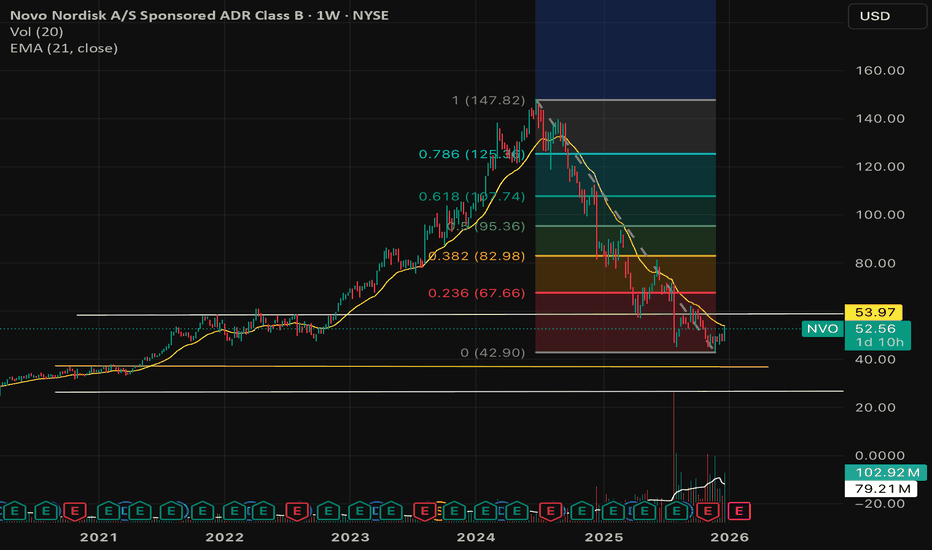

$NVO Quality GIGA-LONNNNNNNGGGGG!!!This is a weekly of NVO, a global leader in pharmaceuticals addressing issues like obesity, diabetes, among other things. Ever hear of Ozempic? This company makes it. They also have other products in their pipeline which intend to capitalize on these growing epidemics, such as the recently approve

Novo Nordisk A/S Class B

No trades

Key facts today

Novo Nordisk has cut Wegovy obesity medication prices in China by 48%, now costing about 987 yuan ($141) monthly. This move responds to rising competition in weight-loss treatments.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.115 EUR

13.50 B EUR

38.82 B EUR

3.17 B

About Novo Nordisk A/S Class B

Sector

Industry

CEO

Maziar Mike Doustdar

Website

Headquarters

Bagsværd

Founded

1923

Identifiers

2

ISINDK0062498333

Novo Nordisk A/S is a global healthcare company, which engages in the discovery, development, manufacturing and marketing of pharmaceutical products. It operates through the Diabetes and Obesity Care, and Rare Disease segments. The Diabetes and Obesity Care segment includes diabetes, obesity, cardiovascular, and emerging therapy areas. The Rare Disease segment refers to rare blood disorders, rare endocrine disorders, and hormone replacement therapy. The company was founded by Harald Pedersen and Thorvald Pedersen in 1923 is headquartered in Bagsværd, Denmark.

Related stocks

Novo Nordisk (NVO) 1WI’m looking at the weekly NVO chart as of late December 2025, and this is no longer about fear or headlines. It’s about structure and valuation. After a powerful multi year rally from 2022 to 2024, the stock went through a deep and healthy correction. In 2025, price built a strong weekly demand base

NVO mid-term TANVO keeps getting stronger, there's a positive accumulation on daily and it's currently under the resistance of SMA50 and it should breakout, let's wait and see. Long-term accumulation is getting stronger as well but the indicators are also under the resistance yet, though it shouldn't be hard for N

$NVO is 2026 top trade idea. Offers risk adjusted 50-100%- NYSE:NVO has most likely bottom and offer 50-100% upside from ~$50ish level.

- Weight loss technical addressable market is exploding. People are getting weight & fat conscious.

- Weight loss pill will make it accessible for lot of people. It's quite easy to consume than injectables.

Breaking: Novo Nordisk A/S (NVO) Set For 80% BreakoutShares in Novo Nordisk surged over 7% Tuesday premarket after the Wegovy maker secured approval of its GLP-1 pill — a world first.

The U.S. Food and Drug Administration’s approval of Novo Nordisk’s GLP-1 pill gives the Danish pharmaceutical giant a head start over U.S. rival Eli Lilly

The pill’s s

NVO Long

Early signs of a breakout from falling wdege

Plan is to buy if daily candle closes above 57 $.

Add to position: second entry if price closes above 70 $.

Targets: take profits on the way up in the two marked “fair value gap” zones.

Risk idea: current support area around 45–52 $; invalida

$NVO - Novo Nordisk Has Taken a Beating 2025Novo Nordisk’s bullish scenario centers on sustained global demand for its GLP-1 franchise, with Wegovy and Ozempic expanding beyond diabetes into obesity, cardiovascular protection, and additional metabolic indications. Capacity expansions support multi-year volume growth, while emerging markets ad

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

N

XS323295972

Novo Nordisk Finance (Netherlands) BV 4.0% 20-NOV-2045Yield to maturity

4.26%

Maturity date

Nov 20, 2045

N

XS323295590

Novo Nordisk Finance (Netherlands) BV 3.625% 20-FEB-2038Yield to maturity

3.81%

Maturity date

Feb 20, 2038

N

XS300255582

Novo Nordisk Finance (Netherlands) BV 3.625% 27-MAY-2037Yield to maturity

3.73%

Maturity date

May 27, 2037

N

XS323294453

Novo Nordisk Finance (Netherlands) BV 3.375% 20-FEB-2035Yield to maturity

3.56%

Maturity date

Feb 20, 2035

N

XS282046075

Novo Nordisk Finance (Netherlands) BV 3.375% 21-MAY-2034Yield to maturity

3.47%

Maturity date

May 21, 2034

N

XS300255353

Novo Nordisk Finance (Netherlands) BV 3.125% 27-MAY-2033Yield to maturity

3.29%

Maturity date

May 27, 2033

N

XS323293716

Novo Nordisk Finance (Netherlands) BV 3.0% 20-FEB-2032Yield to maturity

3.15%

Maturity date

Feb 20, 2032

N

XS282045567

Novo Nordisk Finance (Netherlands) BV 3.25% 21-JAN-2031Yield to maturity

3.06%

Maturity date

Jan 21, 2031

N

XS300255329

Novo Nordisk Finance (Netherlands) BV 2.875% 27-AUG-2030Yield to maturity

3.00%

Maturity date

Aug 27, 2030

XS244124704

Novo Nordisk Finance (Netherlands) BV 1.375% 31-MAR-2030Yield to maturity

2.89%

Maturity date

Mar 31, 2030

N

XS300255299

Novo Nordisk Finance (Netherlands) BV 2.375% 27-MAY-2028Yield to maturity

2.74%

Maturity date

May 27, 2028

See all NNO2 bonds

Curated watchlists where NNO2 is featured.

Frequently Asked Questions

The current price of NNO2 is 44.000 EUR — it has increased by 0.57% in the past 24 hours. Watch Novo Nordisk A/S Class B stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on VIE exchange Novo Nordisk A/S Class B stocks are traded under the ticker NNO2.

NNO2 stock has risen by 2.33% compared to the previous week, the month change is a 4.75% rise, over the last year Novo Nordisk A/S Class B has showed a −47.77% decrease.

We've gathered analysts' opinions on Novo Nordisk A/S Class B future price: according to them, NNO2 price has a max estimate of 72.13 EUR and a min estimate of 30.72 EUR. Watch NNO2 chart and read a more detailed Novo Nordisk A/S Class B stock forecast: see what analysts think of Novo Nordisk A/S Class B and suggest that you do with its stocks.

NNO2 reached its all-time high on Jun 25, 2024 with the price of 137.980 EUR, and its all-time low was 17.950 EUR and was reached on Oct 11, 2018. View more price dynamics on NNO2 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

NNO2 stock is 3.36% volatile and has beta coefficient of 1.60. Track Novo Nordisk A/S Class B stock price on the chart and check out the list of the most volatile stocks — is Novo Nordisk A/S Class B there?

Today Novo Nordisk A/S Class B has the market capitalization of 194.50 B, it has decreased by −5.29% over the last week.

Yes, you can track Novo Nordisk A/S Class B financials in yearly and quarterly reports right on TradingView.

Novo Nordisk A/S Class B is going to release the next earnings report on Feb 4, 2026. Keep track of upcoming events with our Earnings Calendar.

NNO2 earnings for the last quarter are 0.60 EUR per share, whereas the estimation was 0.65 EUR resulting in a −8.11% surprise. The estimated earnings for the next quarter are 0.79 EUR per share. See more details about Novo Nordisk A/S Class B earnings.

Novo Nordisk A/S Class B revenue for the last quarter amounts to 10.02 B EUR, despite the estimated figure of 10.23 B EUR. In the next quarter, revenue is expected to reach 10.29 B EUR.

NNO2 net income for the last quarter is 2.67 B EUR, while the quarter before that showed 3.54 B EUR of net income which accounts for −24.57% change. Track more Novo Nordisk A/S Class B financial stats to get the full picture.

Novo Nordisk A/S Class B dividend yield was 1.83% in 2024, and payout ratio reached 50.28%. The year before the numbers were 1.35% and 50.35% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Dec 30, 2025, the company has 76.3 K employees. See our rating of the largest employees — is Novo Nordisk A/S Class B on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Novo Nordisk A/S Class B EBITDA is 20.88 B EUR, and current EBITDA margin is 50.95%. See more stats in Novo Nordisk A/S Class B financial statements.

Like other stocks, NNO2 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Novo Nordisk A/S Class B stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Novo Nordisk A/S Class B technincal analysis shows the neutral today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Novo Nordisk A/S Class B stock shows the sell signal. See more of Novo Nordisk A/S Class B technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.