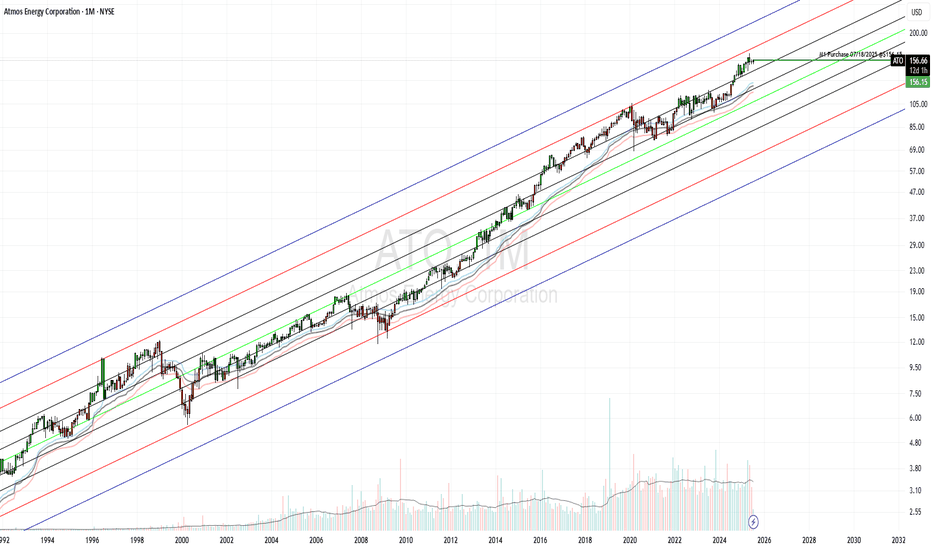

ATO Purchase: Natural GasAtmos Energy is one of the largest fully regulated natural gas utilities in the U.S., serving over 3 million customers across 8 states. It operates in a stable, recession-resistant sector with predictable cash flows and strong regulatory relationships.

$24B Infrastructure Investment Plan through 20

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.20 EUR

936.17 M EUR

3.74 B EUR

159.84 M

About Atmos Energy Corporation

Sector

Industry

CEO

John Kevin Akers

Website

Headquarters

Dallas

Founded

1983

ISIN

US0495601058

FIGI

BBG000J8CB12

Atmos Energy Corp. engages in the provision of natural gas services. It operates through the Distribution and Pipeline and Storage segments. The Distribution segment is involved in regulated natural gas distribution and related sales operations. The Pipeline and Storage segment includes pipeline and storage operations of the Atmos Pipeline-Texas division and natural gas transmission operations. The company was founded in 1983 and is headquartered in Dallas, TX.

Related stocks

ATO: some upside?A price action above 113.00 supports a bullish trend direction.

Increase long exposure for a break above 116.00.

The target price is set at 119.00 (its 78.6% Fibonacci retracement level).

The stop-loss price is set at 111.00 (just above its 38.2% retracement).

An ascending wedge pattern seems to be

ATO: some further upside potential?A price action above 115.50 supports a bullish trend direction.

Further trend support above 117.00.

Consolidation range from 117.00 to 118.50.

Crossing above 118.50 might set the target of 121.50, which is the upper range of the Bollinger Bands.

Crossing below 117.00 will be the first sign of pendin

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ATO.GC

United Cities Gas Co. 6.67% 15-DEC-2025Yield to maturity

—

Maturity date

Dec 15, 2025

ATO4803315

Atmos Energy Corporation 4.125% 15-MAR-2049Yield to maturity

—

Maturity date

Mar 15, 2049

ATO3952982

Atmos Energy Corporation 4.15% 15-JAN-2043Yield to maturity

—

Maturity date

Jan 15, 2043

ATO5263128

Atmos Energy Corporation 2.85% 15-FEB-2052Yield to maturity

—

Maturity date

Feb 15, 2052

ATO.GA

Atmos Energy Corporation 6.75% 15-JUL-2028Yield to maturity

—

Maturity date

Jul 15, 2028

ATO4890350

Atmos Energy Corporation 3.375% 15-SEP-2049Yield to maturity

—

Maturity date

Sep 15, 2049

ATO5483128

Atmos Energy Corporation 5.75% 15-OCT-2052Yield to maturity

—

Maturity date

Oct 15, 2052

ATO4172087

Atmos Energy Corporation 4.125% 15-OCT-2044Yield to maturity

—

Maturity date

Oct 15, 2044

ATO6102067

Atmos Energy Corporation 5.2% 15-AUG-2035Yield to maturity

—

Maturity date

Aug 15, 2035

ATO5483126

Atmos Energy Corporation 5.45% 15-OCT-2032Yield to maturity

—

Maturity date

Oct 15, 2032

ATO4890349

Atmos Energy Corporation 2.625% 15-SEP-2029Yield to maturity

—

Maturity date

Sep 15, 2029

See all AEO bonds

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange Atmos Energy Corporation stocks are traded under the ticker AEO.

We've gathered analysts' opinions on Atmos Energy Corporation future price: according to them, AEO price has a max estimate of 156.82 EUR and a min estimate of 131.83 EUR. Watch AEO chart and read a more detailed Atmos Energy Corporation stock forecast: see what analysts think of Atmos Energy Corporation and suggest that you do with its stocks.

Yes, you can track Atmos Energy Corporation financials in yearly and quarterly reports right on TradingView.

Atmos Energy Corporation is going to release the next earnings report on Nov 5, 2025. Keep track of upcoming events with our Earnings Calendar.

AEO earnings for the last quarter are 0.98 EUR per share, whereas the estimation was 0.97 EUR resulting in a 1.72% surprise. The estimated earnings for the next quarter are 0.80 EUR per share. See more details about Atmos Energy Corporation earnings.

Atmos Energy Corporation revenue for the last quarter amounts to 712.04 M EUR, despite the estimated figure of 697.92 M EUR. In the next quarter, revenue is expected to reach 581.72 M EUR.

AEO net income for the last quarter is 158.19 M EUR, while the quarter before that showed 448.61 M EUR of net income which accounts for −64.74% change. Track more Atmos Energy Corporation financial stats to get the full picture.

Yes, AEO dividends are paid quarterly. The last dividend per share was 0.75 EUR. As of today, Dividend Yield (TTM)% is 2.12%. Tracking Atmos Energy Corporation dividends might help you take more informed decisions.

Atmos Energy Corporation dividend yield was 2.32% in 2024, and payout ratio reached 47.16%. The year before the numbers were 2.79% and 48.53% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Sep 9, 2025, the company has 5.26 K employees. See our rating of the largest employees — is Atmos Energy Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Atmos Energy Corporation EBITDA is 1.91 B EUR, and current EBITDA margin is 48.63%. See more stats in Atmos Energy Corporation financial statements.

Like other stocks, AEO shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Atmos Energy Corporation stock right from TradingView charts — choose your broker and connect to your account.