JPMorgan Chase & Co. Shs -CAD hedged- Canadian Depositary Receipt Repr Shs Reg S

No trades

Key facts today

A U.S. judge dismissed an antitrust lawsuit against JPMorgan Chase and nine banks, ruling investors failed to prove price manipulation in corporate bond trading. The case cannot be refiled.

JPMorgan Chase is a joint lead on a new 10-year UK government bond, maturing in October 2035, with initial pricing guidance of 8.25-8.75 basis points and a 4.75% coupon.

On September 1, 2025, JPMorgan Chase & Co. reported a significant acquisition of Adriatic Metals PLC holdings, marking a key change in its financial instruments portfolio.

27.26 CAD

79.63 B CAD

386.08 B CAD

About JP Morgan Chase & Co.

Sector

Industry

CEO

James Dimon

Website

Headquarters

New York

Founded

1799

ISIN

CA46653U1066

FIGI

BBG013V21T17

JPMorgan Chase & Co is a financial holding company. It provides financial and investment banking services. The firm offers a range of investment banking products and services in all capital markets, including advising on corporate strategy and structure, capital raising in equity and debt markets, risk management, market making in cash securities and derivative instruments, and brokerage and research. It operates through the following segments: Consumer and Community Banking, Corporate and Investment Bank, Commercial Banking, and Asset and Wealth Management. The Consumer and Community Banking segment serves consumers and businesses through personal service at bank branches and through automated teller machine, online, mobile, and telephone banking. The Corporate and Investment Bank segment offers a suite of investment banking, market-making, prime brokerage, and treasury and securities products and services to a global client base of corporations, investors, financial institutions, government and municipal entities. The Commercial Banking segment delivers services to U.S. and its multinational clients, including corporations, municipalities, financial institutions, and non profit entities. It also provides financing to real estate investors and owners as well as financial solutions, including lending, treasury services, investment banking, and asset management. The Asset and Wealth Management segment provides asset and wealth management services. The company was founded in 1968 and is headquartered in New York, NY.

Related stocks

JPMorgan Chase (NYSE) (W) - Quiet Base, Bullish BiasPrice / Momentum : Weekly close $296.24 (+1.98%) — holding just above the prior breakout area. Market structure = higher highs / higher lows since the spring low.

Volume : Weekly volume has eased after the earlier surge (no fresh big-volume breakout). That shows consolidation/rotation rather than

JPM Technical Outlook – Range-Bound Between Support & Resistance🏦 JPM Technical Outlook – Range-Bound Between Support & Resistance

Ticker: JPM (JPMorgan Chase & Co.)

Timeframe: 30-minute candles

🔍 Current Setup

JPM has been trading inside a horizontal range for several weeks, with price repeatedly rejecting both resistance and support.

Range Resistance: ~295

JPM Technical Outlook (30m Chart)📈

🔹 Current Price: $291.48

📉 Support Zone: $291.00 – $291.50

📊 Resistance Levels:

🔺 $292.28 (key breakout)

🎯 $293.12 (target)

📝 Trade Setup

✅ Entry: Near $291.50 (breakout)

🛑 Stop-loss: Below $291.00

🎯 Target: $293.12

⚖️ Risk/Reward: ~1:2 (strong setup)

🔎 Takeaway

🟢 Bullish bias above tr

JPM: Mean Reversion (FREMA)🏛️ Research Notes

Already looks mature to me

Conditional averaging of percentage change shows weakening bullish momentum

Testing FREMA as an indicator for mean reversion, where I will look for deviations from the average and anticipate a price movement back towards that mean. The band

JPM + $500B Capital Forecast + Banks to Profit from Tar NYSE:JPM , 4H chart

ALVO13 Insight: A strong mix of technical structure and positive fundamentals.Technical Setup (Elliott Waves):

The chart suggests a potential start of wave (5) after a completed correction (4).

Stochastic is in the oversold zone, and $280 support is holding — a key signal for

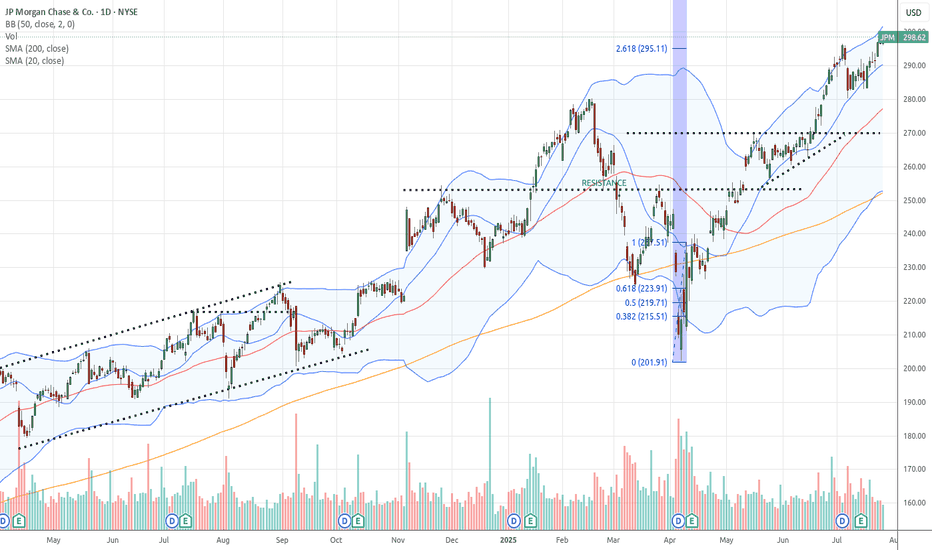

JP Morgan Chase Stock Chart Fibonacci Analysis 073025Trading Idea

Hit the 300/261.80% resistance level.

Chart time frame:D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:E

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise fro

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

J

JPM5152122

JPMorgan Chase Financial Co. LLC 0.0% 24-MAR-2026Yield to maturity

—

Maturity date

Mar 24, 2026

J

JPM5946157

JPMorgan Chase Financial Co. LLC 4.5036% 02-JAN-2026Yield to maturity

—

Maturity date

Jan 2, 2026

See all JPM bonds