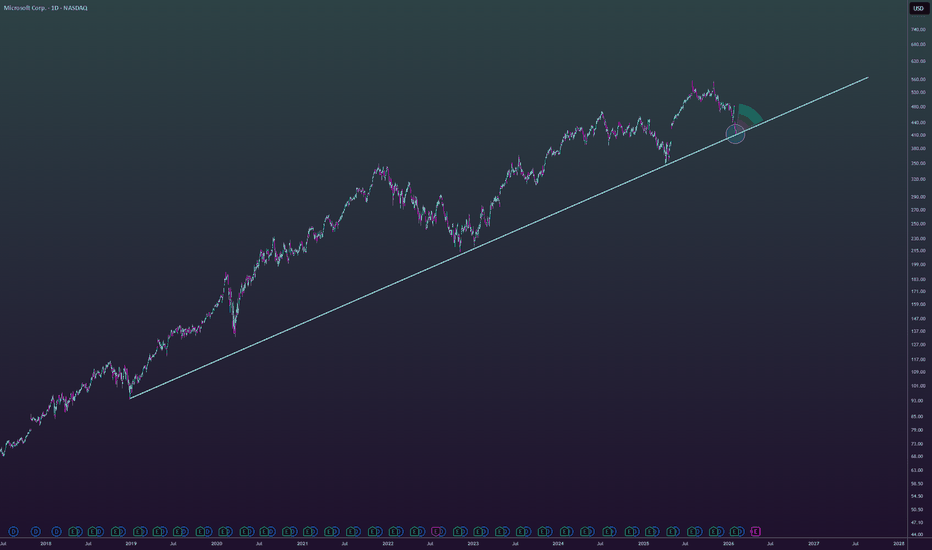

$MSFT I expect further downsideI see a lot of investors buying NASDAQ:MSFT , but in my view it’s far too early. The technical structure is still bearish, and I expect further downside.

On the fundamental side, Microsoft Office will become far less essential as AI increasingly automates these tasks. Despite the Copilot narrative

Microsoft Corp.

No trades

Key facts today

Microsoft (MSFT) saw a 13.9% drop in stock price over two weeks, losing $481.3 billion in market cap. It now trades at 22.3 times forward earnings, below its five-year average.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

12.72 CHF

80.79 B CHF

223.52 B CHF

7.32 B

About Microsoft Corp.

Sector

Industry

CEO

Satya Nadella

Website

Headquarters

Redmond

Founded

1975

IPO date

Mar 13, 1986

Identifiers

3

ISIN US5949181045

Microsoft Corp engages in the development and support of software, services, devices, and solutions. It operates through the following business segments: Productivity and Business Processes; Intelligent Cloud; and More Personal Computing. The Productivity and Business Processes segment comprises products and services in the portfolio of productivity, communication, and information services of the company spanning a variety of devices and platform. The Intelligent Cloud segment refers to the public, private, and hybrid serve products and cloud services of the company which can power modern business. The More Personal Computing segment encompasses products and services geared towards the interests of end users, developers, and IT professionals across all devices. The firm also offers operating systems; cross-device productivity applications; server applications; business solution applications; desktop and server management tools; software development tools; video games; personal computers, tablets; gaming and entertainment consoles; other intelligent devices; and related accessories. The company was founded by Paul Gardner Allen and William Henry Gates III in 1975 and is headquartered in Redmond, WA.

Related stocks

ReversalThe price closes the session at the lower boundary of the parallel channel highlighted in yellow, within which it has been moving for the past 4 years.

It is possible (and also likely) that a reversal may occur at this support level, offering an entry or accumulation opportunity.

In the event of a

MSFT Near a Decision Area — How I’m Approaching Feb 21-Hour View — Setting the Context

On the 1-hour timeframe, MSFT is still in a bearish structure. Price has been making lower highs, and the recent bounce doesn’t change that yet. It looks more like a pause after selling rather than a confirmed reversal.

As long as price stays below the downward chan

MSFT AnalysisMSFT Analysis: Wave 4 Correction or Bear Trap? 📉🚀

Microsoft is currently at a critical junction. While the recent price action looks scary, the bigger picture suggests we are witnessing a classic Elliott Wave 4 correction rather than a trend reversal.

Key Technical & Fundamental Insights:

• The "Sha

Buy The Dip in this MAG7 StockMicroSoft looks like a better value with Meta at a close second. Support coming into the low 400s into a log trend line after a rapid sell off from their Q4 earnings report.

Forward P/E Ratio,Meta Platforms (~20x),Microsoft (~25x–26x)

PEG Ratio,Microsoft (~1.15),Leader (Best value relative to

MSFT Long Term Setup with ConfluenceStarting from the monthly chart, MSFT presents a very rare technical feature: a large upside gap from April 2025 to May 2025. Gaps on monthly timeframes are rare; therefore, increasing the probability of a future fill before a continuation higher.

Historically, MSFT has respected the Monthly 50 EMA

Microsoft (MSFT) Macro Correction Aheadhi traders,

This analysis of the Microsoft ( NASDAQ:MSFT ) monthly chart identifies a bearish technical pattern that suggests a significant correction is imminent, likely forming a necessary higher low before the continuation of the macro bull market.

Key Technical Observations

Rising Wedge Patte

Microsoft - The worst day in 5 years!🚀Microsoft ( NASDAQ:MSFT ) remains bullish despite the crash:

🔎Analysis summary:

Today Microsoft created its worst day in five years. But at the same time, Microsoft is also approaching a significant confluence of support. And if we soon see bullish confirmation, Microsoft will just create an

Microsoft | MSFT | Long at $421.50Technical Analysis

Microsoft's NASDAQ:MSFT stock price entered its historical simple moving average area last week. This regression to the mean for high-growth companies with forward momentum is often, but not always, an area of support (currently between $407 and $435). I suspect ongoing near

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ATVI4499883

Activision Blizzard, Inc. 4.5% 15-JUN-2047Yield to maturity

6.31%

Maturity date

Jun 15, 2047

ATVI5026499

Activision Blizzard, Inc. 2.5% 15-SEP-2050Yield to maturity

6.11%

Maturity date

Sep 15, 2050

See all MSFT bonds

Frequently Asked Questions

The current price of MSFT is 310.00 CHF — it has decreased by −2.75% in the past 24 hours. Watch Microsoft Corp. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SIX exchange Microsoft Corp. stocks are traded under the ticker MSFT.

MSFT stock has fallen by −16.10% compared to the previous week, the month change is a −17.63% fall, over the last year Microsoft Corp. has showed a 137.44% increase.

We've gathered analysts' opinions on Microsoft Corp. future price: according to them, MSFT price has a max estimate of 568.31 CHF and a min estimate of 305.18 CHF. Watch MSFT chart and read a more detailed Microsoft Corp. stock forecast: see what analysts think of Microsoft Corp. and suggest that you do with its stocks.

MSFT reached its all-time high on Dec 8, 2025 with the price of 394.91 CHF, and its all-time low was 22.25 CHF and was reached on Nov 20, 2008. View more price dynamics on MSFT chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

MSFT stock is 2.82% volatile and has beta coefficient of 0.95. Track Microsoft Corp. stock price on the chart and check out the list of the most volatile stocks — is Microsoft Corp. there?

Today Microsoft Corp. has the market capitalization of 2.32 T, it has increased by 3.89% over the last week.

Yes, you can track Microsoft Corp. financials in yearly and quarterly reports right on TradingView.

Microsoft Corp. is going to release the next earnings report on Apr 28, 2026. Keep track of upcoming events with our Earnings Calendar.

MSFT earnings for the last quarter are 3.28 CHF per share, whereas the estimation was 3.10 CHF resulting in a 6.00% surprise. The estimated earnings for the next quarter are 3.15 CHF per share. See more details about Microsoft Corp. earnings.

Microsoft Corp. revenue for the last quarter amounts to 64.43 B CHF, despite the estimated figure of 63.67 B CHF. In the next quarter, revenue is expected to reach 63.27 B CHF.

MSFT net income for the last quarter is 30.49 B CHF, while the quarter before that showed 22.10 B CHF of net income which accounts for 37.95% change. Track more Microsoft Corp. financial stats to get the full picture.

Yes, MSFT dividends are paid quarterly. The last dividend per share was 0.73 CHF. As of today, Dividend Yield (TTM)% is 0.85%. Tracking Microsoft Corp. dividends might help you take more informed decisions.

Microsoft Corp. dividend yield was 0.67% in 2025, and payout ratio reached 24.34%. The year before the numbers were 0.67% and 25.42% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 7, 2026, the company has 228 K employees. See our rating of the largest employees — is Microsoft Corp. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Microsoft Corp. EBITDA is 146.47 B CHF, and current EBITDA margin is 57.74%. See more stats in Microsoft Corp. financial statements.

Like other stocks, MSFT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Microsoft Corp. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Microsoft Corp. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Microsoft Corp. stock shows the buy signal. See more of Microsoft Corp. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.