DOTUSDT.3L trade ideas

WHAT GOES UP, MUST COME DOWN – $DOT DUMP TIME?In my last analysis we nailed the move: CRYPTOCAP:DOT pumped to sweep the weak 14 Aug high exactly as projected. ✅ That mission is complete – now it’s time for the other side of the trade.

Analysis

14 Aug high swept → equilibrium reached.

Price in HTF Golden Pocket + strong Fib cluster.

Bearish harmonic + hidden bear div on CVD.

Orderflow: longs piling in, OI ↑ but price stuck → squeeze risk.

Likely SFP around $4.65 (take out Sept 13 high) → then dump.

First target: $3.75.

DOT is Ready for 130% Up Move DOT is making a pattern at Support zone and It has given a Breakout from that pattern . and at the same time Altcoin Season Index is at 74 , when it is >75 it is sign of very bullish in altcoins and Breakouts will have very high potential to give a big move .

and at the same time Bitcoin dominance is decreasing and altcoins dominance is started increasing , so look on all the altcoins

and follow proper risk management , it has very good chances to move UP side but first we have to protect the down side , where risk management comes into game .

Follow for more Ideas and potential coins/ Stocks .

DOT Breakout Incoming – Get Ready!

CRYPTOCAP:DOT Polkadot is showing early signs of a reversal from its long accumulation phase. After months of sideways action, the chart is hinting at a major upside move! 🧠📈

Targets to watch:

🎯 $8.54

🎯 $11.73

🎯 $14.41

This could be the start of a powerful rally. DOT is looking explosive! 💣

DOTUSDT - 200% Upside - Long SetupDOTUSDT has been in a long consolidation. A bullish divergence was there and now a wedge pattern was in play and finally a bullish breakout and retest could be observed. This would mean a trend reversal and further Higher Highs and Higher Lows. Therefore, giving the perfect opportunity for a long entry for a 3x (200%) return.

Fundamentally the new tokenomics and immense focus on interoperability makes it more promising that PolkaDot could be seen flying in a matter of no time.

So going long on PolkaDOT.

DOT — Key Levels Reclaimed, Breakout Ahead?DOT has been in sideways chop for 222 days, but things are finally getting interesting. Price is now sitting above the yearly level ($4.309), the daily 233 EMA/SMA, and the weekly 21 EMA/SMA. Even better, it reclaimed the POC of the entire 222-day range.

Why $4 Is So Important

Yearly level → $4.309

Daily 233 EMA → $4.37 / Daily 233 SMA → $4.21

Weekly 21 EMA → $4.15 / Weekly 21 SMA → $4.05

POC of 222-day range → $4

0.618 Fib retracement (current move) → $4

That’s a whole lot of support stacked at one zone.

Where It Gets Exciting (Targets)

First major target is the monthly 21 EMA/SMA ($5.3–$5.5), which also lines up with the range highs. That’s the first real test. The swing target zone sits around $6–$6.5, with multiple layers of confluence:

Key Level → ~$6

Fair Value Trend Model Line → ~$6.5

0.382 Fib retracement of the downtrend → ~$6.19

0.618 Fib speed fan → ~$6.2 (October projection)

1.618 trend-based Fib extension → $6.308

Market Cap Confluence: 10B market cap at $6.18

Yearly Open: $6.642 → the overall target and an additional layer of resistance

📌 This creates a solid resistance cluster between $6–$6.6, ideal for taking profits and potentially looking for shorts.

🟢 Long Trade Idea

Entry: Ladder longs from $4.36 down to $4

Stop: Below $4 (clear invalidation)

Take Profit: If $4 holds, DOT’s path is clear: first stop $5.3-$5.5, then $6.0–$6.6 as the macro target with the yearly open at $6.642 marking the final resistance.

Key Levels

Support → $4.36–$4

Resistance → $5.3–$5.5, then $6.2–$6.6 (10B market cap $6.18 + yearly open $6.642)

🔍 Indicators used

LuxAlgo — Liquidity Sentiment Profile (Auto-Anchored)

DriftLine — Pivot Open Zones → For identifying key yearly/monthly/weekly/daily opens that act as major S/R reference points

Multi Timeframe 8x MA Support Resistance Zones → to identify support and resistance zones such as the monthly 21 EMA/SMA.

Fair Value Trend Model → Calculates a regression-based fair value curve

➡️ Available for free. You can find it on my profile under “Scripts” and apply it directly to your charts for extra confluence when planning your trades.

_________________________________

💬 If you found this helpful, drop a like and comment!

Polkadot Eyes $7.67 as Breakout LoomsPolkadot’s structure shows signs of bottoming. Accumulation above the 0.618 Fibonacci support has created a solid foundation, and price is now challenging resistance. This phase is critical, as confirmed breakouts from such levels often lead to sharp upward momentum.

Key Technical Points

- $3.39 Support: Defended strongly with Fibonacci alignment.

- $4.52 Resistance: Key level that has capped rallies for months.

- Upside Targets: $5 initially, with $7.67 the broader high-time-frame objective.

Analysis

DOT’s accumulation phase above $3.39 highlights strong buying activity. The presence of the 0.618 Fibonacci retracement adds weight to the case that this region marks a structural bottom. The next obstacle is resistance at $4.52, which has historically limited upward movement.

If price closes above this barrier, momentum is likely to accelerate into $5, and sustained demand could push toward the broader high-time-frame target at $7.67. This structure resembles a bottoming formation, where accumulation transitions into expansion. However, bullish volume nodes must persist for this breakout to materialize.

What to Expect

Polkadot remains bullish as long as $3.39 holds. A breakout above $4.52 would validate the bullish case, opening the path toward $5 and eventually $7.67. Traders should monitor volume closely to confirm the move.

$dot potentialGreat opportunities here imo…

We could see a draw back but I don’t see anything lower than the $4 handle here.

The whole handle from the early into mid $4 pricing plays heavy here.

Again, some nice closures above $4.50 should see us above $6 with a crucial handle sitting @$8.30+ which is reasonable and demands playback!

If we do make ground on that target respectfully, $18 should be no problem!!!! 😉

🚀

[DOTUSDT] Polkadot Approaching Breakout: Round Bottom TargPolkadot (DOT) is currently forming a round bottom pattern with a key resistance level at $4.40. On the daily timeframe, DOT has been attempting to break through this resistance but has not yet succeeded.

If this breakout attempt fails, DOT could retrace back to the $4.20 support zone for another retest. However, the round bottom structure suggests a gradual accumulation phase. Combined with the broader market’s anticipation of an altcoin season and the upcoming approval processes for DOT-related ETFs, this setup positions DOT as a compelling investment candidate.

From a technical perspective, should the breakout materialize, a rally toward the $6.50 target zone appears to be a realistic and achievable scenario.

$DOT clean ENTRY on daily candle CLOSE above $4.70CRYPTOCAP:DOT on the DAILY chart still under that long-term horizontal resistance up there at $4.60 - $4.70 which is also now the upper trendline of our ASCENDING TRIANGLE that has been forming since late June.

Same strategy, entries above $4.7 with a good daily candle close. Also about to materialize is the GOLDEN CROSS with a yellow 50SMA poised to cross above the green 200SMA.

A lot of Liquidity is trapped between $3.90 - $4.10 in the last 30 days though, so that's another reason to stay cautious here.

Have a look at the Liquidity heatmap attached, from the $4 zone could be our golden opportunity for increasing our positions.

Good things after a bullish RSI divergence, nicely shaped bottom, bullish patterns.. What's not to like about this DAILY chart? 👽💙

DOT ; Boring movementsHello friends

According to the decline we have, you can see that the price has created an ascending channel and is slowly rising.

But there is an important resistance in its way, which it has hit once and caused a price correction, and the price is gathering strength to rise again.

Now, if this resistance is reliably broken and the price stabilizes above it, the price can move to the specified targets.

*Trade safely with us*

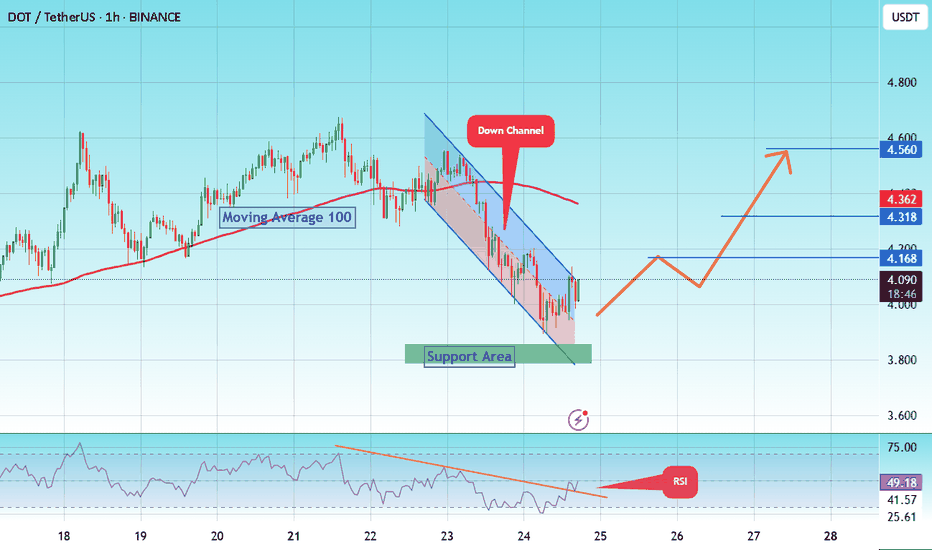

#DOT/Eyes 15% Rally, Targeting Key $ 4.560 Resistance Level#DOT

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower limit of the channel at 3,870, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price higher at 3,800.

Entry price: 4.084

First target: 4.168

Second target: 4.318

Third target: 4.560

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

DOT/USDT has not made a new all-time high in the current cycle.In my opinion, in this cycle, considering the end of the trend and the fact that it hasn’t formed a proper bottom, we are unlikely to see a new high. However, we could reach the 50% or 68% retracement levels of the previous decline and start the first impulsive wave. This movement is similar to what XRP experienced in the previous cycle.

DOT - Confirmed!DOT Technical Outlook

On the weekly timeframe, DOT has confirmed a breakout from its long-term downtrend, followed by a successful retest. This establishes a solid technical foundation, with confluence now forming between the weekly and daily structures.

On the daily chart, price action has moved decisively above the previous bearish zone, signaling renewed momentum. In the short term, the key resistance levels to monitor are $5, $6, and $8. A sustained breakout above these thresholds would provide confirmation for a broader bullish scenario.

From a technical perspective, the upward trend has been validated. The next catalyst for continuation will likely come from upcoming market developments and potential positive news flow, which could act as triggers to remove remaining resistance barriers.

Overall, the technical setup suggests that DOT is positioned for further upside, with a constructive outlook in the near to medium term.

$DOT - LONG - LOADING A SUPER SWEEP?DOT: Loading a SUPER SWEEP? 🚀

Context

Downtrend since 21 Jul → bounce 02 Aug → local high 14 Aug at 0.75 fib → drop & range.

Weak/Bad High (TPO/VP)

No excess at the 14 Aug high (flat top, multiple TPOs, no selling tail) → unfinished business above → likely sweep/revisit.

Magnet

0.786 fib aligns with LTF & HTF single prints around $4.40 → prime repair target to rebalance the auction.

Order Flow & Positioning

Futs CVD (coin & USDT): ↓ → perps are the aggressive sellers.

Hidden bull div (USDT-perps CVD): price prints a higher low while USDT-margined CVD makes a lower low → sellers got louder but couldn’t make new price lows → absorption → squeeze odds up.

Spot CVD: ↑ while price flat/slightly ↓ → bullish divergence (spot accumulation absorbing perp selling).

OI (USDT-margined): drifting lower → deleveraging; few fresh longs.

OI (coin-margined): flat/↑ → shorts/hedges still on = squeeze fuel if price turns.

Location & Momentum

Accumulating in the golden pocket (02 Aug → 14 Aug range).

Sitting at Fixed-Range VAL (21 Jul → 30 Aug).

1H RSI: clear bullish divergence.

My Take 🎯

I think price is primed for a SUPER SWEEP UP — a quick run to $4.40x to clean that weak high/singles and restore balance.

Confirmation to go with it

Reclaim local RH/VWAP +

(1) Futs CVD turns up, and

(2) coin-OI drops on the push (short cover) or USDT-OI starts adding on dips (fresh longs).

Invalidation

Acceptance below VAL / golden pocket with coin-OI rising (new shorts in control) or loss of the HL that created the hidden bull div.

If accepted above $4.40–4.41 → continuation runway. Sharp wick/reject there → fade back to VWAP/POC.

#DOT #Crypto #Perps #OrderFlow #CVD #OpenInterest #PriceAction #SuperSweep #DOTUSDT #FuturesTrading #Derivatives #FundingRate #GoldenPocket #Fibonacci #Breakout #Reclaim #CryptoTrading

DOT at a decision point: breakout or just a stop hunt?DOT is currently attacking a new high, but the question is whether this move is a true breakout or just a liquidity grab.

This time I’m looking for a quick long setup.

My main zone of interest is 4.25–4.31.

This area lines up with multiple previous highs, which I now consider potential new support. It also includes:

• the 0.314–0.222 retracement from the latest pump,

• the 0.684 level (inverse of 0.314 from the bottom),

• the highest anchored VWAP line.

On top of that, divergences on RSI (14) and MACD (12:26) suggest price could push higher.

We’ve already tested the triangle breakout, so I believe that phase of interest is over. From here, price may dip slightly lower, but it doesn’t have to. A ~3% move against the position is acceptable.

I’m already in the trade.

If DOT retests the 4.25–4.31 zone, I see it as a strong buying opportunity.

Target: At least a new local high around 4.70, where I’ll take my first partial profit.

$DOT bullish MARKET STRUCTURE CHANGE - 1st one in 2025!CRYPTOCAP:DOT first bullish Market Structure change in 2025 just HAPPENED.

Very first sequence of higher low followed by a higher high.

I'm expecting more bullishness, actually.

Bullish divergences recently on OBV and RSI anad this daily chart is flashing its main target (falling wedge's one).

RSI only at 63 so fully expecting much more momentum to build. Follow for lower timeframes analyses in next posts💙👽

DOT — September 01, 2025.CRYPTOCAP:DOT #Polkadot — September 01, 2025.

Good ol' Polkadot is trading sideways on the daily chart and has hit the Long Max Pain level. I think this is a solid spot entry point with a potential for a +15% move.

Entry price: $3.612 - $3.650

Take Profit: $4.160 (+15.18%)

➖➖➖

Short Max Pain = $4.160

Long Max Pain = $3.612