Nikkei 225 Retreats From Record HighNikkei 225 Retreats From Record High

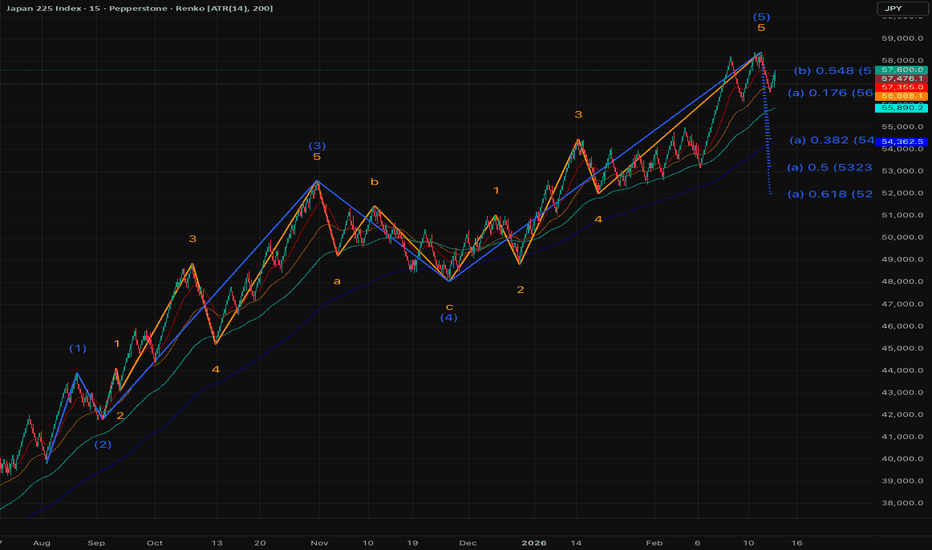

As the chart shows, the Nikkei 225 index reached a historic high near 58,500 points on Monday. Bullish sentiment was driven primarily by political developments.

According to media reports, the rally followed the decisive victory of the Liberal Democratic Party

Japan 225 Index

No trades

Related indices

Japan 225 Index🔑 Key Levels

Resistance (Short Zone): Channel top / current highs

Target: 54,000

Invalidation: Daily close above channel resistance

📌 Trade Logic

Short: Favorable risk-reward from channel resistance → target 54,000

Buy: Only valid after pullback and strong bullish reaction at support

If price

Short ZoneBias: Bearish (fade the rally into resistance)

Setup: Pure price-action channel play — no indicators.

Short Entry Zone: Near channel upper boundary / recent highs (around current area after recent peak near 58,000+).

Target: 54,000 (major downside objective, ~5–6% potential drop from today's levels)

Nikkei 225 4H: Flat Correction with Bullish Target 59,600【Nikkei 225 (JAPAN225CFD) - 4H Chart】

From the April low last year:

Double Zigzag W-X-Y completed on November 4

→ Large Flat correction A-B-C now in progress

→ Currently, from the November 21 low as the starting point:

Inside the Flat B-wave Double Zigzag (w)-(x)-(y),

likely in the (y) wa

Japan 225 IndexKey Levels

Resistance (Short Zone): Channel top / current highs

Target: 54,000

Invalidation: Daily close above channel resistance

📌 Trade Logic

Short: Favorable risk-reward from channel resistance → target 54,000

Buy: Only valid after pullback and strong bullish reaction at support

If price b

Nikkei moves in a strong momentumNilkkei index is in play

The change in the political landscape and economic conditions creates a bullish pressure for Nikkei index, as now this market represents a perfect combination of monetary policy conditions (when the interest rate is increasing but is still very low compared to other countie

See all ideas

Displays a symbol's value movements over previous years to identify recurring trends.

Frequently Asked Questions

The weakest component of Japan 225 Index is TSE:3697 — it's lost −56.46% over the year.

Japan 225 Index is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy Japan 225 Index futures or funds or invest in its components.

The Japan 225 Index is comprised of 225 instruments including TSE:7203, TSE:8306, TSE:9984 and others. See the full list of Japan 225 Index components to find more opportunities.