Bullish pennant pattern! This is what I'm looking at on the 2hr chart! It has finally broken out of this bullish pennant that was formed Monday, my price target now is somewhere 478/480 in the next few days! Will see ... this is NOT financial advice! Just sharing my personal analysis! That's all, Thanks!

TL0 trade ideas

Tesla - SHOW ME THE CHART AND I WILL TELL YOU THE NEWS!Back in June and July, Elon and Tesla were STILL getting a lot of bad press (Elon fighting with President Trump, people burning Tesla cars etc). Those that follow me may recall on July 29th I wrote the following:

"Tesla just needs a narrative shift (ie -new invention etc), & price action changes in a heart beat.

Yet, price action really has less to do with the news making Elon a hero, then a villain and then back and forth...but moreso to do with price action patterns that just keep repeating".

And you'll note that my July chart suggested that the huge pump to $400+ would begin around Sept 1st (Huge green arrow after the retest). What a coincidence that 2 weeks later Elon announces a $1Billion dollar Tesla stock buy (the new anticipated "narrative"). My huge green arrow was there many weeks before this "news". How could I have known?

SHOW ME THE CHART AND I WILL TELL YOU THE NEWS.

On July 29th Tesla was $321 and I suggested that Tesla was about to have a major breakout to at least $400 "with no major retraces". That target has now been hit. Is it because of the news or is it the patterns that just keep repeating?

My T1 targets are probable targets, so I anticipate them almost always getting hit. My ideal buy and sell targets are T2. Tesla now appears to be headed into my T2 target, so it's time to start monitoring price action closely.

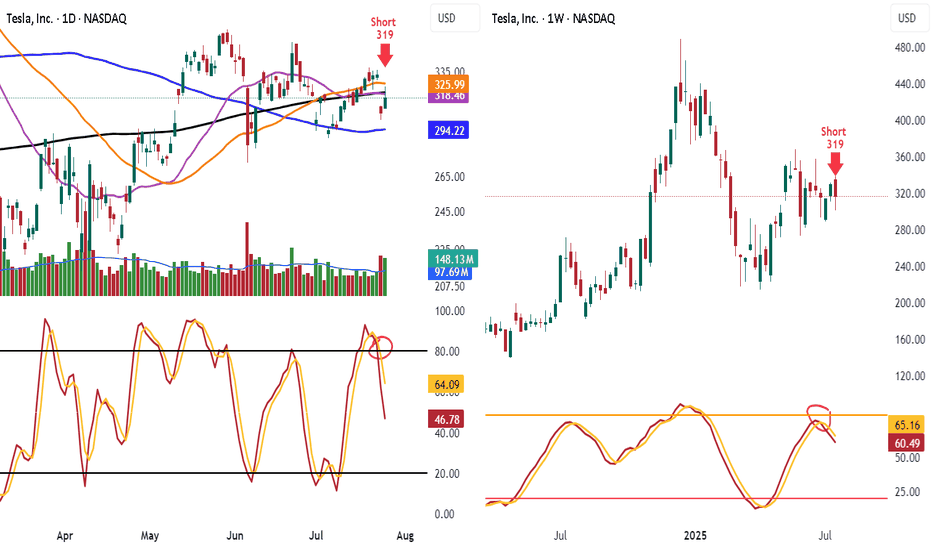

Shorted TSLA 319 Look at TSLA hit 50 day and 200 day MA and failed and know under them

Look at the lower highs and see the stoch heading down

Know lets look weekly stoch heading down and lower highs

Target is 100 day ma 294.22 take some off. When it breaks will add back on

Have trailing stop in place

$TSLA broke down today on the 15-minute chart.NASDAQ:TSLA broke down today on the 15-minute chart.

Not with fireworks, but with precision — the type of move that punishes late longs and rewards those who prepared.

The truth? It’s never about guessing the direction.

It’s about setting the framework before the bell: pre-market levels mapped, risk defined, noise filtered.

When the signal confirms, you don’t hesitate. You execute.

Most of the time, the market whispers.

Sometimes, it shouts.

Your edge is built in the quiet hours, so when the move comes, you’re already positioned.

Cut losers fast.

Let winners breathe.

Keep showing up until probability pays you.

Tesla: Bullish Momentum Points to $500 Breakout Current Price: $426.07

Direction: LONG

Targets:

- T1 = $450.00

- T2 = $500.00

Stop Levels:

- S1 = $410.00

- S2 = $395.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify Tesla's high-probability trade setups. The wisdom of crowds principle suggests that the aggregated views from professional traders often produce high-quality forecasts. Tesla’s position as one of the most active and closely monitored equities by institutional investors amplifies the importance of consensus-driven strategies in this stock.

**Key Insights:**

Tesla has benefited from its strong electric vehicle (EV) market leadership, underpinning its growth trajectory as the EV industry expands globally. Traders highlight Tesla's ability to maintain robust operational margins despite headwinds such as rising commodity and transportation costs. Tesla’s ambitious Full Self-Driving (FSD) vision and upcoming AI developments have sparked significant enthusiasm among tech-focused investors, bolstering its long-term growth outlook.

From a technical perspective, Tesla is trading above its 50-day and 200-day moving averages, signaling upward strength. Recent trading volumes show consistent institutional accumulation, and the Relative Strength Index (RSI) remains below overbought levels, confirming room for continued upside. Professional traders expect Tesla to test the $450 level in the coming sessions, with the $500 mark identified as the next major extension point.

**Recent Performance:**

Tesla has demonstrated impressive resilience in 2025, rallying over 30% year-to-date while outperforming many of its peers in both the automotive and technology sectors. This upward momentum has been fueled by strong quarterly revenue growth and better-than-expected production numbers, despite macroeconomic concerns like inflationary pressures and volatile supply chains. Tesla’s recent price movement shows a robust support zone around $400, with increasing buying pressure pushing the price toward new highs.

**Expert Analysis:**

Market experts are largely optimistic about Tesla's future prospects, emphasizing the rapidly unfolding EV growth story and Tesla’s early entry advantages. As governments worldwide implement tighter emissions regulations and incentivize clean-energy adoption, Tesla stands out with its scalable production capacity and differentiated market position. Analysts also highlight catalysts such as the Cybertruck launch scheduled for late 2025 and margin expansion driven by cost-saving measures at key Gigafactories.

Technically, experts highlight Tesla’s bullish setup, formed by a series of higher lows and higher highs. Fibonacci retracement analysis places the next major resistance at $450, with $500 highlighted as the psychological and technical breakout point for long-term investors. Tesla’s MACD indicator remains strong, supporting an extended bullish trend.

**News Impact:**

Recent news regarding Tesla's continued success in expanding its market share in Europe and Asia has positively influenced sentiment. Additionally, CEO Elon Musk's statement outlining new advancements in robotics and AI platforms has sparked excitement about non-automotive revenue streams. Tesla's upcoming Investor Day, scheduled for Q4 2025, is likely to introduce updates on strategic innovations, driving higher investor confidence.

**Trading Recommendation:**

Based on Tesla’s technical setup, strong fundamentals, and favorable news flow, a long position is recommended. Traders should consider targeting the $450 level as the first resistance, while $500 serves as the medium-term price objective. Stops should be placed at $410 and $395, reflecting prudent risk management. Tesla’s continued momentum in 2025 makes this trade a compelling opportunity for growth-focused investors.

Do you want to save hours every week? Register for the free weekly update in your language!

Bullish Tesla Mission Activated – Grab the Loot Now!💎🚨 TESLA STOCK MARKET HEIST PLAN 🚨💎

🕵️♂️ Attention All Thief OG’s, Chart Ninjas & Wall Street Pickpockets!

We’re gearing up for a full-blown Tesla loot mission — bullish, layered, and locked on target! 📈💰

🎯 Plan:

Bullish Layered Entry Strategy 🤑

We’re stacking multiple BUY LIMIT layers like a pro bank job:

💵 (330.00) | 💵 (320.00) | 💵 (310.00) | 💵 (300.00)

(You can add more layers if you want to steal bigger)

🛑 Stop Loss:

The Thief’s SL @ 280.00 💣

📌 Adjust to your own risk — every crew member knows their escape route!

Remember: A good thief never leaves fingerprints, only profits.

🏆 Target:

🚓 Police barricade at 420.00 — better vanish before the sirens!

🎯 Secure the main loot at 400.00 before making a clean getaway.

💡 Thief Strategy Tip:

Layering lets you grab more loot if price dips — like breaking into multiple vaults.

Keep your disguise on and watch the charts — Wall Street guards are always watching. 👀🖤

⚠️ Warning for the Crew:

Major news drops = cops on every corner.

Stay hidden, trail your stops, and protect the stash.

💥 Smash the ❤️ LIKE button if you’re in for this Tesla mission!

📌 Follow the crew for more Thief Trader blueprints — next heist drops soon!

TESLA - Robotaxi will drive the price above 1000This is not a short-term trade as you know from me on FX, Crypto and Indices. This is buy and hold investment. I got already good bag of share and Im still adding without trying to time if perfectly, but now I think its time to buy bigger positions.

Tesla is my 3rd biggest position after the Bitcoin and Strategy (MicroStrategy). Many people see it only as an EV cars company, but it's not all what they do, just read bellow to see why I see a huge potential in this company.

📍Why Tesla is Considered a Top Investment

Tesla stands out as a leading player in the EV market, with a strong brand and a history of delivering innovative products. In 2024, it produced about 459,000 vehicles and delivered over 495,000 in the fourth quarter alone, showcasing its ability to meet growing demand Tesla Fourth Quarter 2024 Production, Deliveries & Deployments.

💾Financially, Tesla reported $97,690 million in total revenue for 2024, with the automotive segment contributing $87,604 million and energy solutions adding $10,086 million Tesla, Inc. Annual Report on Form 10-K for 2024. This diversification into energy, alongside investments in autonomous driving, positions Tesla for long-term growth, making it attractive for investors seeking exposure to future trends in sustainability and technology.

📍What Tesla Does Beyond EV Cars

Beyond EVs, Tesla is deeply involved in energy solutions:

📍Solar Products: Offers solar panels and solar roofs for clean energy generation.

📍Energy Storage: Provides Powerwall for homes and Megapack for large-scale projects, helping stabilize grids and manage energy costs.

📍Charging Infrastructure: Operates a network of Supercharger stations, increasingly open to other EVs.

Services: Includes vehicle maintenance through service centers and body shops.

📍Robotaxi: Plans to launch a fully autonomous ride-hailing service in June 2025 in Austin, Texas, potentially opening new revenue streams Tesla's robotaxis by June? Musk turns to Texas for hands-off regulation.

📍Tesla Optimus: Developing a general-purpose robotic humanoid for tasks like household chores or industrial work, which could lead to new markets.

This expansion into energy and services, along with unexpected ventures like Robotaxi and Tesla Optimus, enhances Tesla's role in the transition to sustainable energy and technology, offering benefits like grid stability and potential robotics applications.

The growth in the energy segment, with a 67% increase from 2023 to 2024, highlights Tesla's expanding role in sustainability, potentially attracting investors focused on long-term trends. Additionally, Tesla's commitment to innovation, particularly in autonomous driving technology, is noteworthy. The company is developing features like Full Self-Driving (FSD), which could open new revenue streams, such as robotaxi services, enhancing its investment appeal.

🤔I think Optimus and Robotaxi will exceed rapidly exceed their EV cars revenue. Elon musk is predicing over 1000% growth in 5 years. Which would be way above $2900 without stocks splits.

I m a bit conservative and I think we can go somewhere between 3 - 4 standard deviations.

Wishing you continued success on your trading journey. May this educational post inspire you to become an even better trader!

“Adapt what is useful, reject what is useless, and add what is specifically your own.”

Perfectly nailed bottom around 200 and our positions are now 50% in profit good luck

David Perk ⚔

HOW MUCH HIGHER CAN TESLA GO? (September 17, 2025)Since my last video Tesla stock is up over 25% in the past week and we are breaking a very key Fibonacci levels.

In this video, we look at a higher timeframe charts to determine if Tesla can keep pushing towards $600 and $1000 in the coming months ahead given how much it is outperforming everything else in the stock market

TESLA Wave Analysis – 24 September 2025

- TESLA rising inside impulse wave iii

- Likely to reach resistance level 460.00

TESLA has been rising in the last few trading sessions inside the sharp upward impulse wave iii – which belongs to the intermediate impulse wave C from June.

The price earlier broke above the round resistance level 400.00 - which strengthened the bullish pressure on TESLA.

Given the clear daily uptrend, TESLA can be expected to rise further in the active impulse wave iii toward the next resistance level 460.00 (target price for the completion of the active impulse wave iii).

TSLA Sep 23 – Bulls Testing 440, Gamma Fuel Could Stretch This MPrice Action & Setup (1-Hour Chart)

TSLA pushed from the mid-420s and tagged 440 intraday before easing into a tight sideways drift around 436. Price is riding the lower rail of an ascending channel that started last week. Key intraday support is stacked near 433 and 426; a deeper flush could revisit 417.5. Holding above 433 keeps the short-term trend intact and gives bulls a clean springboard for the next leg.

Momentum Read

MACD on the 1-hour is still positive though histogram bars are tapering—classic sign of a healthy pause rather than a breakdown. Stoch RSI hovers near 80, so a quick reset or sideways chop would help build energy for another push.

GEX (Options Flow) Confluence

Options positioning leans bullish and matches the chart:

* Highest positive GEX / Call resistance: ~436

* 2nd Call Wall: ~450 (near 70% call concentration)

* 3rd Call Wall: ~457.5–460

* Main Put Defenses: 417.5, 410, 405 and a big floor at 400

If TSLA can stay north of 436, market makers may keep hedging upward, creating a gamma squeeze potential into 450 and beyond. A clean break below 433 would start unwinding that gamma and bring 417.5 into play.

Trading Plan

* Upside scalp: Buy strength on a 440 break with a first target at 450 and a trailing stop under 433.

* Retest entry: If we dip to 433–426 and bounce with volume, that’s a low-risk reload spot aiming again for 440+.

* Bear hedge: Below 426 with heavy sell volume, short toward 417.5 makes sense.

Option Angle

For bullish plays, short-dated calls around the 440–450 strikes look attractive if 436 holds and IV stays reasonable. For hedging or quick shorts, puts near 417.5 or 410 work if a breakdown confirms.

Bottom Line

Trend bias stays up as long as TSLA holds 433–426. A strong hourly close over 440 could pull in more gamma fuel toward 450–457. Fail that zone and expect a deeper check toward 417.

Disclaimer: This is for educational discussion only and not financial advice. Always do your own research and manage risk.

what is market needs ?market need a huge money to move < money will pass in market pocket to pocket.

each move is not same profit for them they also does not know how much they can earn so to minimize their loss they go for test .in test they have a pool we call it range/side. they feed small institute. they will help them with hedge funds in sharp move /.

when you want to trade . trust in just one trend do not trade by whole moves .

A Bullish Long-Term Outlook Tesla continues to present a compelling case for long-term investors, underpinned by its innovation-led growth trajectory and emerging dominance in autonomous mobility. Technically, recent market structure reveals an imbalance within a quarterly bullish breaker, suggesting further price expansion. If macroeconomic conditions remain favorable, the next algorithmic target zones fall between $594 and $690, signaling potential upside.

On the fundamental front, Tesla’s recent moves—particularly its rollout of the robotaxi network—have ignited fresh investor optimism. Analysts now estimate that autonomous driving could account for a substantial portion of Tesla’s future valuation, with some long-range forecasts placing the stock above $2,000 within the next several years.

While short-term pressures such as softening EV demand and regulatory barriers persist, Tesla’s consistent execution on AI-driven mobility may unlock new valuation territory.

I know you dont like me but..but... the whole universe is a huge fractal. Repetition inside a repetition repeated over time. Trading and investing is not far away from philosophy.

Look ar my BTC fractal prediction. its simple on point week by week.

Not an investment advice. Go to meditate.

Elon rules.

TSLA looking for rejection around 200HMASo, I've been bearish on TSLA around that $400 mark and was waiting for more PA to evolve before calling the shots. It broke down. Quite rapidly actually. Currently looking to see what happens when price floats around that 200HMA in red. Also looking at weekly RSI that broke down the centre of the channel. If RSI on weekly cannot reclaim above centra at 50 and price has a hard time returning above 200HMA, I'll be looking for another leg down on HTF. I'm looking at weekly timeframe here so be mindful about that. I'm fluid. For me, price doesn't have to get a clean rejection for me to make up my mind. Although, that would make life easier, I'll also look at how price behaves around a certain price level. What I mean by that is: I don't care whether the price will go higher than that 200HMA in daily candles. I care about weekly closes and formations around that area.

Every counter has a sweet spot. Every counter has a sweet spot. The only question: are you trading it at the right time?

Most traders obsess over what to trade, but few stop to ask when to trade it.

Timing is the difference between a setup that compounds consistently… and one that bleeds capital.

That’s exactly why I built thenexxtradealpha — Adaptive Opening Framework.

It’s designed to identify the optimal timeframe for any counter, so you’re not second-guessing whether you should be looking at the 5-minute, 15-minute, or daily chart.

The framework adapts to the counter itself — helping you trade in alignment with its natural rhythm, not against it.

Because once you know the right time, you stop forcing trades…

And start trading with precision.