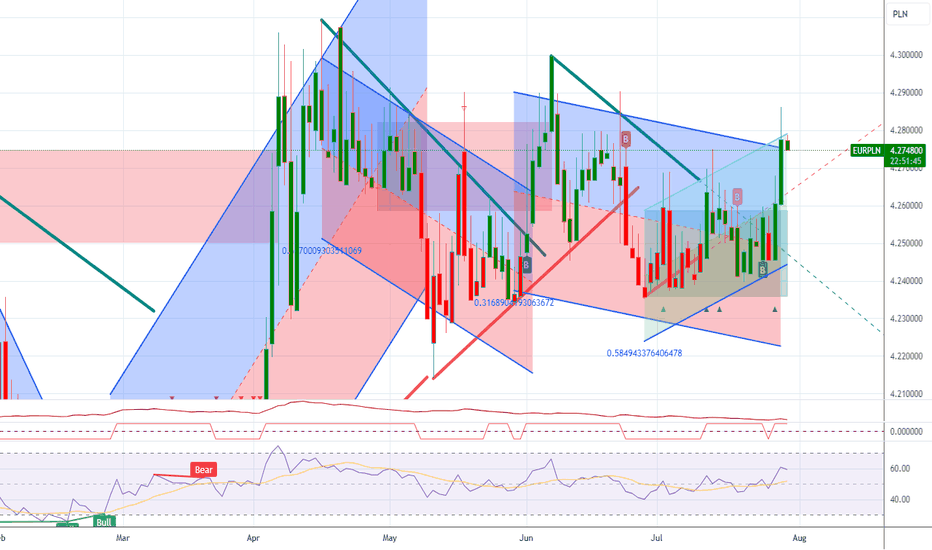

#EURPLN watch for a pennant breakEURPLN has been trading in an extremely tight range of 4.2350 - 4.2900 since may, with lower highs and higher lows forming a pennant. Should it break out on the top side with a decisive close above 4.2750-4.2800, the measured target would be around 4.43, which also aligns with a major horizontal key

Related currencies

EUR/PLN SHORT Investment Opportunity 4HHello, I am Trader Andrea Russo and today I want to show you a SHORT investment opportunity on EUR/PLN. We are currently on a 4-hour (4H) chart, and some technical indicators suggest increasing bearish pressure. The overbought signals and the loss of momentum suggest that we could be facing a possib

Zloty vs Euro 5.20 - timespan boundariesTwo years ago, I found the probability with the current zloty price of 4.15 PLN; and forecasted new extremum terminal point >6.5 zloty per single euro. The first part of the prediction has worked out, 4.15 was reached.

How i received the 6.50 PLN value? I got the value by applying the Elliott Wave

EUR/PLN 4H SHORT Selling Opportunity

Hello, I am Trader Andrea Russo and today I want to show you a SHORT investment opportunity on EUR/PLN. We are currently in a 4-hour chart (4H) and my indicator "WaveTrend + Multi-Timeframe Alerts", published in the SCRIPT section of my TradingView profile, signals an overbought situation both at

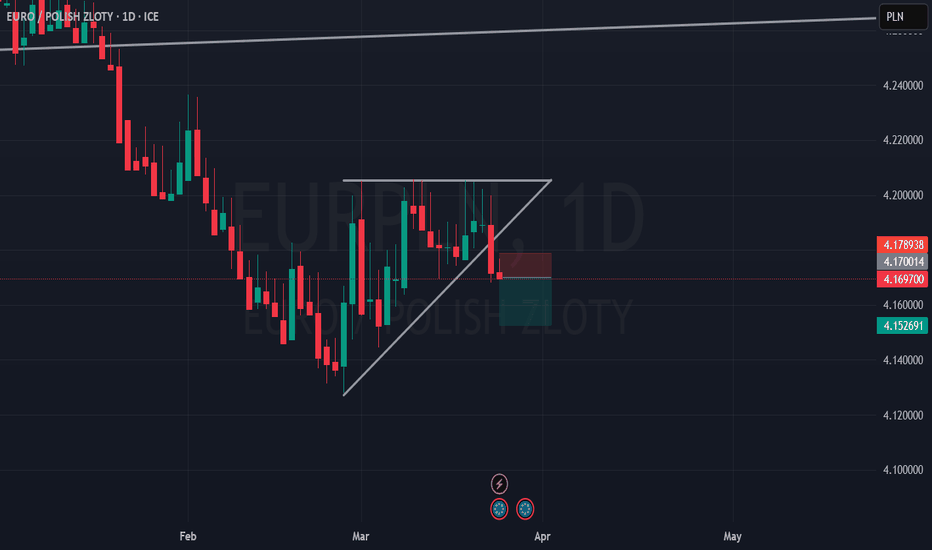

Zloty Long Trade SetupCurrent Position:

FPMARKETS:EURPLN recently approached the lower bound of its trading range for the past year, presenting an attractive entry point for a long trade.

Supporting Factors:

NBP Hawkishness: The National Bank of Poland's hawkish guidance at its December meeting has supported the

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of EURPLN is 4.25979 PLN — it has increased by 0.08% in the past 24 hours. See more of EURPLN rate dynamics on the detailed chart.

The value of the EURPLN pair is quoted as 1 EUR per x PLN. For example, if the pair is trading at 1.50, it means it takes 1.5 PLN to buy 1 EUR.

The term volatility describes the risk related to the changes in an asset's value. EURPLN has the volatility rating of 0.19%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The EURPLN showed a 0.36% rise over the past week, the month change is a 0.19% rise, and over the last year it has decreased by −0.82%. Track live rate changes on the EURPLN chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade EURPLN right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with EURPLN technical analysis. The technical rating for the pair is buy today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the EURPLN shows the buy signal, and 1 month rating is sell. See more of EURPLN technicals for a more comprehensive analysis.