Brent Crude Oil | DailyBrent crude has been in a medium-term corrective phase since June 2025. Recent price action suggests this correction is nearing exhaustion.

The latest move below the previous low appears to be a liquidity sweep rather than a true bearish continuation, followed by a quick reaction from the lows, ind

About CFDs on Brent Crude Oil

The Brent Сrude oil was originally produced from the Brent oilfield in the North Sea. About 2/3rds of all crude oil contracts around the globe include Brent Сrude oil, making it the most popular marker. Its relatively low density and sulphur content are the reasons why it’s described as light and sweet. One of the advantages is transportation since this type of oil is waterborne. The Brent Crude oil marker is also known as Brent Blend, London Brent and Brent petroleum and has a UKOIL ticker symbol.

Brent uptrend supported at 6726The BRENT crude oil remains in a bullish trend, with recent price action showing signs of a consolidation within the broader uptrend.

Support Zone: 6726 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 6726 would confirm ongoin

The Silence Before the $70 Storm in Brent OilThe Silence Before the $70 Storm in Brent Oil

Look at the chart.

The energy market is holding its breath.

We are witnessing a classic standoff in Brent Crude.

A battle between two massive forces. And right now, nobody is winning.

🤔 On one side, we have the bears. Look at the yellow line

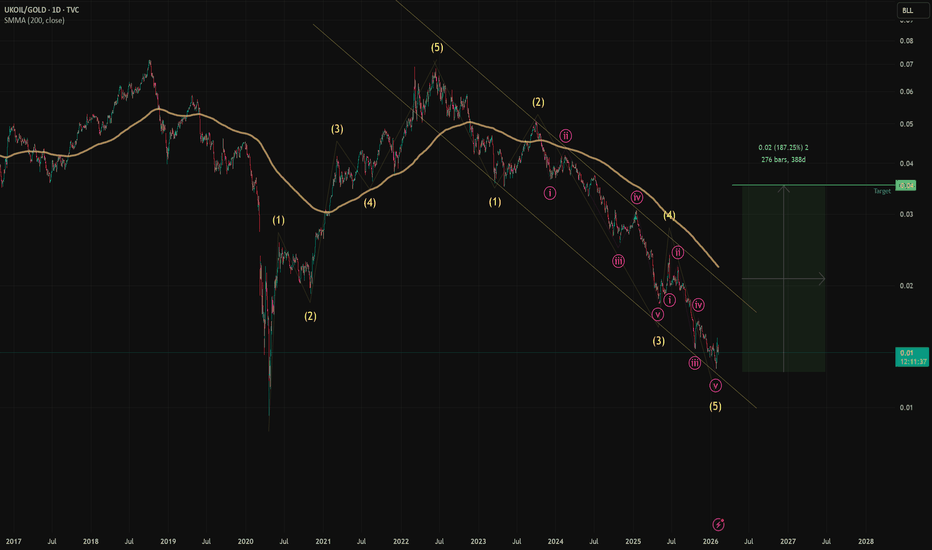

Accelerating Fiat Debasement: The Inevitable Path AheadThroughout history, whenever a new power rises to challenge global hegemony, incumbent nations shift toward protectionism. They raise tariff barriers to shield their internal economies from competition and often resort to conflict—either directly or via proxies—to disrupt their rivals. You can find

Brent Oil Setup: Pre-Talks Correction ScenarioBrent Crude OIL ( FX_IDC:USDBRO ), over the past two months, has been rising due to escalating tensions in the Middle East and the potential for conflict between Iran and the U.S. If these tensions materialize, global oil supply could be impacted—especially given the significance of the Strait of Ho

BCOUSD OIL Trend line break out, Low Risk trade LONGHI Traders!

This idea is based on several factors:

- Indicated falling trade line has been broken

- Daily RSI above the 50

-Political situation, and other economical reasons to believe proce will go up

My prediction and speculation on the price is based on Fib levels hence TP as indicated at 88USD

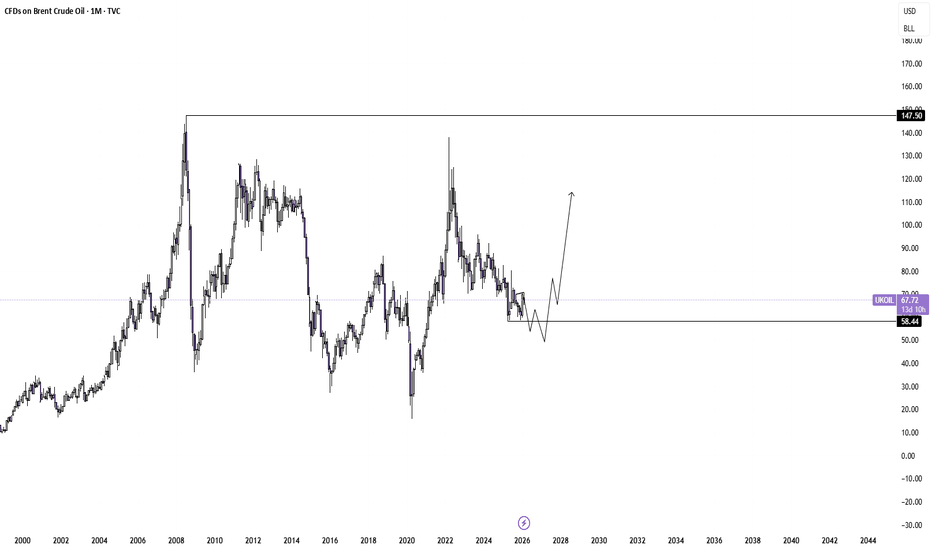

Long term idea on UKOILI expect one more liquidity sweep to form a new low before price breaks structure and initiates a sustained move higher. The groundwork for this shift has been forming for years, and the expansion phase now seems close. I believe we will see new ATH and potential for price to reach 240.

This oil does not show a good outlook...This oil does not show a good outlook???

It may be due to the policies of seizure (you read theft) of oil wells, and after the seizure of oil, we had up to 3 times the price in history, which has become expensive to cover the costs of shameless war by killing children and men and of course women in

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.