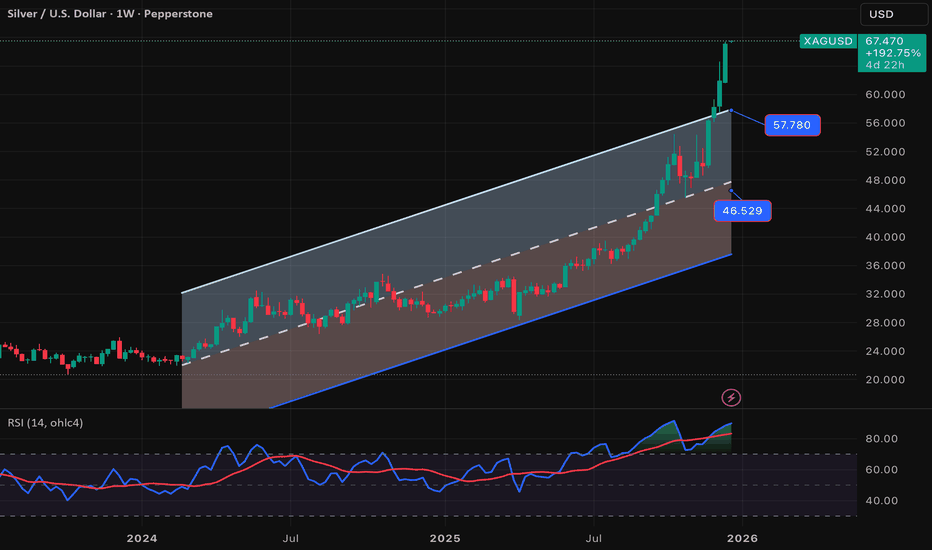

XAGUSD (Silver) 1H chart patterns...XAGUSD (Silver) – Target Levels (Based on my Chart)

From the image, price is moving inside an ascending (bullish) channel and is currently near the upper zone / high point of the market. The marked arrows show a possible correction.

🎯 Downside Target Levels

If price gets rejected from the upper c

About Silver / U.S. Dollar

Silver Prices have been followed for centuries. Silver (XAG) is a precious metal used in jewelry, silverware, electronics, and currency. Silver prices are widely followed in financial markets around the world. Silver has been traded for thousands of years and was once used for currency backing. Silver continues to be one of the most commonly traded commodities today. Silver prices are highly volatile due to speculation and supply and demand. Ag is the chemical symbol for silver on the periodic table of elements and its ISO currency symbol is XAG.

Silvers Worth More than Oil! CAUTION!The last time silver traded above both oil and gold was during the Hunt Brothers’ attempt to corner the silver market (arguably the original anti-government Crypto Bros speculators with Lambos, if you think about it. LOL!)

What makes the current setup different is that this move is occurring wit

The Christmas Silver Finally Breaks FreeFor decades, Silver has celebrated the holidays the same way 🎄

Strong rallies.

Rising excitement.

And a familiar ceiling.

🎄 Christmas 1980

Silver climbed like a Christmas tree, fast, vertical, and emotional.

The star was reached at the $50 level.

And just like that, the lights went out ✨

The

Silver Bullish Structure into Supply, Pullback Targets MarkedThis 1H Silver (XAGUSD) chart highlights a well-defined bullish market structure with multiple BOS (Break of Structure) confirmations as price trends higher along a rising trendline. After a strong impulsive move, price enters a consolidation phase, then continues upward, respecting the dynamic tren

This is why $SILVER Bears are WRONGThe TVC:SILVER bears have been arguing that the recent parabolic move in TVC:SILVER will end the same way it did in 2011. However, market conditions were different in 2011 than they are now. In 2011 the long end of the rate curve TVC:US10Y was DECLINING (see bottom chart). The situation now

SILVER SHORT FROM RESISTANCE

SILVER SIGNAL

Trade Direction: short

Entry Level: 6,544.8

Target Level: 6,229.1

Stop Loss: 6,754.8

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analy

SILVER (XAG/USD): Bull Run ContinuesSILVER appears poised for continued upward movement, potentially reaching new highs.

A bullish breakout from the neckline of an ascending triangle pattern on a 4-hour timeframe suggests a strong trend-following bullish signal.

It is highly probable that the price will soon reach the 67.00 level.

Factors In Favor of Profit-Taking (Price Downside)Factors In Favor of Profit-Taking (Price Downside)

Year-End Closing: Investment funds and traders lock in gains to report strong performance to clients and secure year-end bonuses. With the asset up over 100%+ year-to-date, the desire to "take money off the table" is a natural process.

Tec

SILVER Is Very Bearish! Short!

Take a look at our analysis for SILVER.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 6,339.4.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend sh

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.