Banks and Global Markets: Their Crucial Role in World Trade1. Banks as the Financial Backbone of Global Trade

Banks have always played a central role in international commerce. From early merchant banking in medieval Europe to today’s digital global banking networks, banks provide the essential functions that allow trade to happen smoothly and safely.

1.1 Facilitating International Payments

The most basic function of banks in world trade is cross-border payments.

Exporters often demand payment certainty, and importers want delivery assurance. Banks bridge this trust gap using instruments such as:

SWIFT-based international transfers

Letters of Credit (LCs)

Bills of exchange

Bank guarantees

Documentary collections

A Letter of Credit, for example, ensures the exporter receives payment once shipment documents are provided and verified. This reduces default risk significantly and increases trade participation, especially in emerging markets where trust and creditworthiness are uncertain.

1.2 Financing Trade Operations

Trade finance is one of the oldest and largest banking activities. Banks provide capital for:

Pre-shipment finance (raw materials, manufacturing)

Post-shipment finance (waiting for payment)

Export credit from export-import banks

Foreign currency loans to purchase goods

Supply chain financing

Global trade is a long cycle—goods take time to produce, ship, and sell. Banks keep the cycle running by injecting liquidity, enabling even small companies to engage in large transactions.

1.3 Currency Exchange and Forex Operations

Every international transaction involves at least two currencies. Banks:

convert currencies for exporters and importers

provide hedging instruments (forwards, futures, swaps)

stabilize businesses against currency volatility

Since foreign exchange markets trade over $7 trillion per day, banks play a large role in making global trade more predictable by protecting businesses from sudden currency swings.

1.4 Risk Management and Trade Insurance

Trade naturally involves:

political risk

credit risk

transport risk

currency risk

legal and regulatory risk

Banks partner with insurers, export credit agencies, and global institutions to reduce these risks. For example, an exporter doing business in a politically unstable country may rely on export credit insurance provided through banks. Without such risk-mitigation tools, global trade flows would shrink dramatically.

2. The Role of Global Markets in World Trade

Beyond banks, global markets — stock markets, bond markets, commodity markets, and currency markets — form the infrastructure that supports the expansion of world trade.

2.1 Financial Markets Provide Capital for Expansion

Stock exchanges and global bond markets give companies the ability to raise funds for:

international expansion

building factories and export infrastructure

acquiring foreign companies

research and development

modernizing supply chains

Multinational corporations like Toyota, Apple, or Tata operate globally because they access international investors who fund their growth.

2.2 Commodity Markets Set Global Prices

International trade depends heavily on commodities—oil, metals, food grains, energy, chemicals, and more. Commodity exchanges like:

NYMEX (oil and gas)

LME (metals)

CME (agriculture, energy)

help determine global benchmark prices.

These markets:

ensure price transparency

reduce volatility through futures contracts

allow producers and buyers to hedge price risks

influence shipping routes and logistics costs

For example, when crude oil prices rise, global transportation and manufacturing costs increase, directly affecting trade flows.

2.3 Foreign Exchange Markets Enable Global Pricing

The global forex market ensures that:

companies can price goods in stable currencies

exchange rates remain liquid

central banks can stabilize currency movements

investors can allocate capital globally

Because of forex markets, a business in India can export to Japan, price goods in USD, hedge currency risk, and receive converted INR payments seamlessly.

2.4 Global Bond Markets Support Government Trade Infrastructure

Governments borrow from global investors to build:

ports

highways

airports

logistics parks

customs facilities

These projects reduce trade barriers and enhance a country’s export competitiveness. Countries with better credit ratings borrow at cheaper rates, giving them an advantage in global trade.

3. Banks and Markets Work Together to Power World Trade

Banks and financial markets are deeply interconnected. Their cooperation harmonizes global trade flows.

3.1 Banks Operate Inside Global Markets

Banks participate in:

currency markets

commodity trading

government and corporate bond markets

derivatives markets

This allows them to provide hedging and financing services to customers engaged in international trade.

3.2 Capital Markets Reduce Dependence on Bank Loans

When companies raise equity or issue bonds, they reduce stress on banks, freeing up bank capital for trade finance. This creates a balanced financial ecosystem.

3.3 Digital Platforms and Fintech Strengthen the Relationship

New technologies are transforming global trade:

Blockchain-based trade finance reduces fraud

Digital LCs speed up transactions

Fintech exporters’ platforms simplify international payments

Cross-border instant payment networks lower costs

Banks and fintech firms are creating a more transparent, faster, and more inclusive global trade system.

4. The Global Role of Banks and Markets in Shaping World Trade Patterns

Financial systems do more than facilitate trade—they influence who trades, what is traded, and how trade grows.

4.1 Emerging Markets Gain Access to Global Buyers

Banks in developing countries partner with global institutions to integrate local businesses into world supply chains.

4.2 Financial Markets Boost Competition

Open global capital markets allow companies from any country to compete on equal terms. For example:

Indian IT firms

Chinese manufacturing companies

Southeast Asian textile exporters

grew faster due to access to foreign investment.

4.3 Crisis Management and Global Stability

During crises (like 2008 or 2020), central banks and global markets stabilize economies by:

injecting liquidity

reducing interest rates

supporting currency stability

protecting banks and trade credit

This support keeps world trade from collapsing.

Conclusion: Banks and Markets Are the Lifeblood of Global Trade

World trade depends fundamentally on the smooth functioning of banks and global markets. Banks provide the trust, credit, payment systems, and risk management essential to international transactions. Global markets supply capital, set global prices, enable hedging, and ensure liquidity across borders.

Together, they form the invisible infrastructure powering globalization. Without banks and markets, trade would be slow, risky, and extremely limited. With them, businesses of all sizes—from small exporters to multinational giants—can participate confidently in the world economy.

Trade ideas

BTC Retracement - Is it a FAKEOUT? Uh...YES!!!Following up on my analysis of BTC after this weekend and going into this Thanksgiving Week. Please take a look at my previous analyses of BTC after we hit the All Time High to see how I've mapped out this progression to where we are now. We have seen BTC drop down to exactly where we projected....the Weekly Demand Source. And as targeted for our more precise level, it came right down to the top of the Daily Zone of the Weekly Source (~80.6K). Wow! You can't make this stuff up, guys. This is solid thorough Technical Analysis that you too can learn!!!

Well, where do we go from here:

This review is a closer dive down into the Hourly time frame, where I think we have to monitor the prices for the short-term. We have seen a pullback this weekend that pushed us back up to the top of this Weekly Demand Source. That level is going to have strong resistance again, and I expect a rejection back down into this large Weekly zone.

It's important to note this weekend push up, we had an H1 BOS - H1 candle close above 86.4K. I expect that to be retested and see the price possibly bounce between this 86.4 - 88.4K range for a little bit. A close of an H1 candle back below 85.7K will be the sign that it is falling back to the source of this H1 break and back to the Daily Zone of the Weekly Source (80.6K).

Remember, we touched the top of the Daily Zone (80.6K), but I don't think that touch was significant enough. There are a LOT of buyers inside of that Daily Zone, and touching it with a wick is not sufficient from my experience. We need to see at least a 4 Hour Candle go deeper into that zone and see a strong bullish rejection.

When will we go bullish again:

The real sign of the fall being over is going to show up first on the H1, with an H1 BOS outside of that Daily Zone (77K - 80.6K). IF we see that, expect a return to the source of that BOS. From there, the bullish momentum needs to be confirmed on the H4 for the REAL BULL BUY.

For now, the higher time frames are still ruling. The Weekly MUST be satisfied with enough volume and activity within this weekly Source. Until then, again, don't get tricked into buying BTC unless you are short-term trading it.

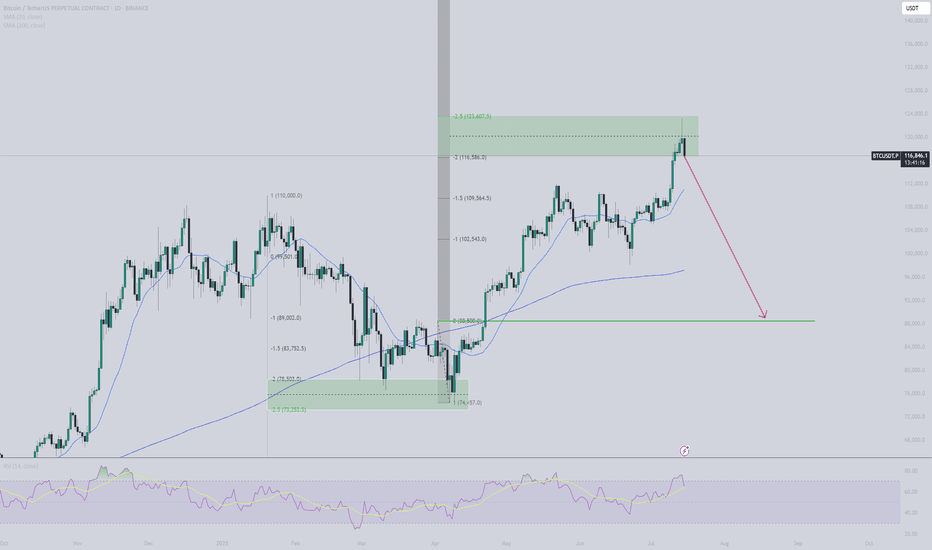

Final 2025 Forecast for BTCUSDT 24th November 2025 (Updated)Same idea as previous post, just zoomed in to see the potential gyrations towards to move towards ~$128k and hopefully beyond ✌️

1. Friday session dip to around ~$81k

2. Pump to around ~$87k over the weekend

3. Dump down to ~$80k for Monday Trap

4. Black Friday Pump to ~$89k

5. Max Pain Dump to ~$75k-$79k

6. Final pump to ~$128k to end the cycle

If we are lucky and price pullbacks from ~$128k and then exceeds it. Here are the targets I would be looking at;

Target #1 $140k-$145k,

Target #2 $170k-$175k

Target #3 $200k-$205k

This of course could be 100% wrong so remember (as always) to ruthlessly ✂️ cut your losers when wrong, and hold ✊ onto your winners when right.

--

I might also add, come early December 1st - 5th the following celestial events will take place which support the run up to $128k (and possibly beyond);

1. Super Full Moon (“Cold Moon”) 🌖

• On December 4, 2025, there’s a nearly full moon (~98% illuminated).

• This will be a supermoon, meaning the Moon appears slightly larger and brighter than average.

• The Moon is in Taurus, and near the Pleiades (M45) — Taurus is represented no other than the Bull.

Supermoons correlate with:

• spikes in emotion

• increased speculative behavior

• temporary liquidity expansions

• bigger candles (up OR down)

A near-super full moon tends to:

• mark volatility apexes

• precede relief rallies

• create short-term “energy reversals”

2. Moon–Jupiter conjunction (Dec 7) — traditionally expansive 🌖

Jupiter is symbolically linked with:

• expansion

• optimism

• big moves

• risk-on thinking

• growth

• speculation

When the Moon (sentiment) aligns with Jupiter (expansion), it often coincides with:

• higher risk appetite

• FOMO

• bullish short-term flows

In Summary;

1. Moon–Jupiter conjunction (Dec 7) → Expansive, optimistic, risk-on symbolism

2. Super Full Moon (Dec 4) → Volatility peak → Reversal → Upward burst

BTC Fibo RetracementIn the meantime, here is my BTC plan. Now we are very close to ATH and I would wait for next retracement to enter long, if we are going to 120.

Zone Of Interest combines several reasons to make an entry.

• 0.5 Fibo

• Sell Side Liquidity

• Valid 8H FVG

• And a border of discount zone

It is not at all necessary that the price will fall to these levels, but if it will, I`ll be watching price action there and make my decision.

Have a good trades!

BTC MID TERM LONGWe can still wick to around 70k-ish levels on the weekly but no problem should close the month always above the middle green VIDYA line which currently sits at around 82k, any close below that would invalidate this and almost guarantee the 70k.

I don't believe the "cycle ended 1 year bear markat" narrative that everyone's talking about (yet?). Lots of bullish catalysts are upcoming such as further rate cuts, QT ending, QE starting, stimmy checks from Japan, China and U.S potentially. Global M2 supply increasing, potential gold profit taking and many others.

Update on a post I made Nov. 11thMy opinion on the matter still hasn't changed. This is only an idea. Do I believe this is going to play out this way? I have no idea. It for sure could though so still something to keep in the back of your mind. The weekly candle will be closing in roughly an hour. Closing at current price would indicate a clear breakout from the chart pattern and actually locking in a potential (sickening) price target of $17,881 USD per BTC. I'll be keeping this chart as is and post updates from time to time to see if this very large time frame chart pattern plays all the way out.

On a side note, I do not have any trades open based on this pattern breaking down. Nor do I plan to either. Just following this purely for educating myself and anyone else who might gain anything from it.

BTC Volatility Is Spiking — And 5/7 Times That Meant a Market DrBitcoin volatility ( DERIBIT:DVOL ) is rising sharply again — and historically, that’s rarely a neutral signal.

When we look back at recent market behavior, the pattern is clear:

🔹 5 of the last 7 volatility spikes happened during corrections

Each major volatility surge aligned with:

aggressive liquidations,

forced unwinding of leverage,

or the start of a broader market pullback.

Not every spike triggers a crash…

but most crashes start with a volatility spike.

🔹 Why this matters now

Volatility is picking up while price momentum weakens — the same dynamic that preceded previous drawdowns.

This usually reflects:

stressed long positions,

risk being repriced in options,

and rising uncertainty across the market.

🔹 What history suggests

When volatility returns aggressively, Bitcoin tends to enter:

a sharp flush lower, or

a sustained corrective phase.

Given that 5 out of the last 7 spikes led to significant declines, the probability that BTC is entering another corrective leg should not be ignored.

BTC/USDT 1W chart review📉 1. Market structure – trend and break

• The chart shows a black upward trend line that has led the market since 2023.

• This line has been clearly broken, which means:

✔ weakening of the structure

✔ the first serious threat to the upward trend

✔ possible move towards lower support levels

A breakout of the weekly trendline usually ends a medium-term upward trend.

⸻

📉 2. Current price

BTC is around USDT 87,770 and the weekly candle is heavily bearish.

This means that buyers do not react to the first support.

⸻

🟥 3. Most important support levels

1) 92,086 USDT – local resistance zone (previously support)

• Price has broken this support from above → now acts as resistance.

• To return to growth, BTC would have to close the week above this zone.

2) 84,583 USDT – first major support

• Price is just above the zone.

• If this fails → there will be an increased chance of continued declines.

3) 74,324 USDT – key macro support (MAIN LEVEL)

This is the most important level of the chart.

• This is the level where demand must occur if BTC is to maintain its long-term structure.

• Breaking this barrier will open the way to declines even to around 60-65k.

⸻

🟩 4. Resistance levels

1) USDT 92,086

Closest resistance – key to recovery.

2) USDT 100,794

Big weekly resistance that stopped the market earlier.

Only a breakout → continuation of the bull market.

⸻

📊 5. Stochastic (week) – very important

At the bottom you can see Stochastic sliding down, almost at the value of 0-20 (oversold).

Interpretation:

• There is no buy signal yet because the lines have not turned upwards.

• Weekly momentum is still down, so the pressure on support continues.

📈 7. Scenarios

Bullish (less likely for now)

1. Maintaining 84.5k

2. Stochastic weekly turns upwards

3. Price returns above 92k

➡️ Target: 100.7k

Bearish (more likely)

1. Breakthrough 84.5k

2. Retest from the bottom

3. Drop to 74.3k

➡️ If 74k breaks → 65-68k

BTC Euphoria to Fear: Is This the Start of the Bitcoin Winter?Is the Bitcoin bear market here? A deep dive Into cycles, tech risks & what comes next.

Bitcoin has now dropped –36% from its all-time high in just 46 days, and naturally the big questions emerge:

Has the bear market officially begun?

How long could it last?

And what catalysts could accelerate it?

Let’s break this down from cycle structure to macro-technological risks.

BTC Has Turned Bearish Across All Major Timeframes

Bitcoin is now trading below the yearly open at $93,576, flipping all major timeframes into bearish alignment (from the daily to the yearly).

Monthly MACD Bearish Cross Incoming

The monthly MACD is set to print a bearish crossover this month.

The last bullish MACD phase lasted 28 months, which has now ended → a strong macro signal.

Cycle Timing: What History Says

Historically, Bitcoin bottoms approximately one year after the top:

2017 → 2018: 363 days

2021 → 2022: 376 days

If the current cycle repeats, the macro bottom may form around:

October 2026

The previous bull market lasted 1061 days, this one 1050 days → almost identical.

This strongly supports the thesis that the cycle has already peaked.

How Low Could Bitcoin Go?

Macro target:

0.786 Fibonacci Retracement → $39,173

Aligning with:

Half-year 21 EMA confluence

Macro corrective structures

Prior cycle bear market depth

Historical Precedent: The 2022 Bottom Zone

Back in 2022, Bitcoin spent 210 days (over 7 months) consolidating at the bottom of the bear market.

This was especially clear on the weekly timeframe, where price formed a clean multi-month accumulation range.

Weekly TF:

Daily TF:

This is crucial context:

👉 The market gave more than half a year to load up at the bottom.

No chasing, no rushing → anyone paying attention had time to scale into positions for the next cycle.

The 2025 Macro Top Landed Perfectly in the 1.618–1.666 Fib Target

Fib 1.618–1.666

→ $122,056 – $125,218

This area was the ideal sell zone, and Bitcoin respected it perfectly.

What happened after hitting the Fib target?

The market entered a 3-month distribution phase, giving plenty of time to:

scale out

take profit

derisk

rotate into stablecoins or simplified portfolios

Then came the aggressive sell-off → classic macro cycle behavior.

Macro Catalysts That Could Drive the Bear Market Deeper

1️⃣ Quantum Computing Acceleration

A credible quantum breakthrough (or even a strong rumor) could trigger systemic fear.

Bitcoin’s ECDSA signatures are theoretically vulnerable to quantum attack models.

2️⃣ Fast-Paced AI Threats

AI is accelerating:

algorithmic optimization

cryptographic analysis

zero-day discovery

hardware design

The risk matrix is evolving faster than coding standards can update.

3️⃣ Regulatory Momentum

Expect:

stablecoin restrictions

exchange tightening

AML/KYC global enforcement

This would accelerate risk-off behavior.

Technical Confluence: Where BTC Is Now

Monthly 21 EMA/SMA → 86.6K

Current support test.

Quarterly (3M) 21 EMA/SMA

EMA: $58.5K

SMA: $53.5K

Strong structural support zone.

Half-Year (6M) 21 EMA/SMA

EMA: $39.5K

SMA: $29.8K

The EMA aligns perfectly with the 0.786 retracement → $39,173.

Remember that the EMA/SMA levels mentioned are dynamic and will continue to shift over time as new price data comes in, so these confluence zones will gradually adjust.

Additional Confluence: Potential Head & Shoulders (Bars Pattern Symmetry)

A potential Head & Shoulders Pattern is forming in symmetry with the previous bull market top, as shown through the bars pattern overlay.

Trading Playbook: Short the Bull Trap

The most likely scenario:

BTC bounces into $95K–$100K → traps late bulls → rejects → cascade lower

Targets:

TP1: $76K

TP2: $70K

Remaining: trail into $65K → $58K → $39K

Final Outlook

Bitcoin is now deeply aligned with a macro reversal:

Perfect Fib 1.618–1.666 top

Break of yearly open

Cycle timing consistent

Monthly MACD turning bearish

Quantum + AI risk factors accelerating

Structural confluence targets $70K → $40K

Pattern mirroring the previous cycle top

_________________________________

💬 If you found this helpful, drop a like and comment!

BTC 71,689.50 — The Capital Sector. Price Slice. 23.11.2025 Capital Sector. Price Slice. Dated 23.11.2025

74,715.11 USD — not yet reached as of publication.

71,689.50 USD — not yet reached as of publication.

Esteemed international community,

I demand your unequivocal attention: as the sole Architect of the Capital Sector and originator of the Price Slice methodology, I hereby attach to this publication documentary evidence confirming the integrity of my analytical architecture.

On 16.10.2025 , I formally designated the sector with a Price Slice at 71,689.50 USD .

Original screenshot:

TradingView publication:

Across global timeframes, we observe the instrument’s deliberate inclination toward retesting the specified level —not a coincidence, but a structural imperative.

All prices I publish represent capital’s intent , not speculative hypotheses.

Until the instrument physically touches these levels on their respective timeframes, these precisely carved and calculated values remain absolute . Each price carries its own temporal projection—disregard of this principle leads to analytical collapse.

Study the logic of my work:

Institutional capital does not follow charts—it draws them.

It fabricates deceptive candles tailored to your indicators, feeding you illusions.

I, in turn, reveal to you the pre factum method —analysis of the future before it manifests.

The question is not where price is heading .

The question is which Price Slice to select within the context of the global trend .

The Map of Unexecuted Prices is your strategic instrument. Deploy it with precision.

English is not my native language. I formally apologize for any stylistic imperfections—yet I emphasize: the essence of my analytics remains unaltered across any translation. It is as immutable as market structure itself.

Bitcoin Weekly Analysis |Good Time to Buy Bitcoin? 📉 Bitcoin Weekly Analysis | Are We Near a Turning Point?

Alright traders, let’s jump into this week’s Bitcoin outlook.

As you can see, the market has been in sellers’ control for several weeks, with a noticeable rise in bearish volume. But toward the end of the week, sellers lost a good chunk of their momentum, and the weekly candle closed much weaker than expected.

Right now, price has reacted to two major supports:

The $80,000 support zone, and

The Weekly 99 SMA

And yes — Bitcoin is showing a reaction here.

But the real question is:

💡 Is This a Good Time to Buy Bitcoin?

For me personally, I never buy any asset during bearish momentum — whether it’s Bitcoin, an altcoin, or even a stock.

Buyers need to prove their strength first.

And how do they prove that?

👉 By printing a higher high and a higher low on the daily timeframe.

I recently sold my Bitcoins around $100,000, right after the daily candle closed below that level.

From my point of view, this is not a great time to buy BTC for spot positions. Staying away until buyers return is smarter than getting trapped in a falling market.

My strategy has always been simple:

❝I don’t buy at the best price — I buy at the best time. I don’t want my money stuck in a sinking asset.❞

Yes, Bitcoin has a bright future long-term…

but right now? I’m staying on the sidelines until the structure flips bullish again.

📌 If You Still Haven’t Sold Your BTC…

If you still hold Bitcoin and plan to exit, here are the key escape levels:

$80,000 support

And the final defensive line at $77,000

Below these levels, we may see sharp, aggressive selloffs.

On the flip side — if BTC manages to reclaim $100,000, that could be a strong signal to return to crypto.

At that point, depending on Bitcoin dominance, we’ll decide whether:

to rotate back into BTC, or

move into major altcoins like Ethereum.

(Capital management is key — don’t skip it.)

🎯 Final Thoughts

Thanks for reading my analysis!

If you enjoyed it, your support means a lot.

Wishing you a profitable week ahead — stay sharp and stay safe in the markets! 🚀📈

BTC Weekly Candle Thoughts?I find the weekly candle on BTC very interesting right now, because if the candle pulls itself up to to 94k its on the 61.8% (golden ratio) of the impulse, plus the liquidity it just took by this wick could mean pretty bullish structure for the future.

What's your thoughts on this, do you think it could be bullish structure of do you think this big wick could be bearishness in the future? Pretty interesting.

BTC at Key Support Zone - Bullish Setup in Progress?BTC at Key Support Zone - Bullish Setup in Progress?

Bitcoin has reached a major long-term support zone between 75,100 – 80,800, an area that previously acted as strong support in March 2024 and April 2025 on the monthly timeframe. The current monthly candle is testing this zone again, suggesting that buyers may step in to defend this historically important level.

On the daily chart, BTC has formed a sharp decline toward this support area, but the recent reaction indicates early signs of accumulation. If buyers continue to hold this zone, a mid-term recovery could develop.

As long as the 75,100 support holds, BTC maintains strong potential for a medium-term rebound. However, a clean break below this zone would invalidate the bullish outlook and expose deeper downside.

Key Levels to Watch:

Support: 75,100 – 80,800

Target 1: 98,000

Target 2: 107,500

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

BITCOIN : Where is the price floor (full analysis)Hello friends

Well, the fall in Bitcoin has really scared the market these days, and that's why we had a sharp fall, as it turned out.

Well, if we examine the past price, you will see that there has always been an upward trend and sometimes we have had price corrections, and this is completely normal.

Before this drop, Bitcoin formed a double top pattern and the price corrected, and was again supported by the area indicated by buyers, and the price hit a higher ceiling.

But at the price ceiling, we witnessed weakness in buyers and, more importantly, a rounding of the price, which caused a heavy drop to 80,000. Now, after this sharp drop, the price is unlikely to go straight back up and make a new ceiling.

Now, after this strong spike by sellers, we can expect a descending range or channel.

What do we need to climb to?

Well, obviously the price needs to recover and buyers need to provide good support for the price, and first of all we see a range or channel, and then if they can break the channel or range, buyers can hope for a new ceiling. Otherwise, the price pivots we identified are the most important supports that the price can reach over time.

So, can we say that the rise is over?

No, nothing can be said with certainty. Maybe the price will bottom out at 70,000 to 80,000 and buyers will come in.

But in order to minimize the risk, we must move forward with the market and according to market behavior, not predict...

For this reason, it is not possible to say at this time that the price will go to a new ceiling from here because we do not see any buyers!!!

What is the solution?

Well, let's be logical: when the price goes down and Bitcoin becomes cheaper, better opportunities for buying are available to us, and we should take advantage of this situation and not enter the price ceiling emotionally and suffer losses.

Finally,

We need to see what the buyers' reaction is and if they want to support, then we can enter safely, not now that the Sharp price is falling.\

Be sure to observe risk capital management and do not get excited.

*Trade safely with us*

BTCUSDT.P - November 24, 2025Bitcoin recently formed a short-term ascending channel, showing improving momentum after a strong prior selloff. Price is currently consolidating near 86,900, with key support at 85,900 and 84,400, and resistance at 88,100 and 91,900. A breakout above 88,100 would signal additional bullish momentum toward 91,900, while any failure to hold above the rising trendline could trigger a retest of lower support levels. The current structure suggests neutral to slightly bullish momentum in the immediate term.

BTCUSDT: Trend in 4-H time frameThe color levels are very accurate levels of support and resistance in different time frames.

A strong move requires a correction to major support and we have to wait for their reaction in these areas.

So, Please pay special attention to the three accurate trend, colored levels, and you must know that SETUP is very sensitive.

BEST,

MT

BTC/USD/ Bullish. Trend Read The captionSMC Trading point update

Technical analysis of summary of this BTC/USDT H1 chart:

---

Overall Bias: Bullish Short-Term

The chart shows a bullish continuation structure after mitigation of the Fair Value Gap (FVG) and support from EMAs.

---

Key Technical Points

Price retested and respected the FVG zone

Located around 85,300 – 86,000 area, acting as demand.

Price above EMA 50 (blue) and approaching EMA 200 (black)

→ Indicates building bullish momentum and potential trend reversal if EMA 200 breaks.

Structure

Higher lows forming

Price breaking minor structure highs

Strong bullish impulse candles

Target Zone Target highlighted near 90,000 – 90,100

---

Trade Idea Concept

Entry Idea:

Look for retracement back into the FVG/EMA zone for continuation long (mitigation + breakout strategy).

TP Target:

90,000 – 90,100 resistance and liquidity level

Invalidation / Stop:

Clean break below 85,300 demand zone would negate the bullish setup.

---

Smart Money Concept Perspective

FVG used as institutional demand

Liquidity grab below previous lows during correction phase

Targeting premium pricing near EMA 200 and liquidity pool

Mr SMC Trading point

---

Summary

BTC is showing strength and continuation potential. As long as price stays above 85,300–86,000 zone, the path of least resistance is upward toward 90,000.

---

Please support boost 🚀 this analysis

Bitcoin Macro Wave Count – Deep ABC Correction Into Key Fib SuppThis chart provides a long-term Elliott Wave and Fibonacci confluence analysis for Bitcoin on the weekly timeframe.

After completing a full 5-wave impulsive structure, BTC appears to have entered a corrective ABC pattern, with Wave (C) extending sharply into major support levels. Current price action is testing a powerful cluster of Fibonacci retracements and extensions, including the 1.618, 0.618, and a long-term ascending trendline.

Expection: weekly candle closing above 87,143 and go upwards.