Aussie vs Yen: Setup for a Clean Long Robbery💣AUD/JPY Forex Heist: Aussie vs Yen 🔥Master Robbery Plan Unfolded!

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers, Bandits & Chart Pirates 🤑💰💸✈️

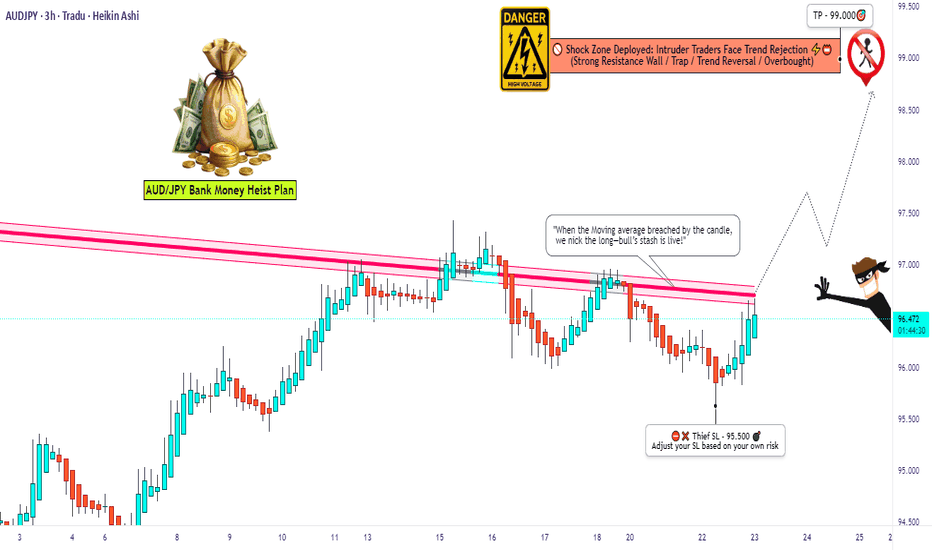

It's time to reload your gear and lock in the blueprint. Based on our 🔥Thief Trader Technical + Fundamental Intelligence🔥, we’re all set to ambush the AUD/JPY "Aussie vs Yen" battlefield. This ain’t no casual walk—it’s a full-scale market operation targeting the High Voltage Reversal Trap Zone⚡. The pressure is real: Overbought, Tricky Consolidation, and Bears camping at resistance. Your job? Steal profits before they smell the breakout! 🏆💪💵

🎯 Entry Point — "Let the Heist Begin"

🗝 Entry Level: Wait for the Breakout @ 94.500. When price shatters the Moving Average ceiling—that's your greenlight!

🚀 Execution Choices:

Place Buy Stop above the breakout point

Or, use Buy Limit Orders near recent swing highs/lows on the 15/30-min chart using Layering/DCA tactics (that’s how the real thieves sneak in 🕶️).

🔔 Set an alert to stay sharp—don’t miss the vault crackin’ open!

🛑 Stop Loss — “Cover Your Escape”

🎯 SL Level: Just under the recent swing low on the 3H timeframe (around 95.500)

🚫 Never place the SL before the breakout confirms! Let the move prove itself first.

🧠 SL sizing depends on your capital, lot size, and number of entries stacked. You control the risk, not the other way around!

🎯 Target — "Cash Out or Vanish"

💎 First Take-Profit: 99.000

🚪Optional Escape: Secure the bag early if momentum fades. Better leave rich than be late!

👀 For Scalpers & Swing Robbers Alike

🔍 Scalpers: Only ride the Long wave.

💼 Big pockets? Hit straight entry.

👟 Small capital? Tag in with swing trades and trail that SL like a pro.

🎣 Use a Trailing SL to lock profits as price sprints toward resistance.

📰 The Bigger Picture: Why AUD/JPY?

The pair is pumped by:

📈 Macro Economics

📊 Quant Analysis

📰 COT Reports

📉 Intermarket Correlations

🧠 Sentiment Heatmaps

🔥 Future Price Dynamics

Don’t pull the trigger blind. Read the battlefield before charging in.

⚠️ Thief’s Caution Zone: News Traps Ahead

🛎 News = chaos.

📌 Avoid entering fresh trades during major data drops.

🔐 Use Trailing SLs to protect ongoing plays.

📉 Let the market dance, but you control the music.

💥Hit the Boost Button!💥

If this heist plan pumps your portfolio, smash that boost. That’s how we fund more blueprints, fuel the Thief Gang’s vault, and keep the robbery cycle alive.

🤑💵 Together, let’s rob this market clean—Thief Style.

New plan drops soon. Stay locked. Stay sharp. Stay profitable.

🧠💰🏴☠️

— Thief Trader Out 🐱👤🔓🚀

JPYAUD trade ideas

AUD/JPY Daily Chart📈 AUD/JPY Daily Chart

🛠 Tools Used:

🔹 Volume Profile (Visible Range) – to spot high-activity price zones.

🔹 Support & Resistance Lines – key zones at 99.428 🛑 and 86.681 🟢.

🔹 50, 100 & 200-Day SMAs – to track trend direction and dynamic support.

📊 Market Snapshot:

AUD/JPY is currently at 96.364, showing steady bullish momentum 📈 after bouncing from the 50-day SMA.

The Volume Profile reveals a large cluster of trading activity between 95.00 – 97.50, making this the current value area.

⚠️ Key Zones to Watch:

Resistance: 97.50 → 99.428 (Major hurdle 🚧)

Support: 94.50 → 92.00 → 86.681 (Long-term floor)

💡 Trade Idea:

✅ Bullish scenario: Break & close above 97.50 could trigger a rally towards 99.40.

❌ Bearish scenario: Drop below 94.50 could invite sellers back to test 92.00 and possibly 86.68.

📌 Summary:

The bulls are in control, but the real test lies ahead at 99.428 – a zone where sellers historically step in. Watch price action closely near resistance for confirmation before entering a breakout trade.

Why the VMS Strategy Works – A Live Example using AUDJPY 4HHere’s a perfect example of why following the rules matters.

The first setup was a strong hammer reversal right after an impulsive move to the downside (which we also traded). We got a clean engulfing candle and volume was decent…

But — both momentum lines must be hooking in our favor for confirmation. In this case, one was and one was not.

Daily chart was also in a downtrend but hitting support

So not bad, but not great

✅ Discipline says: Pass.

The very next day, we got a better setup:

All VMS rules met (Volume, Momentum, Structure)

Bonus: Momentum divergence in our favor

That’s the power of combining volume and momentum with structure — it filters out the “almost” trades and keeps us focused on the high-probability setups.

Disclaimer: This is for educational purposes only — not financial advice. Always do your own research, practice extensively, and use proper risk management before trading live.

AUDJPY Key tarding level retest at 96.00Key Support and Resistance Levels

Resistance Level 1: 97.527

Resistance Level 2: 98.091

Resistance Level 3: 99.00

Support Level 1: 96.00

Support Level 2: 95.574

Support Level 3: 95.060

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

AUDJPY Forming Bullish MomentumAUDJPY has recently bounced from a strong demand zone near the 94.50–95.00 region, as seen on the 4H chart. This zone has acted as a key support area in previous price action, and the market is now printing higher lows after rejecting it multiple times. Price is showing bullish momentum, and with buyers stepping in aggressively from this area, we are now anticipating a continuation to the upside toward 96.80 and beyond.

From a fundamental perspective, the Australian dollar is gaining traction due to recent upbeat economic sentiment, especially as the Reserve Bank of Australia (RBA) maintains its data-dependent stance. Although rate hikes are on pause, the RBA is leaving the door open for further tightening should inflation remain sticky. On the flip side, the Japanese yen remains weak across the board, with the Bank of Japan maintaining ultra-loose monetary policy and no near-term signals of change. This divergence in central bank policy continues to support bullish pressure on AUDJPY.

Technically, the risk-reward profile is favorable. The bullish engulfing candles off the demand zone suggest strong buyer intent. A break and hold above the intraday resistance around 96.00 would confirm bullish continuation, with upside targets stretching toward 96.80–97.20. Meanwhile, stops can be managed tightly below 94.50, keeping the setup clean and structured. With the yen facing broad weakness and Aussie resilience in play, this pair offers momentum trading potential.

Overall, AUDJPY is primed for upside as long as the support zone holds. Traders should monitor price action around current levels for bullish confirmation and scale in on minor pullbacks. This setup aligns with market sentiment and fundamental divergence, creating a high-probability opportunity in the current forex landscape.

Bullish rise?AUD/JPY is reacting off the support level which is an overlap support and could bounce from this level to our take profit.

Entry: 95.77

Why we like it:

There is an overlap support.

Stop loss: 94.92

Why we like it:

There is a swing low support.

Take profit: 97.22

Why we like it:

There is a multi swing high resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

AUD/JPY – 4H Technical & Fundamental AnalysisAUD/JPY – 4H Technical & Fundamental Analysis

AUD/JPY is currently hovering around the 95.00 psychological level. A decisive break below this level could open further downside potential. The Japanese Yen is gaining traction amid a global risk-off sentiment, acting as a safe-haven currency. Meanwhile, the Australian Dollar is under pressure as speculation grows about potential rate cuts by the Reserve Bank of Australia (RBA).

In addition, AUD is highly correlated with commodities. The recent decline in commodity prices is dampening investor appetite for the Aussie.

From a technical perspective, the pair recently formed a double top near the 97.300 resistance zone, signaling a potential trend reversal. Price then broke below a major support level at 95.500, followed by a period of accumulation, indicating sellers entering the market.

However, we are still waiting for clear signs of liquidity to form. Our plan is to wait for a liquidity grab near the zone, then execute a Sell Stop strategy once confirmation is present.

🔽 Sell Setup Plan:

Entry (Sell Stop): 95.380

Stop Loss: 96.120

Take Profit: 93.890

We remain cautious but biased toward bearish continuation upon confirmation of liquidity and key level rejection.

📌 Disclaimer:

This is not financial advice. Always wait for proper confirmation before executing trades. Manage risk wisely and trade what you see—not what you feel.

Bearish reversal off 61.8% Fibonacci resistance?AUD/JPY is rising towards the pivot which acts as a pullback resistance and could reverse to the 1st support, which aligns with the 61.8% Fibonacci retracement.

Pivot: 96.11

1st Support: 94.30

1st Resistance: 97.25

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bullish reversal off Fibonacci confluence?AUD/JPY is falling towards a support level, which is a pullback support aligning with the 138.2% Fibonacci extension, the 50% Fibonacci retracement, and the 61.8% Fibonacci projection. A bounce from this level could push the price toward our take-profit target.

Entry: 94.75

Why we like it:

There is a pullback support level that aligns with the 50% Fibonacci retracement, the 138.2% Fibonacci extension and the 61.8% Fibonacci projection.

Stop loss: 93.80

Why we like it:

There is a pullback support that lines up witht he 100% Fibonacci projection.

Takeprofit: 95.77

Why we like it:

There is an overlap resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

AUDJPY Love Story: One Last Red Candle and I’m GoneWe had a beautiful connection between 97.06 and 95.10 —

our special place, our Sell Range of memories. 💑

But then came a small pullback… from 95.10 to 95.81.

Just when I thought we were falling together, AUDJPY pulled away (retracement) — classic mixed signals. 😢

Now, I’m patiently watching...

If AUDJPY sends me a clear sign — a bearish candle closing below 50EMA —

I’ll know it's real.

No more mind games, no more confusion. I’m in. 💔➡️📉

If it's a strong Marubozu, I’ll give it my full trust — SL just above it.

TP? Back to where it all began… 95.10.

That’s where I’ll let go — and close the chapter. 📘

WHAT IF IT WONT CROSS?

This is day trading setup. While watching 15m candle to bear below 50EMA also I glance 1hr chart. This setup will be valid as long as 1hr chart is still in bearing range.

Wish me luck… and a big bearish Marubozu kiss! 😈📉

AUDJPY Breakdown Signals Deeper Correction: Key Zones to WatchAUDJPY Breakdown Signals Deeper Correction: Key Zones to Watch

On the 4-hour chart, AUDJPY has broken out of a bearish formation, signaling strong downside momentum.

On Friday, the pair declined by nearly 180 pips—a move echoed across multiple XXXJPY pairs, triggered during the release of NFP data.

While the fundamental catalyst remains unclear, the technical setup supports a continuation of the bearish trend.

There’s a high probability that AUDJPY may retest the broken structure near the 96.00 level before extending its decline toward the projected zones of 94.30 and 92.50.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD/JPY WINAUD/JPY – Triple Top ✅

We posted this potential triple top setup on Thursday, July 31st, and the trigger came during the Friday morning session (August 1st) with a clean engulfing candle.

As soon as we entered, the market dropped hard — a textbook move, and one we don’t see play out this cleanly very often. That’s the power of the VMS strategy when all elements align.

This one hit our 2:1 risk-reward target smoothly and with precision.

Add it to the win column, stay patient, and get ready for the next aligned setup.

“Prepare for the setup. Wait for alignment. Let the market do the rest.”

— War Room Discipline

AUDJPY Will Go Lower! Sell!

Take a look at our analysis for AUDJPY.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 96.734.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 96.102 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

AUDJPY Set To Grow! BUY!

My dear subscribers,

AUDJPY looks like it will make a good move, and here are the details:

The market is trading on 95.649 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 96.260

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK