CADJPY: JPY Weakness Supported by Election UncertaintyCADJPY: JPY Weakness Supported by Election Uncertainty

Fundamental Analysis:

JPY weakness is supported by the following news:

Prime Minister Sanae Takaichi, who is running in a snap election that she is widely expected to win this Sunday, sparked a sell-off in the yen earlier this week after a c

Canadian Dollar / Japanese Yen

No trades

About Canadian Dollar / Japanese Yen

The Canadian Dollar vs. the Japanese Yen. When a trader is unsure about trading the US Dollar, the CADJPY is often determined to be a suitable replacement. However, the historically higher yield of the Canadian dollar in the past has made the CADJPY more sensitive to market wide sentiment changes than the USDJPY. Also, Canada’s large amount of energy exports, most notable oil, causes it to be affected by crude oil prices.

Related currencies

CADJPY Breaks Out of Another Bullish PatternCADJPY Breaks Out of Another Bullish Pattern

CADJPY has broken out of a descending wedge on the 1H chart, signaling bullish continuation.

Price is currently trading near 115.10, with upside targets at 115.50 and 116.00.

As long as the breakout holds, momentum favors buyers aiming for the highe

TheGrove | CADJPY Sell | Idea Trading AnalysisYou can expect a reaction in the direction of selling from the specified Resistance area

CADJPY moving higher as it tests the strong resistance level..

We expect a bearish move from the confluence zone.

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOO

CAD/JPY Strength Emerges — Trend Traders Watch!🚀 CAD/JPY BULLISH SWING/DAY TRADE OPPORTUNITY 📈

Professional Technical Setup with Risk Management Guide

📊 ASSET: Canadian Dollar vs Japanese Yen (CAD/JPY)

Market: Forex | Category: Major Currency Pair | Liquidity: High

Current Price (Feb 02, 2026): 113.69 JPY per CAD | Volatility: Moderate

🎯 TRADE

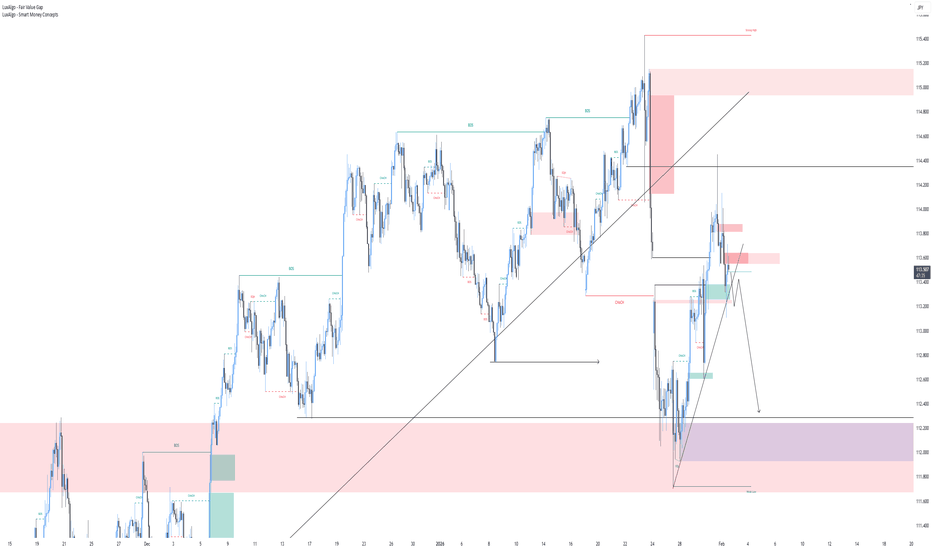

CadJpy Trade IdeaWith CadJpy being bullish and respecting the support levels below I personally decided to execute some longs for a 1:3rr. We had price come below a support level (blue line) before closing back above after the retest. I wanted to see the level get tapped into last week to continue longs but price se

CAD/JPY BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

We are going short on the CAD/JPY with the target of 113.961 level, because the pair is overbought and will soon hit the resistance line above. We deduced the overbought condition from the price being near to the upper BB band. However, we should use low risk here because the 1W

Sell Cad/JPY into broken descending trendline.Most of the JPY crosses are starting to look like topping now. CAD is one of the weakest majors so makes sense to sell this pair. I am hoping for one more spike into the broken trendline and then take profit at recent lows.

Sell Limit : 114.35 spike into broken descending trendline

Stop

CAD/JPY Will Fall wait and watch CAD/JPY is on the way to have a historical fall and I will explain you exactly why:

1) Breakout from Trendline HTF

2) Chooch From HTF

3) Chooch from LTF

4) Double Chooch

5) Retest of the OB of the DAILY TF

6) A hammer candle formed after the retest

7) Todays hammer candle

8) See the bearish m

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of CADJPY is 114.988 JPY — it has increased by 0.38% in the past 24 hours. See more of CADJPY rate dynamics on the detailed chart.

The value of the CADJPY pair is quoted as 1 CAD per x JPY. For example, if the pair is trading at 1.50, it means it takes 1.5 JPY to buy 1 CAD.

The term volatility describes the risk related to the changes in an asset's value. CADJPY has the volatility rating of 0.93%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The CADJPY showed a 1.38% rise over the past week, the month change is a 1.65% rise, and over the last year it has increased by 8.61%. Track live rate changes on the CADJPY chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

CADJPY is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade CADJPY right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with CADJPY technical analysis. The technical rating for the pair is buy today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the CADJPY shows the strong buy signal, and 1 month rating is buy. See more of CADJPY technicals for a more comprehensive analysis.