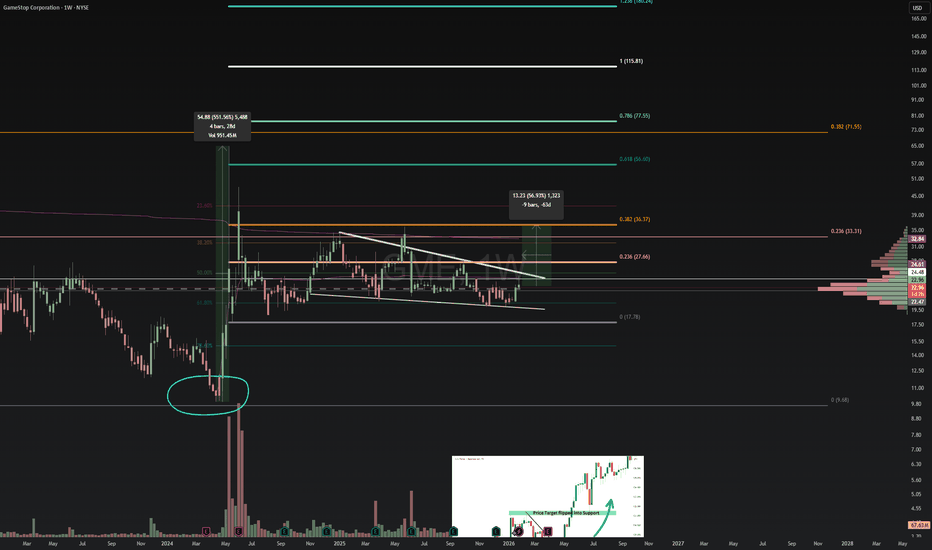

Gamestop: Got To Love ItWell hasn't the narrative changed around GME

I've been WRONG and MORE WRONG about almost everything regarding pure timing with this one

But what I havent been wrong about is the fact that I said all last year that GME would hold that 20-22 region

What Im also not wrong on is the fact that there i

GameStop Corp. Class A

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.815 EUR

126.77 M EUR

3.69 B EUR

408.20 M

About GameStop Corporation

Sector

Industry

CEO

Ryan Cohen

Website

Headquarters

Grapevine

Founded

1996

IPO date

Feb 12, 2002

Identifiers

3

ISIN US36467W1099

GameStop Corp. engages in offering games and entertainment products through its ecommerce properties and stores. The firm’s stores and ecommerce sites operate primarily under the names GameStop, EB Games, and Micromania. It operates through the following geographical segments: United States, Canada, Australia, and Europe. The company was founded by Daniel A. DeMatteo in 1996 and is headquartered in Grapevine, TX.

Related stocks

$GME Cycle Swap BULLISHPrice previously made strong impulsive moves off long-term support and is now consolidating without breaking structure. If this resolves upward, the first reaction area is around 27.50, followed by 32 and then 40 based on prior resistance, with a higher-risk extension toward 55 if momentum expands.

GME Bulls Reloading? MA Breakout Strategy Explained🎮 GAMESTOP (NYSE: GME) — "THIEF HEIST LAYERING STRATEGY" 💰

Multi-Entry Breakout Accumulation Playbook | Day/Swing Trading

🔥 "THE GRAND THEFT PROFIT OPERATION" — Executive Setup

Current Market Data ✅ Feb 4, 2026 — Real-Time Feed

Price: $24.52 | Range: $23.84 - $26.09 (Today) | Trend: Bullish Momentu

GAMESTOP Coiling While Market Waits on Cohen’s Next MoveI'm bullish NYSE:GME now, with that I bought some $28 call contracts last Friday before market closed.

Why?

1. High-profile insider buying

2. Burry’s accumulation and long-term angle

3. Big acquisition narrative from Cohen (this is the moment of truth)***

***Market likes surprises. The first 2

GameStop (GME) Ryan CohenP/E (TTM),~25.7x,HIGH ⚠️. The market is paying a premium for cash and volatility.

Forward P/E,~22.0x,Based on EPS estimates of around $1.00 in 2026

Free Cash Flow,~$130 - $160 million,POSITIVE ✅. They are managing to generate cash after the layoffs.

ROE,~9.4%,LOW ❌.

Debt/Equity,~0.78 (or 0.01 withou

GME Eyes Big Acquisition: Bullish Targets AheadGME’s CEO recently hinted at a major strategic acquisition—an exciting signal of potential growth and market expansion.

In the chart, I’ve highlighted key short-to-medium term price targets, assuming the stock maintains its current bullish momentum. If the trend holds, it could open up compelling o

$GME Only UpI strongly believe we’re on the edge of an aggressive move upward in the coming weeks. The recent convertible notes were for a large amount—with no detailed breakdown of where that money is going. Could Ryan be planning an acquisition? A major expansion? No one knows for sure.

But here's what we do

Time to riseTime to rise, weekly chart buy, expect 30 usd +

GameStop Corp. offers games and entertainment products through its ecommerce properties and stores. It operates through the following geographic segments: United States, Canada, Australia, and Europe. Each segment consists primarily of retail operatio

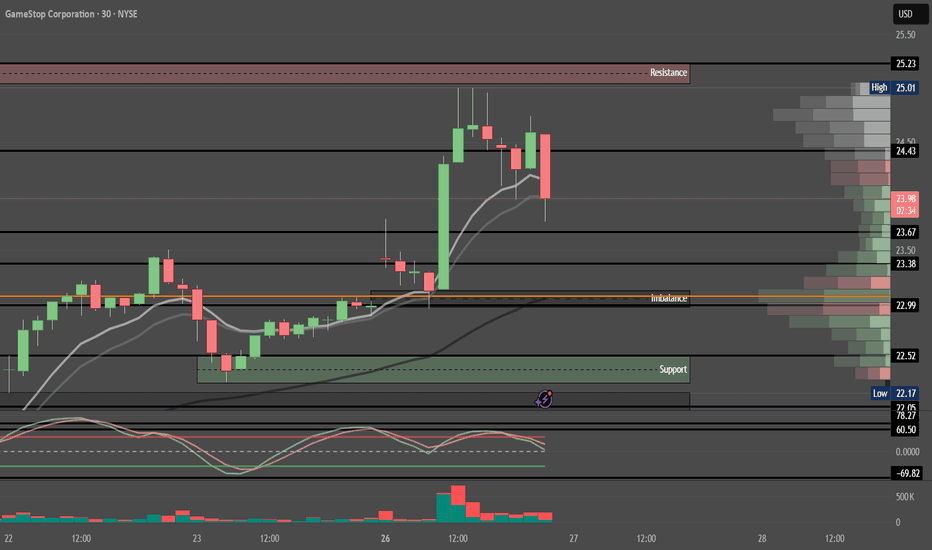

GME News Pop into Supply — Buy the Rumor, Sell the News SetupNYSE:GME 📊 | Buy the Rumor, Sell the News?

🔴 Resistance / Supply

• 24.64 → 25.01

• 25.23 (major sell zone)

🟢 Support / Demand

• 22.99 (imbalance / decision level)

• 22.52 → 22.05

• 21.45 (major support)

Trade the reaction — not the headline 🎯

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of GS2C is 21.135 EUR — it has increased by 0.86% in the past 24 hours. Watch GameStop Corp. Class A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SWB exchange GameStop Corp. Class A stocks are traded under the ticker GS2C.

GS2C stock has risen by 8.57% compared to the previous week, the month change is a 20.18% rise, over the last year GameStop Corp. Class A has showed a −11.51% decrease.

GS2C reached its all-time high on Jan 28, 2021 with the price of 104.600 EUR, and its all-time low was 0.600 EUR and was reached on Apr 3, 2020. View more price dynamics on GS2C chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

GS2C stock is 4.68% volatile and has beta coefficient of 0.53. Track GameStop Corp. Class A stock price on the chart and check out the list of the most volatile stocks — is GameStop Corp. Class A there?

Today GameStop Corp. Class A has the market capitalization of 9.50 B, it has decreased by −1.96% over the last week.

Yes, you can track GameStop Corp. Class A financials in yearly and quarterly reports right on TradingView.

GameStop Corp. Class A is going to release the next earnings report on Mar 31, 2026. Keep track of upcoming events with our Earnings Calendar.

GS2C earnings for the last quarter are 0.21 EUR per share, whereas the estimation was 0.17 EUR resulting in a 20.00% surprise. The estimated earnings for the next quarter are 0.31 EUR per share. See more details about GameStop Corp. Class A earnings.

GameStop Corp. Class A revenue for the last quarter amounts to 711.61 M EUR, despite the estimated figure of 855.74 M EUR. In the next quarter, revenue is expected to reach 1.24 B EUR.

GS2C net income for the last quarter is 66.83 M EUR, while the quarter before that showed 147.69 M EUR of net income which accounts for −54.75% change. Track more GameStop Corp. Class A financial stats to get the full picture.

GameStop Corp. Class A dividend yield was 0.00% in 2024, and payout ratio reached 0.00%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 8, 2026, the company has 6 K employees. See our rating of the largest employees — is GameStop Corp. Class A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. GameStop Corp. Class A EBITDA is 210.45 M EUR, and current EBITDA margin is 0.56%. See more stats in GameStop Corp. Class A financial statements.

Like other stocks, GS2C shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade GameStop Corp. Class A stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So GameStop Corp. Class A technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating GameStop Corp. Class A stock shows the buy signal. See more of GameStop Corp. Class A technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.