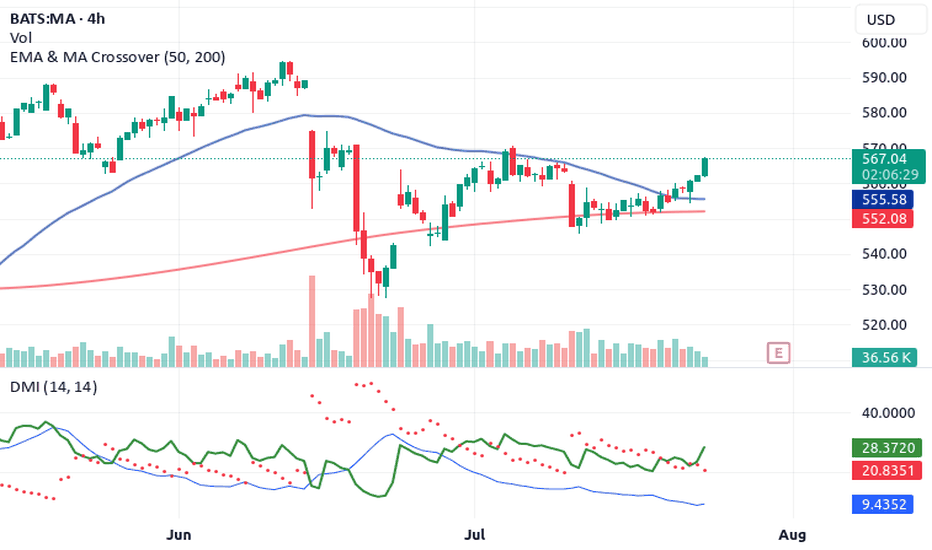

Mastercard - Master your uptrend NYSE:MA is looking at a potential bullish upside after resuming back into its major uptrend line. With the resistance zone between 575.60-595.90 tested multiple times, the stock is looking at a weakening resistance zone, therefore increasing the probability of an upside break. MACD is looking at st

Mastercard Incorporated Shs -A CAD hedged- Canadian Depositary Receipt Repr Shs A Reg S

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

20.22 CAD

18.53 B CAD

40.52 B CAD

820.41 M

About Mastercard Incorporated

Sector

Industry

CEO

Michael E. Miebach

Website

Headquarters

Purchase

Founded

1966

ISIN

CA57637G1054

FIGI

BBG013V238Y5

Mastercard, Inc. is a technology company, which engages in the provision of payment solutions for the development and implementation of credit, debit, prepaid, commercial, and payment programs through its brands including Mastercard, Maestro, and Cirrus. It also offers cyber and intelligence solutions. The company was founded in November 1966 and is headquartered in Purchase, NY.

Related stocks

MASTERCARD Best Buy Entry Now, Target $577.50.

## 💳 MA Options Play: Weekly Bullish Setup with Caution!

**Mastercard (MA)** showing bullish momentum — but options flow says: “Proceed carefully.”

---

### 🟢 Bullish Signals (4/5 Models Agree):

* 📈 Weekly RSI uptrending

* 🔊 Strong weekly volume

* 🌀 Low volatility = cleaner setup

* 🧠 Multiple mo

Top 4 Buy Signals Lighting Up Mastercard (MA) 🚀 Top 4 Buy Signals Lighting Up Mastercard (MA) | Rocket Booster Strategy

Mastercard Inc. (MA) is showing explosive potential, and it’s not just one signal—it’s a whole confluence of confirmations. When

you align this much market momentum, you don’t ignore it. Let’s break down how Rocket Booster

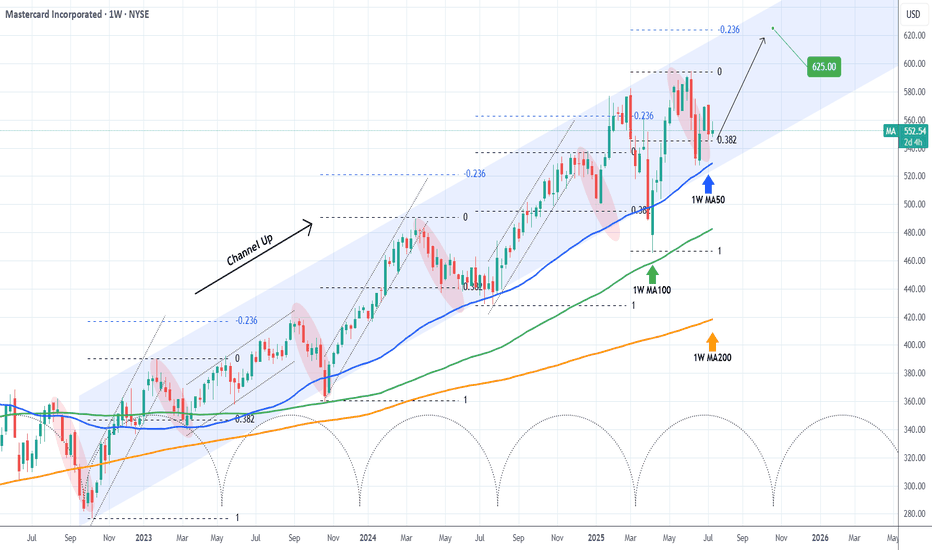

MASTERCARD Best buy entry now. Target $625.Mastercard (MA) has been trading within almost a 3-year Channel Up that only broke (but recovered naturally) during Trump's trade war. Still, the 1W MA100 (green trend-line) contained the downfall, as it always had.

Normally the Bearish Legs of this pattern tend to find Support on the 1W MA50 (blue

Mastercard Could Face ResistanceMastercard fell hard in June on the threat of stablecoin competition. Now, after a rebound, some traders may expect another push to the downside.

The first pattern on today’s chart is the selloff that began on June 13 when the Wall Street Journal reported that major retailers were considering sta

Who will win? Crypto or Dollar?How Stablecoin Payments Can Hurt Visa & Mastercard

Bypassing the Interchange System

-Stablecoins allow peer-to-peer or business-to-consumer payments without using credit/debit card rails.

-Visa & Mastercard earn billions from interchange fees (0.1%–3% per transaction). If people pay directly vi

Mastercard and Visa Shares Decline Due to Stablecoin BillMastercard (MA) and Visa (V) Shares Decline Due to Stablecoin Bill

Yesterday, we reported that the US Senate had passed the GENIUS stablecoin bill, which establishes a legal framework for regulating the stablecoin market. This development led to a sharp rise in the share price of cryptocurrency ex

A whole new type of cash back offer - LONG at 562.03I've posted ideas about MA before. I will continue posting buy ideas about MA until the final breath leaves my body. The average credit card APR is 24.3% - I think this trade can do better. Around 60% APR on average, with a good chance at 270%+ APR.

MA is in a multi-year uptrend, only 2 days re

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MA4970636

Mastercard Incorporated 3.3% 26-MAR-2027Yield to maturity

—

Maturity date

Mar 26, 2027

MA5142474

Mastercard Incorporated 1.9% 15-MAR-2031Yield to maturity

—

Maturity date

Mar 15, 2031

MA4970637

Mastercard Incorporated 3.35% 26-MAR-2030Yield to maturity

—

Maturity date

Mar 26, 2030

MA5552137

Mastercard Incorporated 4.875% 09-MAR-2028Yield to maturity

—

Maturity date

Mar 9, 2028

MA5808459

Mastercard Incorporated 4.875% 09-MAY-2034Yield to maturity

—

Maturity date

May 9, 2034

MA5552138

Mastercard Incorporated 4.85% 09-MAR-2033Yield to maturity

—

Maturity date

Mar 9, 2033

MA4970638

Mastercard Incorporated 3.85% 26-MAR-2050Yield to maturity

—

Maturity date

Mar 26, 2050

MA5885399

Mastercard Incorporated 4.1% 15-JAN-2028Yield to maturity

—

Maturity date

Jan 15, 2028

MA6009561

Mastercard Incorporated 4.95% 15-MAR-2032Yield to maturity

—

Maturity date

Mar 15, 2032

MA6009559

Mastercard Incorporated FRN 15-MAR-2028Yield to maturity

—

Maturity date

Mar 15, 2028

MA6009560

Mastercard Incorporated 4.55% 15-MAR-2028Yield to maturity

—

Maturity date

Mar 15, 2028

See all MA bonds