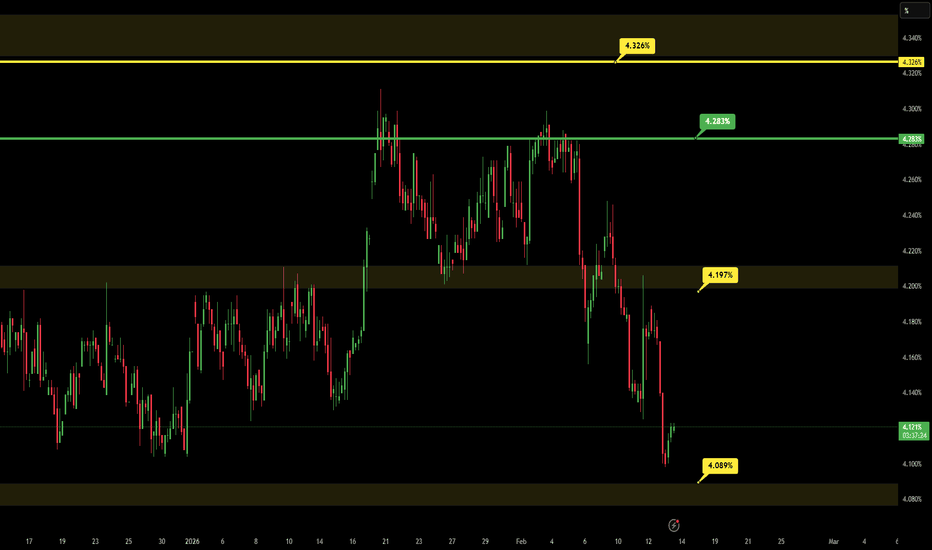

US 10Y TREASURY: back to 4,2%U.S. Treasury yields edged lower this week as investors weighed the health of the economy and softer labor market signals, with the 10-year Treasury yield dipping toward around 4.2%, its lowest in about three weeks. This week only JOLTs Job Openings were posted at a level strongly lower from expecta

US Government Bonds 10 YR Yield

No trades

Related bonds

US10Y Daily priceaction and directional bias.US10Y is the yield on the U.S .10-year treasury notes government debt security maturing in 10 years that serves as a global benchmark for interest rates, reflecting investors expectations on growth ,inflation and federal reserve policy.

The US10Y represents the effective return investors demand to l

The Truth Behind Rising Rates (US10Y Time Wave Analysis update)Hello. It has been a long time since I last greeted you.

I am now living a new life. I have come to share the truth with you.

First, based on my past experience in market analysis, I would like to briefly review the current U.S. 10-year Treasury yield.

The blue support line at the bottom is a long

US 10Y TREASURY: Warsh nomination eased yieldsThere has been two important news for investors during the previous week. The first was related to the FOMC Meeting, where the Fed decided to hold interest rates, which was highly expected. The second important news was related to the nomination of Kevin Warsh as the next Fed Chair in May. Markets g

Liquidity Trickle at RiskThis dashboard is built around a simple idea: short-term funding can look calm while liquidity support quietly fades . The top-left panel, FRED:SOFR − FRED:EFFR , is the “plumbing alarm.” When it rises, secured funding is getting more expensive relative to unsecured funding—often a sign that cas

100 years!www.tradingview.com

Does this keep you up at night? You might look for this pattern across smaller time frames, but to see it across 100 years is well.. (no words).

3 Scenarios:

1. Yields blast off directly from here.

2. A crisis (real/manufactured) comes in allowing them to pull rates down to

US10Y United states government 10 year bond yieldThe US10Y refers to the yield on the 10-year US Treasury note, a benchmark rate for the return investors demand to lend to the US government over 10 years.

the US10Y is Issued by the US Treasury, these notes pay semi-annual interest and return principal at maturity; yields move inversely to prices b

US10Y Analysis – 10-Year US Treasury YieldsUS10Y Analysis – 10-Year US Treasury Yields

The US10Y Treasury yield has recently exhibited a clear internal Market Structure Shift (MSS),

reflecting a change in price behavior that favors the bullish scenario.

📈 Technical Bias:

Following the internal MSS, the likely expectation is a continuation

See all ideas

A graphical representation of the interest rates on debt for a range of maturities.

Frequently Asked Questions

The current yield rate is 4.050% — it's decreased by −2.83% over the past week.

The current yield of United States 10 Year Government Bonds is 4.050%, whereas at the moment of issuance it was 3.520%, which means 15.06% change. Over the week the yield has decrased by −2.83%, the month performance has showed a −3.04% decrease, and it has fallen by −12.28% over the year.

Maturity date is when a debt comes due and all principal and/or interest must be repaid to creditors. For example, the United States 10 Year Government Bonds maturity date is Feb 15, 2036.

You can buy United States 10 Year Government Bonds through brokers — choose the one that suits your needs and go ahead. You can also purchase bonds directly from the issuing organization. Closely track the price dynamics and market news before making any decision.

A bond is a debt security issued by a corporation or a government. By buying bonds, investors loan the issuer money in return for an interest rate. By issuing bonds, the state receives funds that can then be injected into the economy, and corporations raise funds for new research or other operational activities. The alphanumeric code of government bonds represents the abbreviated name of the issuing state, as well as its time to maturity. For example, United States 10 Year Government Bonds is the US government bonds with the maturity of 10 years.

Bonds can be of various maturities, e.g. short-term (less than three years), medium-term (four to 10 years), or long-term ones (more than 10 years). So United States 10 Year Government Bonds are medium-term bonds — they have the maturity of 10 years.