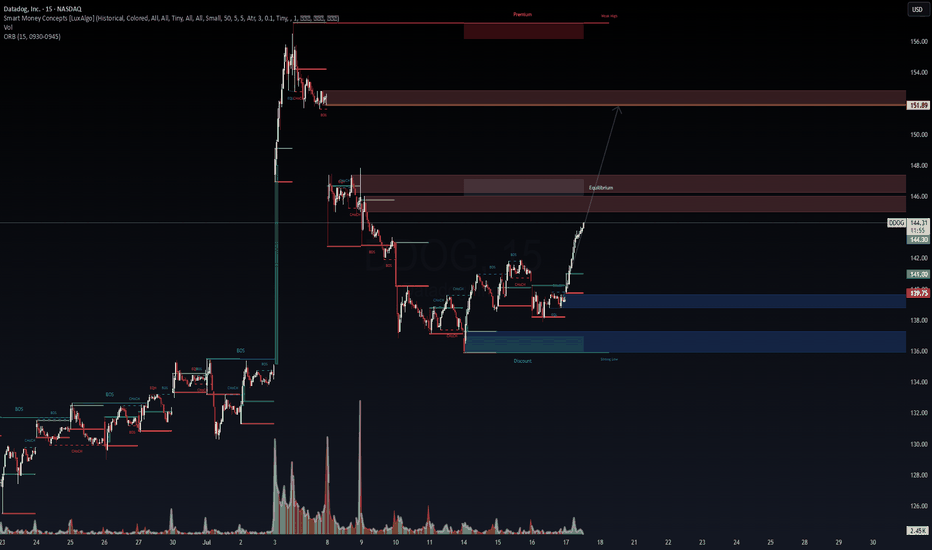

Last time I played this same set up I made some good money!We all know the markets bullish right now.

If your shorting, your most likely scalping or completely cooking yourself trying to catch big moves.

Trust me, I have spy puts open right now as a hedge and they are down 70%...

Look to the left on my chart. Thats the last time I played DDOG and it was

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.32 EUR

177.49 M EUR

2.59 B EUR

313.36 M

About Datadog, Inc.

Sector

Industry

CEO

Olivier Pomel

Website

Headquarters

New York

Founded

2010

ISIN

US23804L1035

FIGI

BBG00V5LV9Y8

Datadog, Inc. engages in the development of a monitoring and analytics platform for developers, information technology operations teams and business users. Its platform integrates and automates infrastructure monitoring, application performance monitoring and log management to provide real-time observability of its customers' entire technology stack. The company was founded by Olivier Pomel and Alexis Lê-Quôc on June 4, 2010 and is headquartered in New York, NY.

Related stocks

DDOG | Strong Momentum | LONGDatadog, Inc. engages in the development of a monitoring and analytics platform for developers, information technology operations teams and business users. Its platform integrates and automates infrastructure monitoring, application performance monitoring and log management to provide real-time obse

DDOG eyes on $116.34: Golden Genesis fib to determine the TrendDDOG bounce just hit a Golden Genesis at $116.34

The sister Goldens above and below marked extremes.

This one could mark the orbital center for some time.

It is PROBABLE that we orbit this fib a few times.

It is POSSIBLE that we see a pullback from here.

It is PLAUSIBLE but unlikely to continue non

DDOG 15m – Discount Reversal Targeting $151.89 | VolanX Protocol📈 Datadog (DDOG) has completed a clean bullish structural shift off a deep discount zone, rejecting institutional demand around the $137–139 range. Now breaking above key internal CHoCH and BOS levels, price is accelerating into equilibrium, suggesting momentum is building toward premium inefficienc

DDOG: Navigating Key Support and Resistance ZonesAscending Trendline/Channel:

o A prominent green ascending trendline, starting from the lows in April, defines the current bullish momentum.

o This trendline has acted as dynamic support, with the price bouncing off it on multiple occasions. As long as the price remains above this line, the interme

DDOG - Recent entry to S&P500, looking for entry point on $150+I've started looking into #DDOG with its recent addition into the S&P500. The current chart setup looks like a cup and handle. It will be re-testing the 150 and 160 level. If it can break out beyond $155, it has momentum to climb higher with more institutional investors coming in. Note it has been

Datadog's S&P 500 Entry: A New Tech Paradigm?Datadog (DDOG), a leading cloud observability platform, recently marked a significant milestone with its inclusion in the S&P 500 index. This pivotal announcement, made on July 2, 2025, confirmed Datadog's replacement of Juniper Networks (JNPR), effective before the opening of trading on Wednesday,

Destination 160$The price is moving within a compression triangle and has turned bullish again above the purple trendline.

It may break out immediately to the upside, or it could continue moving for a few days or weeks between the two horizontal light blue trendlines before the breakout.

After the breakout, the ta

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where 3QD is featured.

Software stocks: US companies at our finger tips

49 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of 3QD is 117.12 EUR — it has decreased by −3.40% in the past 24 hours. Watch Datadog, Inc. Class A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SWB exchange Datadog, Inc. Class A stocks are traded under the ticker 3QD.

3QD stock has risen by 4.05% compared to the previous week, the month change is a −4.18% fall, over the last year Datadog, Inc. Class A has showed a 11.25% increase.

We've gathered analysts' opinions on Datadog, Inc. Class A future price: according to them, 3QD price has a max estimate of 196.54 EUR and a min estimate of 89.72 EUR. Watch 3QD chart and read a more detailed Datadog, Inc. Class A stock forecast: see what analysts think of Datadog, Inc. Class A and suggest that you do with its stocks.

3QD stock is 0.02% volatile and has beta coefficient of 1.51. Track Datadog, Inc. Class A stock price on the chart and check out the list of the most volatile stocks — is Datadog, Inc. Class A there?

Today Datadog, Inc. Class A has the market capitalization of 40.71 B, it has increased by 5.88% over the last week.

Yes, you can track Datadog, Inc. Class A financials in yearly and quarterly reports right on TradingView.

Datadog, Inc. Class A is going to release the next earnings report on Oct 30, 2025. Keep track of upcoming events with our Earnings Calendar.

3QD earnings for the last quarter are 0.39 EUR per share, whereas the estimation was 0.35 EUR resulting in a 12.12% surprise. The estimated earnings for the next quarter are 0.39 EUR per share. See more details about Datadog, Inc. Class A earnings.

Datadog, Inc. Class A revenue for the last quarter amounts to 701.84 M EUR, despite the estimated figure of 671.59 M EUR. In the next quarter, revenue is expected to reach 728.20 M EUR.

3QD net income for the last quarter is 2.25 M EUR, while the quarter before that showed 22.78 M EUR of net income which accounts for −90.13% change. Track more Datadog, Inc. Class A financial stats to get the full picture.

No, 3QD doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Sep 2, 2025, the company has 6.5 K employees. See our rating of the largest employees — is Datadog, Inc. Class A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Datadog, Inc. Class A EBITDA is 68.29 M EUR, and current EBITDA margin is 6.01%. See more stats in Datadog, Inc. Class A financial statements.

Like other stocks, 3QD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Datadog, Inc. Class A stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Datadog, Inc. Class A technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Datadog, Inc. Class A stock shows the buy signal. See more of Datadog, Inc. Class A technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.