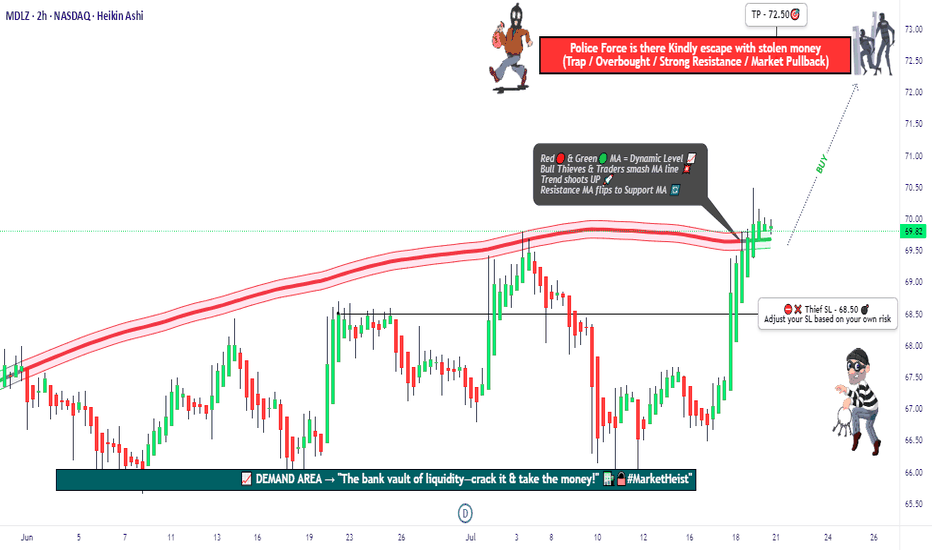

"MDLZ Heist LIVE! Quick Profit Grab Before Reversal!"🚨 MONDELEZ HEIST ALERT: Bullish Loot Zone! (Swing/Day Trade Plan) 🚨

Thief Trading Strategy | High-Risk, High-Reward Play

🌟 Greetings, Market Pirates! 🌟

Hola! Oi! Bonjour! Hallo! Marhaba!

To all Money Makers & Strategic Robbers 🤑💸—this is your blueprint to plunder "MONDELEZ INTERNATIONAL, INC" with

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2,570 CLP

4.60 T CLP

36.37 T CLP

1.29 B

About Mondelez International, Inc.

Sector

Industry

CEO

Dirk van de Put

Website

Headquarters

Chicago

Founded

1903

FIGI

BBG00YFS94K7

Mondelez International, Inc. engages in the manufacture and marketing of snack food and beverage products. Its products include beverages, biscuits, chocolate, gum and candy, cheese and groceries, and meals. Its brands include 5Star, 7Days, Alpen Gold, Barni, Belvita, Bournvita, Cadbury, Cadbury Dairy Milk, Chips Ahoy! Clif, Clorets, Club Social, Côte d'Or, Daim, Enjoy Life Foods, Freia, Grenade, Halls, Honey Maid, Hu, Kinh Do, Lacta, Lu, Marabou, Maynards Bassett’s, Mikado, Milka, Oreo, Perfect Snacks, Philadelphia, Prince, Ritz, Royal, Sour Patch Kids, Stride, Tang, Tate’s Bake Shop, Tiger, Toblerone, Triscuit, TUC, and Wheat Thins. It operates through the following geographical segments: Latin America, Asia, Middle East, and Africa, Europe, and North America. The company was founded by James Lewis Kraft in 1903 is headquartered in Chicago, IL.

Related stocks

MDLZ - Bullish Flag patternBullish Flag pattern

The Bull Flag pattern forecasts in the near future. Currently, it's just early planning with small profits and a reminder to set a stop loss if the pattern cannot breakout upwards.

Both the M50 and MACD indicators suggest the potential for price increase.

The volume is still l

Mondelez (MDLZ): Snack Giant Preps for Possible BreakoutMondelez International, Inc. (MDLZ) is a global snacking powerhouse, best known for beloved brands like Oreo, Chips Ahoy, Cadbury, Ritz, and Toblerone. With a presence in over 150 countries, the company continues to grow by focusing on high-margin snacks, expanding into emerging markets, and boostin

Reversal on Mondelez Looking Favorable. MDLZA clear Elliott 5 wave impulse down is complete, along with classical divergences on the momentum indicator. Willing to bet that this is a reversal with MIDAS line cross and US/vWAP acting as resistance in synchronicity. Interestingly, there's a double harmonic that formed in the more long term aspe

Mondelez at the Edge: Can Bulls Hold the Line?A Pivotal Moment for Mondelez – Will the Bulls Step Up?

Mondelez International (NASDAQ: MDLZ) is trading at $58.05, clawing back some ground but still down 26.1% from its all-time high of $78.59. The stock has been oscillating near a critical resistance level at $58.40, testing the patience of bot

Long-Term Target Analysis for Mondelēz International (MDLZ):Bullish Long-Term Scenario:

If MDLZ reverses course and breaks above the $60.50-$65.00 resistance zone, a long-term bullish trajectory could emerge. Historical price action and Fibonacci projections suggest:

First bullish target: $67.00, the 200-day EMA level and a previous key resistance point.

Se

MDLZ $72.00 - Don't Miss Out on This 18%NASDAQ:MDLZ announced it would like to buy NYSE:HSY which led to a drop to $60. The sell-off came with a high volume and an oversold RSI. The buyers were able to buy the stop up to $61.44 getting it into the support zone. The sell-off did also respect the current bearish channel we're in. From th

MDLZ - 1W - Trade in ProgressThis trade was initiated when the price reached our area of interest, where the bottom of the uptrend channel, the EMA200, medium-term support, and the weakening downtrend converged.

The target is the top of the bullish channel, but the trade will likely be closed at the first signs of weakening on

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MDLZ4797239

Mondelez International, Inc. 3.625% 13-FEB-2026Yield to maturity

—

Maturity date

Feb 13, 2026

MDLZ3673483

Mondelez International, Inc. 6.875% 26-JAN-2039Yield to maturity

—

Maturity date

Jan 26, 2039

MDLZ5878983

Mondelez International, Inc. 4.75% 28-AUG-2034Yield to maturity

—

Maturity date

Aug 28, 2034

MDLZ6067981

Mondelez International, Inc. 5.125% 06-MAY-2035Yield to maturity

—

Maturity date

May 6, 2035

M

MDLZ5263459

Mondelez International Holdings Netherlands BV 1.25% 24-SEP-2026Yield to maturity

—

Maturity date

Sep 24, 2026

M

MDLZ5472069

Mondelez International Holdings Netherlands BV 4.25% 15-SEP-2025Yield to maturity

—

Maturity date

Sep 15, 2025

MDLZ3672261

Mondelez International, Inc. 6.875% 01-FEB-2038Yield to maturity

—

Maturity date

Feb 1, 2038

MDLZ5755555

Mondelez International, Inc. 4.75% 20-FEB-2029Yield to maturity

—

Maturity date

Feb 20, 2029

See all MDLZCL bonds

Curated watchlists where MDLZCL is featured.

Frequently Asked Questions

The current price of MDLZCL is 64,264 CLP — it has increased by 3.73% in the past 24 hours. Watch Mondelez International, Inc. Class A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BCS exchange Mondelez International, Inc. Class A stocks are traded under the ticker MDLZCL.

We've gathered analysts' opinions on Mondelez International, Inc. Class A future price: according to them, MDLZCL price has a max estimate of 85,519.92 CLP and a min estimate of 65,111.76 CLP. Watch MDLZCL chart and read a more detailed Mondelez International, Inc. Class A stock forecast: see what analysts think of Mondelez International, Inc. Class A and suggest that you do with its stocks.

MDLZCL reached its all-time high on Jan 31, 2024 with the price of 70,546 CLP, and its all-time low was 55,430 CLP and was reached on Sep 2, 2022. View more price dynamics on MDLZCL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

MDLZCL stock is 3.59% volatile and has beta coefficient of 0.05. Track Mondelez International, Inc. Class A stock price on the chart and check out the list of the most volatile stocks — is Mondelez International, Inc. Class A there?

Today Mondelez International, Inc. Class A has the market capitalization of 77.26 T, it has increased by 1.67% over the last week.

Yes, you can track Mondelez International, Inc. Class A financials in yearly and quarterly reports right on TradingView.

Mondelez International, Inc. Class A is going to release the next earnings report on Nov 4, 2025. Keep track of upcoming events with our Earnings Calendar.

MDLZCL earnings for the last quarter are 682.88 CLP per share, whereas the estimation was 633.55 CLP resulting in a 7.79% surprise. The estimated earnings for the next quarter are 719.51 CLP per share. See more details about Mondelez International, Inc. Class A earnings.

Mondelez International, Inc. Class A revenue for the last quarter amounts to 8.40 T CLP, despite the estimated figure of 8.29 T CLP. In the next quarter, revenue is expected to reach 9.50 T CLP.

MDLZCL net income for the last quarter is 599.63 B CLP, while the quarter before that showed 383.22 B CLP of net income which accounts for 56.47% change. Track more Mondelez International, Inc. Class A financial stats to get the full picture.

Yes, MDLZCL dividends are paid quarterly. The last dividend per share was 439.66 CLP. As of today, Dividend Yield (TTM)% is 3.06%. Tracking Mondelez International, Inc. Class A dividends might help you take more informed decisions.

Mondelez International, Inc. Class A dividend yield was 3.00% in 2024, and payout ratio reached 52.29%. The year before the numbers were 2.24% and 44.76% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Sep 1, 2025, the company has 90 K employees. See our rating of the largest employees — is Mondelez International, Inc. Class A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Mondelez International, Inc. Class A EBITDA is 5.68 T CLP, and current EBITDA margin is 18.20%. See more stats in Mondelez International, Inc. Class A financial statements.

Like other stocks, MDLZCL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Mondelez International, Inc. Class A stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Mondelez International, Inc. Class A technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Mondelez International, Inc. Class A stock shows the strong buy signal. See more of Mondelez International, Inc. Class A technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.