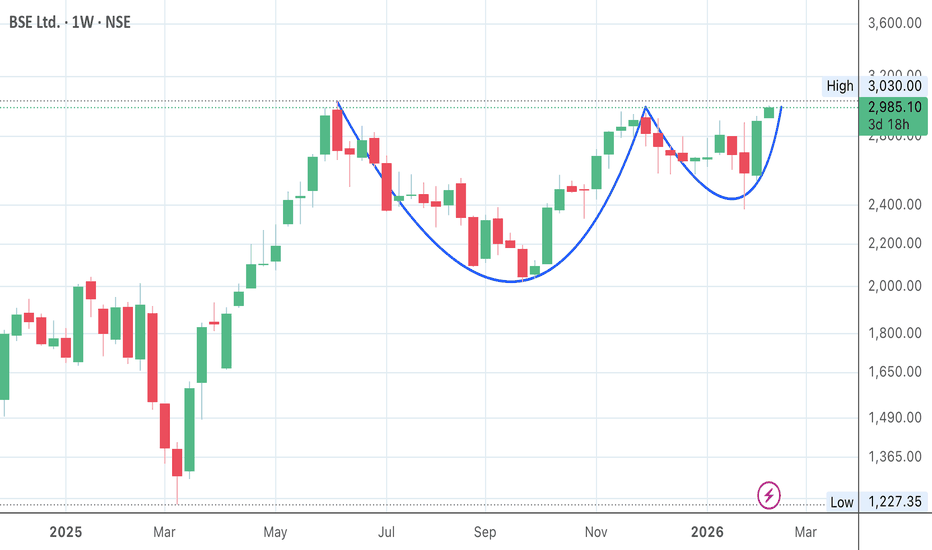

ALL TIME HIGH BREAKOUT ---------- BSE !!!!You may consider buying BSE if it sustains the breakout till this friday . This is a fantastic opportunity to buy and hold it forever .

BSE is a fantastic and sound stock , fundamentals are great , technicals now confirms that the stock is yet to sky rocket .

MUST REQUIRED

* The stock should sus

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

53.90 INR

13.26 B INR

32.31 B INR

385.92 M

About BSE Ltd.

Sector

Industry

CEO

Sundararaman Ramamurthy

Website

Headquarters

Mumbai

Founded

1875

IPO date

Feb 3, 2017

Identifiers

2

ISIN INE118H01025

BSE Ltd. is a securities exchange, which engages in the provision of a platform for trading in equity, currencies, debt instruments, derivatives, and mutual funds. The company focuses on facilitating trading in securities and other related ancillary services. It also provides a platform for trading equities of small-and-medium enterprises and a host of other services to capital market participants, including risk management, clearing, settlement, market data services, and education. The company was founded in 1875 and is headquartered in Mumbai, India.

Related stocks

BSE Ltd – Bullish Continuation Setup | Result-Driven MomentumBSE Ltd is showing a strong bullish structure on the daily timeframe. Price has respected the rising trendline support and recently gave a decisive breakout above the prior resistance zone near ₹3,020–₹3,050, indicating a shift from consolidation to continuation.

🔹 Structure & Price Action

Higher hi

BSE – High Volatility, High Return Potential?🟦 BSE – High Volatility, High Return Potential?

BSE is showing high volatility, and when backed by structure, volatility can translate into opportunity.

📊 Technical View

• Sharp fall after NSE IPO announcement, followed by strong recovery

• Price action suggests upside as long as recent lows hold

BTR PRO RECOVERY DAY – Morning Loss Recovered Successfully!🔥 BTR PRO RECOVERY DAY – Morning Loss Recovered Successfully! ✅

BSE LTD | 15m | 30 Jan 2026

Today was a perfect example of why discipline beats emotion.

📌 Morning session: whipsaw / false move → loss booked

📌 But BTR PRO stayed active and gave a clean reversal opportunity

📌 Final session: strong

BSE LTD | BTR Pro 36 Points | 29 Jun 2026BSE LTD | Intraday Setup | 29 Jun 2026

✅ BUY Entry: 2830

🛑 Stop Loss: 2800 (30 pts risk)

🎯 Target 1: 2848 ✅ (+18 pts)

🎯 Target 2: 2866 ✅ (+36 pts)

📌 Clean execution with BTR PRO SL + Targets

📌 No noise. No emotions. Only rule-based trading.

💬 Follow for daily BTR PRO updates & setups

BTR PRO Delivers Again – +50 Points INTRADAY! 27 Jan 2026🔥 BTR PRO DELIVERS AGAIN – +50 POINTS INTRADAY! 🔥

📅 Date: 27 Jan 2026

Stock: BSE LTD

Indicator: BTR PRO Price Action (SL + Targets)

✅ BUY ENTRY: 2705

🎯 T1 HIT

🎯 T2 HIT

🎯 T3 HIT

📈 INTRADAY EXIT: 2755

💰 PROFIT: +50 POINTS CLEAN MOVE

No noise.

No emotions.

Pure Price Action + Rule-Based Targets.

📌

BSE LTD | Swing Trade Update | BTR Sell Signal (23 Jan 2026)📅 Date: 23 Jan 2026

📉 Signal: BTR Generated SELL

📊 Outcome Today: No Movement → No Profit, No Loss (Neutral Day)

BSE LTD triggered a BTR Sell Signal on 23 Jan 2026, however price remained range-bound throughout the session. Lack of follow-through confirms indecision, not signal failure.

This is a

BTR delivers +50 points | 22 JAN 2026 | BSE LTD🔥BTR delivers +50 points | 22 JAN 2026 | BSE LTD 🔥

Live trade shared in advance.

End of day = CLEAR +50 POINTS PROFIT ✅

No noise. No emotion. Only BTR Price Action.

👉 Follow for LIVE trading setups

💰 +50 POINTS DONE & DUSTED | BTR POWER 💰

22 Jan 2026 — Live setup → Clean execution → 50 POINTS PRO

BTR Live Bullish Trade Setup | BSE Ltd | 22 Jan 2026Market opened with strength and BTR Price Action Indicator confirmed a clean bullish opportunity.

🔹 Stock: BSE Ltd

🔹 Timeframe: 15-Min

🔹 Date: 22 Jan 2026

✅ BTR Trade Plan

• Buy Entry: Near 2670–2675 (BTR Buy Signal candle close)

• Trend Bias: Bullish continuation

• Structure: Higher low + stro

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of BSE is 2,741.00 INR — it has decreased by −7.28% in the past 24 hours. Watch BSE Ltd. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange BSE Ltd. stocks are traded under the ticker BSE.

BSE stock has fallen by −3.87% compared to the previous week, the month change is a −1.61% fall, over the last year BSE Ltd. has showed a 61.25% increase.

We've gathered analysts' opinions on BSE Ltd. future price: according to them, BSE price has a max estimate of 3,760.00 INR and a min estimate of 2,202.00 INR. Watch BSE chart and read a more detailed BSE Ltd. stock forecast: see what analysts think of BSE Ltd. and suggest that you do with its stocks.

BSE stock is 2.76% volatile and has beta coefficient of 2.29. Track BSE Ltd. stock price on the chart and check out the list of the most volatile stocks — is BSE Ltd. there?

Today BSE Ltd. has the market capitalization of 1.23 T, it has increased by 4.34% over the last week.

Yes, you can track BSE Ltd. financials in yearly and quarterly reports right on TradingView.

BSE Ltd. is going to release the next earnings report on May 7, 2026. Keep track of upcoming events with our Earnings Calendar.

BSE earnings for the last quarter are 14.80 INR per share, whereas the estimation was 14.43 INR resulting in a 2.58% surprise. The estimated earnings for the next quarter are 15.54 INR per share. See more details about BSE Ltd. earnings.

BSE Ltd. revenue for the last quarter amounts to 12.44 B INR, despite the estimated figure of 12.38 B INR. In the next quarter, revenue is expected to reach 15.06 B INR.

BSE net income for the last quarter is 6.02 B INR, while the quarter before that showed 5.58 B INR of net income which accounts for 7.77% change. Track more BSE Ltd. financial stats to get the full picture.

BSE Ltd. dividend yield was 0.33% in 2024, and payout ratio reached 18.64%. The year before the numbers were 0.60% and 26.47% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 17, 2026, the company has 1.52 K employees. See our rating of the largest employees — is BSE Ltd. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BSE Ltd. EBITDA is 29.59 B INR, and current EBITDA margin is 58.23%. See more stats in BSE Ltd. financial statements.

Like other stocks, BSE shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BSE Ltd. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So BSE Ltd. technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating BSE Ltd. stock shows the buy signal. See more of BSE Ltd. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.