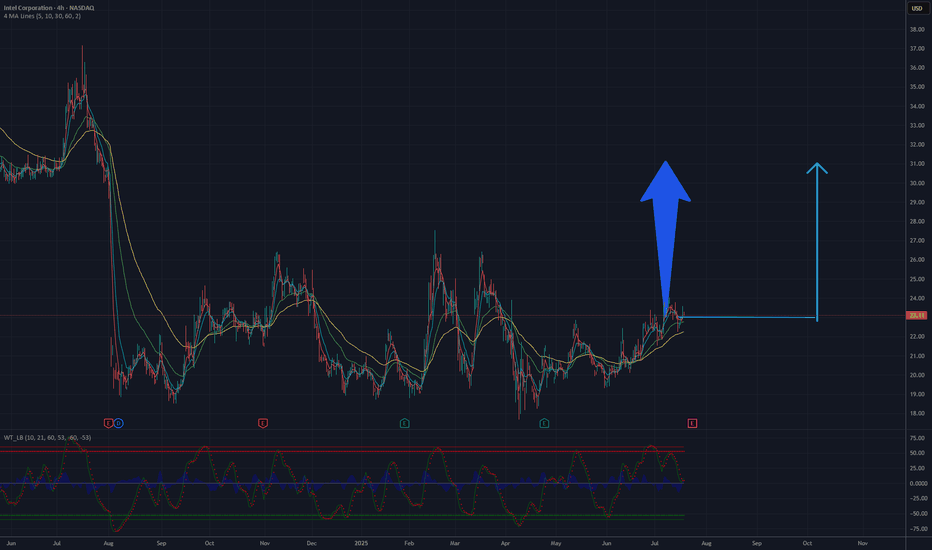

Intel - The breakout happens now!💰Intel ( NASDAQ:INTC ) will break out quite soon:

🔎Analysis summary:

For the past two decades, Intel has overall been moving sideways. While we witnessed significant swings during this period of time, Intel recently retested another strong support area. If Intel now breaks the short term resi

Key facts today

Intel's stock rose 6.3% after talks with Apple and a rating upgrade to 'Neutral'. It gained 3.2% in premarket, reaching $33.99, and is up nearly 40% in September.

Intel allowed the U.S. government to buy a 10% stake for $8.9 billion to boost domestic chip production and support national semiconductor goals.

Intel sought investment from Apple, but Bernstein analysts recommend Apple focus on stock buybacks instead, highlighting no clear advantages in investing in Intel.

−0.77 USD

−16.66 B USD

47.16 B USD

About Intel Corporation

Sector

Industry

CEO

Lip-Bu Tan

Website

Headquarters

Santa Clara

Founded

1968

ISIN

ARDEUT110210

FIGI

BBG000DW09R5

Intel Corp. engages in the design, manufacture, and sale of computer products and technologies. It delivers computer, networking, data storage, and communications platforms. The firm operates through the following segments: Client Computing Group (CCG), Data Center and AI (DCAI), Network and Edge (NEX), Mobileye, Accelerated Computing Systems and Graphics (AXG), Intel Foundry Services (IFS), and All Other. The CCG segment consists of platforms designed for notebooks, 2-in-1 systems, desktops, tablets, phones, wireless and wired connectivity products, and mobile communication components. The DCAI segment delivers solutions to cloud service providers and enterprise customers, along with silicon devices for communications service providers and high-performance computing customers. The NEX segment offers computing system solutions from inflexible fixed-function hardware to general-purpose compute, acceleration, and networking devices running cloud native software on programmable hardware. The Mobileye segment develops driving assistance and self-driving solutions. The AXG segment provides products and technologies designed to help customers solve the toughest computational problems. Its products include CPUs for high-performance computing and GPUs targeted for a range of workloads and platforms, from gaming and content creation on client devices to delivering media and gaming in the cloud, and the most demanding high-performance computing and AI workloads on supercomputers. The IFS segment refers to full stack solutions created from the foundry industry ecosystem. The All Other segment represents results from other non-reportable segments and corporate-related charges. The company was founded by Robert Norton Noyce and Gordon Earle Moore on July 18, 1968 and is headquartered in Santa Clara, CA.

Related stocks

Intel Is Up 20%+ on the Nvidia Deal. What Does Its Chart Say?Struggling Intel NASDAQ:INTC had its best market session in nearly four decades the other day when Nvidia NASDAQ:NVDA unexpectedly announced plans to invest $5 billion in the company. Does INTC's chart show this is the start of an uptrend -- or just a short-term rebound?

Let's take a look:

Nv

Intel (INTC) Shares Trade Around $30Intel (INTC) Shares Trade Around $30

In August, we noted that:

→ Intel (INTC) shares gained strong bullish momentum following reports that the US government was in talks to acquire a stake in the company;

→ the INTC chart was signalling that the depressed market, in place since 2021, was undergoi

INTC Short 5M Aggressive CounterTrend Day TradeAggressive CounterTrend Trade

- long impulse

+ biggest volume T1

+ resistance level

+ biggest volume 2Ut+

+ weak approach

- no test

Calculated affordable virtual stop loss

1 to 2 R/R take profit

1H CounterTrend

"- long impulse

+ T1 level

+ resistance level

+ 1/2 correction?"

1D CounterTrend

";- l

Mag 7 + Holding Companies + The RingLemme tell ya, Intel’s finally stretchin’ its legs. Don’t get me wrong — it’s been brutal watchin’ every other stock moon 30, 50, 100% while INTC’s been joggin’ like it’s late for the bus but don’t really care if it misses it. But listen, the DD’s done, the will’s strong, and right now the algos are

DOW THEORY PLAY - INTC CONFIRMS BREAKOUT FROM ACCUMULATION PHASEINTC - CURRENT PRICE : 29.58

Key Technical Highlights:

1. Breakout from Accumulation Phase with Strong Volume

Intel has successfully broken out of a prolonged sideways accumulation zone. The breakout is accompanied by significantly higher-than-average volume , indicating strong buying interest

Is it a time for INTEL? 32 $ will be soon.The Intel Corporation (INTC) chart on NASDAQ illustrates the stock price dynamics from 2024 to July 2025. Initially, the price rose to a peak in the first half of 2024, followed by a significant decline, reaching its lowest point around 24 USD by the end of 2024. Since then, the price has been conso

Intel INTC: Bullish Falling Wedge, Growth CatalystsNow is a great time to consider investing in Intel due to its strong fundamentals and positive industry catalysts. The company is benefiting from a major $5 billion investment by Nvidia and is ramping up significant U.S.-based manufacturing expansion backed by government support. Management’s turnar

Intel gets on radar after deal with NVDAIntel gets in play.

The deal announced with Nvidia had pushed the price higher substantially, for more than 3 values of daily volatility (measured in ATR). We can expect the momentum to go higher.

The move is happening in the context of Q2 results where revenue exceeded expectations, alongside man

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US458140CK4

Intel Corporation 5.9% 10-FEB-2063Yield to maturity

6.07%

Maturity date

Feb 10, 2063

INTC5456467

Intel Corporation 5.05% 05-AUG-2062Yield to maturity

6.00%

Maturity date

Aug 5, 2062

US458140AY6

Intel Corporation 4.1% 11-MAY-2047Yield to maturity

5.94%

Maturity date

May 11, 2047

INTC4969550

Intel Corporation 4.95% 25-MAR-2060Yield to maturity

5.94%

Maturity date

Mar 25, 2060

US458140BM1

Intel Corporation 4.75% 25-MAR-2050Yield to maturity

5.93%

Maturity date

Mar 25, 2050

INTC5456466

Intel Corporation 4.9% 05-AUG-2052Yield to maturity

5.92%

Maturity date

Aug 5, 2052

US458140BX7

Intel Corporation 3.2% 12-AUG-2061Yield to maturity

5.92%

Maturity date

Aug 12, 2061

US458140CJ7

Intel Corporation 5.7% 10-FEB-2053Yield to maturity

5.91%

Maturity date

Feb 10, 2053

INLB

Intel Corporation 4.9% 29-JUL-2045Yield to maturity

5.90%

Maturity date

Jul 29, 2045

US458140BK5

Intel Corporation 3.1% 15-FEB-2060Yield to maturity

5.90%

Maturity date

Feb 15, 2060

US458140AV2

Intel Corporation 4.1% 19-MAY-2046Yield to maturity

5.89%

Maturity date

May 19, 2046

See all INTCD bonds