Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.38 EUR

5.65 B EUR

39.00 B EUR

1.67 B

About Commonwealth Bank of Australia

Sector

Industry

CEO

Matthew Comyn

Website

Headquarters

Sydney

Founded

1991

Identifiers

2

ISIN:AU000000CBA7

Commonwealth Bank of Australia engages in the provision of banking and financial services. It operates through the following segments: Retail Banking Services, Business Banking, Institutional Banking and Markets, New Zealand, Corporate Centre and Other, and Wealth Management. The Retail Banking Services segment provides home loan, consumer finance, and retail deposit products and servicing to all retail bank customers and non-relationship managed small business customers. The Business Banking segment offers specialized banking services to relationship managed business and Agribusiness customers, private banking to high-net-worth individuals, and margin lending and trading through CommSec. The Institutional Banking and Markets segment serves the firm's major corporate, institutional, and government clients using a relationship management model based on industry expertise and insights. The New Zealand segment comprises of banking, funds management, and insurance businesses operating in New Zealand. The Corporate Centre and Other segments include support functions such as investor relations, group marketing and strategy, group governance, and group treasury. The Wealth Management segment includes the global asset management, platform administration, and financial advice and life and general insurance businesses of the Australian operations. The company was founded in 1911 and is headquartered in Sydney, Australia.

Related stocks

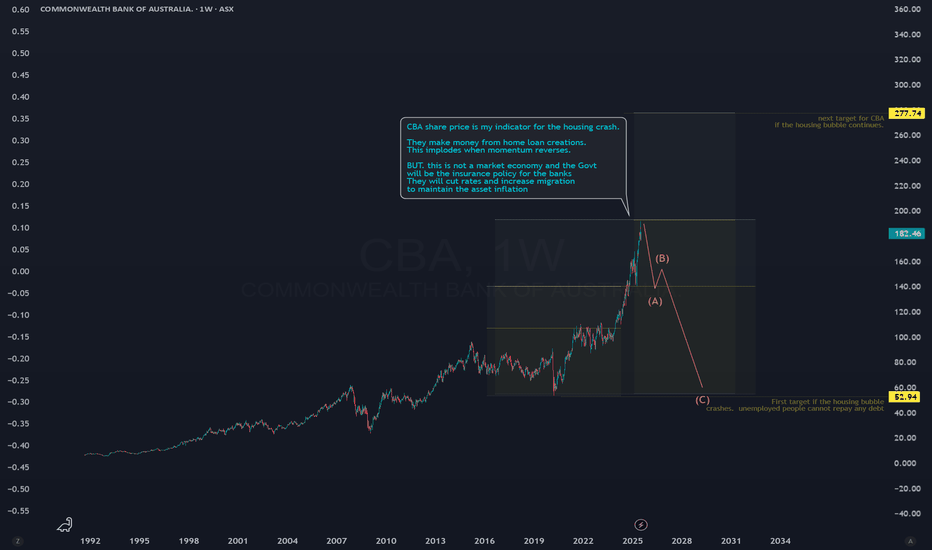

Buy CBA at 160BA is approaching a long-term horizontal support level at $160, which has acted as a strong floor multiple times in the past.

Technical View:

Support Zone: $160–$161 (historical demand zone since mid-2023).

Trend Context: Price has been in a sideways range between $160 and $175, consolidating aft

$CBA in a Strong Uptrend: Long at $162!Commonwealth Bank of Australia ( ASX:CBA ) is showing a “Strong Uptrend” on a 1-week chart. 📈 We bought at $126.49 and sold at $159.24 previously. Now at $162.98, we’re in a long position at $162. With a Trend Score of 8/8 and 100% signal alignment, the projected price is $166.2 ( +1.1% ), suppor

Short Commonwealth Bank of Australia at 156.25 Target 132Hello Followers

Id like to take another shot at shorting CBA here due to the interesting risk reward setup.

I had failed trying to short this once in the 130's and have been patient waiting for another setup.

Fundamental Reasons:

-Potential rolling over of the Australian housing market.

-Extr

Buying idea CBACBA just like the WBC bouncing back from 50 day moving avg. market sentiment positive and these two shares should see taking off again to highs we show few weeks a go. stop at 132.

DISCLAIMER : The content and materials featured are for your information and education only and are not attended to

CBA extreme downside risk2024 dividend per share annual, $4.65. Current share price $159.03 If you are an investor you are paying 34.2 times the div return with substanstial risk. Should you choose to put the $159.03 into a 5% term deposit with zero risk your return will be $7.95 being nearly double the return with zero ris

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

XS180718354

Commonwealth Bank of Australia 9.0% 18-APR-2028Yield to maturity

8.28%

Maturity date

Apr 18, 2028

CBAU5766460

Commonwealth Bank of Australia 5.837% 13-MAR-2034Yield to maturity

5.88%

Maturity date

Mar 13, 2034

CBAU4583829

Commonwealth Bank of Australia 4.316% 10-JAN-2048Yield to maturity

5.62%

Maturity date

Jan 10, 2048

USQ2704MAF5

Commonwealth Bank of Australia 3.305% 11-MAR-2041Yield to maturity

5.60%

Maturity date

Mar 11, 2041

US2027A1JN8

Commonwealth Bank of Australia 3.9% 12-JUL-2047Yield to maturity

5.36%

Maturity date

Jul 12, 2047

CBAAU4881224

Commonwealth Bank of Australia 3.743% 12-SEP-2039Yield to maturity

5.26%

Maturity date

Sep 12, 2039

CBAAU5766461

Commonwealth Bank of Australia 5.837% 13-MAR-2034Yield to maturity

5.01%

Maturity date

Mar 13, 2034

USQ2704MAD0

Commonwealth Bank of Australia 2.688% 11-MAR-2031Yield to maturity

4.73%

Maturity date

Mar 11, 2031

CBAAU5373848

Commonwealth Bank of Australia 3.784% 14-MAR-2032Yield to maturity

4.67%

Maturity date

Mar 14, 2032

CBAU6023899

Commonwealth Bank of Australia 4.608% 14-MAR-2030Yield to maturity

4.52%

Maturity date

Mar 14, 2030

See all CWW bonds

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on SWB exchange Commonwealth Bank of Australia stocks are traded under the ticker CWW.

We've gathered analysts' opinions on Commonwealth Bank of Australia future price: according to them, CWW price has a max estimate of 82.45 EUR and a min estimate of 54.25 EUR. Watch CWW chart and read a more detailed Commonwealth Bank of Australia stock forecast: see what analysts think of Commonwealth Bank of Australia and suggest that you do with its stocks.

Yes, you can track Commonwealth Bank of Australia financials in yearly and quarterly reports right on TradingView.

Commonwealth Bank of Australia is going to release the next earnings report on Feb 11, 2026. Keep track of upcoming events with our Earnings Calendar.

CWW earnings for the last half-year are 1.66 EUR per share, whereas the estimation was 1.71 EUR, resulting in a −2.44% surprise. The estimated earnings for the next half-year are 1.78 EUR per share. See more details about Commonwealth Bank of Australia earnings.

Commonwealth Bank of Australia revenue for the last half-year amounts to 8.02 B EUR, despite the estimated figure of 7.97 B EUR. In the next half-year revenue is expected to reach 8.39 B EUR.

CWW net income for the last half-year is 2.78 B EUR, while the previous report showed 3.07 B EUR of net income which accounts for −9.36% change. Track more Commonwealth Bank of Australia financial stats to get the full picture.

Commonwealth Bank of Australia dividend yield was 2.63% in 2025, and payout ratio reached 80.16%. The year before the numbers were 3.65% and 81.96% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Dec 12, 2025, the company has 51.35 K employees. See our rating of the largest employees — is Commonwealth Bank of Australia on this list?

Like other stocks, CWW shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Commonwealth Bank of Australia stock right from TradingView charts — choose your broker and connect to your account.