Sterling Micro Futures: The Calm Before Poor Decisions.M6B is consolidating after a strong impulse leg from 1.3230 into the 1.3360 range, with price now rotating inside a tight equilibrium pocket while liquidity builds on both sides. The upper boundary at 1.3380 remains the primary upside liquidity cluster, repeatedly defended but not yet cleared, while the 1.3315–1.3323 zone acts as the key demand shelf generated by the last displacement candle.

Structure remains mildly bullish while this shelf holds, with London ORB expected to reveal intent: acceptance back above 1.3345 would likely re-open the path toward 1.3380 and the clean highs beyond, whereas a decisive break below 1.3315 would flip the model into corrective mode and target the unfilled inefficiency down toward 1.3280. Momentum has flattened, signalling compression rather than trend reversal the next session provides the expansion.

Quant Probability Model:

• Continuation to Upside Liquidity (1.3380): 55%

• Break of 1.3315 and Repricing Toward 1.3280: 45%

Trade ideas

GBP: Next Upside Move PositioningTraders in the British Pound (6BH2026 -March futures) are acting quite predictably.

After last week’s rally (by the way — GBP rose to the outer 95% ER boundary, which rarely happens), we started seeing naked puts appear on Thursday and Friday.

Their break-even points sit right within the recent bullish move (#1 and #2 on screenshot).

Here’s how to interpret this:

If GBP starts to decline, these levels could act as support zones — and potentially mark the end of the correction.

The mechanics behind it?

By adding a long futures position to a long put, traders create a synthetic call — a structure designed to profit from upside after the dip.

In short:

They’re not just betting on a drop — they’re positioning for the next leg up.

#GBP futures

GU Future - 6BMonthly bias: I am bullish on the monthly timeframe. Price has filled the monthly FVG, swept the low of the previous month, and returned back into the range with a wick below the low.

Weekly: It closed above the previous week’s candle, so the weekly bias is also bullish.

Additionally, we have a DCRT that aligns with the higher-timeframe DoL.

Note to myself:

Even during this bullish monthly bias (assuming price moves according to my current outlook), we will still experience retracement and temporary bearish moves . Stay patient and focus on entering only at the correct price level and at the right time (Specially focus on W2 and W3 of the month).

Massive Put Wall at 1.30Sterling is entering a critical zone where fiscal tensions, macroeconomic fragility, and unfavorable technical signals overlap. The 6BZ5 contract is moving along the edge of a structural threshold that could shape the trajectory of the coming weeks. As the UK budget approaches and monetary divergence between the Bank of England and the Fed widens, listed options, retail sentiment, and market microstructure collectively reinforce the scenario of a market vulnerable to a downside acceleration if support breaks.

Fundamental analysis

The fundamental backdrop remains unfavorable for the pound, driven by a convergence of domestic and external pressures. In the UK, fiscal credibility has once again become a central issue: contradictory announcements on taxation, rumors of future tax increases followed by reports of a reversal, have revived doubts about the coherence of the government’s economic strategy. This uncertainty has triggered a sharp rise in gilt yields, signaling an increased risk premium on UK assets. Markets are also focused on the 26 November budget, perceived as a major catalyst. A presentation judged insufficiently rigorous could reignite concerns around a “UK risk premium” and amplify sterling weakness.

The Bank of England adds another layer of fragility: the combination of a slowing labor market, improving inflation dynamics, and deteriorating activity indicators strengthens expectations of monetary easing. Markets now assign more than a 75% probability to a rate cut in December, which mechanically weighs on the currency.

By contrast, the Fed maintains a relatively more restrictive stance, supported by the resilience of the US macroeconomic environment and the gradual return of economic publications after the shutdown. This policy divergence continues to favor the dollar and limits rebound attempts in GBP.

Technical Analysis

The technical setup shows a clearly bearish and vulnerable structure below 1.32, with price firmly trading under the 20-day moving average, which now acts as dynamic resistance and could guide price action toward a major level at 1.30.

Below that zone, the Volume Profile reveals a deep liquidity vacuum between 1.285 and 1.27, an area likely to attract prices rapidly in the event of a breakout.

Sentiment Analysis

Aggregated FX/CFD broker data shows that roughly 60–65% of retail traders are currently long, an elevated level indicating a broad attempt to “buy the dip.” Historically, such a long-heavy bias tends to be interpreted contrarian: when retail traders buy aggressively into a falling market, the probability of further downside increases.

The context complicates broader positioning analysis because the US government shutdown has interrupted COT publications, depriving markets of their usual source on institutional speculative positioning.

Nevertheless, most major FX bank analyses consider that rebounds remain fragile and that the broader bias still leans toward additional downside pressure, particularly in the run-up to the 26 November budget.

Options analysis

Activity in listed options highlights a massive cluster of puts around 1.30, now the mechanical pivot of the market. This level concentrates most of the dealers’ negative gamma: as the spot approaches it, dealers must sell GBP/USD to hedge their exposure, which naturally pulls spot toward 1.30. This zone therefore acts not as a technical magnet, but a microstructural one.

A clean break would amplify this dynamic: delta would fall sharply, forcing market makers to increase hedging, generating a self-reinforcing wave of selling pressure. In effect, 1.30 is more than a support level; it is the key threshold to monitor and a potential point of structural rupture.

Trade idea

While more aggressive traders may consider short positions already, a more disciplined approach favors waiting for a confirmed break below 1.30 before initiating a short targeting 1.2715, with the aim of quickly filling the volume gap, supported by abundant stop-loss clusters and put positions in that area. This scenario would be invalidated by a daily close above 1.32.

Final thoughts

The 6BZ5 contract sits at the intersection of macro, technical, and microstructural forces that all converge toward an elevated risk of breakdown. Dollar strength, the UK’s uncertain fiscal credibility, a Bank of England now oriented toward easing, and a retail market saturated with long positions together create a fragile environment. The 1.30 level concentrates stops, dealer gamma, and a clear liquidity vacuum, making it the central pivot point of the moment. A decisive break would open an almost unobstructed path toward 1.2715. Conversely, only a solid daily close above 1.32 would neutralize the bearish bias.

---

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: tradingview.com/cme/ .

This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

British Pound to hit at least 1.29 before end of yearCME:6B1! FX:GBPUSD OANDA:GBPUSD FOREXCOM:GBPUSD

I expect November and December to drive the pound to at least 1.29 and the purple highlighted area .

I also expect November will retrace first and will offer the best sell entries (around 11-17 November) and I expect December to be the fastest .

Key support at 1.3330, bulls eye 1.3570-1.3630The British pound is trading at a turning point, with futures consolidating after rebounding from late-September lows. The Fed’s shift toward potential rate cuts contrasts with the Bank of England’s reluctance to ease, giving sterling short-term support while leaving medium-term risks intact. Technically, the market is confined within a clear corridor, while sentiment signals remain mixed: retail traders are largely short, a contrarian bullish sign, whereas institutional flows are split between asset managers and leveraged funds. Options activity adds another dimension, with heavier open interest in puts but greater premium flows into calls, creating an area of attraction around 1.3450–1.3550. Taken together, these factors suggest a market in balance, with the next decisive move likely to come from a break outside this range.

Fundamental Analysis

The current GBP/USD dynamics are largely driven by the policy divergence between the Federal Reserve and the Bank of England, against a backdrop of U.S. political uncertainty and the UK’s fiscal constraints.

On the U.S. side, the Fed has maintained a restrictive stance, but market expectations are shifting toward two rate cuts by the end of 2025, supported by cooling inflation and signs of slower activity. The looming U.S. government shutdown has added volatility, but overall it tends to weigh on the dollar in the near term.

In contrast, the Bank of England remains constrained by persistent inflation, particularly in services and food, leaving little room to consider rate cuts in the short run. Recent BoE commentary indicates that rates are likely to stay elevated for longer, even as UK growth shows signs of weakness.

In essence, the Fed appears to be moving toward a more accommodative path while the BoE maintains a hawkish bias to contain inflation. This divergence supports sterling in the short term. However, the UK still faces structural headwinds such as a large current account deficit and fiscal pressures, which could cap medium-term upside for the pound.

Technical Analysis

On the December contract, the technical structure remains dominated by a wide congestion area around 1.3440, identified as a key volume control point. As long as prices hold above this level, the bias remains moderately positive, supported by visible buying volume on recent rebounds. Immediate resistance stands at 1.3490–1.3525, which corresponds to the 100-DMA on spot and the 50% retracement of the 1.3726–1.3324 move. Beyond that, the 1.3570–1.3630 area (61.8% Fib and upper Bollinger band) marks the next critical barrier. On the downside, 1.3425 and especially 1.3330 (September 25 low) act as major supports: a break would reopen a bearish bias toward 1.3260. In summary, the immediate trend remains fragile but constructive, with direction hinging on a decisive breakout above 1.3525.

Sentiment Analysis

Sentiment on GBP/USD remains mixed across market participants. Among FX/CFD brokers, around two-thirds of retail traders are short, which sends a contrarian signal leaning bullish in the short term. However, COT data shows the opposite picture: asset managers hold a significant net short position (-44,909), reflecting structural caution toward the UK’s economic and fiscal outlook, while leveraged funds maintain a net long position (+27,662), betting more on tactical rebounds. This divergence between retail, speculative, and institutional flows creates a polarized market, prone to volatility spikes.

Options Activity

On the current expiry, option activity shows an interesting contrast. Open interest is heavier on the put side, highlighting demand for downside protection. However, in terms of premiums paid, calls clearly dominate, suggesting traders are willing to spend more to capture potential upside. The densest clusters of open interest are found around 1.3350–1.3400 for puts and 1.3450–1.3550 for calls, creating a key technical corridor. In short, the market keeps safety nets in place against a drop, but the premium flows reveal a moderate bullish bias, with expectations leaning toward further gains if spot holds above 1.3450.

Trade Idea

Direction: Long GBP futures (6BZ5) while above 1.3450

Entry Zone: 1.3460–1.3480, just above the key support cluster

Take Profit (TP1): 1.3570, aligning with 61.8% Fib retracement and option OI cluster

Take Profit (TP2): 1.3630, upper Bollinger band and stronger resistance zone

Stop Loss (SL): Close below 1.3330, which invalidates the support and reopens the 1.3260 risk

Final Thoughts

Sterling futures are at an important crossroads, caught between supportive short-term dynamics and persistent structural headwinds. On the fundamental side, the dollar’s softer tone, driven by expectations of Fed rate cuts, has provided the pound with breathing space, while the Bank of England’s reluctance to ease keeps policy divergence working in sterling’s favor. Technically, however, the market remains capped by heavy resistance around 1.3570–1.3630, a zone reinforced by Fibonacci levels, moving averages, and historical supply. Sentiment adds to the mixed picture: retail traders leaning short point to contrarian upside risk, but institutional positioning highlights lingering caution. Meanwhile, options activity reveals a market hedged against downside but increasingly willing to pay for upside exposure, anchoring prices in a corridor between 1.3450 and 1.3550.

In this environment, sterling’s path will likely be shaped by which side of this corridor breaks first. Until then, buying dips above 1.3450 with disciplined stops offers the cleaner tactical play.

---

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: tradingview.com/cme/ .

This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

6B1!: GBPUSD Futures Outlook: Bearish Momentum Persists The GBPUSD CFD continues its cautious descent following a rejection from the critical 1.3590 supply area. This level, historically a significant resistance point, has thwarted recent bullish attempts, reinforcing the prevailing bearish sentiment among traders and investors alike.

Technical Breakdown

After failing to sustain gains above 1.3590, sellers have gained momentum, targeting lower levels of support. The immediate focus now shifts to the daily demand zone around 1.3300. Should the price reach this level, it is plausible that buyers will emerge, viewing it as an attractive entry point with a well-defined risk below the zone. A successful bounce here could trigger a rally, offering traders an opportunity to position for a potential reversal.

Potential for Further Decline

If market conditions remain unchanged—particularly in terms of Commitment of Traders (COT) data and fundamental factors—there is a possibility that the pair could test even lower support levels. Currently, the next significant demand zone lies near 1.3230, which could serve as the next target for bears if selling pressure intensifies.

Broader Market Context

Meanwhile, the US dollar index (DXY) appears to be demonstrating resilience, finding demand at current levels. This inverse relationship suggests that, despite the weakening GBP, the USD might be strengthening or stabilizing, adding weight to the bearish outlook for GBPUSD.

Trading Strategy and Outlook

Our current stance is to maintain our short positions with a close eye on the 1.3300 support zone. If the price holds above this level, it could serve as a foundation for a potential rebound, provided macroeconomic fundamentals and sentiment remain unchanged. Conversely, a decisive break below 1.3230 could accelerate the decline toward next support levels, confirming a sustained bearish trend.

✅ Please share your thoughts about 6B1! in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

GBP: ER & Options Align — A Signal Worth Watching📌 GBP: ER & Options Align — A Signal Worth Watching

Interesting confluence on the British Pound:

The 1σ Expected Range (ER) for the Friday expiry (22.08) perfectly aligns with the cluster of put options at 1.35 — the same level I highlighted earlier.

🎯 Why it matters:

When market structure (ER) meets real positioning (puts), you get a reasonable support zone.

GBP/USD Faces Key 8-Hour Supply ZoneToday, the GBP/USD futures approached an 8-hour supply zone, presenting a potential shorting opportunity. The price action indicates the beginning of a possible downtrend within this timeframe. Additionally, the latest COT report reveals that non-commercial traders are increasing their short positions, reinforcing the bearish outlook.

It will be crucial to review the upcoming COT report over the weekend for a clearer market perspective. However, based on current signals, the market may be poised for decline. Should this 8-hour supply zone be breached or ignored, another supply area lies just above, which could serve as an alternative resistance level to monitor.

✅ Please share your thoughts about 6B1! in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

Short the Slip Above 1.3500Fundamental Outlook: A stagflation trap

The UK economy continues to emit worrying signs of stagflation: inflation remains uncomfortably high, growth is weak, and the once-tight labor market is starting to soften. Consumer confidence has deteriorated, and house prices are experiencing record declines, a trend that underscores the fragility of household wealth and future consumption.

In this challenging context, any rally in the pound should be treated with caution. The broader macro backdrop still favors the US dollar, especially if incoming US data continues to support a "soft landing" narrative. In contrast, the UK's trajectory appears more constrained.

On monetary policy, the Bank of England is expected to maintain a predictable, yet clearly dovish, easing cycle through the second half of 2025. Market consensus leans toward a 25 bps cut in August, followed by a pause in September, then another cut in November. This gradual pace of easing may keep the pound under persistent pressure, especially if the Federal Reserve maintains a more stable or data-driven stance.

On the political front, Trump’s critical remarks toward Powell and evolving UK-US relations represent potential flashpoints. Any surprises here could further erode confidence in the pound.

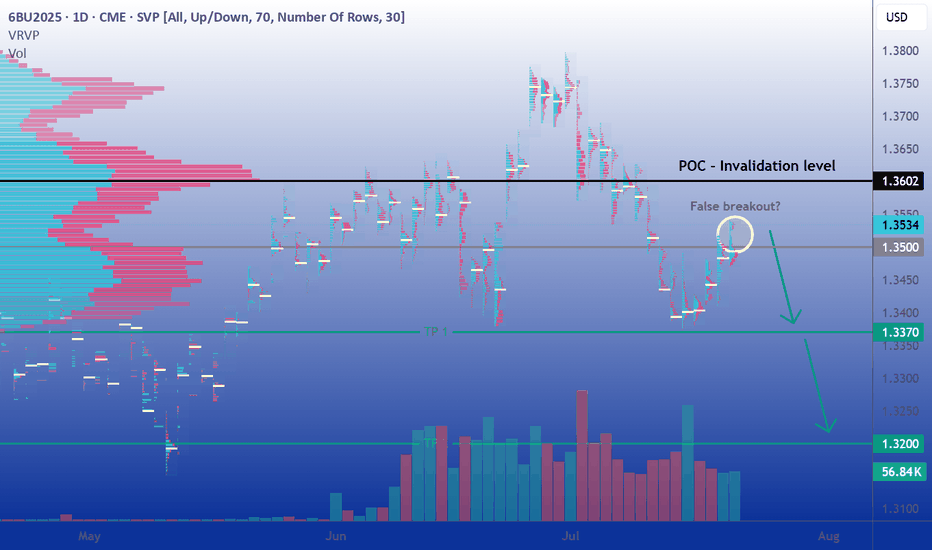

Technical Analysis: Signs of breakdown below 1.34

The September futures contract (6BU2025) has dropped over 2.5% in a straight line during the first two weeks of July, pressuring the 1.34 USD support zone before rebounding in recent sessions. So far, each rebound attempt has been met with consistent selling, and the brief move above 1.3500 appears fragile, offering a potential short opportunity to re-enter the previous range.

A sustained daily close below 1.3370 would likely pave the way for further downside toward the 1.32 level, which hasn’t been visited since May 13th. Notably, the volume profile reveals a liquidity vacuum in that region, potentially acting as a price magnet.

Overall, the technical setup favors another leg lower, barring the emergence of a strong bullish catalyst capable of reversing the prevailing trend.

Sentiment Analysis: Mixed but fragile

From a positioning standpoint, the CFTC's latest Commitment of Traders (COT) report shows asset managers increasing their bearish exposure. Net short positions grew from 13,154 to 27,611 contracts, hinting at rising institutional pessimism toward the pound.

In the FX/CFD retail segment, positioning remains relatively balanced. However, we notice a pattern: retail traders tend to increase long exposure on dips, profiting from short-term rebounds, a classic contrarian signal that the market may still have room to move lower.

Volatility remains muted, with the VIX trading below 17, close to its annual lows. This low-volatility environment tends to reinforce technical trading patterns and increases the likelihood that price respects key support/resistance zones, unless jolted by surprise macro events.

Options Market: Downside risk priced in

In the listed options market, we see a clear asymmetry in favor of downside protection. Out-of-the-money (OTM) puts trade at higher premiums than equivalent calls, confirming a market pricing greater fear of a GBP decline.

Open interest (OI) is notably concentrated in the 1.34–1.35 strike zone. This suggests potential pinning around these levels near expiry, but also highlights the risk of increased volatility if the spot price deviates sharply. A move away from this cluster could spark rapid adjustments in hedging flows, adding fuel to the next directional move.

Trade Ideas: Two ways to play the bearish bias

1. Classic directional strategy

Entry: Short at current price (around 1.3535)

Stop Loss: Daily close above 1.3602 (Volume Profile Point of Control)

Take Profit 1: 1.3370 (recent support)

Take Profit 2: 1.3200 (liquidity void)

This strategy targets a clean technical setup with clearly defined risk. A break below 1.3370 would confirm downside momentum and offer a high-reward second leg toward the 1.32 region.

2. Alternative strategy: Replace your stop loss with an OTM call option

Rather than exiting prematurely via a hard stop loss in case of a false breakout, consider purchasing an OTM call option as a form of insurance. This allows you to stay in the trade while limiting your maximum loss.

For instance, buying the August 1.355 call, currently trading around 0.0059 on CME (59 ticks), caps your loss in the event of an unexpected breakout above resistance. If the cable squeezes sharply higher, the call option will compensate part or all of the loss on the short position beyond the strike price.

This hybrid approach works particularly well in setups like this one, where fundamentals and sentiment support a bearish outlook, but positioning and low volatility leave room for abrupt technical counter-moves.

Final thoughts

The pound faces an increasingly precarious setup. Fundamental conditions in the UK remain soft, monetary policy is turning more accommodative, and political uncertainty looms large. Meanwhile, technical and sentiment indicators tilt bearish, and the options market reflects elevated downside risk premiums.

In short, while the market may already be pricing in some of this pessimism, the risks of a deeper GBP correction remain high. Traders should watch upcoming catalysts, BoE and Fed meetings, US/UK economic data, and geopolitical signals, and adjust positions accordingly.

Until we see a clear shift in macro data or a breakdown in technical patterns, fading rallies remains a strategy with attractive risk/reward potential.

---

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: tradingview.com/cme/ .

This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

GBPUSD. 14.07.2025. The plan for the next few days.The nearest interesting resistance zone was already worked out in the morning and gave a good reaction. Let's mark the others where we can expect a reaction. It's not certain that there will be a major reversal, but I think we'll see a correction that can be monetized. We're waiting for a reaction and looking for an entry point.

The post will be adjusted based on any changes.

Don't forget to click on the Rocket! =)

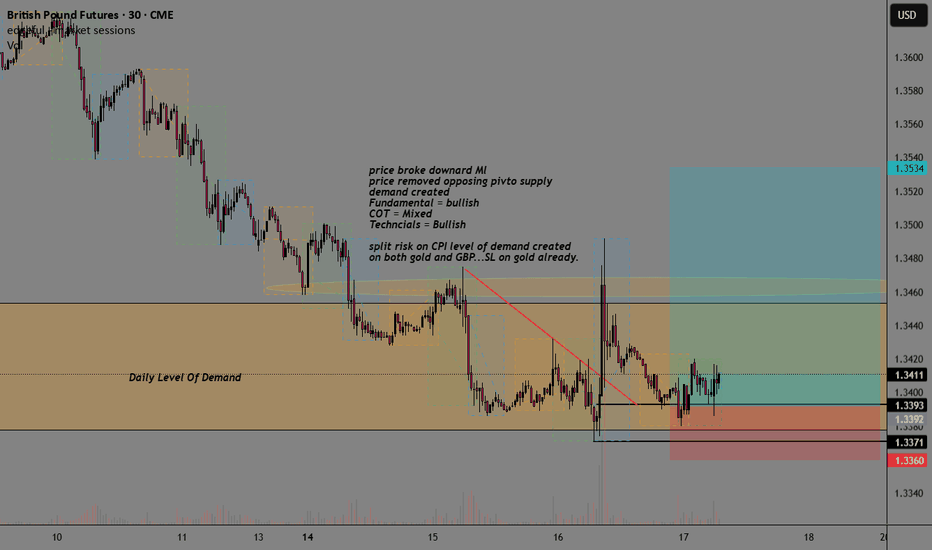

GBP GBPUSD Supply-Demand Long SignalHigher Timeframe Analysis:

- Price inside daily/Weekly level of demand + pivot

- Long term trend = uptrend

- Fundamentals Bullish

- COT Mixed

- Technicals Bullish

Lowertimeframe:

- Price broke downard ML

- Price removed the opposing pivotal level of demand

- DBR Demand created from CPI event

- Split risk on GC + GBP

This is a mix of using Sentiment, technical analysis, and fundamental analysis with supply-demand.

Mid-Session Market ReviewMid-Session Market Review

S&P 500: After some initial volatility from the 8:30 news, the market accepted above the prior day’s levels but has since pulled back within range, consolidating just below the highs.

NASDAQ: The NASDAQ remains above all of yesterday’s levels and is currently balancing between the high of the day and the 23,100 level, showing a rotational pattern.

Russell 2000: This market is rotational within the prior day’s range and has accepted below the CVA and PVA. Potential trade opportunities might come with a pullback to the 2,245 area.

Gold: Gold has accepted below the prior value area and is still rotational within the CVA. Trade opportunities could present themselves near the prior day’s low.

Crude Oil: The market is quite choppy, hovering around the prior day’s low and value area low. Caution is advised, with potential long opportunities on a pullback, as long as conditions align.

Euro Dollar: The Euro is dropping significantly, moving below all key levels without much respect for them. This could provide short opportunities if there’s a pullback.

Yen: Similar to the Euro, the Yen is also pushing below previous levels. It’s getting choppy near the CVA low, so caution is needed until it shows more respect for those levels.

Natural Gas: The market is rotational within the prior day’s range and respecting the CVA high. Long opportunities might be possible if conditions are right.

Aussie Dollar: It’s showing some respect for the CVA low and is still rotational. There could be a potential long setup forming, depending on how it plays out.

British Pound: The Pound has accepted below all key levels, and a pullback to the CVA low might provide short opportunities, though caution is needed around the VWAP.

British Pound Futures (6B1!) Face Supply Area.Pound Futures: 6B1 Area Tests Bearish Resolve

Pound Futures are approaching a critical weekly supply zone (6B1). Today's price action saw a touch and rejection of this level, marked by a bearish candlestick. This suggests a potential for a short-term pullback, and we're eyeing a re-entry opportunity at this level, watching for a drop to the next significant demand zone on our chart.

Further reinforcing the bearish outlook is an intriguing divergence in the Non-Commercial trader positions revealed in the latest Commitment of Traders (COT) report, noticeable on the daily chart. This divergence hints at a possible shift in sentiment, paving the way for a short position. Should the price successfully breach the 6B1 area, our chart indicates another supply zone as the next potential target.

✅ Please share your thoughts about 6B1! in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

GBP/USD Futures – Short Trade Active📉 GBP/USD Futures – Short Trade Active

🕒 Timeframe: 1H

💼 Instrument: Micro GBP/USD Futures (M6B1!)

📍 Entry: 1.3651

🎯 Target: 1.3614

📊 Analysis:

Price tapped into a clear area of liquidity and resistance at 1.3651, aligning with previous sell pressure. I’ve entered short expecting a rejection and return toward support near 1.3614.

The market just completed a strong leg up — this is a textbook area to fade the strength and catch the retrace.

🎯 Bias: Intraday short

📲 Trade in progress – managing risk actively

#GBPUSD #FuturesTrade #MicroFutures #PriceAction #ShortSetup #CME #FXFutures #SupplyAndDemand #Forex