MCHP watch $52.86-53.55: Dual Fib support zone may hold the DUMPMCHP apparently had a disappointing earnings report.

It dumped into a significant support at $52.86-53.55

Look for consolidation above the zone then recovery.

.

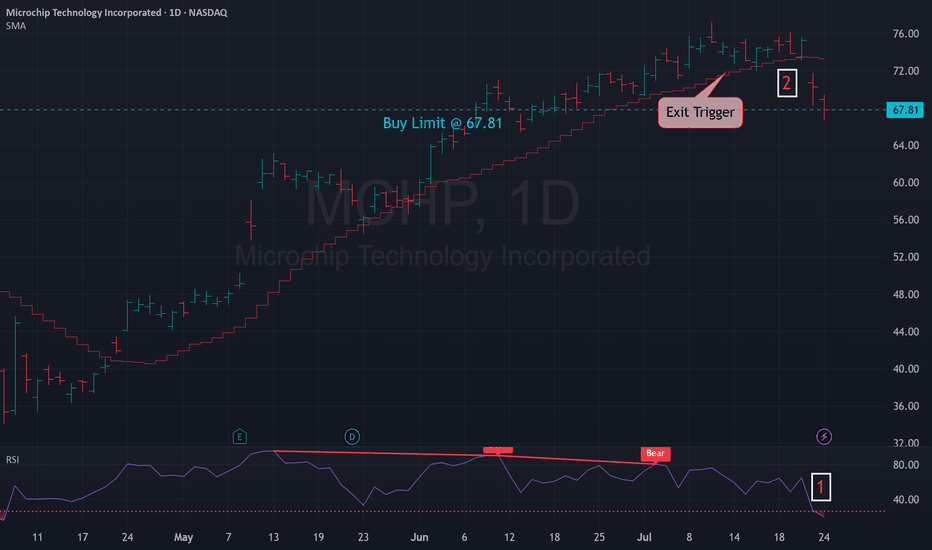

Previous Analysis that caught a PERFECT entry AND exit:

Hit BOOST and FOLLOW for more such PRECISE and TIMELY charts.

=================

Key facts today

Microchip Technology's growth outlook is mixed, with FQ3 growth expected but below estimates. Analysts have cut price targets, yet the stock is rated Moderate Buy with 25% upside potential.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.360 CHF

−442.62 K CHF

3.90 B CHF

529.01 M

About Microchip Technology Incorporated

Sector

Industry

CEO

Steve Sanghi

Website

Headquarters

Chandler

Founded

1989

ISIN

US5950171042

FIGI

BBG006TLS0S7

Microchip Technology, Inc. engages in the provision of semiconductor products. It operates through the Semiconductor Products and Technology Licensing segments. The Semiconductor Products segment is involved in designing, developing, manufacturing, and marketing microcontrollers, development tools and analog, interface, mixed signal, connectivity devices, and timing products. The Technology Licensing segment offers license fees and royalties associated with technology licenses for the use of SuperFlash embedded flash and Smartbits one-time programmable technologies. The company was founded on February 14, 1989 and is headquartered in Chandler, AZ.

Related stocks

MCHP Shows Upward Momentum, Target $77 (15% Move)MCHP has been trading in a sideways wedge range between roughly $62/68 since July, forming a descending wedge pattern. The price is approaching a breakout above the upper boundary of this consolidation, near the 1.618 Fibonacci level. It sits slightly above both the 50 and 200 day SMAs, offering dyn

MCHP: accumulatelooking good here on the daily as it broke out of its price wedge and took out its volume shelf. lower indicators all look positive. Really want to see a good candle build into week's end along with stronger volume bars (hence accumulate). Everyone focused on direct AI plays at the moment. Dotte

$MCHP | Microchip Technology — Monthly Macro PlaybookNASDAQ:MCHP | Microchip Technology — Monthly Macro Playbook

This chart illustrates the multi-decade rhythm of NASDAQ:MCHP , highlighting how past cycles and technical structure provide clarity on the current setup.

Historical Market Cycles & RSI Trends

Each gray circle marks a key market struc

MCHP – 30-Min Long Trade Setup!📈

🔹 Ticker: MCHP (NASDAQ)

🔹 Setup: Falling Wedge Breakout + Oversold Bounce

🔸 Breakout Zone: ~$40.74 (yellow zone breakout)

📊 Trade Plan (Long Position)

✅ Entry Zone: $40.60–$40.80

✅ Stop Loss (SL): Below $39.08 (white key level)

✅ Take Profit Targets:

📌 TP1: $43.27 (red zone – resistance shelf)

📌

MCHP – 30-Min Long Trade Setup!📈

🔹 Ticker: MCHP (NASDAQ)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Falling Trendline Break + Support Reclaim

🔸 Breakout Price: ~$48.47

📊 Trade Plan (Long Position)

✅ Entry Zone: $48.40–$48.50 (bullish breakout + yellow resistance zone retest)

✅ Stop Loss (SL): Below $47.62 (white support zone – str

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MCHP5960317

Microchip Technology Incorporated 5.05% 15-FEB-2030Yield to maturity

4.54%

Maturity date

Feb 15, 2030

MCHP5767179

Microchip Technology Incorporated 5.05% 15-MAR-2029Yield to maturity

4.43%

Maturity date

Mar 15, 2029

MCHP5960316

Microchip Technology Incorporated 4.9% 15-MAR-2028Yield to maturity

4.29%

Maturity date

Mar 15, 2028

MCHP4610421

Microchip Technology Incorporated 1.625% 15-FEB-2027Yield to maturity

—

Maturity date

Feb 15, 2027

MCHP6091412

Microchip Technology Incorporated 0.75% 01-JUN-2030Yield to maturity

—

Maturity date

Jun 1, 2030

See all MCP bonds

Curated watchlists where MCP is featured.

Frequently Asked Questions

The current price of MCP is 52.342 CHF — it has decreased by −8.99% in the past 24 hours. Watch Microchip Technology Incorporated stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange Microchip Technology Incorporated stocks are traded under the ticker MCP.

We've gathered analysts' opinions on Microchip Technology Incorporated future price: according to them, MCP price has a max estimate of 70.88 CHF and a min estimate of 45.10 CHF. Watch MCP chart and read a more detailed Microchip Technology Incorporated stock forecast: see what analysts think of Microchip Technology Incorporated and suggest that you do with its stocks.

MCP stock is 9.88% volatile and has beta coefficient of 1.98. Track Microchip Technology Incorporated stock price on the chart and check out the list of the most volatile stocks — is Microchip Technology Incorporated there?

Today Microchip Technology Incorporated has the market capitalization of 24.50 B, it has decreased by −1.28% over the last week.

Yes, you can track Microchip Technology Incorporated financials in yearly and quarterly reports right on TradingView.

Microchip Technology Incorporated is going to release the next earnings report on Jan 29, 2026. Keep track of upcoming events with our Earnings Calendar.

MCP earnings for the last quarter are 0.28 CHF per share, whereas the estimation was 0.27 CHF resulting in a 3.48% surprise. The estimated earnings for the next quarter are 0.30 CHF per share. See more details about Microchip Technology Incorporated earnings.

Microchip Technology Incorporated revenue for the last quarter amounts to 908.32 M CHF, despite the estimated figure of 905.50 M CHF. In the next quarter, revenue is expected to reach 912.30 M CHF.

MCP net income for the last quarter is 33.21 M CHF, while the quarter before that showed −14.76 M CHF of net income which accounts for 325.07% change. Track more Microchip Technology Incorporated financial stats to get the full picture.

Yes, MCP dividends are paid quarterly. The last dividend per share was 0.37 CHF. As of today, Dividend Yield (TTM)% is 3.23%. Tracking Microchip Technology Incorporated dividends might help you take more informed decisions.

As of Nov 10, 2025, the company has 19.4 K employees. See our rating of the largest employees — is Microchip Technology Incorporated on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Microchip Technology Incorporated EBITDA is 695.18 M CHF, and current EBITDA margin is 25.57%. See more stats in Microchip Technology Incorporated financial statements.

Like other stocks, MCP shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Microchip Technology Incorporated stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Microchip Technology Incorporated technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Microchip Technology Incorporated stock shows the sell signal. See more of Microchip Technology Incorporated technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.