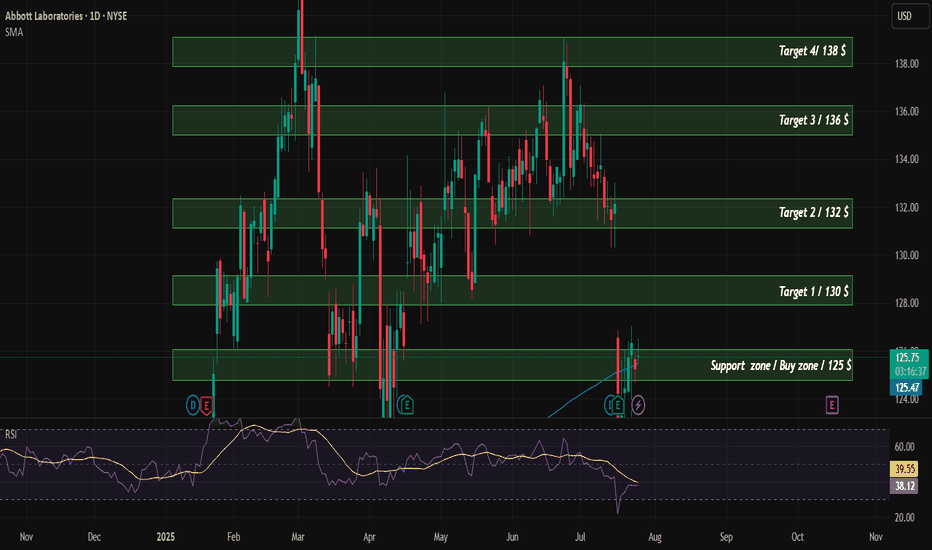

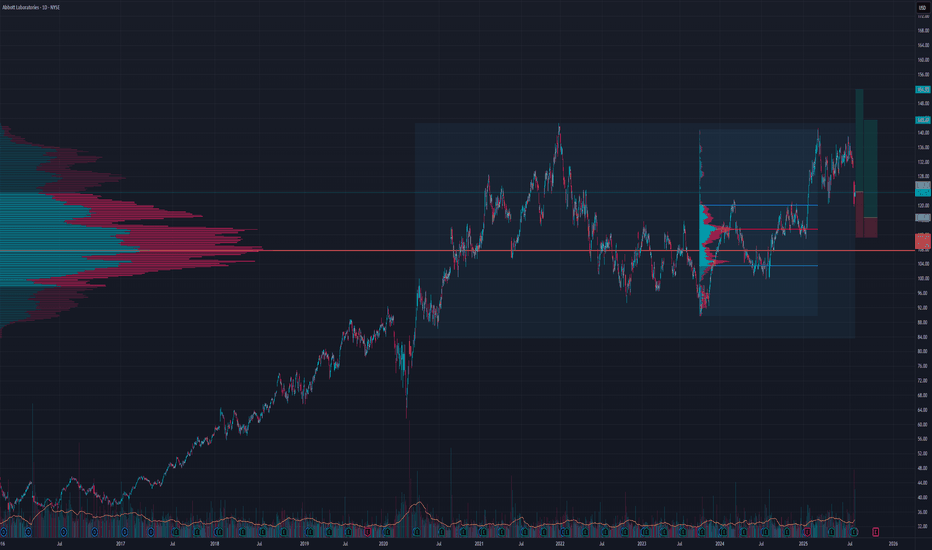

ABT (Abbott Laboratories) - Long SetupTrading Idea: NYSE:ABT (Abbott Laboratories) - Long Setup

🎯 Idea: LONG

⏰ Timeframe: Daily

📊 Pattern: Bullish Breakout from Consolidation

Fundamental Context:

Fundamental Score: 5/9 (Neutral).

Business: Global Healthcare Leader (Medical Devices, Diagnostics, Nutrition).

Growth: Weak Revenue + S

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.82 EUR

12.90 B EUR

40.52 B EUR

1.73 B

About Abbott Laboratories

Sector

Industry

CEO

Robert B. Ford

Website

Headquarters

Abbott Park

Founded

1888

ISIN

US0028241000

FIGI

BBG01TNY9309

Abbott Laboratories engages in the discovery, development, manufacture, and sale of healthcare products. It operates through the following segments: Established Pharmaceutical Products, Diagnostic Products, Nutritional Products, and Medical Devices. The Established Pharmaceutical Products segment refers to the line of branded generic pharmaceuticals manufactured worldwide and marketed and sold outside the United States in emerging markets. The Diagnostic Products segment markets diagnostic systems and tests for blood banks, hospitals, commercial laboratories, clinics, physicians' offices, retailers, government agencies, and alternate care testing sites. The Nutritional Products segment caters to the worldwide sales of pediatric and adult nutritional products. The Medical Devices segment includes a broad line of rhythm management, electrophysiology, heart failure, vascular and structural heart devices for the treatment of cardiovascular diseases, and diabetes care and continuous glucose monitoring products, as well as neuromodulation devices for the management of chronic pain and movement disorders. The company was founded by Wallace Calvin Abbott in 1888 and is headquartered in Abbott Park, IL.

Related stocks

ABT - Possible break out Hello everyone,

This is the last one for today.

ABT Abbott Laboratories .

What they do?

Abbott Laboratories offers pharmaceutical, diagnostic, and nutritional products, as well as medical devices to treat cardiovascular disease and diabetes care products. Operating internationally, the company wa

ABT Trade Setup: Breakout Play with 10.6% Upside🏥 Abbott Labs (ABT) Trade Alert

Positioning in this healthcare giant as it breaks out from consolidation - here's the strategic play:

📌 Trade Levels

▶ Entry: $133.12 (confirmed above SMA 50)

🎯 Target: $147.21 (+10.6%)

🛑 Stop Loss: $126.00 (-5.3% risk)

⚖️ Risk/Reward: 1:2

Why ABT Now?

✅ Fundamental

ABT – Clean Technical Setup with Strong Risk/Reward📈 Ticker: NYSE:ABT (Abbott Laboratories)

🕒 Timeframe: Daily

💡 Strategy: Ichimoku + MACD + Risk/Reward Setup

Abbott ( NYSE:ABT ) is showing a compelling long opportunity after a pullback to the Tenkan-sen (conversion line) within the Ichimoku Cloud structure. Price action remains bullish as it res

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A

XS207615510

Abbott Ireland Financing DAC 0.375% 19-NOV-2027Yield to maturity

2.39%

Maturity date

Nov 19, 2027

See all 1ABT bonds

Curated watchlists where 1ABT is featured.

Frequently Asked Questions

The current price of 1ABT is 114.32 EUR — it has increased by 0.95% in the past 24 hours. Watch Abbott Laboratories stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on MIL exchange Abbott Laboratories stocks are traded under the ticker 1ABT.

1ABT stock has fallen by −0.07% compared to the previous week, the month change is a 0.79% rise, over the last year Abbott Laboratories has showed a 0.33% increase.

We've gathered analysts' opinions on Abbott Laboratories future price: according to them, 1ABT price has a max estimate of 135.50 EUR and a min estimate of 110.79 EUR. Watch 1ABT chart and read a more detailed Abbott Laboratories stock forecast: see what analysts think of Abbott Laboratories and suggest that you do with its stocks.

1ABT reached its all-time high on May 20, 2025 with the price of 120.94 EUR, and its all-time low was 104.28 EUR and was reached on Jul 18, 2025. View more price dynamics on 1ABT chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

1ABT stock is 0.94% volatile and has beta coefficient of 0.36. Track Abbott Laboratories stock price on the chart and check out the list of the most volatile stocks — is Abbott Laboratories there?

Today Abbott Laboratories has the market capitalization of 199.93 B, it has increased by 0.07% over the last week.

Yes, you can track Abbott Laboratories financials in yearly and quarterly reports right on TradingView.

Abbott Laboratories is going to release the next earnings report on Oct 15, 2025. Keep track of upcoming events with our Earnings Calendar.

1ABT earnings for the last quarter are 1.07 EUR per share, whereas the estimation was 1.07 EUR resulting in a 0.33% surprise. The estimated earnings for the next quarter are 1.11 EUR per share. See more details about Abbott Laboratories earnings.

Abbott Laboratories revenue for the last quarter amounts to 9.46 B EUR, despite the estimated figure of 9.42 B EUR. In the next quarter, revenue is expected to reach 9.72 B EUR.

1ABT net income for the last quarter is 1.53 B EUR, while the quarter before that showed 1.20 B EUR of net income which accounts for 27.16% change. Track more Abbott Laboratories financial stats to get the full picture.

Yes, 1ABT dividends are paid quarterly. The last dividend per share was 0.51 EUR. As of today, Dividend Yield (TTM)% is 1.72%. Tracking Abbott Laboratories dividends might help you take more informed decisions.

Abbott Laboratories dividend yield was 1.98% in 2024, and payout ratio reached 29.33%. The year before the numbers were 1.89% and 63.81% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Oct 5, 2025, the company has 114 K employees. See our rating of the largest employees — is Abbott Laboratories on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Abbott Laboratories EBITDA is 9.09 B EUR, and current EBITDA margin is 24.00%. See more stats in Abbott Laboratories financial statements.

Like other stocks, 1ABT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Abbott Laboratories stock right from TradingView charts — choose your broker and connect to your account.