Trade ideas

SOYBEAN OIL FUTURES (MAR 2019), 1D, CBOTTrading Signal

Short Position (EP) : 30.62

Stop Loss (SL) : 30.91

Take Profit (TP) : 30.04

Description

ZSH2019 formed Double Repo Sell at 1d time frame. Trade setup with Sell Limit at 0.382 Level (30.62) and place stop after 0.618 level (30.91). Once the position was hit, place take profit before an agreement (30.04)

Money Management

Money in portfolio : $1,000,000

Risk Management (1%) : $10,000

Position Sizing

$0.01 = +-$ 6.00/std-contract

Commission fee = -$5.64/contract (Standard)

EP to SL = $0.29 = -$174

Contract size to open = 57 standard contracts

EP to TP = $0.58 = +$348

Expected Result

Commission Fee = -$321.48

Loss = -$9,918

Gain = +$19,836

Risk/Reward Ratio = 1.91

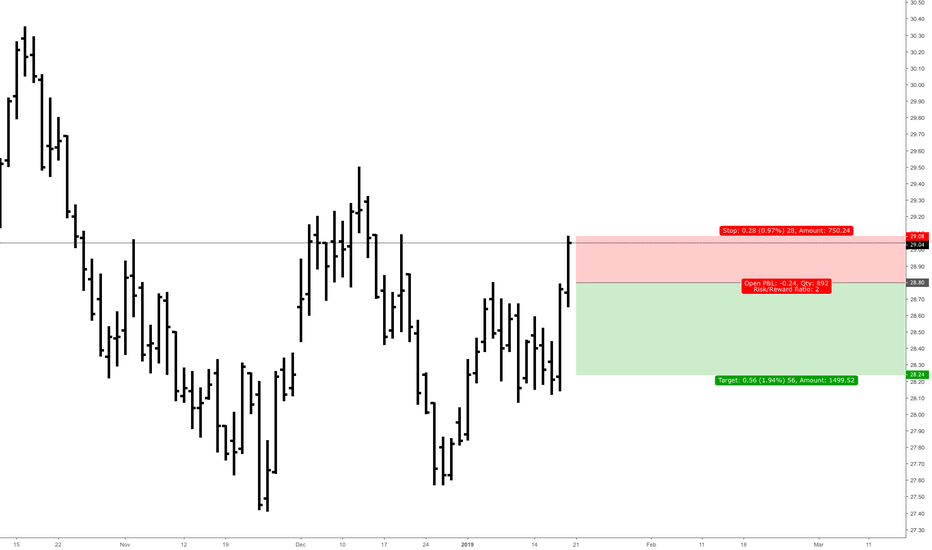

SOYBEAN OIL FUTURES (MAR 2019), 1D, CBOTTrading Signal

Short Position (EP) : 28.8

Stop Loss (SL) : 29.08

Take Profit (TP) : 28.24

Description

ZLH2019 formed Turtle Soup Sell at 1d time frame. Trade setup with Sell Limit at 0.382 Level (28.8) and place stop after 0.618 level (29.08). Once the position was hit, place take profit before an agreement (28.24)

Money Management

Money in portfolio : $280,000

Risk Management (1%) : $2,800

Position Sizing

$0.01 = +-$ 6.00/std-contract

Commission fee = -$5.64/contract (Standard)

EP to SL = $0.28 = -$168

Contract size to open = 16 standard contracts

EP to TP = $0.56 = +$336

Expected Result

Commission Fee = -$90.24

Loss = -$2,688

Gain = +$5,376

Risk/Reward Ratio = 1.9

Kathy Lien Double Bollinger Band Strategy.As per Kathy Lien's Double Bollinger Band Strategy, here we can see a short opportunity as the price action has broken and closed below the 20 day, 1 standard deviation band. We take the open, or as i do the low of the previous close plus 1 tick for a short sell stop order.

Initial stop loss once in the trade is 1 tick about the 15 day simple MA and I aim for a profit target of 1.6 times entry and stop loss difference.