DatTong

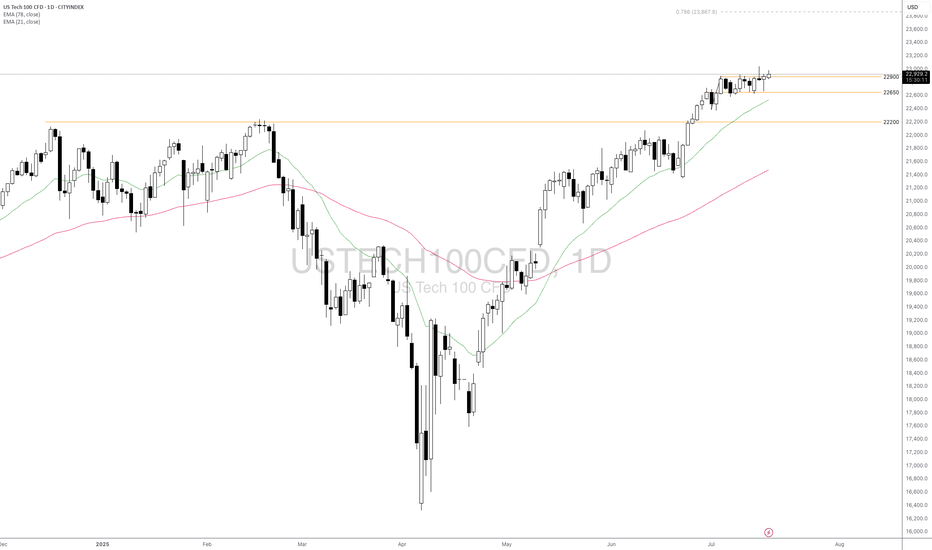

PremiumFundamental approach: - The Dow Jones Industrial Average (US30) rose this week amid cooling US labor signals that reinforced expectations for a Sep Fed rate cut, while upbeat ISM services activity tempered growth concerns. - ADP private payrolls slowed and jobless claims ticked higher, bolstering bets for easier policy ahead of today's NFP release. This kept risk...

Fundamental approach: - The Pound was mildly softer this week amid firmer US data impulses and pre-NFP caution, while UK growth signals from Aug PMIs offered only limited support to the Pound. - UK Services PMI accelerated to 53.6 in Aug, the fastest in a year, hinting at resilient activity but with persistent employment softness and sticky price pressures,...

Fundamental approach: - Last week, USOIL was modestly higher amid risk-on sentiment and tighter supply signals after a larger‑than‑expected US crude draw. - Support came from the EIA’s reported six-million-barrel crude draw tied to lower imports and stronger exports, reinforcing a tightening balance even as Cushing stocks ticked up; broader sentiment also leaned...

Fundamental approach: - Bitcoin prices declined amid a risk-off tone and sizeable spot ETF outflows following last week's post-record pullback and liquidation-driven volatility. - Selling pressure was reinforced by Tue's sharp net redemptions from US spot Bitcoin ETFs (about $523M), alongside broader crypto weakness early in the week; traders also positioned...

Fundamental approach: - USDJPY edged higher this week amid resilient US growth signals and firm Treasury yields, while dovish-leaning BoJ communication kept Japanese rates anchored. Risk sentiment was mixed ahead of Fed minutes and Jackson Hole. - US data and Fed repricing supported the US dollar as markets weighed sticky services momentum and steady consumption...

Fundamental approach: - US30 has been pushing toward a fresh high this week, aided by softer CPI and growing confidence in a Sep Fed cut. On Wed, it was within about 1% of a record and posted substantial gains earlier in the week. - The US Jul PPI rose 0.9% MoM and 3.3% YoY, well above forecasts, reviving tariff-driven inflation worries and pressuring cyclicals....

Macro approach: - USDCAD edged higher this week amid softer Canadian labor data, boosting BoC cut odds and pre‑CPI caution that kept the USD supported as traders eyed key US inflation prints. - Canada shed 40.8k jobs in Jul while unemployment held at 6.9%, reinforcing expectations for a 17 Sep BoC cut and pressuring the loonie. With Canada's calendar light, focus...

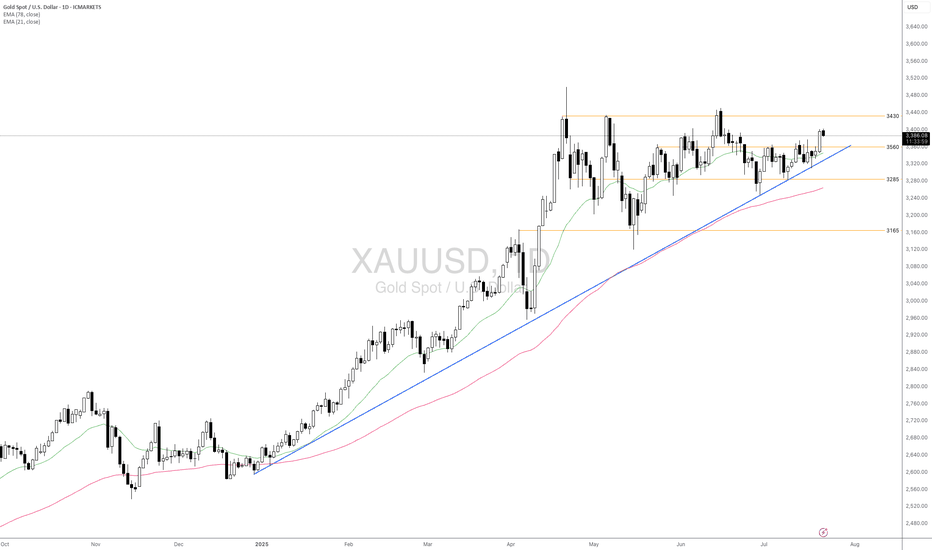

Fundamental approach: - Gold gained this week, supported by renewed trade tensions following new US tariffs on major partners and rising expectations of a Fed rate cut in Sep. - Safe-haven demand strengthened after weak US NFP data heightened concerns about economic growth and reinforced market bets on monetary easing, while US President Trump's tariff...

Macro approach: - The Dow Jones Industrial Average advanced this week, rebounding strongly as risk appetite improved following last week’s pullback, supported by a soft jobs report and easing global tariff concerns. - Sentiment was aided by the Fed’s increased hopes of a near-term rate cut after Non-farm Payrolls missed expectations, prompting a 1.3% surge on...

Fundamental approach: - USDCAD advanced this week, supported by broad US dollar strength and renewed trade tensions as the US announced higher tariffs on Canadian imports. - The pair was further buoyed after the BoC left rates unchanged and signaled caution amid persistent core inflation and ongoing trade negotiations. - Meanwhile, US labor data indicated that...

Macro approach: - Gold retreated this week, reversing early gains to trade near four-week lows amid renewed US dollar strength and caution ahead of the Fed's policy decision. - The retreat was mainly pressured by stronger-than-expected US economic data and a tentative revival in risk appetite, offsetting pockets of safe-haven demand. - Key drivers included robust...

Macro approach: - The US dollar index has traded mixed since last week, pressured by lingering trade uncertainty and cautious market sentiment ahead of major economic events. - Dovish Fed expectations and subdued US inflation continued to weigh on the greenback, while news of a fresh US-EU trade agreement and upcoming talks with China contributed to two-way...

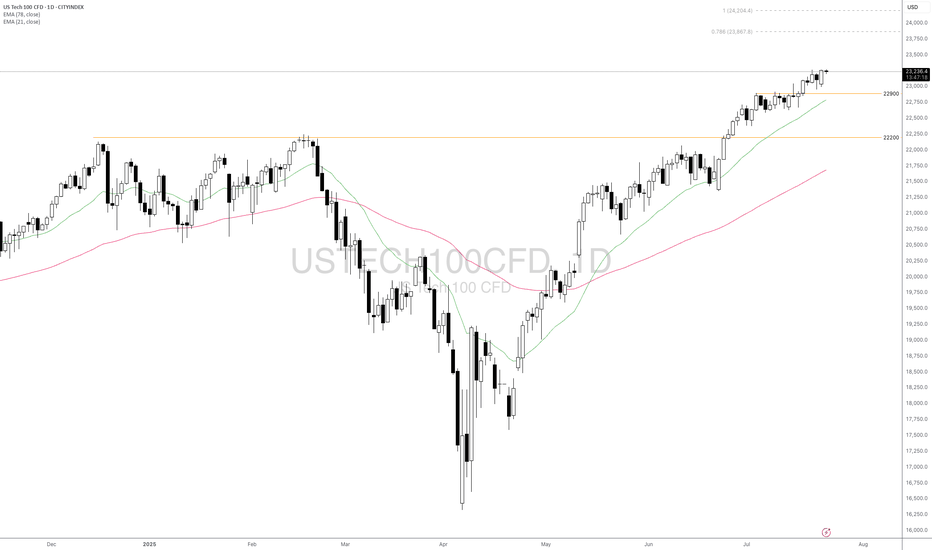

Macro approach: - USTEC advanced modestly this week, supported by upbeat corporate earnings and resilience in economic data amid ongoing policy uncertainty. - The index benefited from strong expected results in major tech firms such as Microsoft (MSFT) and Nvidia (NVDA), as top giant AI leadership, helping to bolster sentiment despite lingering concerns about...

Macro approach: - XAUUSD advanced this week, supported by broad-based US dollar weakness and reviving safe-haven demand amid rising global trade tensions. The yellow metal briefly reached a five-week high as investors sought safety following headlines of escalating US tariffs and uncertainty over the Fed’s policy direction. - Gold may remain well-supported if risk...

Fundamental approach: - USTEC climbed to fresh record highs this week, supported by positive investor sentiment amid consolidation ahead of key catalysts. - Sentiment was buoyed by expectations of continued AI and semiconductor strength, with Nvidia (NVDA) and Amazon (AMZN) registering gains, while Tesla (TSLA) rebounded on optimism despite recent...

Macro approach: - GBPUSD has weakened since last week, pressured by disappointing UK economic data and rising expectations of a BoE rate cut. Meanwhile, the US dollar found support amid cautious risk sentiment and anticipation of key US inflation data. - UK GDP contracted for a second consecutive month in May, and recent labor market surveys signaled further...

Macro approach: - Gold traded defensively this week, consolidating above the $3,300 level amid shifting risk sentiment and anticipation of significant trade policy developments. The yellow metal's performance was pressured by a firmer US dollar and easing geopolitical tensions, as optimism around potential trade deals and tariff suspensions reduced safe-haven...

Macro approach: - Gold prices have recently pulled back as investors took profits at elevated levels to offset losses elsewhere amid rising geopolitical tensions in the Middle East and steady Fed holding rates. - Speculation is mounting that the US may involve into the Middle East conflicts, raising fears of a broader regional tensions. - Meanwhile, a dovish Fed...