#SXP/USDT looking extremely bullish #SXP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.1580, which represents a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.1619

First target: 0.1637

Second target: 0.1662

Third target: 0.1691

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Trade ideas

SXP/USDT — Triangle Nearing Breakout, Bullish or Bearish?🔎 Summary

SXP/USDT is currently trading within a long-term contracting triangle pattern that has formed since late 2024. This setup indicates reduced volatility and energy build-up. As the price approaches the apex of the triangle, the probability of a strong breakout — either bullish or bearish — becomes increasingly high.

The latest close is around 0.1809 USDT, right at a critical decision zone.

---

🧩 Pattern & Key Technical Levels

Main pattern: Contracting triangle (lower highs + flat/slightly rising support).

Key support zone: 0.16–0.18 (highlighted yellow box).

Major structural low: 0.1416 USDT.

Step resistances (dashed lines):

0.2244 → 0.2536 → 0.2951 → 0.3836 → 0.4632 (with a major high at 0.4824).

Volume condition: Declining volume indicates market indecision. A confirmed breakout should come with a strong volume spike.

---

🚀 Bullish Scenario

Confirmation:

2D candle closes above 0.19–0.20.

Stronger confirmation once price breaks and holds above 0.2244 with notable volume.

Upside targets:

1. 0.2244 → first resistance.

2. 0.2536 → secondary psychological zone.

3. 0.2951 → major resistance, potential take-profit zone.

4. 0.3836 and 0.4632 → higher upside targets.

5. Measured move (aggressive target): Full triangle breakout could push price toward ~0.52 USDT.

---

🐻 Bearish Scenario

Confirmation:

2D close below 0.16 with failed retest.

Downside targets:

1. 0.1416 (major low).

2. If breakdown continues, market may seek new historical support below 0.13, though no clear structure is visible on this chart.

---

⚖️ Conclusion & Strategy

Neutral bias: As long as price remains inside the triangle, direction is undecided. Wait for breakout confirmation.

Bullish case: Safer entry above 0.2244 with strong volume.

Bearish case: Valid short setup if breakdown occurs below 0.16.

Note: Triangle breakouts often produce false moves (fakeouts) — always wait for candle close and volume confirmation.

---

📌 Key Notes for Traders

Apply risk management: risk only 1–3% of capital per trade.

Triangle breakouts tend to move fast and impulsively — use take-profit targets or trailing stops.

Keep an eye on overall crypto market sentiment, since SXP tends to follow BTC and ETH trends.

---

#SXP #SXPUSDT #Crypto #Breakout #TechnicalAnalysis #Altcoins #CryptoTrading #ChartAnalysis

sxp looking extremely bullish overall consolidating in symmetrical triangle, but recently bounced from bottom of triangle, and cleared multiple hurdles. now expecting rally towards consolidation range descending trendline, then will see price action reaction in that area, and will share further update.

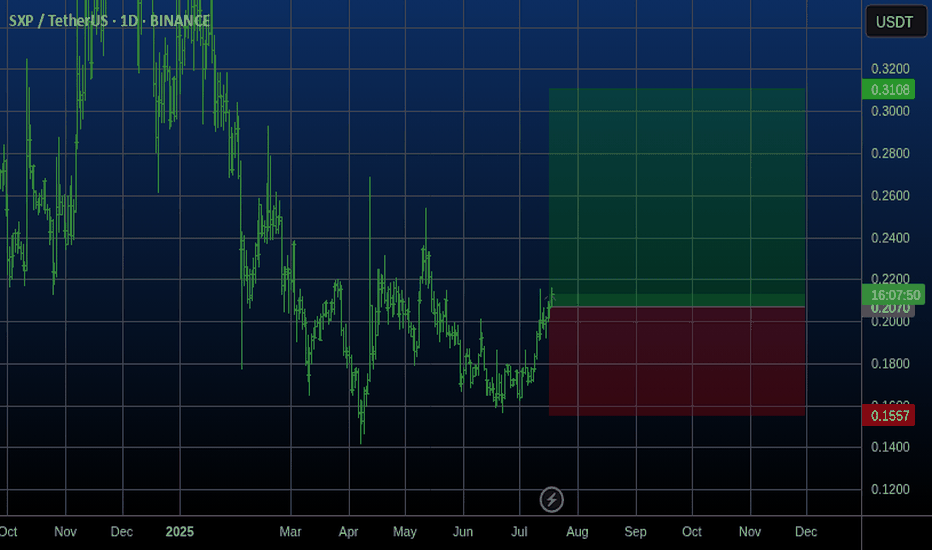

#SXP/USDT moment for try to Buy SXP .

#SXP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area (in green) at 0.1640, which represents a strong basis for the upside.

For inquiries, please leave a comment.

We are in a consolidation trend above the 100 moving average.

Entry price: 0.1772

First target: 0.1837

Second target: 0.1924

Third target: 0.2050

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#SXP/USDT moment for try to Buy SXP.#SXP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area (in green) at 0.1640, which represents a strong basis for the upside.

For inquiries, please leave a comment.

We are in a consolidation trend above the 100 moving average.

Entry price: 0.1772

First target: 0.1837

Second target: 0.1924

Third target: 0.2050

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Sxpusdt Buy opportunitySXPUSDT is showing signs of a potential falling wedge formation, with price breaking above the setup near the $0.3 level to reach a temporary high around $0.6. Following this, the price has begun a pullback, retesting the trendline of the falling wedge. The current bounce indicates a reaction at a major support level, presenting a favorable accumulation opportunity. The suggested accumulation zone, along with target levels, is marked on the chart.

Let us know your thoughts on this analysis.

SXPUSDT UPDATE

Pattern: Falling Wedge Breakout

Current Price: \$0.1836

Target Price: \$0.2470

Target % Gain: 35.20%

Technical Analysis: SXP has broken out of a falling wedge pattern on the 12H chart with a strong bullish candle and volume spike, confirming the breakout. This setup signals potential continuation to the upside.

Time Frame: 12H

#SXP/USDT#SXP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 0.1587.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.1624

First target: 0.1666

Second target: 0.1736

Third target: 0.1807

SXPUSDT | Clean Demand Zone BelowSXPUSDT is approaching a blue box that looks like a well-structured demand zone. The last reactions from this area were strong, and it may attract buyers again.

If price revisits that zone with low-timeframe confirmation, I’ll be watching closely. It’s not about predicting, it’s about reacting when the structure aligns.

“I will not insist on my short idea. If the levels suddenly break upwards and do not give a downward break in the low time frame, I will not evaluate it. If they break upwards with volume and give a retest, I will look long.”

Patience here could lead to precision. Let others rush. You wait with intent.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

SXP - Pivoting at 0.2100SXP is trading near 0.2100, which is at the lower end of its recent range between 0.1953 and 0.2357. This level seems to be a key pivot point, as the price is holding above the 100-period moving average, a line that has acted as support so far. However, the price is showing signs of consolidation, and a breakout or breakdown from this 0.2100 level will likely set the next direction. If SXP pushes above 0.2100 with strength, it could target resistance at 0.2258 and 0.2357. On the other hand, a drop below the 100-period moving average might lead to a decline toward support at 0.1953 or even 0.1820. Watch this 0.2100 zone closely for the next move.

Technical Indicators:

The Relative Strength Index (RSI) on the 4H timeframe is sitting at 76.5, which puts it in overbought territory. This suggests that the recent upward momentum might be overstretched, and a pullback could happen soon. Despite this, the price being above the 100-period moving average keeps the short-term outlook somewhat bullish. The overbought RSI, combined with the price nearing the upper part of its range, hints at possible selling pressure ahead. Traders should look for confirmation of direction before jumping in, as the risk of a correction is higher with these levels.

External Factors

The broader crypto market is currently volatile, with major coins like Bitcoin and Ethereum experiencing big swings. This choppiness could influence SXP’s price on the 4H chart, making its movements less predictable. There’s no specific news or event tied to SXP driving its price right now, so its direction will likely follow the overall market mood. Keep an eye on external market trends, as a sudden shift could spark a sharp reaction in SXP.

Potential Scenarios:

For a bullish setup, wait for a strong move above 0.2100 with volume to confirm momentum. If that happens, potential targets are 0.2258 and 0.2357. But with the RSI overbought, consider entering after a dip or clear breakout to avoid chasing. For a bearish setup, a break below the 100-period moving average could signal a short, aiming for 0.1953 and 0.1820 as downside targets.

#SXP/USDT#SXP

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.2030, which acts as strong support from which the price can rebound.

Entry price: 0.2115.

First target: 0.2190.

Second target: 0.2258.

Third target: 0.2357.

$SXPUSDT — Watching the Blue Box for the Next Decision PointI’ve had BINANCE:SXPUSDT on my radar today, not randomly — it’s one of the top gainers by volume percentage, which usually hints that the smart money has rotated into this chart.

🔵 Blue Box Support Zone in Play

We’re sitting just above a clear demand zone — the blue box marks where the last big impulse originated. This isn't retail-driven. That area was built on commitment.

We’ve already seen price test it once with a sharp wick and high absorption, and it’s quietly creeping back into that range again. If we get another test with selling pressure absorbed and delta divergence, I’ll be interested in entering long — but only after confirmation on the lower timeframes.

🔁 Possible Playbook

If price taps into the blue box again and forms a bullish structure on the 1m or 5m, with signs of exhaustion from sellers (volume fading on red candles), I’m in. That’s my long setup.

If price pierces through the box but reclaims it fast, especially on volume spike with low delta, that’s even stronger. That’s a liquidity hunt, and the trap has just been set.

If it fails and breaks clean below, I won’t touch the long.

I’ll wait to see if we get a retest from the underside for potential short continuation — again, only with confirmation.

I will not insist on my long idea.

If we break the level and don’t reclaim it with strong volume and confirmation, I’ll drop the bias.

If we break down and retest from below, I’ll look short instead.

🔍 Order Flow Clues

There’s already a subtle CDV divergence from the last low — buyers stepped in, but price didn’t follow. That’s usually front-running or large orders absorbing early.

Also saw a burst in volume on a down candle — that tells me someone's filling up while others panic. That’s the kind of stuff most traders miss.

💭 Final Word

This is the kind of setup people ignore until it moves 10% in one candle.

Then they chase it emotionally and get trapped on the wrong side.

Don’t be that guy.

If you miss this reclaim, you might regret it.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

SXPUSDT D1 Analysis | Rank : 264👀 Welcome to my Trading View Analysis and Trading Channel Here , we share the latest market analysis, trading signals, and key insights together .

Ready for smarter trades ? ⭐️

⚡️Today , we're going to analyze the SXP (Solar) coin together on the daily timeframe and find triggers for our positions .

The price chart has successfully broken out of the descending channel , signaling the end of the downtrend , and this breakout has been confirmed . Currently , the price is consolidating below a key horizontal resistance level , exhibiting back-and-forth volatility . At this stage , a bullish flag pattern is forming , which is a strong indication of potential price appreciation . If the price decisively breaks through this resistance , it could pave the way for a significant upward move , potentially targeting $0.40 . 👇🏻

More precisely , if the support at $0.1977 holds , we can be optimistic about this coin’s upward movement . Additionally , if the resistance at $0.2190 is closed above on the daily timeframe and a setup candle provides an entry signal for a spot trade , we can initiate a buy and open a long position . 🐈

I researched this coin on CoinMarketCap on your behalf , and I'm sharing a summary of the information I gathered .

Read carefully , as you need to have this information . 🌈

SXP (Solar) is the native cryptocurrency of the Solar Network, a blockchain platform focused on scalability, speed, and low-cost transactions. Here’s a brief overview:

- Purpose : SXP powers the Solar ecosystem, used for transaction fees , staking, and governance .

- Tech: Solar Network aims for high throughput with a Delegated Proof-of-Stake (DPoS) consensus , making it energy-efficient .

- Use Cases: Primarily for DeFi , payments , and dApps , with a focus on user-friendly wallet solutions .

- Market : As of my last data (Oct 2023) , SXP has a moderate market cap , often fluctuating with market trends . Check CoinMarketCap or CoinGecko for real-time price and volume .

- Community : Active development and partnerships , especially in payment processing and blockchain interoperability .

For trading or investment , check recent price action , volume, and on-chain metrics . Want specific details or analysis tips for SXP ? Let me know !

I love you all so much . 👀

don't forget about capital management and risk management .

Be careful with your positions . 🥇

#SXP/USDT#SXP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 0.1915.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.1979

First target: 0.2016

Second target: 0.2065

Third target: 0.2121