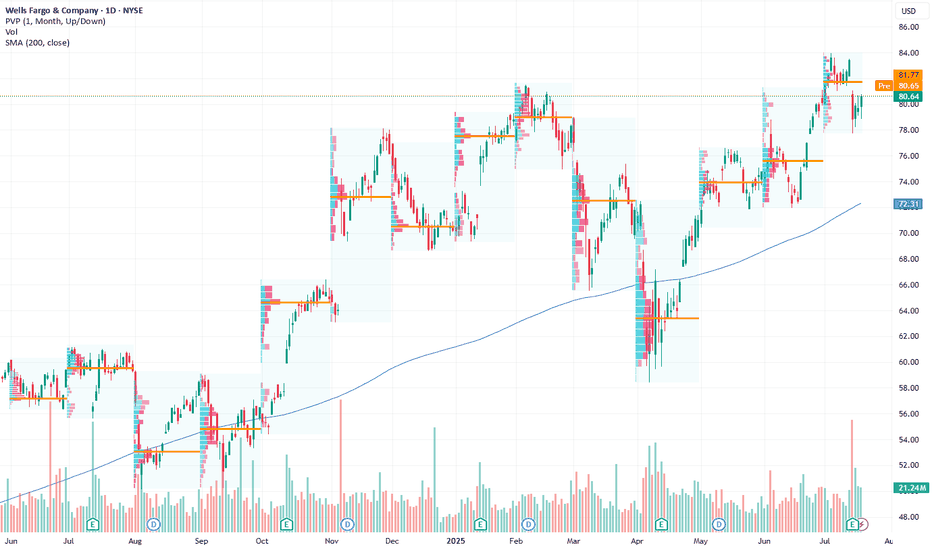

Wells Fargo Beat the S&P 500 Over 12 Months. What Its Chart SaysWells Fargo NYSE:WFC will report earnings next week at a time when the banking giant's stock recently hit an all-time high and is beating the S&P 500 SP:SPX on a one-year and five-year basis, but trailing more recently. What does the stock's technical and fundamental analysis show?

Let's check

Wells Fargo & Company Depositary Shares, each representing a 1/1,000th interest in a share of Non-Cumulative Perpetual

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.15 USD

19.72 B USD

126.28 B USD

3.20 B

About Wells Fargo & Company

Sector

Industry

CEO

Charles William Scharf

Website

Headquarters

San Francisco

Founded

1852

ISIN

US95002Y2028

FIGI

BBG00Z19HY08

Wells Fargo & Co. is a diversified and community-based financial services company, which engages in the provision of banking, insurance, investments, mortgage, and consumer and commercial finance products and services. It operates through the following segments: Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth and Investment Management. The Consumer Banking and Lending segment offers consumer and small business banking, home lending, credit cards, auto, and personal lending. The Commercial Banking segment provides banking and credit products across industry sectors and municipalities, secured lending and lease products, and treasury management. The Corporate and Investment Banking segment is composed of corporate banking, investment banking, treasury management, commercial real estate lending and servicing, and equity and fixed income solutions, as well as sales, trading, and research capabilities. The Wealth and Investment Management segment refers to personalized wealth management, brokerage, financial planning, lending, private banking, trust, and fiduciary products and services. The company was founded by Henry Wells and William G. Fargo on March 18, 1852 and is headquartered in San Francisco, CA.

Related stocks

US banks on shaky ground Macro conditions are turning hostile. The commercial real estate market, especially office, is structurally impaired in certain segments. Vacancy rates in major US metros are above 20%. Office prices are down 30–40% from their 2022 peaks. With over $1.2 trillion in CRE debt maturing by 2027, refinan

$WFC following through on weekly evening starLike other financial companies the sheen has come off #WFC recent chart. Even before Fridays market tantrums we saw price printing a weekly bearish evening star, and then last week we closed beneath the Weekly 20MA. Will WFC earning tomorrow provide fuel for a move lower, or rescue this decline? Wat

WFLWe’re maintaining a bullish outlook on Wells Fargo. After a sustained period of consolidation, the stock has now broken through its RSI trend line to the upside – a classic technical signal indicating strengthening momentum and a potential continuation of the uptrend.

Why we’re bullish on WFC:

Mom

Shorted WFC 78.68 target 74 or lowerLooking at the daily chart u can see we have lower highs, and engulfing candle. Look closely u have 25 day rolling down bottom arrow. We also broke 50 day ma with vol. We have daily stoch heading down.

Also I explain this all time cannot go far in a car with out fuel same with market looking at vo

Wells Fargo Stock Chart Fibonacci Analysis 073025Hit the 84.5/423.60% resistance level.

Trading Idea

Chart time frame:D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:E

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise fr

Trade Setup: LONG on WFC!📈

🕰️ Timeframe: 30-minute chart

🔍 Pattern: Bull flag / descending channel breakout

📉 Previous Trend: Uptrend with healthy retracement

🧭 Setup: Breakout from short-term correction, aligning with trendline support

🧩 Technical Breakdown:

Support Zones:

$83.00 (holding on ascending trendline)

$82.50

Wells Fargo: Bearish Sentiment Signals Potential DownsideCurrent Price: $80.64

Direction: SHORT

Targets:

- T1 = $77.62

- T2 = $74.81

Stop Levels:

- S1 = $82.25

- S2 = $84.12

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identi

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

94CY

Wells Fargo & Company 2.5% 02-MAY-2029Yield to maturity

6.83%

Maturity date

May 2, 2029

WFC5679614

Wells Fargo & Company 6.75% 06-NOV-2033Yield to maturity

6.73%

Maturity date

Nov 6, 2033

WFC5673508

Wells Fargo & Company 6.65% 26-OCT-2033Yield to maturity

6.62%

Maturity date

Oct 26, 2033

WFC5679616

Wells Fargo & Company 6.8% 06-NOV-2038Yield to maturity

6.60%

Maturity date

Nov 6, 2038

WFC5513958

Wells Fargo & Company 5.25% 15-DEC-2025Yield to maturity

6.49%

Maturity date

Dec 15, 2025

WFC5702806

Wells Fargo & Company 6.4% 15-NOV-2033Yield to maturity

6.38%

Maturity date

Nov 15, 2033

WFC5707017

Wells Fargo & Company 6.4% 24-NOV-2033Yield to maturity

6.33%

Maturity date

Nov 24, 2033

WFC6061104

Wells Fargo & Company 6.0% 28-APR-2045Yield to maturity

6.08%

Maturity date

Apr 28, 2045

WFC5643509

Wells Fargo & Company 6.2% 31-AUG-2033Yield to maturity

6.00%

Maturity date

Aug 31, 2033

WFC6091312

Wells Fargo & Company 6.0% 05-JUN-2045Yield to maturity

5.99%

Maturity date

Jun 5, 2045

WFC5711788

Wells Fargo & Company 6.05% 04-DEC-2033Yield to maturity

5.98%

Maturity date

Dec 4, 2033

See all WFC/PC bonds

XPF

iShares S&P/TSX North American Preferred Stock Index ETF (CAD-Hedged) Trust UnitsWeight

0.32%

Market value

546.20 K

USD

Explore more ETFs

Curated watchlists where WFC/PC is featured.

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on BOATS exchange Wells Fargo & Company Depositary Shares, each representing a 1/1,000th interest in a share of Non-Cumulative Perpetual stocks are traded under the ticker WFC/PC.

Yes, you can track Wells Fargo & Company Depositary Shares, each representing a 1/1,000th interest in a share of Non-Cumulative Perpetual financials in yearly and quarterly reports right on TradingView.

Wells Fargo & Company Depositary Shares, each representing a 1/1,000th interest in a share of Non-Cumulative Perpetual is going to release the next earnings report on Jan 14, 2026. Keep track of upcoming events with our Earnings Calendar.

WFC/PC earnings for the last quarter are 1.66 USD per share, whereas the estimation was 1.55 USD resulting in a 7.32% surprise. The estimated earnings for the next quarter are 1.66 USD per share. See more details about Wells Fargo & Company Depositary Shares, each representing a 1/1,000th interest in a share of Non-Cumulative Perpetual earnings.

Wells Fargo & Company Depositary Shares, each representing a 1/1,000th interest in a share of Non-Cumulative Perpetual revenue for the last quarter amounts to 21.44 B USD, despite the estimated figure of 21.15 B USD. In the next quarter, revenue is expected to reach 21.57 B USD.

WFC/PC net income for the last quarter is 5.59 B USD, while the quarter before that showed 5.49 B USD of net income which accounts for 1.73% change. Track more Wells Fargo & Company Depositary Shares, each representing a 1/1,000th interest in a share of Non-Cumulative Perpetual financial stats to get the full picture.

Yes, WFC/PC dividends are paid quarterly. The last dividend per share was 0.27 USD. As of today, Dividend Yield (TTM)% is 1.98%. Tracking Wells Fargo & Company Depositary Shares, each representing a 1/1,000th interest in a share of Non-Cumulative Perpetual dividends might help you take more informed decisions.

Wells Fargo & Company Depositary Shares, each representing a 1/1,000th interest in a share of Non-Cumulative Perpetual dividend yield was 2.14% in 2024, and payout ratio reached 27.96%. The year before the numbers were 2.64% and 26.90% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Oct 19, 2025, the company has 217 K employees. See our rating of the largest employees — is Wells Fargo & Company Depositary Shares, each representing a 1/1,000th interest in a share of Non-Cumulative Perpetual on this list?

Like other stocks, WFC/PC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Wells Fargo & Company Depositary Shares, each representing a 1/1,000th interest in a share of Non-Cumulative Perpetual stock right from TradingView charts — choose your broker and connect to your account.