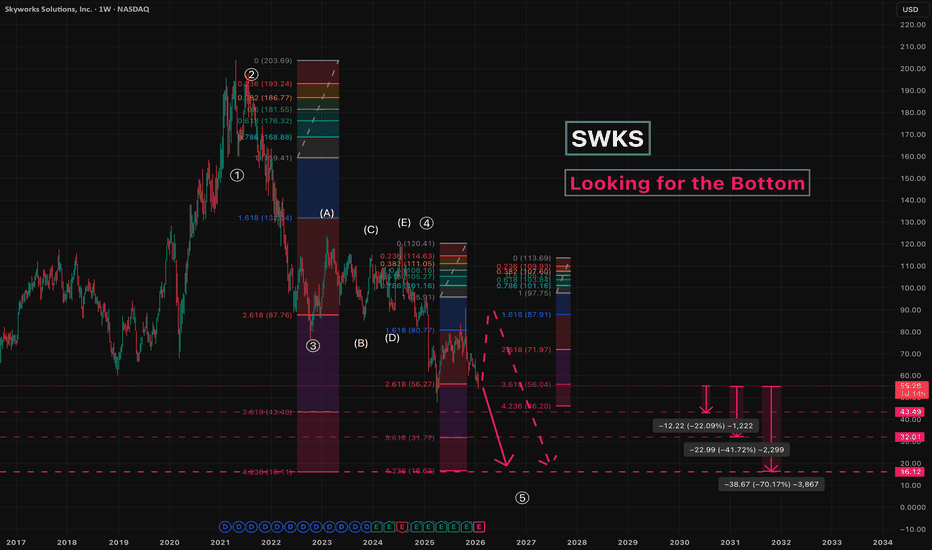

SWKS - Looking for the BottomSince April 2021, a five -wave impulsive decline has been developing.

Only the fifth wave and its internal sub-waves remain to be completed.

At this stage, caution is advised - price may rebound toward the 91 area before starting the final leg down.

Key targets:

43

32

16

Estimated down

Skyworks Solutions, Inc.

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.23 EUR

406.58 M EUR

3.48 B EUR

149.74 M

About Skyworks Solutions, Inc.

Sector

Industry

CEO

Philip G. Brace

Website

Headquarters

Irvine

Founded

1962

IPO date

Jun 2, 1998

Identifiers

3

ISIN US83088M1027

Skyworks Solutions, Inc. engages in the development, manufacture, and provision of analog and mixed-signal semiconductor products and solutions for applications including aerospace, automotive, broadband, cellular infrastructure, connected home, defense, entertainment and gaming, industrial, medical, smartphone, tablet, and wearables. Its products include amplifiers, attenuators, circulators, demodulators, detectors, diodes, directional couplers, front-end modules, hybrids, isolators, lighting and display solutions, mixers, modulators, optocouplers, opt isolators, phase shifters, synthesizers, power dividers and combiners, receivers, switches, and technical ceramics. The company was founded in 1962 and is headquartered in Irvine, CA.

Related stocks

SWKS Monthly: Cycle Low Testing NowSWKS monthly structure is deeply bearish, with price in a multi-year downtrend from 2021–2022 peaks above $180, now grinding toward the low $50s after a series of lower lows and closes below key monthly moving averages. Oversold conditions are extreme, but lack of higher highs keeps sellers in contr

SWKS: Bullish continuation triangleSWKS has been on an upward momentum in recent days after reclaiming its 200dma. It has also broken out of its bullish continuation triangle with healthy volume. It has also filled its previous gap down in February this year after disappointing results. As its 200dma line starts to flatten and potent

Skyworks Solutions & Semiconductor OpportunitiesLet’s also consider semiconductor firms, with a focus on those I’m currently monitoring. The initial company is Skyworks Solutions NASDAQ:SWKS .

I recall observing it previously, and recently, I noted its price has dropped further than expected. The stock has declined from a high of $200 to a low

2/6/25 - $swks - Premkt $63, why not swing long2/6/25 :: VROCKSTAR :: NASDAQ:SWKS

Premkt $63, why not swing long

- did a (private) review of the semis names i've tracked over the years in early Jan to get a start on the year... and NASDAQ:SWKS was a pass

- that being said, 10% fcf yield *seems* to be the place where markets trade stocks (at

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SWKS5184362

Skyworks Solutions, Inc. 3.0% 01-JUN-2031Yield to maturity

4.96%

Maturity date

Jun 1, 2031

SWKS5184361

Skyworks Solutions, Inc. 1.8% 01-JUN-2026Yield to maturity

4.28%

Maturity date

Jun 1, 2026

See all 1SWKS bonds

Frequently Asked Questions

The current price of 1SWKS is 60.91 EUR — it has decreased by −0.37% in the past 24 hours. Watch Skyworks Solutions, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on MIL exchange Skyworks Solutions, Inc. stocks are traded under the ticker 1SWKS.

1SWKS stock has fallen by −1.89% compared to the previous week, the month change is a 2.23% rise, over the last year Skyworks Solutions, Inc. has showed a −3.70% decrease.

We've gathered analysts' opinions on Skyworks Solutions, Inc. future price: according to them, 1SWKS price has a max estimate of 118.59 EUR and a min estimate of 49.13 EUR. Watch 1SWKS chart and read a more detailed Skyworks Solutions, Inc. stock forecast: see what analysts think of Skyworks Solutions, Inc. and suggest that you do with its stocks.

1SWKS reached its all-time high on Jul 16, 2024 with the price of 110.92 EUR, and its all-time low was 43.80 EUR and was reached on Jan 28, 2026. View more price dynamics on 1SWKS chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

1SWKS stock is 14.89% volatile and has beta coefficient of 1.56. Track Skyworks Solutions, Inc. stock price on the chart and check out the list of the most volatile stocks — is Skyworks Solutions, Inc. there?

Today Skyworks Solutions, Inc. has the market capitalization of 7.87 B, it has increased by 9.15% over the last week.

Yes, you can track Skyworks Solutions, Inc. financials in yearly and quarterly reports right on TradingView.

Skyworks Solutions, Inc. is going to release the next earnings report on May 5, 2026. Keep track of upcoming events with our Earnings Calendar.

1SWKS earnings for the last quarter are 1.31 EUR per share, whereas the estimation was 1.19 EUR resulting in a 10.09% surprise. The estimated earnings for the next quarter are 0.88 EUR per share. See more details about Skyworks Solutions, Inc. earnings.

Skyworks Solutions, Inc. revenue for the last quarter amounts to 881.56 M EUR, despite the estimated figure of 852.53 M EUR. In the next quarter, revenue is expected to reach 759.72 M EUR.

1SWKS net income for the last quarter is 67.43 M EUR, while the quarter before that showed 120.50 M EUR of net income which accounts for −44.04% change. Track more Skyworks Solutions, Inc. financial stats to get the full picture.

Yes, 1SWKS dividends are paid quarterly. The last dividend per share was 0.61 EUR. As of today, Dividend Yield (TTM)% is 4.54%. Tracking Skyworks Solutions, Inc. dividends might help you take more informed decisions.

Skyworks Solutions, Inc. dividend yield was 3.64% in 2025, and payout ratio reached 91.35%. The year before the numbers were 2.77% and 74.25% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 17, 2026, the company has 10 K employees. See our rating of the largest employees — is Skyworks Solutions, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Skyworks Solutions, Inc. EBITDA is 784.33 M EUR, and current EBITDA margin is 24.16%. See more stats in Skyworks Solutions, Inc. financial statements.

Like other stocks, 1SWKS shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Skyworks Solutions, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Skyworks Solutions, Inc. technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Skyworks Solutions, Inc. stock shows the neutral signal. See more of Skyworks Solutions, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.