Idea on a chart Patience.

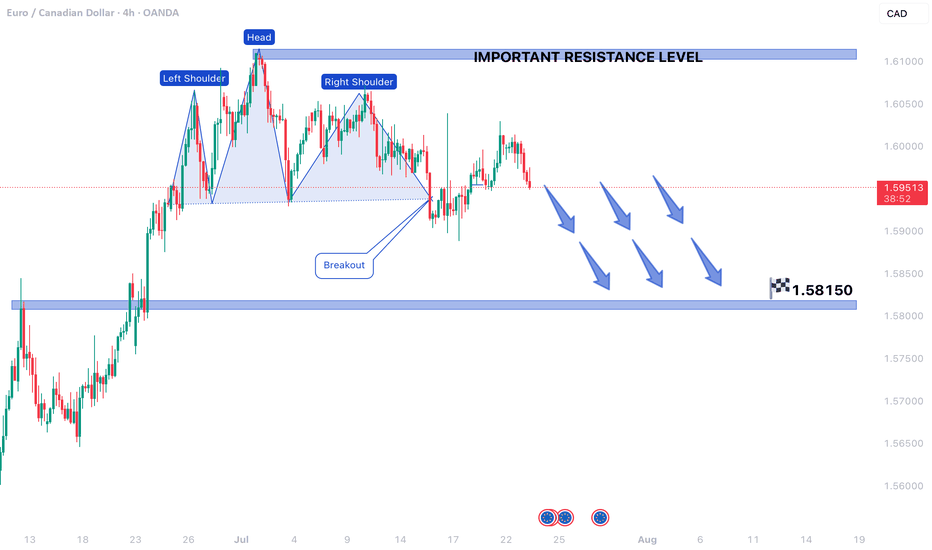

EUR CAD we have a great set up on H4 time frame fib 78.6 zone for a sell patience.

The Dollar trims losses on Monday but remains far from last week's highs near 100.00.

The Greenback lost 1.6% on Friday as the US Nonfarm Payroll report revealed that job creation has been much lower than previously thought.

Friday's employment figures boosted hopes of immediate Fed cuts and undermined speculative demand for the USD.

The US Dollar is trimming some losses on Monday, as the market assimilates Friday’s downbeat employment figures, but remains capped below 98.50, well below last week’s highs near the 100.00 psychological levels.

Trade ideas

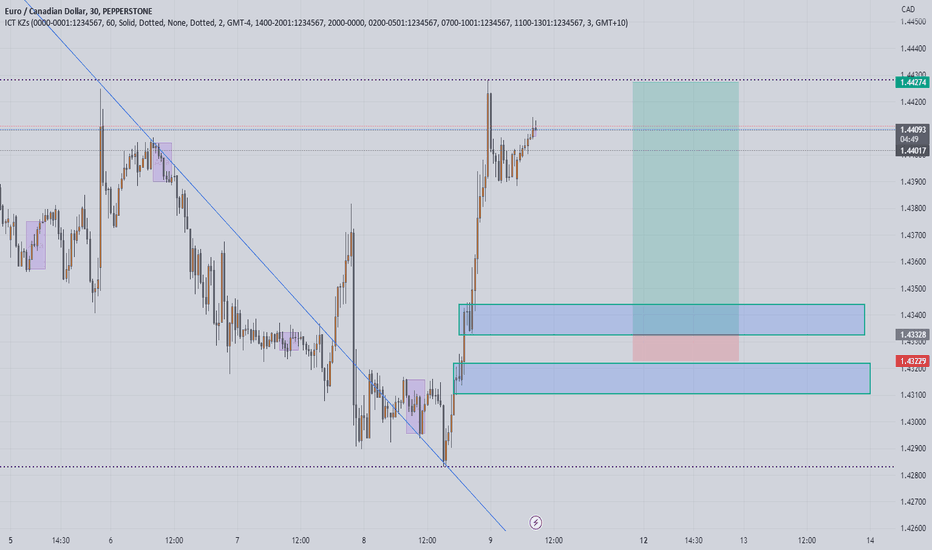

BUY EURCAD 4.8.2025Confluence order: BUY at M15

Type of order: Limit order

Reason:

- The current top is not touching anything, expected to rise to the sub-key of H1 above.

Note:

- Management of money carefully at the last bottom (1,59310)

Set up entry:

- Entry buy at 1,59090

- SL at 1,58910

- TP1: 1,59310 (~1R)

- TP2: 1,59824 (~4R)

- TP3: 1,60200 (~6R)

Trading Method: Price action (No indicator, only trend and candles)

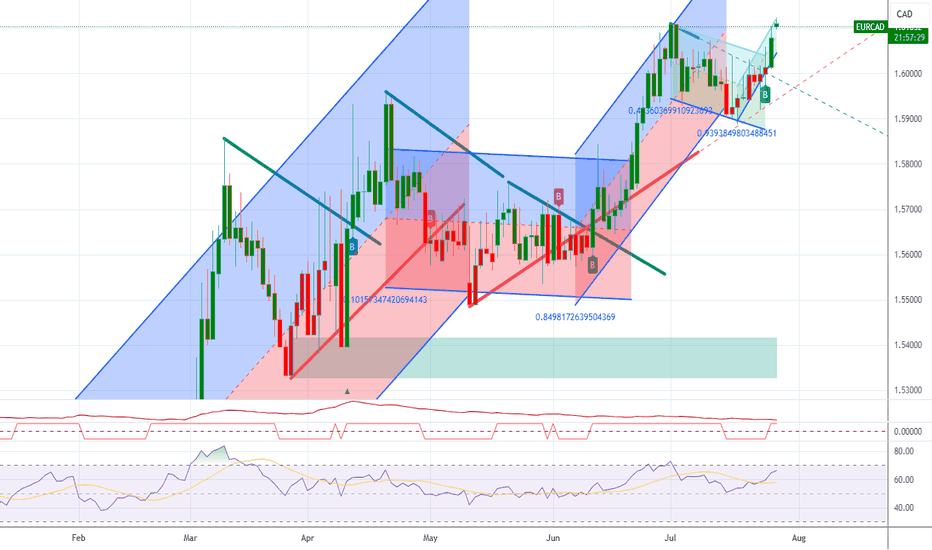

EURCAD 1H longEURCAD 1 H made a beatiful sharp drop, now stalling arround some good support levels.

When such a drop happens with no pullback formed yet I'm happy to buy the way down.

Because the pullback has to come soon buyers step in at the support levels.

My plan is simple I open a manual grid at the support levels I draw and aim for a 2R profit

Current grid 3 levels

1 market order

2 buy limits

Tp 2R

extra confirmation RSI is oversold

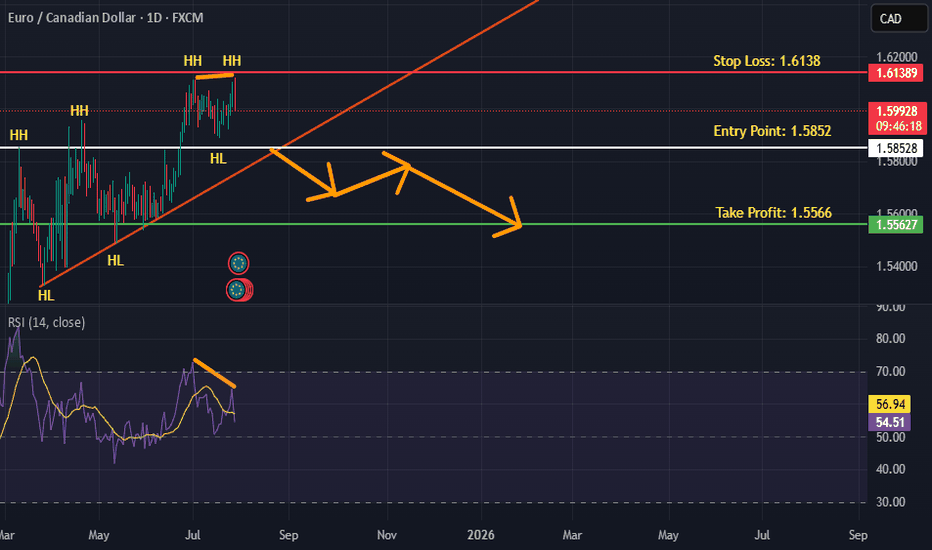

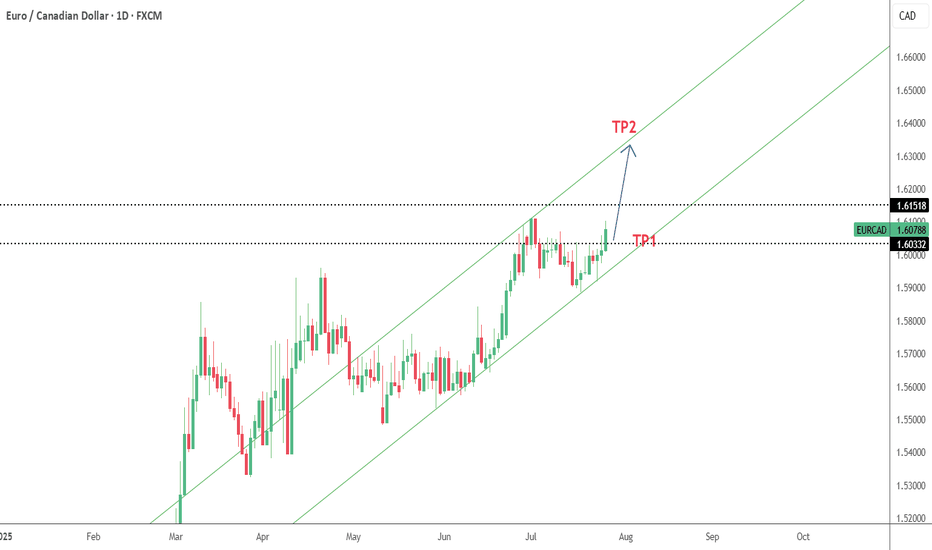

EUR/CAD: Shorting the Climactic Rally Near 1.6000The strong rally in EUR/CAD has pushed the pair into extreme territory, approaching a major psychological and structural resistance zone. While momentum has been strong, this looks like a potential climactic or "blow-off" top, offering a highly favorable risk/reward opportunity to short the pair in alignment with the weak underlying Euro fundamentals.

The Fundamental Why 📰

The core thesis remains bearish for the Euro. The European Central Bank (ECB) maintains a distinctly dovish tone, signaling a willingness to ease policy further to support a slowing Eurozone economy. This fundamental headwind suggests that extreme rallies in Euro pairs are often exhaustive and present prime shorting opportunities.

The Technical Picture 📊

Major Supply Zone: The price is entering a critical multi-month supply zone between 1.5950 and the key psychological level of 1.6000. This is a major ceiling where significant selling pressure is anticipated.

Fibonacci Extension: This area aligns with a key Fibonacci extension level (1.272) from the last major impulse wave, a common zone where trending moves become exhausted and reversals begin.

Pronounced RSI Divergence: A clear bearish divergence is forming on the daily chart. As price makes this final push to a new high, the Relative Strength Index (RSI) is making a significantly lower high, signaling a deep exhaustion of buying momentum.

The Counter-Trade Rationale 🧠

This is a high-level fade. We are positioning for a reversal at a major, technically significant ceiling. The extreme price extension, combined with clear momentum divergence, indicates that the risk of buying at these highs is substantial. By shorting here, we are betting that the powerful technical resistance and weak fundamentals will trigger a significant correction.

The Setup ✅

📉 Pair: EUR/CAD

👉 Direction: Short

⛔️ Stop Loss: 1.63230

🎯 Entry: 1.59490

✅ Take Profit: 1.52008

⚖️ Risk/Reward: ≈ 2:1

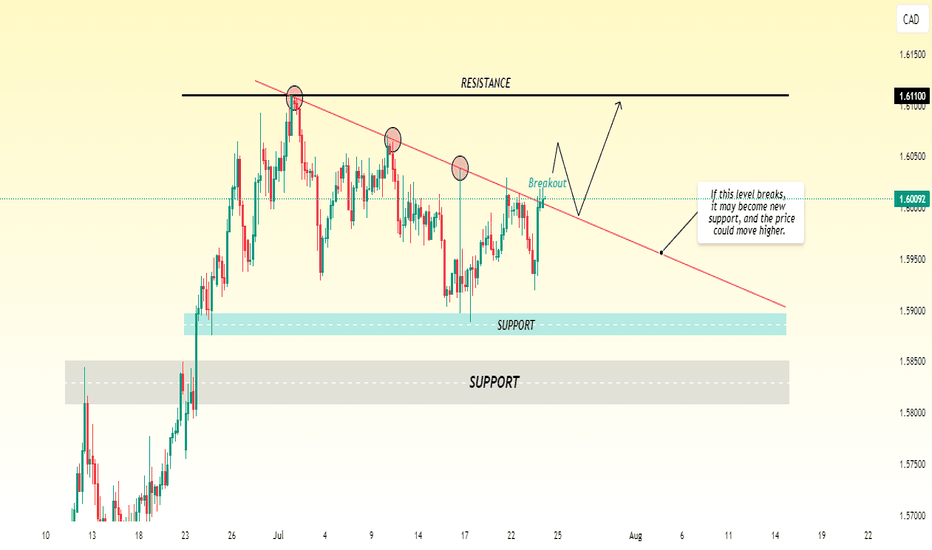

EURCAD is BearishPrice was in a strong uptrend, however now it seems that bulls are exhausted, the notion is further validated by a double top reversal pattern with bearish divergence. If previous higher low is broken with good volume, then we can expect a bearish reversal as per Dow theory. Targets are mentioned on the chart.

EUR/CAD Tests Resistance — Bullish Breakout in Sight?EUR/CAD appears to be showing bullish momentum and is likely heading toward the 1.6110 level. Currently, the pair is testing a key resistance zone. If the price manages to break above this resistance with strong volume or confirmation, we could see further upside continuation toward the next target at 1.6110. Traders should watch for a clear breakout and possible retest of the broken level turning into support, which could provide a good entry point for long positions.

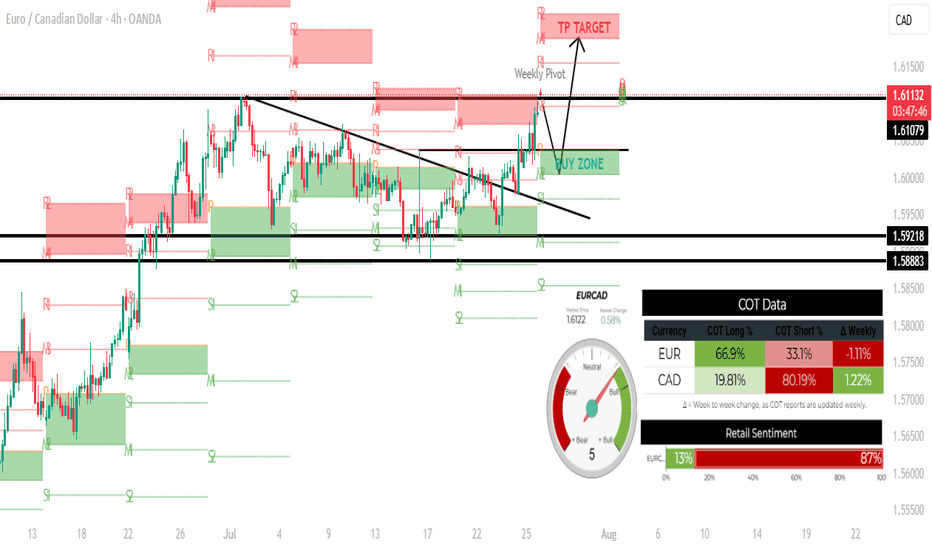

EURCAD LONG SETUP H4: 28 JULY - 1 AUGUST 2025✅ EUR/CAD Trade Plan (4H Timeframe)

🔍 Bias: Bullish

🧠 Why Buy EUR/CAD?

Reason Details

📊 COT Data

Institutions are 66.9% long EUR and 80.19% short CAD

👥 Retail Sentiment

87% of retail traders are short (contrarian signal = bullish)

📈 Technical Setup

Breakout + retest of descending trendline and resistance = bullish continuation setup

🔍 Technical Analysis Summary

✅ Trend & Price Action

The pair broke out of a descending trendline, indicating a shift from a short-term downtrend to a potential uptrend.

📊 Key Levels

1. Resistance / Take Profit (TP) Target Zone:

Around 1.61500 – 1.62000

Marked in red as the TP TARGET, this is a supply zone.

The market may face selling pressure at this point.

2. Current Price Levels:

Price is trading around 1.6088, slightly below the local resistance at 1.6108.

3. Support / Buy Zone:

Between 1.60701 – 1.60884

This zone has previously acted as resistance and may now serve as support, aligning with the breakout retest.

4. Lower Support Levels:

1.59218 and 1.58883 are marked as potential deeper support if the breakout fails.

📈 Indicators and Patterns

Trendline Breakout: The descending black trendline has been broken, suggesting bullish momentum.

Pivot Levels (R1, R2, S1, etc.) are overlaid, providing additional confirmation of key support/resistance zones.

---

📌 Trading Plan (as per the chart)

Bullish Bias: The breakout and retest imply a long entry from the BUY ZONE (1.607 – 1.6088).

TP Target: Around 1.615 – 1.620

Invalidation Level: A break below 1.6070, or especially below 1.5921, may invalidate the setup and turn bias bearish.

📊 COT Data Analysis

EUR (Euro):

Long Positions: 66.9%

Short Positions: 33.1%

Δ Weekly: -1.11% (net longs reduced slightly)

🔎 Interpretation:

Institutions are still heavily long on the Euro, showing confidence in its strength.

However, there's a slight weekly decrease, possibly a bit of profit-taking or caution ahead of upcoming data.

---

CAD (Canadian Dollar):

Long Positions: 19.81%

Short Positions: 80.19%

Δ Weekly: +1.22% (shorts increased further)

🔎 Interpretation:

Institutions are extremely bearish on the Canadian Dollar.

The increase in short positions shows growing conviction that CAD will weaken.

🧮 Institutional Bias:

Bullish on EUR/CAD: Institutions are net long EUR and net short CAD, meaning they expect EUR/CAD to rise.

---

👥 Retail Sentiment (EUR/CAD):

Long: 13%

Short: 87%

🔎 Interpretation:

Retail traders are massively short on EUR/CAD.

This is a contrarian signal: retail traders are often on the wrong side of the market.

Smart money likely sees upside if retail is heavily short.

📌 Conclusion

All signals — COT, retail sentiment, and technical structure — point toward a bullish EUR/CAD outlook.

Institutions are buying EUR and shorting CAD, while retail traders are mostly short, potentially fueling a short squeeze if price rallies. Technically, the breakout and retest also support a bullish trade idea.