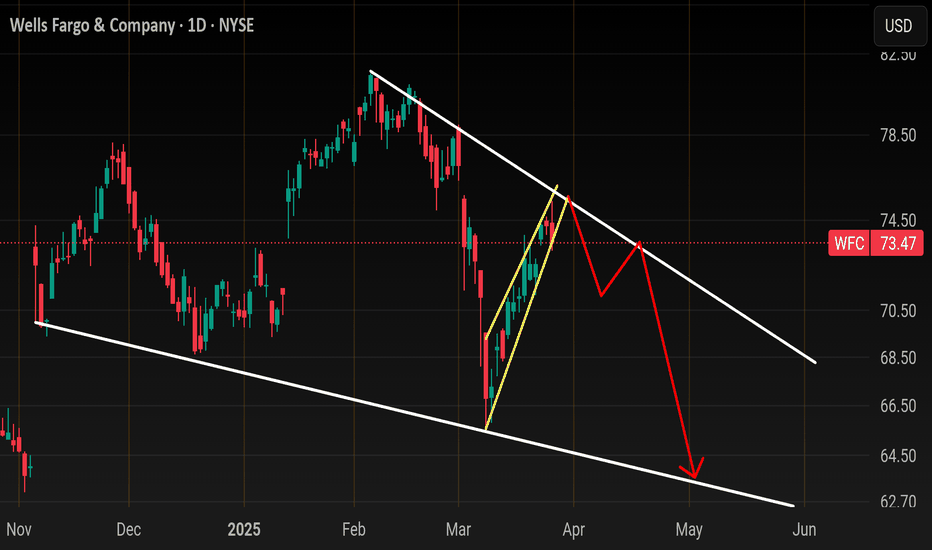

WFC eyes on $74: Major Resistance going into FED rate decision WFC testing a Major Resistance zone going into FED day.

Looking for a Rejection or a Break-and-Retest for next move.

Financials in general are doing well but due for a little dip.

$73.56-74.11 is the key zone of interest.

$68.91-69.60 is first good support below.

==================================

WELLS FARGO & COMPANY CEDEAR EACH 5 REP 1 COM USD1.666666

13,450ARSD

At close at Sep 9, 2024, 16:35 GMT

ARS

No trades

Key facts today

iCapital has acquired a private market funds unit from Citigroup, which includes operations linked to Wells Fargo's feeder funds, marking its 14th back-book acquisition.

1,100 ARS

18.06 T ARS

115.63 T ARS

About Wells Fargo & Company

Sector

Industry

CEO

Charles William Scharf

Website

Headquarters

San Francisco

Founded

1852

ISIN

ARDEUT110434

Wells Fargo & Co. is a diversified and community-based financial services company, which engages in the provision of banking, insurance, investments, mortgage, and consumer and commercial finance products and services. It operates through the following segments: Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth and Investment Management. The Consumer Banking and Lending segment offers consumer and small business banking, home lending, credit cards, auto, and personal lending. The Commercial Banking segment provides banking and credit products across industry sectors and municipalities, secured lending and lease products, and treasury management. The Corporate and Investment Banking segment is composed of corporate banking, investment banking, treasury management, commercial real estate lending and servicing, and equity and fixed income solutions, as well as sales, trading, and research capabilities. The Wealth and Investment Management segment refers to personalized wealth management, brokerage, financial planning, lending, private banking, trust, and fiduciary products and services. The company was founded by Henry Wells and William G. Fargo on March 18, 1852 and is headquartered in San Francisco, CA.

10.0%

11.7%

13.4%

15.1%

16.8%

Q1 '24

Q2 '24

Q3 '24

Q4 '24

Q1 '25

0.00

8.00 T

16.00 T

24.00 T

32.00 T

Total revenue

Net income

Net margin %

Total revenue

Int. expense & PCL

Non-int. expense

Op income

Unusual income/ expense

Pretax income

Taxes & Other

Net income

0.00

8.00 T

16.00 T

24.00 T

32.00 T

Total revenue

Int. & Non-int. expenses

Op income

Expenses & adjustments

Net income

0.00

8.00 T

16.00 T

24.00 T

32.00 T

Loans and customer deposits

Q1 '24

Q2 '24

Q3 '24

Q4 '24

Q1 '25

−500.00 T

−0.06

500.00 T

1,000.00 T

1,500.00 T

Net loans

Total deposits

Loan loss allowances

No news here

Looks like there's nothing to report right now

WFC: Short sell- Round 2Distribution with CHOCH structure confirmed.

Backtest with low supply volume- Good sell signal.

.

Let's see!

NShort

WFC Trade LevelsEither or set-up while in this range.

For day trades, expect price to move between 64.86-66.30 where there is a daily gap down.

For now, the gap is acting as resistance.

When trading gaps, it depends on your objective. Scalpers might be interested in playing off the H/L of the gap.

While intraday

WFC - Faster Up PhaseAs price transitions through fib circle acceleration of price upwards is allowed

Price has been going through an upward movement however slowly, I expect price to move up faster

This is similar to Tesla's moves upward. Kind of moving up in chunks or in big waves

Weekly timeframe

WFC LONG PUTMy game plan on Wells Fargo based on the weekly break of the S-Curve. We are officially bearish in my book. Looking to get in on a retest/key level in the bear zone. I will personally be using puts.

NShort

WFCXLF banking sector is rolling over and this is one of the best setups I can find going into earnings Q2... My target is 64 gap close By beginning of May.

Stop loss over 76.00 or 50sma.

Here's XLF.. same wedge at the 50ma

NShort

WFC is moving ahead of the market for better or worse?My overall thesis is we are in the very early stages of a multi-year decline ultimately with the S&P 500 below 3500. I have been wrong many times before so I will just take this thing in stages and see if it plays out. After this massive decline, we should be in for a great market rally of many deca

NShort

Wells Fargo $WFC at a turning point📌 09.03.2025 Analysis:

✅ 1. Bearish Divergence:

Price Action: Higher high from Nov 26, 2024 → Feb 6, 2025.

SMI: Lower high from Nov 26, 2024 → Feb 19, 2025.

Interpretation: This confirms a bearish divergence—institutions were not supporting the price move despite a new high.

📌 Notes:

Look at how

NLong

NLong

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

WFC4318953

Wells Fargo & Company 3.998043% 23-DEC-2030Yield to maturity

9.36%

Maturity date

Dec 23, 2030

CA949746RQ6

WELLS FARGO 15/25 MTNYield to maturity

9.36%

Maturity date

May 21, 2025

WFC5760754

Wells Fargo & Company 0.0% 28-FEB-2039Yield to maturity

8.85%

Maturity date

Feb 28, 2039

CH54576651

WELLS FARGO 20/25 MTNYield to maturity

8.60%

Maturity date

May 27, 2025

94CY

WELLS FARGO & COMPANY 2.5% SNR EMTN 02/05/29Yield to maturity

7.50%

Maturity date

May 2, 2029

US94974BGT1

WELLS FARGO 2046 MTNYield to maturity

6.97%

Maturity date

Jun 14, 2046

US94974BGU8

WELLS FARGO 2046 MTNYield to maturity

6.77%

Maturity date

Dec 7, 2046

US94974BGE4

WELLS FARGO 2044 MTNYield to maturity

6.74%

Maturity date

Nov 4, 2044

NWTP

WELLS FARGO 15/45 MTNYield to maturity

6.72%

Maturity date

Nov 17, 2045

WFC5679614

Wells Fargo & Company 6.75% 06-NOV-2033Yield to maturity

6.70%

Maturity date

Nov 6, 2033

WFC4979802

Wells Fargo & Company 3.068% 30-APR-2041Yield to maturity

6.67%

Maturity date

Apr 30, 2041

See all WFC.B bonds

Curated watchlists where WFC.B is featured.