168,100 ARS

2.74 T ARS

19.98 T ARS

About Vistra Corp.

Sector

Industry

CEO

James A. Burke

Website

Headquarters

Irving

Founded

1882

ISIN

AR0659507682

FIGI

BBG01V2GMJ06

Vistra Corp. is a holding company, which engages in the provision of electricity and power generation. It operates through the following segments: Retail, Texas, East, West, Sunset, and Asset Closure. The Retail segment sells electricity and natural gas to residential, commercial, and industrial customers. The Texas and East segments are involved in electricity generation, wholesale energy sales and purchases, commodity risk management activities, fuel production and fuel logistics management. The West segment represents the company's electricity generation operations in CAISO. The Sunset segment includes generation plants with announced retirement plans. The Asset Closure segment refers to the decommissioning and reclamation of retired plants and mines. The company was founded in 1882 and is headquartered in Irving, TX.

Related stocks

Vistra Corp. (VST) Thrives on Steady Power DemandVistra Corp. (VST) is a leading integrated retail electricity and power generation company in the U.S. Through its diverse portfolio of natural gas, coal, nuclear, solar, and battery storage assets, Vistra provides energy to millions of residential, commercial, and industrial customers. The company’

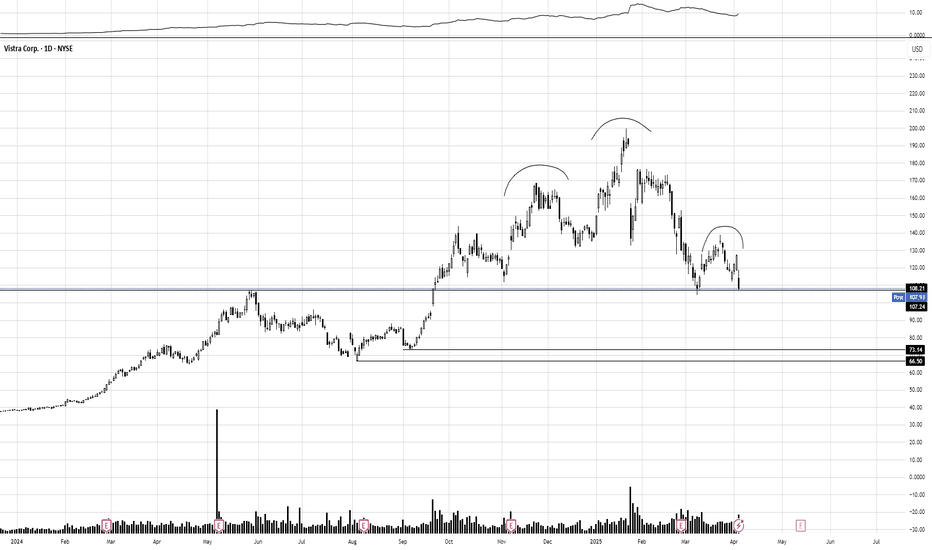

Cup and Handle Breakout Setup – Vistra Corp. (VST)Vistra Corp. (VST) is forming a classic Cup and Handle pattern on the daily chart. The cup formation has developed over several months, with a clear resistance zone around $200 now being tested again.

A confirmed breakout above $200 could trigger the next leg up. Based on the measured move from the

$VST — Breakout Confirmed, Momentum Supports Further Upside

Overview:

Vistra Corp. (NYSE:VST) has broken out of its recent range on the daily chart, supported by rising momentum and a clean bullish structure. The move is supported by volume and follows a textbook continuation pattern.

Price Action & Candlestick Structure

The last 3 daily candles show

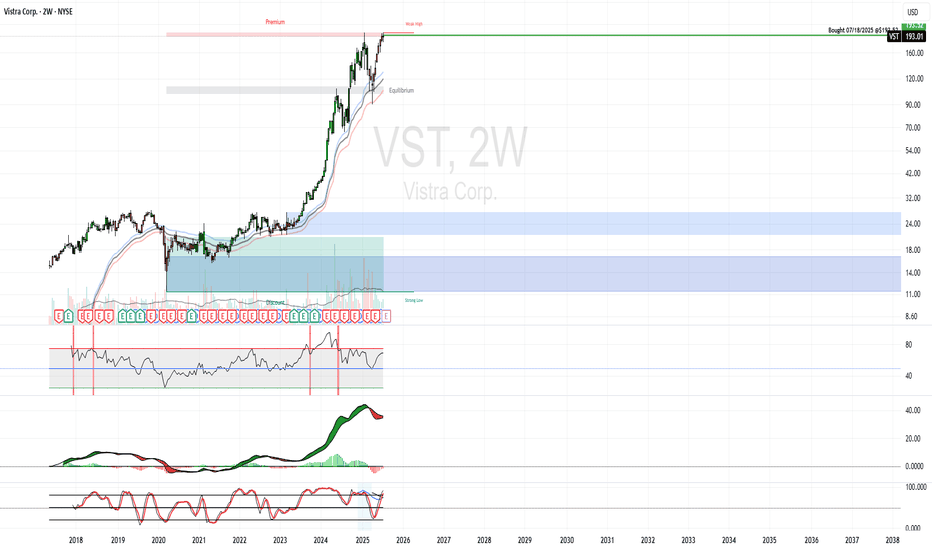

Vistra Corp - Uptrend intactVistra NYSE:VST has shown a steady uptrend being intact and is likely to continue higher after prices closes above the bearish gap and made a new high. Volume remain healthy.

Long-term MACD shows steady state of bullish momentum.

Despite showing overbought by our mid-term stochastic oscillator

VST | Long | Trend Continuation with Correction Setup (Aug 2025)VST | Long | Trend Continuation with Correction Setup (Aug 2025)

1️⃣ Quick Insight: Vistra Corp. has been in a strong uptrend, making new highs. We are now looking for a healthy correction to position for continuation, as "the trend is your friend."

2️⃣ Trade Parameters:

Bias: Long

Entry: $151 (wa

VST Purchase - Nuclear ThemeVistra Corp. (VST) – Cash Flow Machine

$4.09B TTM operating cash flow, highest among peers 2.

Strong nuclear and renewables mix, with AI data center exposure.

Thesis: Balanced growth and income play with upside from AI-driven demand.

Purchased CEG earlier. AI megatrend is tied to nuclear.

N

VST Weekly Analysis Summary (2025-04-16)VST Weekly Analysis Summary (2025-04-16)

Below is a consolidated analysis synthesizing the key points from all the model reports:

──────────────────────────────

Comprehensive Summary of Each Model’s Key Points

• Grok/xAI Report

– Technicals on 5‑minute and daily charts show price holding above key

OptionsMastery: Looking at a H&S on VST! 🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

VSTE5789672

Vistra Operations Co. LLC 6.875% 15-APR-2032Yield to maturity

6.65%

Maturity date

Apr 15, 2032

USU9226VAM9

Vistra Operations Co. LLC 7.75% 15-OCT-2031Yield to maturity

6.54%

Maturity date

Oct 15, 2031

VSTE5789663

Vistra Operations Co. LLC 6.0% 15-APR-2034Yield to maturity

6.03%

Maturity date

Apr 15, 2034

USU9226VAD9

Vistra Operations Co. LLC 4.3% 15-JUL-2029Yield to maturity

6.00%

Maturity date

Jul 15, 2029

VST5789673

Vistra Operations Co. LLC 6.875% 15-APR-2032Yield to maturity

5.88%

Maturity date

Apr 15, 2032

VST4790088

Vistra Operations Co. LLC 5.625% 15-FEB-2027Yield to maturity

5.67%

Maturity date

Feb 15, 2027

USU9226VAW7

Vistra Operations Co. LLC 5.25% 15-OCT-2035Yield to maturity

5.27%

Maturity date

Oct 15, 2035

USU9226VAU1

Vistra Operations Co. LLC 5.7% 30-DEC-2034Yield to maturity

5.26%

Maturity date

Dec 30, 2034

USU9226VAS6

Vistra Operations Co. LLC 6.0% 15-APR-2034Yield to maturity

5.18%

Maturity date

Apr 15, 2034

USU9226VAN7

Vistra Operations Co. LLC 6.95% 15-OCT-2033Yield to maturity

5.18%

Maturity date

Oct 15, 2033

USU9226VAH0

Vistra Operations Co. LLC 4.375% 01-MAY-2029Yield to maturity

5.16%

Maturity date

May 1, 2029

See all VST bonds