AMZN Options Flow Explodes! $230 Call Trade Idea”

# 🚀 AMZN Weekly Options Trade Idea (2025-09-03)

### 📊 Market Recap

* **Daily RSI**: 47.9 ⬇️ (bearish tilt)

* **Weekly RSI**: 57.1 ⬇️ (losing momentum)

* **Volume**: 0.9x 📉 (weak vs prior week)

* **Options Flow**: 💎 Strongly bullish (C/P = 3.30)

* **VIX**: ✅ Favorable (16–17)

👉 **Models Split:**

* 🐻 DeepSeek → \$225 PUT idea (bearish).

* 🐂 Grok + Llama → \$230 CALL (moderate bullish).

* ⚖️ Gemini + Claude → **NO TRADE** (risk > reward).

---

### ✅ Consensus Trade Setup (Flow-Weighted Lean)

```json

{

"instrument": "AMZN",

"direction": "call",

"strike": 230.0,

"expiry": "2025-09-05",

"entry_price": 0.43,

"profit_target": 0.86,

"stop_loss": 0.26,

"size": 1,

"confidence": 0.62,

"entry_timing": "open"

}

```

---

### 🎯 Trade Plan

* 📌 **Strike**: \$230 CALL (Sep 5)

* 💵 **Entry**: 0.43 (ask @ open)

* 🎯 **Target**: 0.86 (+100%)

* 🛑 **Stop**: 0.26 (–40%)

* ⏰ **Max Hold**: Exit by Thu EOD (avoid Fri gamma risk)

* ⚖️ **Size**: 1 contract (small, <2% equity)

* 📈 **Confidence**: 62% (flow-driven edge, weak technicals)

---

⚠️ **Risks**

* Daily + weekly RSI trending down = 🐻 momentum risk

* Weak institutional volume confirmation 📉

* Heavy call flow could be **retail noise / covered calls** 😬

* 2 DTE → **theta burn + gamma whip risk** ⚡

---

AMZ trade ideas

Economic Risks in Global Trading1. Understanding Economic Risks in Global Trade

Definition

Economic risks are uncertainties related to financial losses or reduced profitability due to changes in economic conditions at domestic or international levels. In global trade, these risks can emerge from:

Exchange rate volatility

Inflationary pressures

Interest rate changes

Economic recessions or booms

Global demand and supply shocks

Balance of payments crises

Why They Matter in Global Trade

Businesses deal with multiple currencies. A sudden depreciation can wipe out profits.

International supply chains make companies vulnerable to inflation and disruptions.

Economic downturns in one region spill over into others, shrinking global demand.

Governments adjust monetary and fiscal policies, impacting trade competitiveness.

Thus, understanding economic risks is crucial for firms and policymakers.

2. Types of Economic Risks in Global Trading

2.1 Currency (Exchange Rate) Risk

One of the most common economic risks is exchange rate volatility. Since global trade is often settled in foreign currencies (primarily US dollars, euros, yen, etc.), fluctuations in exchange rates can directly impact profitability.

Exporter’s perspective: If an Indian company exports goods to the US and invoices in dollars, a sudden appreciation of the rupee against the dollar means it will receive less revenue in rupee terms.

Importer’s perspective: An importer who must pay in foreign currency faces higher costs if their domestic currency depreciates.

Real Example: During the 2013 “Taper Tantrum,” the Indian rupee depreciated sharply against the dollar, increasing import costs for oil and electronics.

2.2 Inflation Risk

Inflation erodes purchasing power and increases the cost of goods. In global trade, high inflation in one country can:

Reduce competitiveness of exports (as goods become more expensive).

Increase import demand (as domestic products lose appeal).

Hurt multinational corporations operating in high-inflation economies.

Case Example: Argentina has faced chronic inflation above 50%, making its exports expensive while discouraging foreign investments.

2.3 Interest Rate Risk

Interest rates affect borrowing costs and investment decisions. Central banks worldwide adjust rates to control inflation or stimulate growth. These changes influence global trade through:

Cost of capital for exporters/importers.

Shifts in currency values (as higher interest rates attract foreign investment).

Reduced consumer demand when borrowing costs rise.

Example: The US Federal Reserve’s aggressive interest rate hikes in 2022 strengthened the dollar, hurting emerging markets by making their debt servicing costlier and exports less competitive.

2.4 Economic Recession and Growth Risk

The health of global economies directly impacts trade volumes.

Recession reduces consumer demand, lowers imports, and shrinks export markets.

Booms stimulate cross-border trade and investment.

Example: The 2008 Global Financial Crisis reduced global trade by nearly 12% in 2009, the steepest drop since World War II.

2.5 Credit and Payment Risk

When businesses trade internationally, they face the risk of buyers defaulting or being unable to make payments due to financial crises, insolvency, or capital controls.

Illustration: During the Asian Financial Crisis (1997–98), many firms in Southeast Asia defaulted on foreign trade payments, causing ripple effects across supply chains.

2.6 Supply Chain and Cost Risk

Global supply chains are highly interconnected. Economic risks can emerge from:

Rising raw material prices.

Freight and shipping cost surges.

Energy price volatility.

Example: The COVID-19 pandemic exposed global supply chain vulnerabilities, with container shortages and freight costs skyrocketing.

2.7 Sovereign and Country Risk

Economic instability at the national level—debt crises, currency collapse, or fiscal mismanagement—can affect international traders.

Example: Sri Lanka’s economic crisis in 2022 led to shortages of foreign reserves, making it difficult to pay for imports like fuel and medicines.

2.8 Commodity Price Risk

For economies dependent on commodity exports (oil, gas, metals, agriculture), global price swings are a major risk.

Oil price collapse in 2014 severely affected Venezuela and Nigeria.

Rising energy costs in 2022 hit European industries heavily.

2.9 Balance of Payments Risk

Persistent trade deficits or current account imbalances can weaken a country’s currency and erode investor confidence, impacting trade flows.

3. Causes of Economic Risks in Global Trading

3.1 Globalization and Interconnectedness

While globalization boosts trade, it also spreads risks faster. A crisis in one region (like the US housing bubble in 2008) quickly spreads worldwide.

3.2 Policy and Regulatory Shifts

Changes in monetary policy, tariffs, or trade agreements alter the economic landscape for businesses.

3.3 Geopolitical Tensions

Wars, sanctions, and political instability cause economic disruptions, particularly in energy and commodity markets.

3.4 Market Speculation and Volatility

Speculative trading in currencies, commodities, and financial markets often amplifies price swings, creating instability.

3.5 Structural Economic Weaknesses

Countries with high debt, low reserves, or over-dependence on certain exports face greater economic risks.

4. Impacts of Economic Risks on Global Trade

4.1 On Businesses

Reduced profitability due to currency fluctuations.

Uncertainty in pricing and contracts.

Delays or losses in payments.

Higher operational costs.

4.2 On Governments

Pressure on foreign exchange reserves.

Difficulty in managing inflation and debt.

Social unrest if trade disruptions cause shortages of essential goods.

4.3 On Consumers

Higher prices for imported goods.

Limited availability of products during crises.

Reduced employment opportunities due to business slowdowns.

4.4 On Global Financial Markets

Capital flight from emerging markets during crises.

Sharp fluctuations in stock and bond markets.

Increased demand for safe-haven assets like gold and US treasuries.

5. Real-World Case Studies

Case 1: Global Financial Crisis (2008)

Triggered by the US housing bubble and banking collapse, this crisis spread worldwide, reducing trade volumes drastically. Export-driven economies like China, Germany, and Japan faced sharp slowdowns.

Case 2: COVID-19 Pandemic (2020–21)

Lockdowns disrupted supply chains, consumer demand collapsed, and global trade volumes shrank by 5.3% in 2020. At the same time, inflation surged due to supply shortages.

Case 3: Russia-Ukraine War (2022)

The war caused energy prices to surge, disrupted wheat exports, and increased global inflation, hurting import-dependent nations.

6. Strategies to Manage Economic Risks

6.1 Currency Risk Management

Hedging using futures, options, and swaps.

Invoicing in domestic currency.

Natural hedging (matching revenues and costs in the same currency).

6.2 Inflation and Interest Rate Risk Control

Diversifying sourcing and supply chains.

Adjusting pricing strategies.

Accessing low-cost financing in stable economies.

6.3 Credit Risk Mitigation

Using letters of credit and export credit insurance.

Conducting due diligence on trade partners.

6.4 Supply Chain Risk Management

Building multiple supplier networks.

Holding strategic inventories.

Using digital tools for supply chain monitoring.

6.5 Government and Policy Measures

Creating trade stabilization funds.

Maintaining adequate foreign exchange reserves.

Negotiating bilateral/multilateral trade agreements.

7. The Future of Economic Risks in Global Trade

Looking ahead, the nature of risks will evolve with changing global dynamics:

De-globalization trends (reshoring, regional supply chains).

Digital currencies and blockchain reducing some payment risks but creating new ones.

Climate change influencing commodity prices and trade routes.

AI-driven markets adding volatility but also improving risk prediction.

Conclusion

Economic risks are an unavoidable part of global trading. While they pose significant challenges—currency volatility, inflation, recessions, commodity shocks—they also encourage innovation in risk management and financial instruments. Businesses and governments that anticipate, adapt, and diversify are better equipped to navigate the turbulent waters of international trade.

Global trade thrives on opportunities but survives on resilience. By recognizing economic risks and building robust strategies, the world economy can continue to benefit from interconnectedness while minimizing vulnerabilities.

Catch the Short on AmazonHello I am the Cafe Trader.

Today we are again looking at AMZN.

We are in the middle of a range. Buyers are currently in control in the short term, but I am expecting a Hot reaction off that strong supply level. This can be especially suitable for a quick options flip (same day, or overnight hold).

Short Setup

Entry: $231.30 (Bottom of Strong Supply)

Stop: $234.50 (Top of Strong Supply)

TP: $225.30 (2R target)

Notes: Looking for a hard rejection out of supply. If we do not close inside the strong supply zone, this would be bearish. you may have to be patient intraday on this one.

If we do get a really strong reaction and actually take out the new buyers trying to step in, This will not look good for AMZN as a whole, and we could expect it to break those previous lows (eventually tapping into strong supply)

Hope everyone does well, and happy trading!

@thecafetrader

$AMZN — Triangle WatchNASDAQ:AMZN — Triangle Watch

Price is tightening on the right side of a base:

– Symmetrical triangle forming

– Holding above 50d & 200d MAs

– Breakout attempt faded (not ready yet)

– Volume light during coil, constructive

Still holding w/ trailing stop. Watching $234–236 for breakout confirmation on strong volume.

#SwingTrading #TechnicalAnalysis

AMZN Swing Trade Setup | $235C Targeting 100%+ This Week# 🔥 AMZN Weekly Options Setup (Aug 29 Expiry) 🚀📈

📊 **Consensus from Multi-Model Analysis**

* ✅ Daily RSI rising (Bullish)

* ⚖️ Weekly RSI falling (Neutral)

* 🏦 Institutional Flow: **Strong Call Skew (C/P 3.61)**

* 📉 Volume: Contracting (risk flag)

* 📉 VIX: Low → Favors Call Buying

---

## 📌 Trade Setup

🎯 **Instrument**: AMZN Weekly Call

💵 **Strike**: \$235

📅 **Expiry**: 2025-08-29

💰 **Entry**: \$0.82 (open)

🛑 **Stop Loss**: \$0.41 (-50%)

🎯 **Target 1**: \$1.07 (+30%)

🎯 **Target 2**: \$1.64 (+100%)

📏 **Size**: 1 Contract (risk ≤3%)

⏰ **Hold Window**: Mon → Thu (Exit before Friday Gamma)

📈 **Confidence**: 66%

---

## 🚨 Key Risks

⚠️ Low weekly volume = weak follow-through risk

⚠️ Theta burn accelerates after Wed → exit by Thu

⚠️ VIX spike (>18) = invalidate setup

---

## 🧾 Quick Trade Card

* **Bias**: Moderate Weekly Bullish

* **Edge**: Institutional call flow + Daily RSI momentum

* **Caveat**: Weak weekly volume, fading RSI

---

### 🚀 Viral Hashtags

\#AMZN #OptionsTrading #SwingTrade #UnusualOptionsActivity #StocksToWatch #TradingSetup

Amazon Chart CheckOn the weekly chart, Amazon looks like it’s starting to tire a bit. Price is struggling just under that January high near 24,252.

Looking at the Ichimoku Cloud:

• In mid-2023, price broke strongly above the cloud and bounced cleanly higher after retests.

• More recently (spring 2025), we had a decent correction but bounced again.

• Now, instead of bouncing hard, price is just sitting on top of the cloud — feels weaker than before.

On the daily chart:

• The 200-day moving average has been a line in the sand since May. Several successful tests and bounces.

• Currently, price is hugging the daily cloud.

• If we see erosion near 219–220(top of the cloud), a quick dip back to the 200-day MA (~21,280) is very possible.

• A close below that could signal a potential top forming.

⚠️ For me, this uptrend feels a little tired — worth keeping an eye on and possibly tightening stops if you’re in the trade.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

$AMZN Bear Case Study... NASDAQ:AMZN BEAR CASE THREAD 🧵

Amazon's weekly chart reveals a critical technical breakdown. After failing to sustain momentum above key resistance at $223, price is now forming what appears to be a double top pattern.

The downtrend line from recent highs is firmly intact with accelerating downside momentum on multiple timeframes. RSI showing weakness without reaching overbought territory - bearish divergence forming.

With parabolic SAR now flipped bearish on the 4H chart and stochastic signaling overbought conditions, downside targets include $215 and potentially $200 if selling intensifies.

Earnings optimism priced in, but macro headwinds mounting. Position accordingly. #Bearish #technicalanalysis

Amazon (AMZN) Approaches Cycle Peak Post-August 2025 LowAmazon (AMZN) continues its cycle from the August 2025 low, unfolding as a five-wave impulse in the Elliott Wave framework. From that low, wave (i) peaked at $216.30, followed by a shallow pullback in wave (ii) to $213.25. The stock then surged in wave (iii) to $222.75, with a brief dip in wave (iv) concluding at $220.71. The final leg, wave (v), reached $226.22, completing wave ((i)) in a higher degree. A correction in wave ((ii)) followed, bottoming at $219.05.

After this pullback, the stock resumed its ascent in wave ((iii)). Wave (i) of this sequence hit $222.43, with wave (ii) retracing to $221.07. A strong advance in wave (iii) pushed the price to $233.11, followed by a dip in wave (iv) to $230.10. The final wave (v) concluded at $234.08, marking the end of wave ((iii)). Currently, wave ((iv)) is unfolding as a zigzag Elliott Wave structure. From the wave ((iii)) peak, wave (a) declined to $228.33, and wave (b) rallied to $231.91. Wave (c) of ((iv)) is expected to drive prices lower, targeting the extreme zone of $222.57–$226.14, based on the 100%–161.8% Fibonacci extension of wave (a). As long as the pivot low at $211.42 holds, the pullback should find support in a 3, 7, or 11 swing, setting the stage for further upside. This analysis highlights Amazon’s structured ascent and near-term corrective potential.

potential pullback predicted due to one sided uptrend = BUY preface :

- I can see just as anyone else that we are angled upward ,

as per both LRC's here. regardless there are some points to note

1. smooth flow with a transition of power without much imbalance,

favoring the buyers

2. gap down, then all the way back up to 2

3. a lack of structure to 4, apposed to the smooth flow from 1-2,

could this simply be profit taking by the sellers at two, offloading

their orders to anyone and everyone causing massive spikes back to 4?

4. almost 3 touches of the resistance , wary buyers as per the

analysis of earning caused a dump, unless something changed?

what do I think will happen ?

* between 3-4 we have an unusually strong volitile one sided move,

normally these are followed by a smooth trend the opposing direction,

I could envision price coming back down to 3, or maybe at least 3-4

midpoint. it is taking too much libery to even hint at a turnaround ,

a pullback on the other hand.... possible, especially with this volitlity.

* RSI , MFI and Accumulation distribution all have hidden divergence,

as well as all being oversold, I dont care much about oversold, during

high volitility movements the overbought and sold are pretty much useless,

* over the past 2,500 bars, if price closes below a zone, we have a 67%

chance it follows through to the other end , you can manually verify

by reducing the lookback period. these are great odds!

AMZN Losing Momentum? Put Flow on the Table

# 🛒 AMZN Weekly Options Setup (8/18 – 8/22)

📉 **Consensus: Neutral → Cautious Bearish**

* 🔻 RSI trending down (daily + weekly)

* 📉 Weak volume = no strong institutional conviction

* ⚖️ 4/5 AI models → **NO TRADE**

* 🐻 Only **DeepSeek** calls for puts → bearish divergence

---

## 🎯 Trade Setup (Aggressive Play)

* **Instrument**: AMZN

* **Direction**: PUT (SHORT)

* **Strike**: \$225.00

* **Expiry**: 2025-08-22

* **Entry**: \$0.82

* **Profit Target**: \$0.98 (scalp style)

* **Stop Loss**: \$0.50

* **Confidence**: 65% (only because DeepSeek flagged momentum divergence)

* **Timing**: Enter at open → monitor closely (don’t baghold into Friday ⚠️).

---

## 📈 Breakeven @ Expiry

👉 \$224.18 (Strike – Premium)

AMZN must **close < \$224.18 by 8/22** to finish ITM.

But plan = **exit early on IV / momentum pop**, not expiry hold.

---

## 🧠 Key Risks

* Theta burn 🔥 (short expiry puts bleed fast)

* Market news swings (AMZN often reacts to macro headlines)

* Lack of volume → potential for chop instead of follow-through

---

# ⚡ AMZN 225P WEEKLY PLAY ⚡

🎯 In: \$0.82 → Out: \$0.98

🛑 Stop: \$0.50

📅 Exp: 8/22

📈 Bias: Weak, but playing the downside momentum divergence 📉

AMZN: Bullish Technical Setup Points to $240 TargetCurrent Price: $231.03

Direction: LONG

Targets:

- T1 = $236.50

- T2 = $240.00

Stop Levels:

- S1 = $228.00

- S2 = $225.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to pinpoint high-probability trade opportunities in AMZN. The wisdom of crowds principle suggests that consolidating expert knowledge can highlight actionable patterns with reduced biases.

**Key Insights:**

AMZN is currently demonstrating strong bullish momentum following a breakout above its 50-day moving average. Traders have noted robust demand in AMZN tied to the company’s dominance in e-commerce as well as accelerating growth in its Amazon Web Services (AWS) division. This technical breakout aligns with a period of relative strength in tech stocks overall, making AMZN well-positioned to push higher in the near term.

Another standout factor supporting bullish sentiment is institutional buying activity, which appears to have significantly increased alongside positive earnings expectations. Analysts point to AMZN’s ability to outperform across its business segments during macroeconomic uncertainties. Furthermore, volume profiles indicate that rising accumulation is taking place, reflecting growing confidence among professional investors.

**Recent Performance:**

In the last two weeks, AMZN has climbed approximately 4%, moving from the $221 range to its current price of $231.03. The stock has successfully achieved a higher high after bouncing from key support levels near $220. Additionally, relative strength index (RSI) metrics suggest AMZN remains in bullish territory, with no overbought signals at the current stage. This price action indicates continuing upward momentum backed by solid fundamentals.

**Expert Analysis:**

Technical analysts stress that sustaining prices above $230 represents a significant psychological threshold for AMZN to take aim at $236 and $240 levels. The moving average convergence divergence (MACD) indicator has turned positive, signaling momentum reinforcement. Moreover, Bollinger Bands suggest room for wider upward price moves, as AMZN has remained on the upper side of volatility thresholds but far from breakout extremes.

On the fundamental side, industry experts remain optimistic about AMZN’s ability to drive growth, particularly as AWS continues to expand its customer base across lucrative cloud segments. Revenue forecasts show resilience despite wider market concerns, further bolstering bullish sentiment around the equity.

**News Impact:**

Recent news about AMZN’s push to revolutionize supply chain efficiencies with AI-driven technology has injected optimism into the stock’s outlook. Additionally, improved operational strategies in key international markets have supported confidence in future profitability. Attention around these developments is drawing positive sentiment from institutional investors, further strengthening AMZN's near-term trajectory.

**Trading Recommendation:**

AMZN offers a compelling LONG opportunity at these levels, supported by technical and fundamental evidence. The stock is well-positioned to rally towards its next resistance level of $236.50, while the upside could extend to $240.00 under favorable conditions. Stop placements at $228 and $225 provide ample risk control to safeguard against reversal scenarios. Traders should remain watchful of external events that could impact overall tech sentiment but capitalize on AMZN’s bullish structure.

Do you want to save hours every week?

Amazon.com Inc. (AMZN) – Bullish SetupAMZN closed at $231.03 and is showing strength after bouncing from the support zone around $207 – $213. The weekly chart indicates buyers are regaining control, supported by increasing volume and positive momentum indicators.

🎯 Targets:

• First target: $243

• Second target: $260

Stop-loss: Weekly close below $213.

The 3 Step Rocket Booster "Once you master this strategy ..."When you watch this video i want you to think of the

the 3 step rocket booster strategy.

Once you master this strategy then it will

be easy for you understand the other indicators

and how they work.

This video is very very advanced and i dont expect you to understand

unless you are a trading expert.

But the point am trying to make to you

is that everything is connected.

Even understanding one strategy is better than

understanding not even one.

understanding one strategy is the building block.

So in this video am taking you through

the building blocks of trading.

My strategy is very advanced but i want to show you

that even in this advanced strategy

the Rocket booster strategy

is a building block.

So watch this video to learn more now.

Rocket boost this content to learn more.

Disclaimer:Trading is risky please learn risk management and profit taking strategies also feel

free to use a simulation trading account

before you trade with real money.

AMZN - LONG Swing Entry PlanNASDAQ:AMZN - LONG Swing Entry Plan

Entry Zone 1: $220.00 – $217.00

→ Open initial position targeting +8% from entry level.

Entry Zone 2: $212.00 – $209.00

→ If price dips further, average down with a second equal-sized entry.

→ New target becomes +8% from the average of Entry 1 and Entry 2.

Edit Zone : $192.00 – $190.00

→ If reached, enter with double the initial size to lower the overall cost basis.

→ Profit target remains +8% from the new average across all three entries.

Risk Management:

Stop Loss:

Risk is capped at 12% below the average entry price (calculated across all executed positions including the Edit Zone).

Position Sizing Approach:

Entry 1: 1x

Entry 2: 1x

Edit Zone: 2x

→ Total exposure: 4x

→ Weighted average determines final TP and SL calculations.

______________________________________

Legal Disclaimer

The information provided in this content is intended for educational and informational purposes only and does not constitute financial, investment, or legal advice or recommendations of any kind. The provider of this content assumes no legal or financial responsibility for any investment decisions made based on this information. Users are strongly advised to conduct their own due diligence and consult with licensed financial advisors before making any financial or investment decisions.

Sharia Compliance Disclaimer: The provider makes no guarantees that the stocks or financial instruments mentioned herein comply with Islamic (Sharia) principles. It is the user’s responsibility to verify Sharia compliance, and consultation with a qualified Sharia advisor is strongly recommended before making any investment decisions

Don’t Miss: AMZN Call Opportunity at $242.50! 🚀 AMZN Swing Alert – 2025-08-15 🚀

**Sentiment:** Moderate Bullish

**Setup:** Call Option Trade

---

## 📈 Market Snapshot

* **Daily RSI:** 61.5 → Strong bullish momentum

* **5 & 10-Day Trend:** +3.68% / +7.52% → Confirmed upside

* **Volume:** Avg (1.0x) → Lacks strong institutional confirmation

* **Call/Put Ratio:** 1.00 → Neutral sentiment

* **VIX:** 14.84 → Low volatility, ideal for controlled swings

---

## ⚖️ Consensus & Conflicts

**Agreement:**

* Bullish momentum recognized across multiple models

* Favorable market conditions for swings

* Weak volume highlighted as a risk

**Disagreement:**

* Some models (Claude/Anthropic) advise caution, suggesting no immediate trade

* Confidence varies: DeepSeek favors a stronger bullish call, others remain cautious

---

## 🎯 Trade Setup – AMZN CALL

**Entry Condition:** At market open

**Strike:** \$242.50

**Expiration:** 2025-08-29

**Entry Price:** \$0.85

**Confidence:** 75%

**Profit Target:** \$2.13 (150% gain)

**Stop Loss:** \$0.50 (30% of premium)

**Key Risks:**

* Weak volume may reduce momentum sustainability

* Market shifts require active monitoring

---

## 📝 TRADE DETAILS (JSON)

```json

{

"instrument": "AMZN",

"direction": "call",

"strike": 242.5,

"expiry": "2025-08-29",

"confidence": 0.75,

"profit_target": 2.13,

"stop_loss": 0.50,

"size": 1,

"entry_price": 0.85,

"entry_timing": "open",

"signal_publish_time": "2025-08-15 11:56:23 UTC-04:00"

}

```

---

## 📊 Quick Reference – TradingView Ready

🎯 **Instrument:** AMZN

🔀 **Direction:** CALL (Long)

💵 **Entry Price:** \$0.85

📈 **Profit Target:** \$2.13

🛑 **Stop Loss:** \$0.50

📅 **Expiry:** 2025-08-29

📏 **Size:** 1 contract

⏰ **Entry Timing:** Market Open

🕒 **Signal Time:** 2025-08-15 11:56 EDT

---

### Suggested Viral Title & Tags:

**🔥 AMZN Swing Alert: Call Setup Ready – Strike \$242.50 🚀**

\#AMZN #SwingTrade #OptionsTrading #Bullish #CallOption #Momentum #TradeSetup #TechnicalAnalysis #StockAlerts #Finance #TradingSignals #MarketWatch #LongTrade

AMZN's Path towards 240AMZN: Primed for a Rebound? 🚀 Bullish Signals Emerging!

•Pivotal Support Holding Firm: The price has found robust demand around the 215 support zone 🟢, a critical area that has demonstrated its strength in halting previous declines. This level is proving to be a formidable floor, absorbing selling pressure and hinting at buyer conviction.

•Developing Bullish Reversal Pattern: A clear bullish reversal pattern, resembling an inverse head and shoulders or a W-bottom, appears to be unfolding. This formation, characterized by successive higher lows, signals a significant shift from bearish to bullish sentiment.

•Key Bullish Confirmation Point: For an accelerated move higher, a decisive and sustained break above the 226 level ⬆️ is crucial. This price point represents a significant resistance flip, and a push beyond it would likely trigger further buying momentum, confirming the bullish bias.

•Eyes on the Upside Target: Should AMZN successfully break past the 226 confirmation level, the immediate upside target is projected towards the 240 resistance zone 🎯. This area represents a key supply zone from earlier price action, and reaching it would mark a substantial recovery.

Disclaimer:

The information provided in this chart is for educational and informational purposes only and should not be considered as investment advice. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. The creator of this chart does not guarantee any specific outcome or profit and is not responsible for any losses incurred as a result of using this information. Past performance is not indicative of future results. Use this information at your own risk. This chart has been created for my own improvement in Trading and Investment Analysis. Please do your own analysis before any investments.

AMZN - Amazon Hit The 80% profit Target. Trend change ahead?On this chart we have 2 forks.

Orange: the pullback fork

It shows us where the equilibrium is — at the centerline, which the market respected to the tick (1).

After that, there were several bars that formed support (2).

When the CIB line was broken (3), the market gapped above the orange centerline and made its way up to the white centerline (5), the target that we can expect in around 80% of all cases.

Note the confluence point where the centerline of the white fork and the upper median line parallel (U-MLH) of the orange fork meet.

A day later, we saw a sharp sell-off within just one bar! Is this now another trend reversal?

No, clearly not.

For a trend reversal to occur, the market would have to break the white L-MLH (lower median line parallel). As long as the market is trading within the white fork, we remain long.

I’ll make a YT video soon, covering the details.

Wishing you all a successful new trading week.

Buy Low , Sell High MythOn hindsight, it is easier to say , sell high and buy low since you can see the price movments happening already! On a day to day basis, it is much harder as the price patterns are evolving...

Plus the media would do what it is supposed to do - create sensational headlines to capture your readership and the more bloody or negative the better ! And many retail investors tend to freak out when reading these news and sell their shares. The challenge is they may not be so lucky to capture it at the bottom price and weeks or months later, they decide to enter the market because it is hot again, many people are talking about it, analysts recommendations, etc

The one thing I have learnt throughout the years is sitting tight and doing nothing. It is really difficult at times when you see your profits evaporated or dwindled from say , 25% to 3% and you were thinking to yourself - I should have sold some earlier and took some profits............

Maybe you were busy, lazy or forget about it, after some time when you look back, the market has rewarded you with your patience. Profits start to climb up and things are looking good again. Then it happens again much like the valleys in the chart, up and down , up and down........

On a 10-20 years basis, a fundamentally good stock will be on its upward trajectory and delivers solid capital gains to those who believe in its growth story and willing to ride the short term roller coaster ride and emerge as winners much later........

AMZN Breaking Out of Golden Fib Zone–Next Stop $243 or Pullback?📊 Market Breakdown

AMZN is trading at $222.69, having just broken out of the Golden Fib Zone ($211–$224) after bouncing off the equilibrium (~$206). The breakout puts price on track to test the Premium/Supply Zone ($242.88), but RSI at 56 shows there’s still gas left before hitting overbought territory.

Trend: Strong recovery rally from $161 lows, now riding an ascending channel.

Key Structure: Fib 0.786 retracement level ($224) now being tested; a clean hold here is bullish.

Volume: Breakout volume modest, meaning we still need confirmation from buyers.

Indicators:

MACD: Bullish crossover intact.

RSI: 56.36 – mid-range, plenty of upside potential.

🛒 CALLS (Bullish Scenario)

Buy Zones:

🎯 Aggressive Entry: Retest of $218–$220 support (Fib 0.786 area)

✅ Confirmation Entry: Daily close above $224 with increased volume

Take Profits:

1️⃣ $230 – Minor resistance

2️⃣ $242 – Premium/Supply Zone top

3️⃣ $250 – Channel extension target

Stop-Loss: $216

Why This Works: Holding above the Golden Fib Zone opens the path to supply at $242+ within 2–3 weeks.

🛑 PUTS (Bearish Scenario)

Sell Zones:

🚨 Aggressive Entry: Rejection at $224 resistance

📉 Breakdown Entry: Daily close below $216

Take Profits:

1️⃣ $206 – Equilibrium zone

2️⃣ $190 – Mid-channel support

3️⃣ $161 – Discount/Demand Zone

Stop-Loss: $227

Why This Works: A failed breakout with a close below $216 flips short-term momentum bearish, targeting $206 and possibly $190 in 1–2 weeks.

🔍 Technical Highlights

Golden Fib Zone: Price broke above but needs a retest hold for confirmation.

Supply Zone Test Ahead: $242 is a strong resistance area.

Macro Watch: AMZN often follows consumer spending & retail sales data; keep an eye on macro news.

⏳ Option Expiration Strategy:

1 Week: Rejection at $224 for quick puts

2–3 Weeks: Breakout holding $224 for calls toward $242

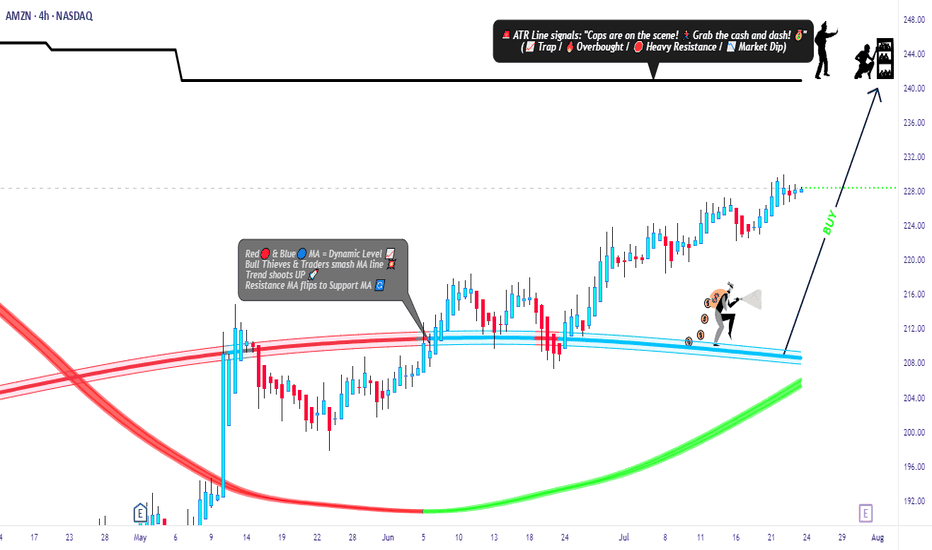

Amazon Market Robbery Blueprint – Swing/Scalp Long Setup🟨💣 “AMZN Market Heist Blueprint – Bullish Robbery in Progress 🚨💼💸” 💣🟨

By Thief Trader – Rob the Market with Precision

🌍 Hello World! Hi, Hola, Ola, Bonjour, Hallo, Marhaba!

🤑💰 Calling all Money Makers & Market Robbers – get ready to execute the next bullish heist on AMAZON.COM, INC (NASDAQ: AMZN), powered by our signature Thief Trading Style™ – where technical precision meets psychological warfare.

🔥 Plan Summary:

Based on our fundamental & technical intel, we’re eyeing a long entry into AMZN. The target? 💥The High-Risk ATR Police Barricade Zone – a zone flooded with liquidity, overbought conditions, fakeouts, and bear traps. It's where most traders get caught – but we walk in with a blueprint.

🟩 Entry Zone – “The Vault Is Wide Open!” 💼📈

🕰 Entry timeframe: 15min / 30min (preferably after confirmation or rejection wick)

💵 Buy Limit Orders: Place multiple layered entries (DCA-style) near recent swing lows/highs. Wait for breakout confirmation; no blind orders before breakout!

Thief Note: This isn’t spray-and-pray – this is sniper-mode. Scope, place, execute.🎯

🛑 Stop Loss – “SL is the Escape Route!”

📍 SL below recent 4H candle wick swing low (around 219.00 – adjust based on your risk/margin size).

Important: Only place SL after breakout; not before. Risk per order must match your lot strategy.

🎯 Target – “Grab the Bag or Escape Before the Alarms!”

💸 Target Zone: 240.00

🧠 Smart robbers know when to bail early – use a trailing SL to lock gains. Exit before reversal or heavy volume shift.

👀 Scalper Alert – “Only One Way – LONG!”

If you’re a quick thief with a fat bag, hit-and-run with a Long scalp. If you’re running lean, swing with the crew. Watch the PA and news timing. Trailing SL = insurance policy.

📊 Why Bullish? Here’s the Background:

🔍 Macro Drivers

💼 COT Report

🌍 Geo-political Influences

🧠 Sentiment Score

📈 Index Correlation

🔮 Intermarket Signals

💹 Institutional Positioning

All lights flashing green for short-to-midterm bullishness, but keep checking real-time updates.

⚠️ Risk Alert – News Triggers Can Blow Your Cover 🚨

🗞 Avoid trading near major news releases – they cause volatility spikes.

🧲 Always protect gains with trailing stops and don’t over-leverage your ammo.

💖 Support the Robbery – Hit BOOST 🔥

Smash that 💥BOOST💥 button if you ride with the Thief Trading Crew!

Let’s build this into the #1 robbery squad on TradingView.

Make money. Protect profits. Trade like a bandit – with a plan. 💼📈🏆

🔔 Stay Tuned for the Next Robbery Mission 🔔

Another heist plan dropping soon. Until then, rob smart, rob safe, and rob rich.

– Thief Trader™ | Rob The Market. Not Your Wallet.