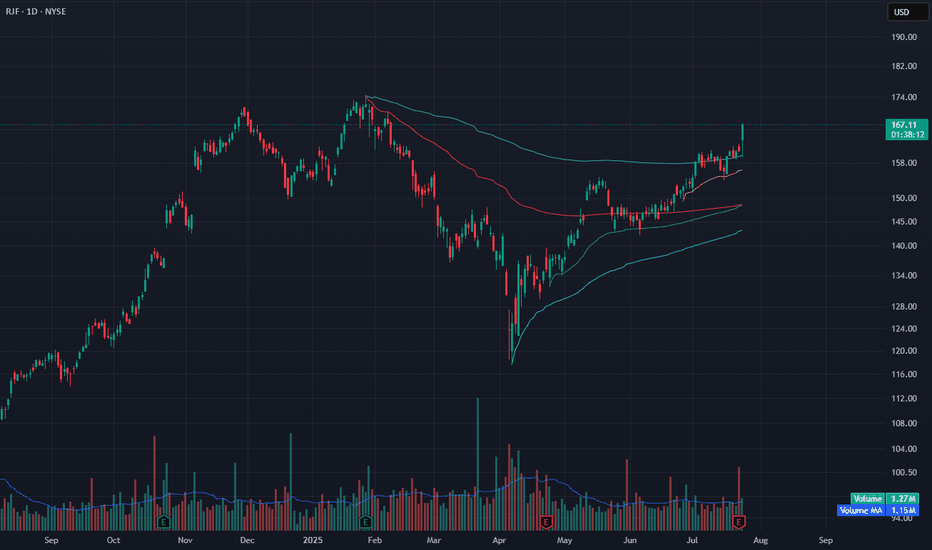

RJF Breaks Out Above Range – Fresh High on Anchored VWAP SupportRJF broke out with a strong +3.88% candle, clearing the previous range and reclaiming its upper VWAP zone. Price is now trading above all key anchored VWAP levels, with the yellow VWAP acting as near-term support.

Volume came in above average (1.27M vs. 1.15M MA), confirming demand. The breakout cl

Raymond James Financial, Inc. Depositary Shares, each representing a 1/40th interest in a share of 6.375% Fixed-to-Floating Rate Series B Non-Cumulative Perpetu

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

10.54 USD

2.13 B USD

15.91 B USD

178.97 M

About Raymond James Financial, Inc.

Sector

Industry

CEO

Paul M. Shoukry

Website

Headquarters

St. Petersburg

Founded

1962

ISIN

US7547304060

FIGI

BBG017WSGSN2

Raymond James Financial, Inc. is an investment holding company, which engages in the provision of financial and investment services. Its services include investment management, merger and acquisition and advisory, the underwriting, distribution, trading and brokerage of equity and debt securities, sale of mutual funds, corporate and retail banking, and trust services. It operates through the following segments: Private Client Group, Capital Markets, Asset Management, Bank, and Other. The Private Client Group segment provides financial planning, investment advisory, and securities transaction services to clients through financial advisors. The Capital Markets segment focuses on investment banking, institutional sales, securities trading, equity research and the syndication, and management of investments in low-income housing funds and funds of a similar nature. The Asset Management segment is involved in asset management, portfolio management, and related administrative services to retail and institutional clients. The Bank segment refers to the results of banking operations. The Other segment includes private equity investments, which predominantly consist of investments in third-party funds. The company was founded by Robert A. James in 1962 and is headquartered in St. Petersburg, FL.

Related stocks

Crooked WBad pattern noted yet strong volume and a pocket pivot noted.

Possible bearish shark which can end at the .886 or the 1.113. If price reaches the 1.113, it would be a new ATH/Current ATH is 117.37

This one just does not look like it will go a whole lot higher, but the volume and PP look bullish f

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

RJF6171330

Raymond James Financial, Inc. 5.65% 11-SEP-2055Yield to maturity

5.84%

Maturity date

Sep 11, 2055

RJF5152088

Raymond James Financial, Inc. 3.75% 01-APR-2051Yield to maturity

5.71%

Maturity date

Apr 1, 2051

RJF4381228

Raymond James Financial, Inc. 4.95% 15-JUL-2046Yield to maturity

5.65%

Maturity date

Jul 15, 2046

RJF6171329

Raymond James Financial, Inc. 4.9% 11-SEP-2035Yield to maturity

5.08%

Maturity date

Sep 11, 2035

RJF4971768

Raymond James Financial, Inc. 4.65% 01-APR-2030Yield to maturity

4.08%

Maturity date

Apr 1, 2030

See all RJF/PB bonds

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on BOATS exchange Raymond James Financial, Inc. Depositary Shares, each representing a 1/40th interest in a share of 6.375% Fixed-to-Floating Rate Series B Non-Cumulative Perpetu stocks are traded under the ticker RJF/PB.

Yes, you can track Raymond James Financial, Inc. Depositary Shares, each representing a 1/40th interest in a share of 6.375% Fixed-to-Floating Rate Series B Non-Cumulative Perpetu financials in yearly and quarterly reports right on TradingView.

Raymond James Financial, Inc. Depositary Shares, each representing a 1/40th interest in a share of 6.375% Fixed-to-Floating Rate Series B Non-Cumulative Perpetu is going to release the next earnings report on Jan 28, 2026. Keep track of upcoming events with our Earnings Calendar.

RJF/PB earnings for the last quarter are 3.11 USD per share, whereas the estimation was 2.83 USD resulting in a 9.97% surprise. The estimated earnings for the next quarter are 2.95 USD per share. See more details about Raymond James Financial, Inc. Depositary Shares, each representing a 1/40th interest in a share of 6.375% Fixed-to-Floating Rate Series B Non-Cumulative Perpetu earnings.

Raymond James Financial, Inc. Depositary Shares, each representing a 1/40th interest in a share of 6.375% Fixed-to-Floating Rate Series B Non-Cumulative Perpetu revenue for the last quarter amounts to 3.73 B USD, despite the estimated figure of 3.64 B USD. In the next quarter, revenue is expected to reach 3.81 B USD.

RJF/PB net income for the last quarter is 604.00 M USD, while the quarter before that showed 436.00 M USD of net income which accounts for 38.53% change. Track more Raymond James Financial, Inc. Depositary Shares, each representing a 1/40th interest in a share of 6.375% Fixed-to-Floating Rate Series B Non-Cumulative Perpetu financial stats to get the full picture.

Yes, RJF/PB dividends are paid quarterly. The last dividend per share was 0.40 USD. As of today, Dividend Yield (TTM)% is 1.31%. Tracking Raymond James Financial, Inc. Depositary Shares, each representing a 1/40th interest in a share of 6.375% Fixed-to-Floating Rate Series B Non-Cumulative Perpetu dividends might help you take more informed decisions.

Raymond James Financial, Inc. Depositary Shares, each representing a 1/40th interest in a share of 6.375% Fixed-to-Floating Rate Series B Non-Cumulative Perpetu dividend yield was 1.16% in 2025, and payout ratio reached 19.42%. The year before the numbers were 1.47% and 18.56% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

Like other stocks, RJF/PB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Raymond James Financial, Inc. Depositary Shares, each representing a 1/40th interest in a share of 6.375% Fixed-to-Floating Rate Series B Non-Cumulative Perpetu stock right from TradingView charts — choose your broker and connect to your account.