EGOLD Consolidates at Critical Swing Low Around $11.47EGOLD is consolidating at support, with traders closely monitoring the $11.47 level. A sweep here could fuel bullish expansion toward $20, while a breakdown risks further correction.

Introduction: EGOLD’s prolonged consolidation has placed the spotlight on its key swing low at $11.47. How price rea

EGLD/USDT – Major Bullish Reversal in Play🚀 Technical Analysis Summary:

EGLD has successfully completed a textbook inverse head and shoulders pattern, signaling a strong bullish reversal after an extended downtrend. The neckline breakout is imminent and could ignite a significant upside move.

📈 Accumulation Zone:

Price has consolidated wit

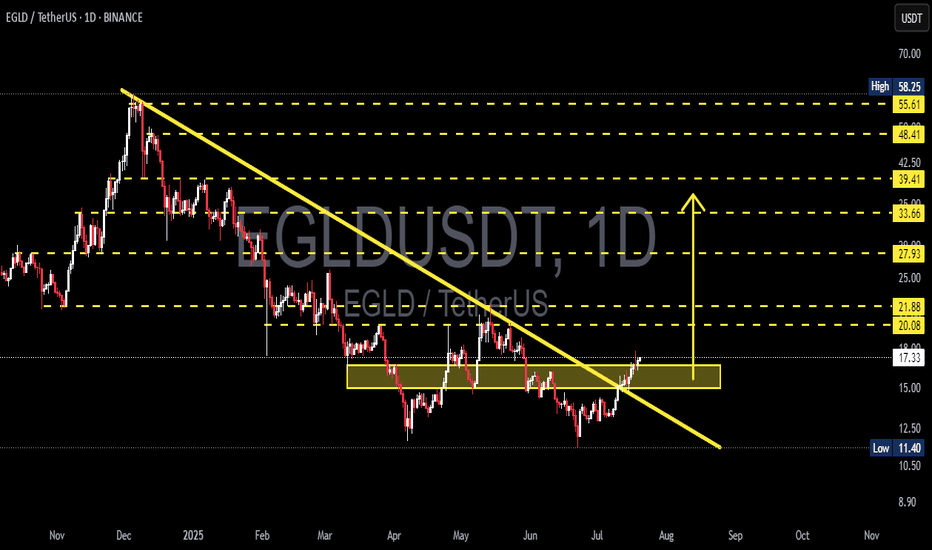

EGLD/USDT — Descending Triangle at a Critical Demand Zone🔎 Overview

The EGLD/USDT (1D, Binance) chart is currently forming a classic descending triangle pattern:

Lower Highs are pressing price downward along the yellow trendline.

A strong horizontal demand zone at 11.40 – 13.50 USDT has been repeatedly tested as support.

Price is compressing toward th

eGold Consolidates at Key Support, Eyes Rally Toward $20eGold (EGLD) continues to respect a critical support zone aligned with the 0.618 Fibonacci retracement and the value area low. Holding above $14.22 could trigger a bullish rotation toward $20.

Introduction:

EGLD’s recent price action has highlighted the importance of its current support region, wh

EGLDUSDT - Great for long positionsIt’s forming a Cup and Handle pattern on the 4H timeframe.

The neckline corresponds to the 0.618 Fibonacci level.

Once it breaks and closes above it, your target will be 20% from here. It’s a good buying opportunity now, but don’t use high leverage.

Best regards:

Ceciliones🎯

EGLD Breaks Key Downtrend – Is This the Beginning?📊 Detailed Technical Analysis (Daily Timeframe):

🔍 1. Market Structure & Chart Pattern

Major Downtrend Line Breakout – Reversal Signal:

After being stuck under a persistent downtrend for nearly 9 months, EGLD has officially broken out of the descending trendline, signaling a potential shift from d

EGLD Eyes Bullish Continuation as Price Tests Point of ControlEGLD is approaching a key resistance level that may determine the next directional move. A reclaim above the point of control could set the stage for an uptrend continuation toward $37 and beyond.

EGLD is currently trading at a critical resistance region — the point of control (POC) — which serves

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where EGLDUST.P is featured.

Proof of Stake: Seeking validation?

26 No. of Symbols

Smart contracts: Make the smart decision

36 No. of Symbols

See all sparks