart pricing, and cost control, positioning the company well as the auto sector nears year-end.

Several financial firms have boosted their price targets for General Motors (GM), with TD Cowen raising it to $100, Barclays to $85, RBC Capital to $86, and UBS to $85.

General Motors aims to introduce hands-free autonomous driving by 2028, beginning with the Cadillac Escalade IQ. The system has logged 700 million crash-free miles and mapped 600,000 miles of roads.

0.93 USD

5.34 B USD

166.49 B USD

About General Motors Company

Sector

Industry

CEO

Mary Teresa Barra

Website

Headquarters

Detroit

Founded

1908

ISIN

ARBCOM460408

General Motors Co. engages in the designing, manufacturing, and selling of trucks, crossovers, cars, and automobile parts, and in providing software-enabled services and subscriptions. It operates through the following segments: GMNA, GMI, Cruise, and GM Financial. The company was founded by William C. Durant on September 16, 1908 and is headquartered in Detroit, MI.

Related stocks

General Motors Could Be AcceleratingGeneral Motors has pushed higher amid low volatility, and some traders may think the automaker is starting to accelerate.

The first pattern on today’s chart is the series of higher lows since mid-August. Prices mostly remained below $59 until last week, creating an ascending triangle. They now seem

GM Breakout Watch – Calls Ready to Pop🚀 GM Swing Trade – \$58 Calls in Play!**

**Moderate Bullish Bias | Aug 15, 2025**

**📊 Key Highlights:**

* **RSI:** 74.2 – Strong bullish momentum 🔥

* **Price Momentum:** 5D +6.0%, 10D +8.0% 📈

* **Volume:** Weak ⚠️ (1.0x avg vs 1.3x needed)

* **Options Flow:** Neutral – No strong institutional lea

General Motors: Strong EV Strategy and Earnings Momentum Signal Current Price: $53.22

Direction: LONG

Targets:

- T1 = $54.45

- T2 = $55.54

Stop Levels:

- S1 = $52.34

- S2 = $51.10

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify

General Motors (NYSE: $GM) Reports 17% Y0Y in Q12025 Sales General Motors (NYSE: NYSE:GM ) opened at $44.46 on April 4th, 2025, down 3.91%. The stock declined $1.80 in early trading. This came a day after Trump’s new 25% auto import tariffs took effect. In a report released on April 2nd, GM delivered 693,363 vehicles in Q1 2025, a 17% year-over-year increa

GM Stock Chart Fibonacci Analysis 032125Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 48/61.80%

Chart time frame: C

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E

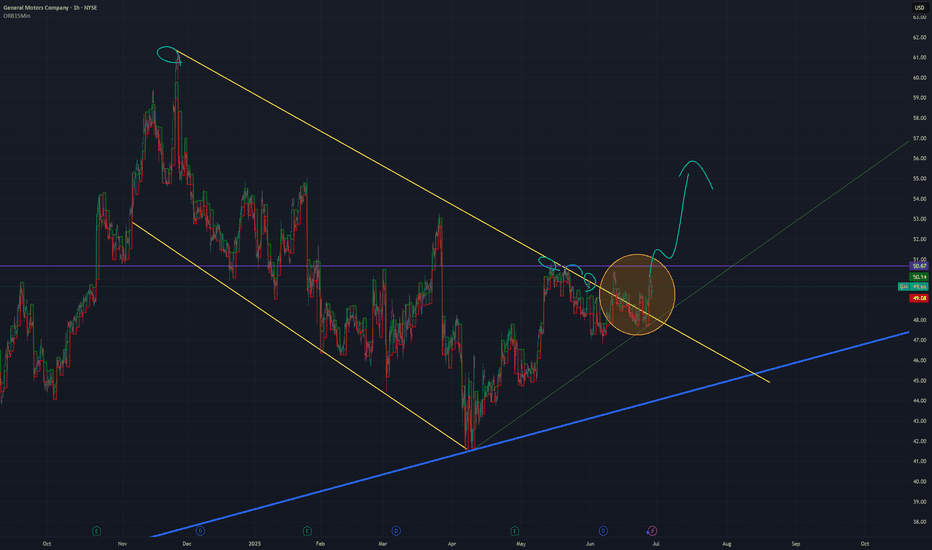

GM 1H Long Swing Conservative CounterTrend TradeConservative CounterTrend Trade

+ long impulse

+ volumed SOS test / T2 level

+ support level

+ 1/2 correction

+ biggest volume Sp

Calculated affordable stop limit

1 to 2 R/R above 1D T1 before 1/2 1M

Daily CounterTrend

"- short balance

- unvolumed expanding T1

+ volumed 2Sp+

+ test"

Monthly Trend

GM 5M Long Conservative Trend TradeConservative Trend Trade

+ long impulse

+ SOS level

+ support level

+ 1/2 correction

+ Sp

Calculated affordable stop limir

1 to 2 R/R take profit

1H Trend

"+ long impulse

+ volumed SOS test / T2 level

+ support level

+ 1/2 correction

+ biggest volume Sp

+ weak test

+ first buying bar closed"

1D C

GM Surging on Buyback & Dividend News! Can Bulls Push to $50+?Technical Analysis for February 27, 2025:

1. Current Price Action:

* GM surged on buyback and dividend news, reaching a high of $50.19 before pulling back to $48.60.

* Forming an ascending wedge pattern, indicating either a continuation or a breakdown.

* POC (Point of Control) at $48 is

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

G

GM5502199

General Motors Financial Company, Inc. 6.75% 20-NOV-2028Yield to maturity

6.66%

Maturity date

Nov 20, 2028

G

GM5509429

General Motors Financial Company, Inc. 5.75% 20-DEC-2026Yield to maturity

5.84%

Maturity date

Dec 20, 2026

G

GM5565379

General Motors Financial Company, Inc. 5.85% 20-APR-2029Yield to maturity

5.82%

Maturity date

Apr 20, 2029

G

GM5390585

General Motors Financial Company, Inc. 4.0% 20-APR-2026Yield to maturity

5.78%

Maturity date

Apr 20, 2026

G

GM6006873

General Motors Financial Company, Inc. 5.7% 20-FEB-2033Yield to maturity

5.78%

Maturity date

Feb 20, 2033

G

GM5477067

General Motors Financial Company, Inc. 5.7% 20-SEP-2028Yield to maturity

5.70%

Maturity date

Sep 20, 2028

See all GMD bonds

Curated watchlists where GMD is featured.