Uniswap (UNI): 2 Bullish CME Gaps To Fill SoonUNI update: we’re still waiting for a clean BOS. The bullish CME gaps are yet to be filled—first around 10.2 and the bigger one near 11.3–11.5.

As long as buyers defend the EMAs and we see that breakout, we’ll look for continuation into those levels. Patience is key here; the gameplan stays the sa

UNIUSDT About to Explode or Break Traders’ Dreams?Yello Paradisers, is #UNIUSDT quietly preparing for its next major rally, or are we sitting right on the edge of a painful trap for impatient traders? Let’s break it down.

💎#UNI has been holding within its ascending channel, bouncing consistently from its demand zone around $9–$9.50. Every retest o

UNIUSDT — Value Slips Under 9.35, Who Holds the Floor?UNI’s auction looks like a bar with a strict bouncer: every rally into 9.7 gets thrown out, while the crowd drifts back toward 9.2. Let’s map the value bands.

High Timeframes (Weekly → 2D → 12H)

– Weekly: Rejecting 10–11 supply. Demand 8.6–9.0, deeper 7.6–8.0.

– 2D: LH sequence into 9.0–9.3 floor.

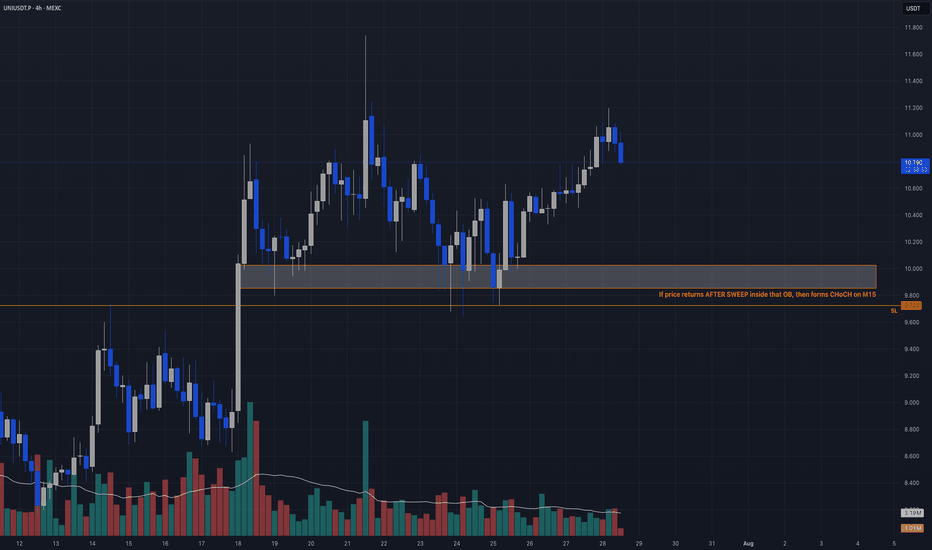

Liquidity Sweep + OB Retest → CHoCH TriggerCandle Craft fam — we’ve got a clean and calculated setup unfolding on UNIUSDT.P (4H). This one fits our criteria perfectly: structure, sweep, and planned trigger. No rush. We wait for the market to show its hand.

⸻

📈 Bias: Long

🧠 Strategy: Liquidity Sweep + OB Retest → CHoCH Trigger

📍 Entry Plan

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.