EUR/AUD: Bearish Trend ContinuesThe 📉EURAUD pair is currently experiencing a prolonged bearish trend.

A significant daily support cluster was violated yesterday, and the formation of a new lower low and lower close indicates considerable selling pressure.

The price is showing a steady recovery today, retesting the previously br

Euro / Australian Dollar

No trades

About Euro / Australian Dollar

The Euro vs. the Australian Dollar. This pair is considered to be a great barometer for global risk. In 2012, during the European sovereign debt crisis the EURAUD reached its low. Since then, due to the European Central Bank’s policy of Outright Monetary Transactions (OTM or the “whatever it takes” measure ) the pair has recovered substantially.

Related currencies

EURAUD Signal : H2 / H4 : Big Long !!!

Hello Traders! 👋

What are your thoughts on EURAUD ?

This correction could offer a buy-the-dip opportunity, with potential for a move back toward the recent highs.

EURAUD H2 / H4

Market price : 1.6840

Buy limit : 1.6800 - 1.6700

Tp1 : 1.7000

Tp2 : 1.7200

Tp3 : 1.7450

Tp4 : 1.7800

Sl : 1.65

EURAUD: Recovery Toward 1.7000?EURAUD: Recovery Toward 1.7000?

EURAUD has completed a strong corrective leg to the downside, respecting a clean descending structure before printing a sharp reaction from the lower boundary of the structure zone.

Price tapped into trendline support and immediately delivered an impulsive bullish

EURAUD Sitting on Major Demand: Base FormingEURAUD has been in a steady grind lower, and now it’s parked right on a higher-timeframe demand zone after a series of sharp impulsive drops and weak corrective bounces. This is the kind of location where reversals can start — but only if structure actually shifts. Right now, I see pressure slowing,

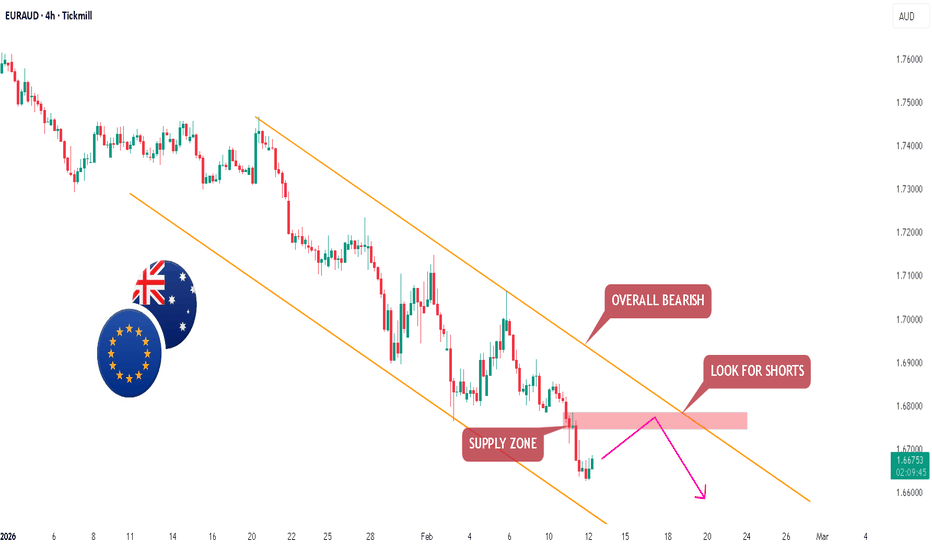

EUR/AUD - Selling the Supply Zone Inside the Falling ChannelHello Traders! 👋

What are your thoughts on EURAUD?

Price is in a clear downtrend inside a descending channel, so bias is bearish.

The marked pink “supply zone” is a previous area of selling; idea is to wait for price to retrace up into that zone near the channel top, then look for short entries a

EURAUD daily to keep selling into demand floor EURAUD on daily to keep selling into demand floor .

demand floor on technical will be 1.6602-1.65584

demand floor on technical will be 1.59711-1.60124

the bond yield and the interest rate differential favor AUD shot.

but market structure on 1.6602-1.65584 zone will be watched from 15min/3min time fr

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of EURAUD is 1.67648 AUD — it has decreased by −0.23% in the past 24 hours. See more of EURAUD rate dynamics on the detailed chart.

The value of the EURAUD pair is quoted as 1 EUR per x AUD. For example, if the pair is trading at 1.50, it means it takes 1.5 AUD to buy 1 EUR.

The term volatility describes the risk related to the changes in an asset's value. EURAUD has the volatility rating of 0.36%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The EURAUD showed a −0.52% fall over the past week, the month change is a −3.43% fall, and over the last year it has increased by 1.47%. Track live rate changes on the EURAUD chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

EURAUD is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade EURAUD right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with EURAUD technical analysis. The technical rating for the pair is sell today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the EURAUD shows the sell signal, and 1 month rating is sell. See more of EURAUD technicals for a more comprehensive analysis.