Continuation Diamond (Bullish) | 19% move possibleVanguard High Dividend Yield ETF forms bullish "Continuation Diamond" chart pattern

"Continuation Diamond (Bullish)" chart pattern formed on Vanguard High Dividend Yield ETF (VYM:NYSE). This bullish signal indicates that the stock price may rise from the close of $110.96 to the range of $130.00 -

Key stats

About Vanguard High Dividend Yield ETF

Expense ratio

0.06%

Home page

Inception date

Nov 10, 2006

VYM offers a diversified, conservative approach to high dividend yield in a low-cost wrapper. The fund`s broad basket stems partly from its comparatively lax dividend screens: Firms are ranked by forecast dividends over the next 12 months, those in the top half are selected. Stocks that make the cut are weighted by market cap rather than dividends, an approach also used by our benchmark. As a result, the broad portfolio aligns well with our benchmark by firm size, yield, and sector exposure. REITs are out of bounds too, in keeping with the conservative approach. The fund is a possible choice for those looking for broad dividend focus.

Classification

What's in the fund

Exposure type

Finance

Electronic Technology

Health Technology

Stock breakdown by region

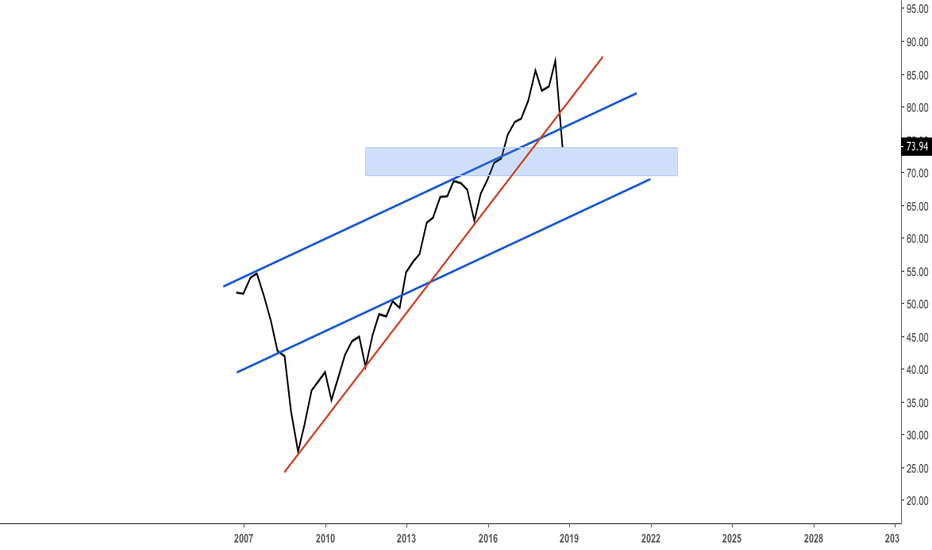

VYM high yield dividend to see a -20% correctionThe Vanguard High Yield dividend fund could see a further repricing of about -20%, considering that supply chain shocks, Inflationary commodities prices, and higher marginal costs have compressed revenue growth margins for corporations. This will make corporations have to reduce dividends and earnin

Long for VYMHigh Dividend ETFs are Beating the Market now, because it contains a lot of save recession proceed assets. This is what all need in current market environment.

We have a nice price action pattern. And reversal pattern with 2 day in row close above last pivot at the D perviod.

I am going to buy afte

Long opportunity Hey guys,

Most stocks breakout after market opening so it makes sense to open a position the previous day before the market close. What we can see on Vanguard is a obvious bullish flag for more upside potential.

Set your SL in profit once it spiked up.

Wanna join my telegram channel ?

Leave me a p

Stock buying opportunity Hey traders,

Although we actually focus on forex trading we keep a look on stocks. In this case we see a wonderful possibility to go long in Vanguard. It’s forming an inverse HS and it’s overall bullish.

BUT

Be careful about 80.00 . It’s a technical and psychological resistance.

Once we broke it,

Popular Vanguard Has High Exposure to Bad Market Conditions.Vanguard funds have substantial exposure to bad market conditions. Investors will usually find their investment weighted towards the most popular stocks - and these can be the most volatile ones. Although the portfolios can own many different stocks, a large share of these is usually condensed i

See all ideas