Molina Healthcare, Inc.

No trades

Key facts today

Molina Healthcare has revised its Credit Agreement with Truist Bank, lowering the minimum interest coverage ratio from 3.00x to 1.75x-2.75x, effective February 4, 2026.

Molina Healthcare (MOH) stock dropped 26% to $131.72 after a profit warning, projecting $5 earnings per share, far below the $14 expected. Trading volume hit 10.3 million shares.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

401.87 M EUR

38.68 B EUR

50.78 M

About Molina Healthcare Inc

Sector

Industry

CEO

Joseph M. Zubretsky

Website

Headquarters

Long Beach

Founded

1980

IPO date

Jul 2, 2003

Identifiers

3

ISIN US60855R1005

Molina Healthcare, Inc. engages in the provision of health care services. It operates through the following segments: Medicaid, Medicare, Marketplace, and Other. The company was founded by C. David Molina in 1980 and is headquartered in Long Beach, CA.

Related stocks

Molina HealthcareRating and Place in Portfolio

If I had to rate Molina, I would say it is a moderate investment — not “super stable” as a brand without any risks, but not super extreme either.

It is suitable for an investor who is looking for growth and has a tolerance for risk, especially if he believes that Moli

MOH Cup and Handle Pattern FormedMOH has had a cup and handle chart patterns form over the last couple of months while bouncing off resistance around 151. The handle portion looks to be complete and it might be primed for a breakout soon. Watching for entry on the options below.

19Dec2025 175c @ 22.4

Molina Healthcare Stock Chart Fibonacci Analysis 081525Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 164/61.80%

Chart time frame:D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:C

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E)

Bearish Breakdown or Oversold Rebound? MOH at Critical Level!

## 🧨 MOH Weekly Trade Alert: RSI 11.1?! Bearish Setup Unfolding 📉

Molina Healthcare (\ NYSE:MOH ) just hit **extreme oversold** levels:

🔻 **Weekly RSI: 11.1**

📉 **Daily RSI: 22.7**

📉 **Volume: Just 0.4x Last Week**

⚠️ Options Flow: Heavier **PUT action at \$150**

💡 VIX at 16.8 – great conditions

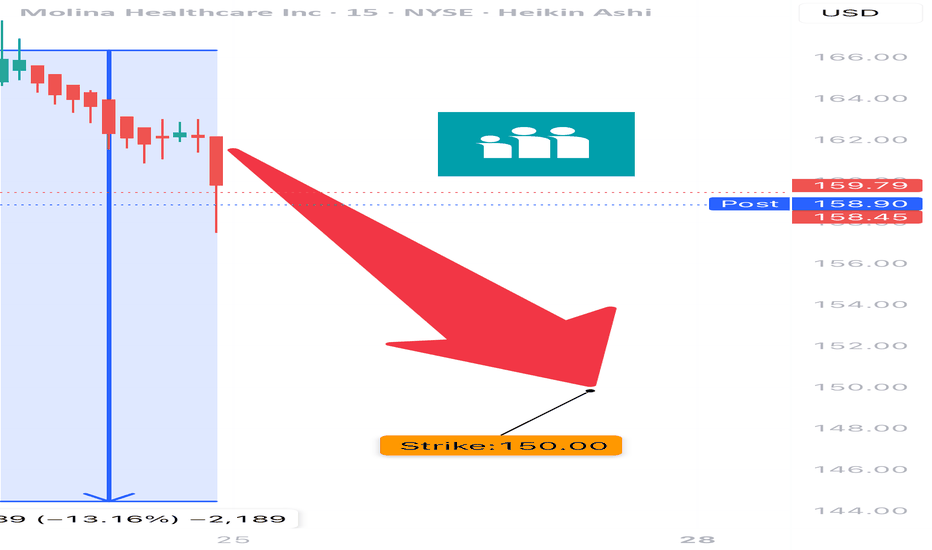

MOH PUT TRADE ALERT (07/24)

🚨 MOH PUT TRADE ALERT (07/24) 🚨

📉 Extreme Oversold. Institutional Selling. Setup is Real.

🧠 Key Stats:

• RSI: 13.2 = insanely oversold

• Volume: 🔺2.6x last week = institutions dumping

• Put/Call Ratio: 0.33 → heavy bearish bets

• VIX: Low → IV still cheap 💰

🔥 TRADE IDEA

🔻 Buy MOH $150 PUT exp 8/1

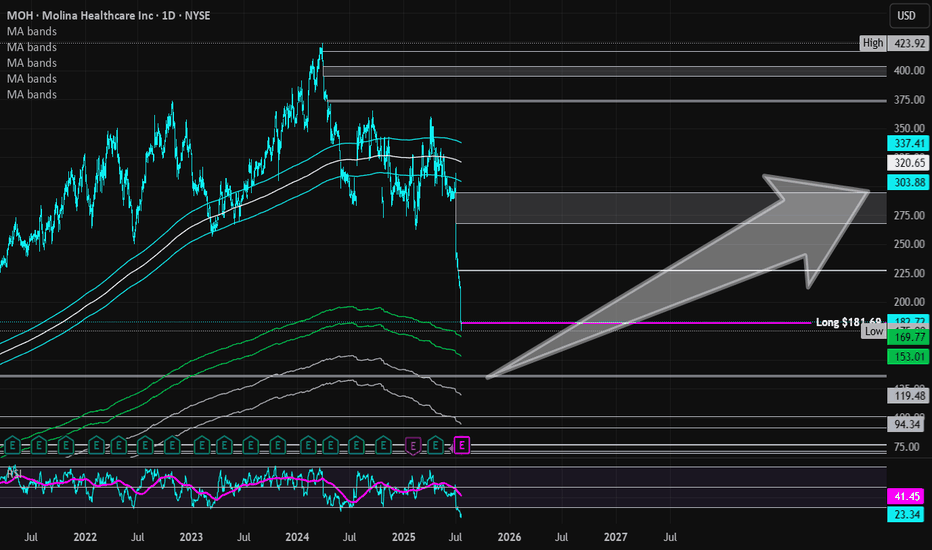

Molina Healthcare | MOH | Long at $181.69Healthcare providers and services are at a major discount right now: and may be discounted even more this year. I am personally buying and long-term holding the fear, knowing the baby boom generation is going to utilize our healthcare system at a rate unseen in modern times. While the price discount

Oooh MolinaMolina has a safe and clean looking chart. I don't see price getting much below the marked level of ~$250, if it even goes there.

The longer it consolidates the lesser the chance of price going there which I think is already the case here (as the consolidation 'washes' out the strength of the down

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MOH5939489

Molina Healthcare, Inc. 6.25% 15-JAN-2033Yield to maturity

6.63%

Maturity date

Jan 15, 2033

MOH5414064

Molina Healthcare, Inc. 3.875% 15-MAY-2032Yield to maturity

5.77%

Maturity date

May 15, 2032

MOH5074366

Molina Healthcare, Inc. 3.875% 15-NOV-2030Yield to maturity

5.70%

Maturity date

Nov 15, 2030

MOH5003223

Molina Healthcare, Inc. 4.375% 15-JUN-2028Yield to maturity

5.11%

Maturity date

Jun 15, 2028

MOH5939488

Molina Healthcare, Inc. 6.25% 15-JAN-2033Yield to maturity

—

Maturity date

Jan 15, 2033

See all MHG bonds

Frequently Asked Questions

The current price of MHG is 111.90 EUR — it has increased by 6.93% in the past 24 hours. Watch Molina Healthcare, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on GETTEX exchange Molina Healthcare, Inc. stocks are traded under the ticker MHG.

MHG stock has fallen by −27.43% compared to the previous week, the month change is a −28.93% fall, over the last year Molina Healthcare, Inc. has showed a −59.16% decrease.

We've gathered analysts' opinions on Molina Healthcare, Inc. future price: according to them, MHG price has a max estimate of 190.18 EUR and a min estimate of 123.11 EUR. Watch MHG chart and read a more detailed Molina Healthcare, Inc. stock forecast: see what analysts think of Molina Healthcare, Inc. and suggest that you do with its stocks.

MHG stock is 13.00% volatile and has beta coefficient of −0.47. Track Molina Healthcare, Inc. stock price on the chart and check out the list of the most volatile stocks — is Molina Healthcare, Inc. there?

Today Molina Healthcare, Inc. has the market capitalization of 5.75 B, it has decreased by −9.48% over the last week.

Yes, you can track Molina Healthcare, Inc. financials in yearly and quarterly reports right on TradingView.

Molina Healthcare, Inc. is going to release the next earnings report on Apr 29, 2026. Keep track of upcoming events with our Earnings Calendar.

MHG earnings for the last quarter are −2.34 EUR per share, whereas the estimation was 0.29 EUR resulting in a −919.54% surprise. The estimated earnings for the next quarter are 3.37 EUR per share. See more details about Molina Healthcare, Inc. earnings.

Molina Healthcare, Inc. revenue for the last quarter amounts to 9.68 B EUR, despite the estimated figure of 9.26 B EUR. In the next quarter, revenue is expected to reach 9.81 B EUR.

MHG net income for the last quarter is −136.23 M EUR, while the quarter before that showed 67.32 M EUR of net income which accounts for −302.35% change. Track more Molina Healthcare, Inc. financial stats to get the full picture.

No, MHG doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

Like other stocks, MHG shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Molina Healthcare, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Molina Healthcare, Inc. technincal analysis shows the sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Molina Healthcare, Inc. stock shows the strong sell signal. See more of Molina Healthcare, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.